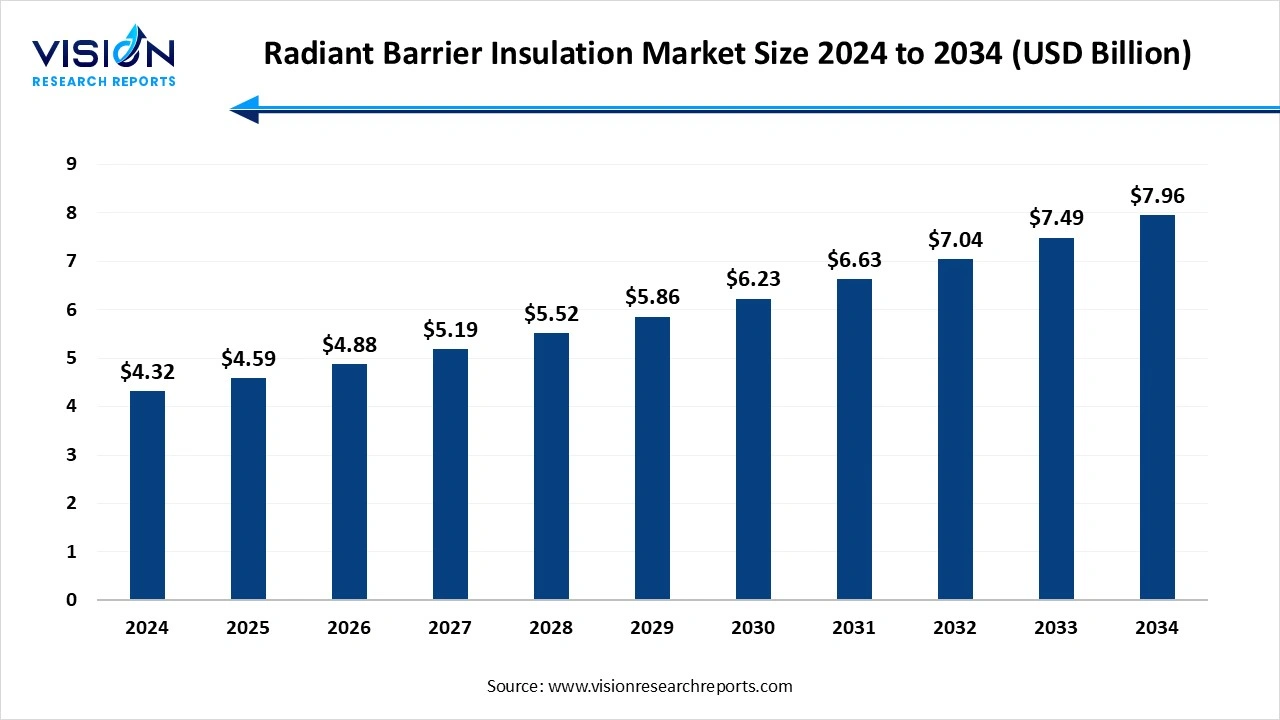

The global radiant barrier insulation market size was valued at USD 4.32 billion in 2024 and it is predicted to surpass around USD 7.96 billion by 2034 with a CAGR of 6.30% from 2025 to 2034.

The radiant barrier insulation market has witnessed steady growth in recent years, driven by increasing demand for energy-efficient solutions in residential, commercial, and industrial construction. Radiant barriers, which reflect heat rather than absorb it, are gaining popularity due to their ability to enhance thermal performance and reduce cooling costs especially in warm climates. As green building practices and stricter energy regulations become more prevalent, manufacturers are innovating with advanced materials and installation techniques to meet diverse application needs.

One of the primary growth drivers of the radiant barrier insulation market is the rising demand for energy-efficient building solutions. As global energy costs continue to rise, homeowners, builders, and commercial developers are increasingly prioritizing insulation methods that offer long-term savings. Radiant barrier insulation significantly reduces heat gain in structures, particularly in hot climates, thereby lowering cooling loads and energy bills. Government initiatives promoting energy conservation and green building certifications, such as LEED and ENERGY STAR, further support the adoption of these solutions, providing incentives for both builders and consumers to invest in advanced insulation technologies.

Another significant factor fueling market growth is the increased construction activity in developing regions and the modernization of existing infrastructure in developed markets. Emerging economies in Asia-Pacific, Latin America, and the Middle East are witnessing rapid urbanization and industrial expansion, creating a robust demand for cost-effective, high-performance building materials.

The Asia Pacific region led the market, capturing the largest revenue share of approximately 39% in 2024. This dominance is attributed to rapid urbanization, ongoing infrastructure development, and escalating energy costs. Nations such as India, Japan, and South Korea are increasingly adopting sustainable construction methods and prioritizing energy-efficient buildings, driving demand for radiant barriers. The region’s hot and humid climate enhances the effectiveness of these barriers, particularly in densely populated urban areas with high cooling needs.

North America, especially the United States, represents a major portion of the global radiant barrier insulation market. The region’s high energy usage in both residential and commercial buildings drives strong demand for insulation products that help lower HVAC expenses. Growing consumer awareness about energy efficiency, combined with tax incentives for energy-efficient upgrades, has boosted market adoption. While the market is well-established, it continues to experience steady growth fueled by renovation activities and increasingly strict building energy regulations.

North America, especially the United States, represents a major portion of the global radiant barrier insulation market. The region’s high energy usage in both residential and commercial buildings drives strong demand for insulation products that help lower HVAC expenses. Growing consumer awareness about energy efficiency, combined with tax incentives for energy-efficient upgrades, has boosted market adoption. While the market is well-established, it continues to experience steady growth fueled by renovation activities and increasingly strict building energy regulations.

The foil-based radiant barrier segment led the market in 2024, capturing the largest revenue share of 56%. Foil-based radiant barriers, typically made from aluminum foil laminated to various substrates such as kraft paper, plastic films, or cardboard, are widely used due to their high reflectivity and cost-effectiveness. These products are especially popular in residential and commercial building applications where they are installed in attics, walls, and roofs to reflect radiant heat and enhance overall thermal efficiency.

On the other hand, metalized film radiant barriers are gaining traction due to their enhanced aesthetic appeal, flexibility, and resistance to tearing and corrosion. These barriers are produced by applying a thin layer of metal onto a polymer film, resulting in a lightweight yet durable material with excellent reflective properties. Metalized film radiant barriers are often used in applications that demand greater mechanical strength and moisture resistance, including industrial facilities, HVAC systems, and high-end commercial buildings.

The residential segment led the market, capturing the largest revenue share of 63% in 2024. Homeowners, especially in regions with warm climates, are turning to radiant barriers to reduce heat gain through attics and roofing systems, which in turn lowers air conditioning usage and electricity costs. The growing awareness of sustainable living practices, along with government incentives for energy-efficient home upgrades, has further fueled the adoption of radiant barrier insulation in new residential constructions as well as retrofitting projects.

The commercial segment also plays a crucial role in the radiant barrier insulation market, with usage expanding across offices, retail spaces, warehouses, and institutional buildings. Commercial facilities often require large-scale climate control solutions, and radiant barriers offer an effective way to manage internal temperatures and reduce reliance on mechanical cooling systems. Businesses are increasingly investing in energy-efficient infrastructure to comply with environmental regulations, reduce operational costs, and meet corporate sustainability goals. In large structures with expansive roofing systems, radiant barriers help maintain thermal comfort and improve HVAC efficiency.

By Product

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Radiant Barrier Insulation Market

5.1. COVID-19 Landscape: Radiant Barrier Insulation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Radiant Barrier Insulation Market, By Product

8.1. Radiant Barrier Insulation Market, by Product

8.1.1. Foil-Based Radiant Barrier

8.1.1.1. Market Revenue and Forecast

8.1.2. Metalized Film Radiant Barrier

8.1.2.1. Market Revenue and Forecast

8.1.3. Spray-On Radiant Barrier

8.1.3.1. Market Revenue and Forecast

8.1.4. Others

8.1.4.1. Market Revenue and Forecast

Chapter 9. Radiant Barrier Insulation Market, By End Use

9.1. Radiant Barrier Insulation Market, by February

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast

9.1.3. Industrial

9.1.3.1. Market Revenue and Forecast

Chapter 10. Radiant Barrier Insulation Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product

10.1.2. Market Revenue and Forecast, by February

Chapter 11. Company Profiles

11.1. Reflectix, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. DuPont de Nemours, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Owens Corning

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Kingspan Group plc

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. E. I. du Pont de Nemours and Company

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Innovative Insulation, Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Fi-Foil Company, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Roxul Inc. (now part of ROCKWOOL Group)

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Ecotherm Insulation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. AtticFoil Radiant Barrier Insulation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others