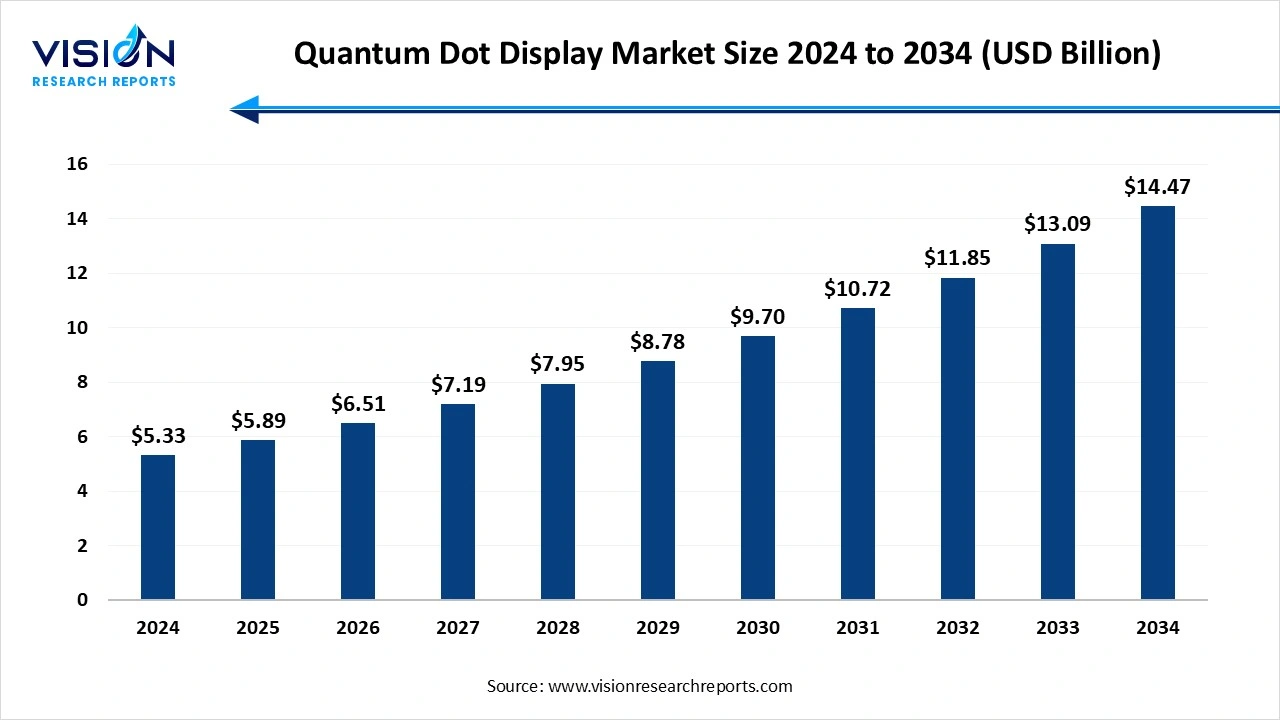

The global quantum dot display market size was exhibited at around USD 5.33 billion in 2024 and it is projected to hit around USD 14.47 billion by 2034, growing at a CAGR of 10.50% from 2025 to 2034.

The quantum dot display market has emerged as a transformative segment within the global display technology industry, driven by the demand for enhanced color performance, energy efficiency, and improved viewing experiences. Quantum dot (QD) displays utilize semiconductor nanocrystals that emit precise light wavelengths when stimulated, resulting in richer, more vibrant colors and better brightness compared to traditional display technologies such as LCD and OLED. As consumers increasingly seek high-resolution content in televisions, monitors, smartphones, and tablets, the adoption of quantum dot displays continues to accelerate.

One of the primary growth factors driving the quantum dot display market is the increasing consumer demand for high-quality visual experiences. Quantum dot technology offers superior color accuracy, brightness, and energy efficiency compared to traditional display technologies, making it a preferred choice for premium TVs, monitors, and mobile devices. As 4K and 8K content becomes more widely available, manufacturers are turning to quantum dot displays to meet the expectations of tech-savvy consumers.

Another significant driver is the expanding application of quantum dot displays across various industries beyond consumer electronics. In automotive displays, quantum dots enhance visual clarity for in-vehicle infotainment systems, while in healthcare and industrial sectors, they offer improved image quality for diagnostics and design applications. Moreover, ongoing R&D efforts and innovations in cadmium-free quantum dot materials are addressing environmental concerns and regulatory challenges, opening up new opportunities in regions with strict environmental standards.

The quantum dot display market is witnessing several key trends that are reshaping the future of display technologies. One major trend is the integration of quantum dots with OLED technology to create QD-OLED displays, which combine the deep blacks and contrast of OLED with the vibrant colors and brightness of quantum dots. This hybrid technology is gaining popularity in high-end TVs and monitors, offering enhanced viewing experiences.

The market is experiencing growing interest in quantum dot micro-LED displays. This emerging trend promises ultra-high brightness, longer lifespan, and low power consumption, making it suitable for outdoor displays and wearable devices. Quantum dot displays are also finding new applications in automotive infotainment systems, digital signage, and medical imaging equipment.

Despite the promising potential of quantum dot (QD) display technology, the market faces several key challenges that could hinder its widespread adoption. One of the primary concerns is the high production cost associated with quantum dot materials and their integration into display systems. The manufacturing processes for QD-enhanced films and components are complex and require precise quality control, which drives up the overall cost of end products. This makes QD displays less accessible in price-sensitive markets and limits their penetration beyond premium electronics.

Another critical challenge is environmental and regulatory pressure, especially concerning the use of cadmium-based quantum dots, which are toxic and restricted in many countries under RoHS (Restriction of Hazardous Substances) directives. Although cadmium-free alternatives like indium phosphide are being developed, they often lag in performance and stability compared to cadmium-based versions. Moreover, the relatively low awareness of quantum dot technology among general consumers and the fierce competition from OLED and mini-LED displays further complicate the market dynamics.

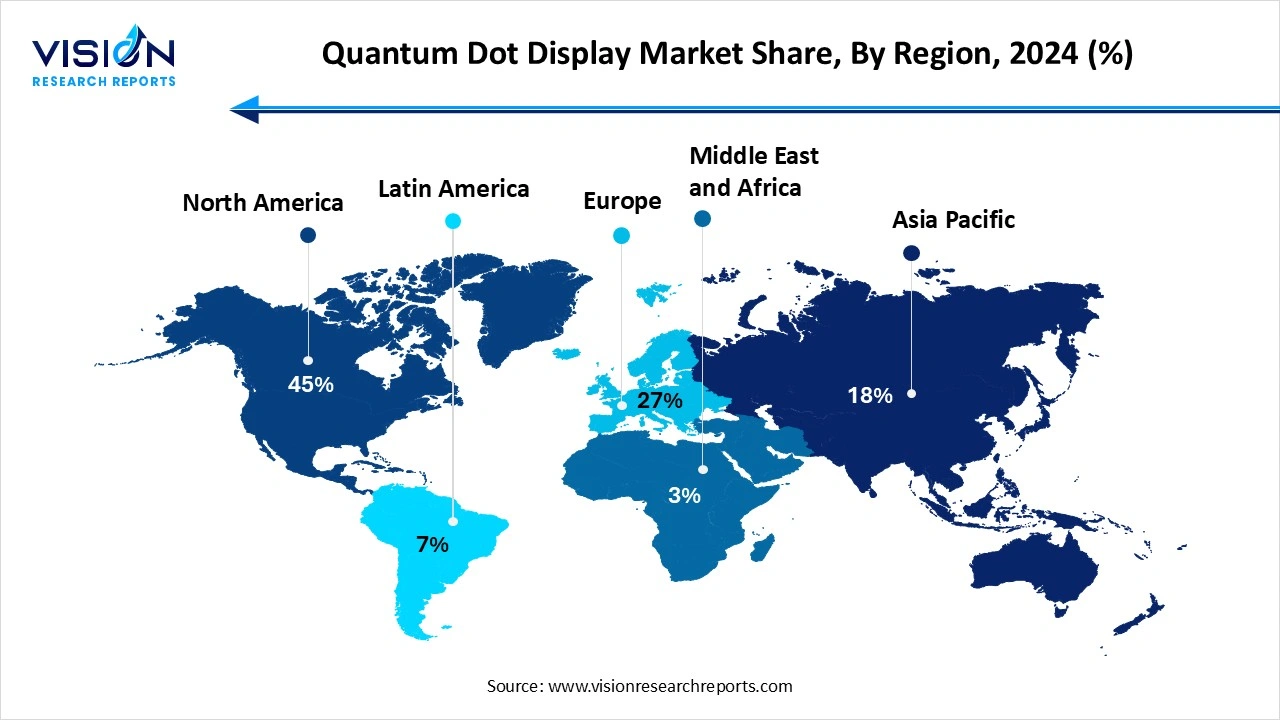

North America accounted for the largest market share, reaching 45% in 2024. The region benefits from a high demand for premium consumer electronics such as UHD televisions, gaming monitors, and high-performance laptops, which are often equipped with quantum dot displays. Moreover, the strong emphasis on research and development, along with supportive government initiatives for environmentally friendly technologies, has encouraged the use of cadmium-free quantum dots.

The Asia Pacific region is projected to experience the highest CAGR throughout the forecast period. Countries like China, South Korea, and Japan are leading the way in terms of production capabilities and innovation in quantum dot display technology. These nations have established robust supply chains and benefit from high investments in display panel manufacturing. The increasing consumption of smart TVs, mobile devices, and advanced monitors, coupled with rising disposable incomes and urbanization, has made Asia Pacific a key growth hub.

The LED segment dominated the market, contributing 49% to the total revenue in 2024. When combined with quantum dot enhancement films, LEDs enable displays to deliver exceptionally vibrant colors and a broader color gamut. The ability of quantum dots to convert blue LED light into precise red and green wavelengths allows for enhanced color accuracy and superior image quality, making them highly desirable in premium televisions, monitors, and other display devices.

The quantum dot tubes are projected to expand at a CAGR of 10.5% during the forecast period. These tubes, often used in the form of thin films or backlight units, house the quantum dots and allow for uniform light dispersion across the display surface. The tube component is essential for maintaining the stability and efficiency of the QD layer, ensuring consistent performance over the device's lifespan. In large-format displays and high-definition panels, these tubes support the scalability and adaptability of QD technology by providing a reliable medium for light conversion and diffusion. With ongoing improvements in material science and nanotechnology, tube components are being engineered for greater flexibility, environmental safety, and compatibility with newer display architectures.

The cadmium-containing QD displays held a higher market share, reaching 53% in 2024. These displays utilize cadmium selenide or similar compounds, which are highly effective in converting light into pure red and green colors, resulting in a wide color gamut and vivid picture quality. As a result, cadmium-based quantum dots have been widely used in high-end televisions, monitors, and display panels.

The cadmium-free segment is expected to grow at a faster CAGR of 14.2% throughout the forecast period. These materials, often based on indium phosphide or other non-toxic elements, are gaining traction among manufacturers aiming to align with environmental standards such as RoHS. Although cadmium-free quantum dots initially faced challenges in achieving comparable performance to cadmium-based variants, continuous advancements in nanomaterial engineering have significantly improved their efficiency, color output, and durability.

The consumer electronics segment led the market, capturing a 70% share of the total revenue in 2024. Quantum dot technology enhances display performance by delivering superior brightness, broader color gamut, and improved color accuracy, making it highly suitable for applications in televisions, smartphones, laptops, and tablets. Leading electronics manufacturers are increasingly integrating quantum dot displays into their premium product lines to meet the expectations of consumers seeking immersive visual experiences. The popularity of 4K and 8K content, combined with the expanding gaming and streaming industries, has further fueled the adoption of QD displays in home entertainment and personal computing devices.

The healthcare sector is projected to witness a faster growth rate than the consumer electronics segment From 2025 to 2034. QD technology enhances the visibility of fine details in radiological scans, surgical planning systems, and digital pathology tools by offering better contrast and a wider range of colors. These improvements contribute to more accurate diagnoses and efficient treatment planning.

By Component

By Material

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Component Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Quantum Dot Display Market

5.1. COVID-19 Landscape: Quantum Dot Display Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Quantum Dot Display Market, By Component

8.1. Quantum Dot Display Market, by Component

8.1.1 Tube

8.1.1.1. Market Revenue and Forecast

8.1.2. Film

8.1.2.1. Market Revenue and Forecast

8.1.3. LED

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Quantum Dot Display Market, By Material

9.1. Quantum Dot Display Market, by Material

9.1.1. Cadmium Containing

9.1.1.1. Market Revenue and Forecast

9.1.2. Cadmium-free

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Quantum Dot Display Market, By Application

10.1. Quantum Dot Display Market, by Application

10.1.1. Consumer Electronics

10.1.1.1. Market Revenue and Forecast

10.1.2. Healthcare

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Quantum Dot Display Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component

11.1.2. Market Revenue and Forecast, by Material

11.1.3. Market Revenue and Forecast, by Application

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component

11.1.4.2. Market Revenue and Forecast, by Material

11.1.4.3. Market Revenue and Forecast, by Application

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component

11.1.5.2. Market Revenue and Forecast, by Material

11.1.5.3. Market Revenue and Forecast, by Application

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component

11.2.2. Market Revenue and Forecast, by Material

11.2.3. Market Revenue and Forecast, by Application

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component

11.2.4.2. Market Revenue and Forecast, by Material

11.2.4.3. Market Revenue and Forecast, by Application

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component

11.2.5.2. Market Revenue and Forecast, by Material

11.2.5.3. Market Revenue and Forecast, by Application

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component

11.2.6.2. Market Revenue and Forecast, by Material

11.2.6.3. Market Revenue and Forecast, by Application

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component

11.2.7.2. Market Revenue and Forecast, by Material

11.2.7.3. Market Revenue and Forecast, by Application

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component

11.3.2. Market Revenue and Forecast, by Material

11.3.3. Market Revenue and Forecast, by Application

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component

11.3.4.2. Market Revenue and Forecast, by Material

11.3.4.3. Market Revenue and Forecast, by Application

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component

11.3.5.2. Market Revenue and Forecast, by Material

11.3.5.3. Market Revenue and Forecast, by Application

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component

11.3.6.2. Market Revenue and Forecast, by Material

11.3.6.3. Market Revenue and Forecast, by Application

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component

11.3.7.2. Market Revenue and Forecast, by Material

11.3.7.3. Market Revenue and Forecast, by Application

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component

11.4.2. Market Revenue and Forecast, by Material

11.4.3. Market Revenue and Forecast, by Application

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component

11.4.4.2. Market Revenue and Forecast, by Material

11.4.4.3. Market Revenue and Forecast, by Application

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component

11.4.5.2. Market Revenue and Forecast, by Material

11.4.5.3. Market Revenue and Forecast, by Application

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component

11.4.6.2. Market Revenue and Forecast, by Material

11.4.6.3. Market Revenue and Forecast, by Application

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component

11.4.7.2. Market Revenue and Forecast, by Material

11.4.7.3. Market Revenue and Forecast, by Application

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component

11.5.2. Market Revenue and Forecast, by Material

11.5.3. Market Revenue and Forecast, by Application

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component

11.5.4.2. Market Revenue and Forecast, by Material

11.5.4.3. Market Revenue and Forecast, by Application

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component

11.5.5.2. Market Revenue and Forecast, by Material

11.5.5.3. Market Revenue and Forecast, by Application

Chapter 12. Company Profiles

12.1. Samsung Electronics Co., Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. LG Display Co., Ltd.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Nanosys, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. TCL Technology Group Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Sony Corporationv.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Sharp Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. BOE Technology Group Co., Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. AU Optronics Corp.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Nanoco Group plc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. QD Vision, Inc. (acquired by Samsung)

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others