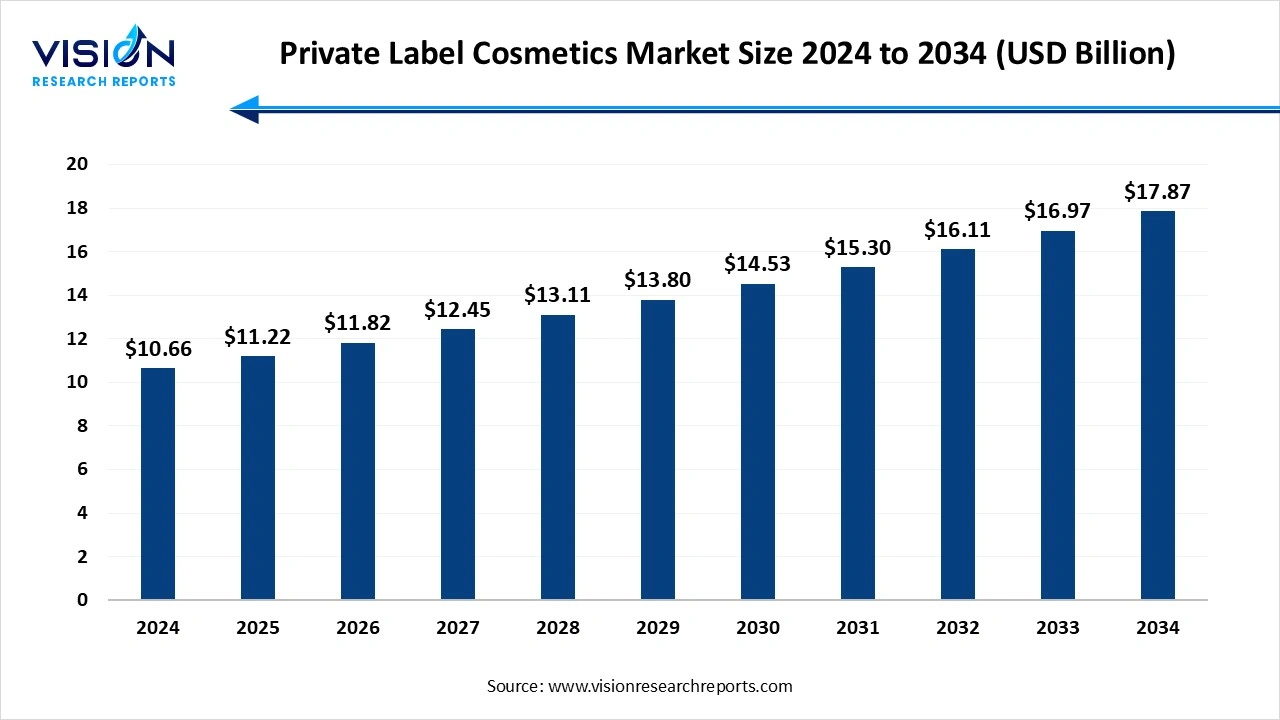

The global private label cosmetics market size was estimated at USD 10.66 billion in 2024 and it is expected to surpass around USD 17.87 billion by 2034, poised to grow at a CAGR of 5.30% from 2025 to 2034.

The private label cosmetics market has experienced significant growth in recent years, driven by increasing consumer demand for affordable yet high-quality beauty products. Retailers and brands are increasingly leveraging private label strategies to offer customized cosmetic lines that cater to niche markets and diverse consumer preferences. This market is characterized by flexibility, faster time-to-market, and greater control over product development and branding, enabling companies to enhance customer loyalty and profitability.

The growth of the private label cosmetics market is primarily driven by shifting consumer preferences towards affordable yet high-quality beauty products. Increasing awareness about skincare and makeup, coupled with rising disposable incomes, encourages consumers to explore diverse cosmetic options beyond traditional branded products. Retailers and manufacturers capitalize on this trend by offering private label cosmetics that deliver competitive pricing without compromising on quality.

Another significant growth factor is the expansion of e-commerce and digital marketing channels, which have revolutionized product accessibility and consumer engagement. Online platforms provide private label brands with direct-to-consumer opportunities, reducing intermediaries and enhancing profit margins. Furthermore, advancements in manufacturing technologies and supply chain efficiencies enable faster product development and customization, facilitating quicker market entry. Retailers also benefit from greater control over branding, packaging, and marketing strategies, which strengthens brand loyalty and differentiation in a highly competitive market.

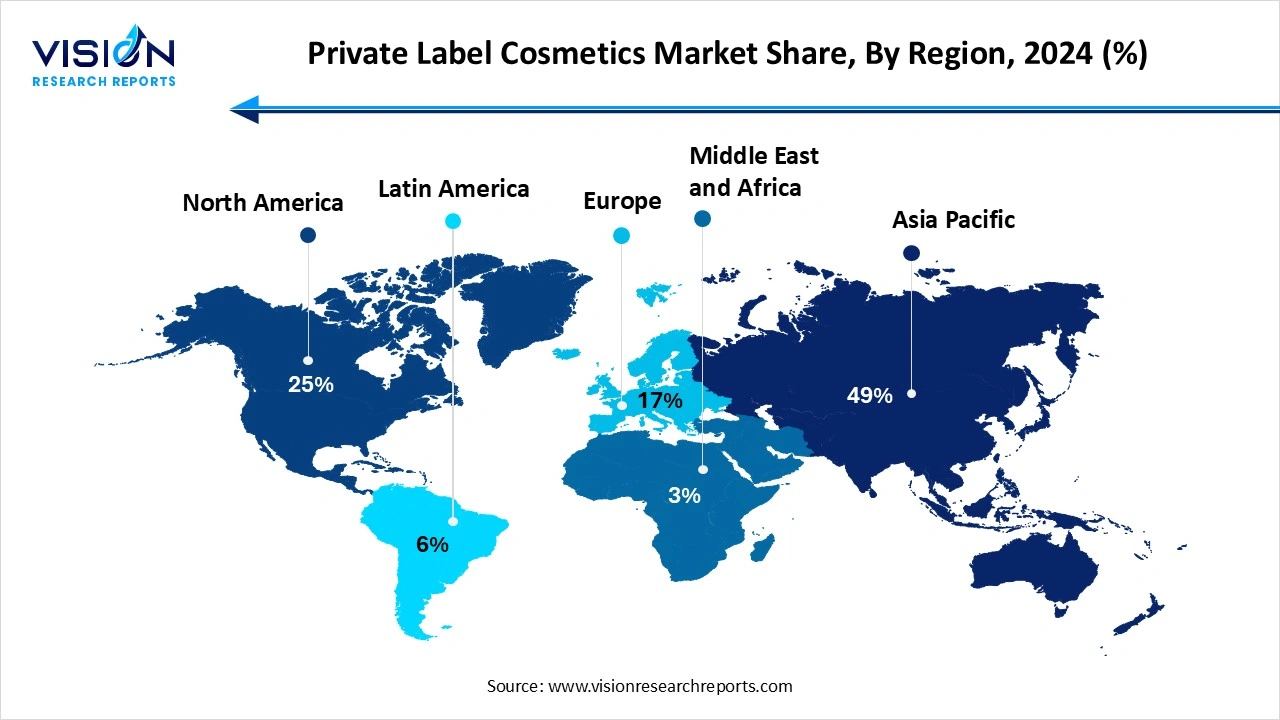

The Asia Pacific region led the private label cosmetics market, capturing the largest revenue share at 49% in 2024. This dominance is driven by the expanding middle-class populations in countries like China, India, and those across Southeast Asia. As consumers in these regions seek high-quality yet affordable beauty products, private label cosmetics have gained traction by offering competitive prices and better alignment with local beauty preferences compared to global brands.

The private label cosmetics market in Europe is projected to experience substantial growth at a notable CAGR over the forecast period. Major retailers like Carrefour, Lidl, and DM Drogerie Markt are actively broadening their private label cosmetic offerings, ensuring compliance with European regulations on safety, sustainability, and ingredient transparency. Additionally, with European consumers increasingly prioritizing eco-friendly packaging, cruelty-free practices, and natural ingredients, private label brands are swiftly adapting to these preferences to maintain a competitive edge.

The private label cosmetics market in Europe is projected to experience substantial growth at a notable CAGR over the forecast period. Major retailers like Carrefour, Lidl, and DM Drogerie Markt are actively broadening their private label cosmetic offerings, ensuring compliance with European regulations on safety, sustainability, and ingredient transparency. Additionally, with European consumers increasingly prioritizing eco-friendly packaging, cruelty-free practices, and natural ingredients, private label brands are swiftly adapting to these preferences to maintain a competitive edge.

The skincare segment dominated the market, accounting for the highest revenue share at 42% in 2024. Private label skincare products, ranging from moisturizers and serums to cleansers and sunscreens, are gaining traction as consumers seek effective yet affordable alternatives to established brands. Retailers and manufacturers are capitalizing on this trend by offering innovative formulations that incorporate natural and organic ingredients, catering to a growing preference for clean and sustainable beauty.

The haircare segment is expected to register the highest compound annual growth rate (CAGR) of 5.6% throughout the forecast period 2025 to 2034. Private label haircare products such as shampoos, conditioners, hair masks, and styling treatments are increasingly favored for their affordability and customization options. Brands are focusing on creating diverse product lines that address specific hair types and concerns, including damage repair, color protection, and scalp care.

The organic and natural cosmetics segment dominated the market, accounting for the highest revenue share at 86% in 2024. Consumers are becoming increasingly conscious of what they apply to their skin and hair, prompting a shift towards cosmetics that are free from harmful chemicals, synthetic fragrances, and artificial preservatives. Private label brands are responding by offering a broad range of organic and natural formulations made from plant-based ingredients, essential oils, and eco-friendly packaging.

The conventional/synthetic cosmetics segment is expected to experience the highest CAGR of 5.2% throughout the forecast period 2025 to 2034. These products are typically formulated using laboratory-derived ingredients that allow for greater control over texture, color, and performance. For many consumers, particularly in price-sensitive markets, synthetic cosmetics offer accessible beauty solutions without compromising on quality or functionality.

The women’s segment dominated the market, capturing the largest revenue share of 64% in 2024. Women consumers are increasingly drawn to private label brands that offer quality, affordability, and trend-responsive innovations in skincare, makeup, and haircare. The rise of conscious beauty movements, Emphasizing natural ingredients, cruelty-free practices, and sustainable packaging, Has further influenced purchasing decisions, with many women turning to private label cosmetics for personalized and ethically made solutions.

The men’s segment is expected to experience the fastest growth, with a CAGR of 5.1% during the forecast period. The men’s segment in the private label cosmetics market has witnessed significant growth, driven by changing grooming habits and a growing acceptance of skincare and beauty routines among male consumers. Men are increasingly seeking targeted solutions for skincare, haircare, and beard care, creating a demand for dedicated product lines tailored to their unique needs. Private label brands are capitalizing on this shift by offering simplified, functional, and masculine-branded cosmetics that align with modern grooming trends.

The offline segment dominated the market, capturing the largest revenue share of 71% in 2024. Offline distribution channels continue to play a vital role in the global private label cosmetics market, particularly through supermarkets, hypermarkets, specialty beauty stores, and pharmacy chains. These retail formats provide consumers with the advantage of physically interacting with products, receiving in-person consultations, and making immediate purchases. Established retailers are increasingly launching their own private label cosmetic lines in-store, leveraging brand trust and foot traffic to promote these offerings.

The online segment is projected to expand at the quickest compound annual growth rate (CAGR) of 5.8% throughout the forecast period. The online distribution channel has emerged as a rapidly growing segment in the private label cosmetics market, driven by the widespread adoption of e-commerce platforms and changing consumer behavior. Online retail allows private label brands to bypass traditional retail markups, offering competitive pricing and a wider range of customizable products. The convenience of home delivery, coupled with access to detailed product descriptions, customer reviews, and influencer endorsements, has made e-commerce a preferred choice, especially among younger consumers.

By Product

By Type

By End Use

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Private Label Cosmetics Market

5.1. COVID-19 Landscape: Private Label Cosmetics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Private Label Cosmetics Market, By Product

8.1. Private Label Cosmetics Market, by Product

8.1.1. Skincare

8.1.1.1. Market Revenue and Forecast

8.1.2. Haircare

8.1.2.1. Market Revenue and Forecast

8.1.3. Color Cosmetics

8.1.3.1. Market Revenue and Forecast

8.1.4. Fragrance

8.1.4.1. Market Revenue and Forecast

Chapter 9. Global Private Label Cosmetics Market, By Type

9.1. Private Label Cosmetics Market, by Type

9.1.1. Organic/Natural

9.1.1.1. Market Revenue and Forecast

9.1.2. Conventional/Synthetic

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Private Label Cosmetics Market, By End Use

10.1. Private Label Cosmetics Market, by End Use

10.1.1. Men

10.1.1.1. Market Revenue and Forecast

10.1.2. Women

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Private Label Cosmetics Market, By Distribution Channel

11.1. Private Label Cosmetics Market, by Distribution Channel

11.1.1. Offline

11.1.1.1. Market Revenue and Forecast

11.1.2. Online/E-Commerce

11.1.2.1. Market Revenue and Forecast

Chapter 12. Global Private Label Cosmetics Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product

12.1.2. Market Revenue and Forecast, by Type

12.1.3. Market Revenue and Forecast, by End Use

12.1.4. Market Revenue and Forecast, by Distribution Channel

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product

12.1.5.2. Market Revenue and Forecast, by Type

12.1.5.3. Market Revenue and Forecast, by End Use

12.1.5.4. Market Revenue and Forecast, by Distribution Channel

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product

12.1.6.2. Market Revenue and Forecast, by Type

12.1.6.3. Market Revenue and Forecast, by End Use

12.1.6.4. Market Revenue and Forecast, by Distribution Channel

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product

12.2.2. Market Revenue and Forecast, by Type

12.2.3. Market Revenue and Forecast, by End Use

12.2.4. Market Revenue and Forecast, by Distribution Channel

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product

12.2.5.2. Market Revenue and Forecast, by Type

12.2.5.3. Market Revenue and Forecast, by End Use

12.2.5.4. Market Revenue and Forecast, by Distribution Channel

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product

12.2.6.2. Market Revenue and Forecast, by Type

12.2.6.3. Market Revenue and Forecast, by End Use

12.2.6.4. Market Revenue and Forecast, by Distribution Channel

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product

12.2.7.2. Market Revenue and Forecast, by Type

12.2.7.3. Market Revenue and Forecast, by End Use

12.2.7.4. Market Revenue and Forecast, by Distribution Channel

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product

12.2.8.2. Market Revenue and Forecast, by Type

12.2.8.3. Market Revenue and Forecast, by End Use

12.2.8.4. Market Revenue and Forecast, by Distribution Channel

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product

12.3.2. Market Revenue and Forecast, by Type

12.3.3. Market Revenue and Forecast, by End Use

12.3.4. Market Revenue and Forecast, by Distribution Channel

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product

12.3.5.2. Market Revenue and Forecast, by Type

12.3.5.3. Market Revenue and Forecast, by End Use

12.3.5.4. Market Revenue and Forecast, by Distribution Channel

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product

12.3.6.2. Market Revenue and Forecast, by Type

12.3.6.3. Market Revenue and Forecast, by End Use

12.3.6.4. Market Revenue and Forecast, by Distribution Channel

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product

12.3.7.2. Market Revenue and Forecast, by Type

12.3.7.3. Market Revenue and Forecast, by End Use

12.3.7.4. Market Revenue and Forecast, by Distribution Channel

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product

12.3.8.2. Market Revenue and Forecast, by Type

12.3.8.3. Market Revenue and Forecast, by End Use

12.3.8.4. Market Revenue and Forecast, by Distribution Channel

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product

12.4.2. Market Revenue and Forecast, by Type

12.4.3. Market Revenue and Forecast, by End Use

12.4.4. Market Revenue and Forecast, by Distribution Channel

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product

12.4.5.2. Market Revenue and Forecast, by Type

12.4.5.3. Market Revenue and Forecast, by End Use

12.4.5.4. Market Revenue and Forecast, by Distribution Channel

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product

12.4.6.2. Market Revenue and Forecast, by Type

12.4.6.3. Market Revenue and Forecast, by End Use

12.4.6.4. Market Revenue and Forecast, by Distribution Channel

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product

12.4.7.2. Market Revenue and Forecast, by Type

12.4.7.3. Market Revenue and Forecast, by End Use

12.4.7.4. Market Revenue and Forecast, by Distribution Channel

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product

12.4.8.2. Market Revenue and Forecast, by Type

12.4.8.3. Market Revenue and Forecast, by End Use

12.4.8.4. Market Revenue and Forecast, by Distribution Channel

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product

12.5.2. Market Revenue and Forecast, by Type

12.5.3. Market Revenue and Forecast, by End Use

12.5.4. Market Revenue and Forecast, by Distribution Channel

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product

12.5.5.2. Market Revenue and Forecast, by Type

12.5.5.3. Market Revenue and Forecast, by End Use

12.5.5.4. Market Revenue and Forecast, by Distribution Channel

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product

12.5.6.2. Market Revenue and Forecast, by Type

12.5.6.3. Market Revenue and Forecast, by End Use

12.5.6.4. Market Revenue and Forecast, by Distribution Channel

Chapter 13. Company Profiles

13.1. Cosmetify, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Kolmar Korea Co., Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Fareva Group

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Intercos Group

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Nox Bellow Cosmetics

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Cosmax Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Groupe Rocher

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. RPC Group Plc (now part of Berry Global)

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. HCP Packaging

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Viva Group

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others