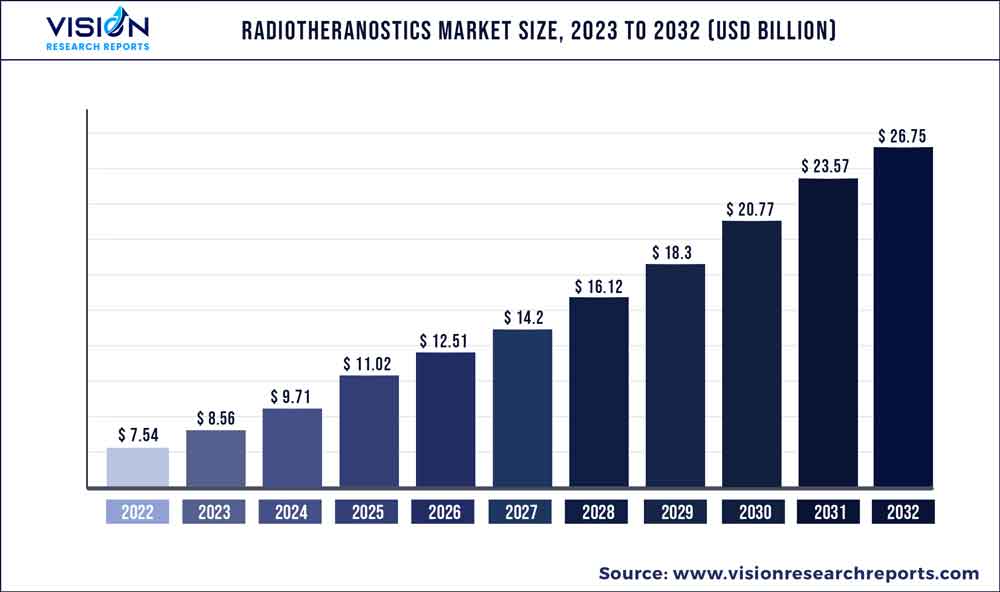

The global radiotheranostics market was valued at USD 7.54 billion in 2022 and it is predicted to surpass around USD 26.75 billion by 2032 with a CAGR of 13.5% from 2023 to 2032. The radiotheranostics market in the United States was accounted for USD 2.91 billion in 2022.

Key Pointers

Report Scope of the Radiotheranostics Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 45.46% |

| Revenue Forecast by 2032 | USD 26.75 billion |

| Growth Rate from 2023 to 2032 | CAGR of 13.5% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Progenics Pharmaceuticals, Inc. (Lantheus); Telix Pharmaceuticals Limited; ITM Radiopharma; Life Molecular Imaging.; RadioMedix; IsoTherapeutics Group, LLC; Q BioMed Inc.; Nordic Nanovector ASA; Novartis AG |

The increasing incidence of cancer coupled with an increasing adoption of injectable radiopharmaceuticals with antitumor effects is the major factor driving the global radiotheranostics market. Radiotheranostics have paved the way for novel cancer diagnostics and treatment approaches as these agents are becoming increasingly popular among healthcare professionals owing to various benefits of these agents.

Radiotheranostics is becoming increasingly important in diagnosis and treatment of wide range of diseases including cancer. Advancements in screening technology for efficient disease diagnosis, widespread application of existing products, and rising approvals of novel radiotheranostic agents are further accelerating the industry expansion. For instance, approval of agents like Lu-PSMA-617, Lu-DOTATAT have facilitated the interest in this field.

Injectable radiopharmaceuticals with antitumor effects have witnessed a rapid development in the recent years. Most of the products are already approved for human use and the more radiotheranostics are under development phase, potentially introducing novel therapeutic choices for the patients. The rising efforts from market players to develop newer route of administrations for radiotheranostic products to reduce toxicity instances is likely to cater market growth. For instance, most of these products are given by IV route, but sometimes it might present some challenge in delivering right amount of dose in patients with localized disease. Hence to overcome this the market players are developing catheter-delivered intra-arterial radiotheranostics.

Moreover, increased inclination towards precision medicine and nuclear medicine, and presence of favorable reimbursement framework for nuclear medicine diagnostics is creating momentum for the industry. For instance, majority of health insurance programs of U.S. and Centers for Medicare & Medicaid Services cover all PET through NCD which include tracers important for diagnosis of solid tumors. In addition, CMS has given certain reimbursement guidelines for radiopharmaceuticals including Tc labeled products, Iodine labeled products, and miscellaneous products.

Radioisotope Insights

The Lutetium-177 segment held the revenue share of 40.93% in 2022 and is anticipated to expand at a lucrative rate during the projected period. The growth of Lutetium-177 segment is driven by the rising availability and adoption of LU-177 product in the market. In addition, Lu-177 has a longer half-life as compare other therapeutic isotopes, which allows for a longer duration of treatment and potentially better outcomes for patients. For instance, according to Springer L-177 has a physical half-life of 6.7 days. Moreover, recent product approvals and new launches are further escalated segment expansion. For instance, in December 2022 Novartis received an EC approval for Pluvicto as a targeted radioligand therapy for management of prostate cancer.

The Gallium-68 segment is anticipated to capture a high revenue share for the market. Advancements in imaging technology, growing trend for precision diagnostics and personalized medicine has driven segment to a significant extent. For instance, Ga-68-based radiopharmaceuticals can be customized to target specific receptors on cancer cells, allowing for more personalized and effective treatment options. Some of the recently approved Ga-68 products include Illucix and Locametz.

Approach Insights

The targeted therapeutic segment expected to expand at a CAGR of 20.72% over the forecast period. The segment growth is accounted to the presence of robust investigation pipeline coupled with rising significance of radiotheranostics in cancer treatment. In addition, growing trend for nuclear medicine, recent commercialization of therapeutic products, and rising efforts from pharmaceutical companies to strengthen their supply chain are further accelerating segment uptake. For instance, in April 2023, Radiopharm Theranostics signed an agreement with TerThera for the supply of Terbium-161.

Presence of large patient base, availability of advanced imaging techniques such as PET, SPECT, and growing adoption of diagnostic isotopes in imaging modalities are driving targeted diagnostic segment. According to the World Nuclear Association Analysis 2021, the demand for radioisotopes rising by around 5% each year and around 40 million nuclear medicine procedures are performed annually. Thus, an increase in demand for radioisotopes in diagnostic modalities is pushing segment uptake.

Application Insights

The oncology segment dominated the market in 2022 with a share of 72.94%. This high share can be attributed to the high availability of oncology radiotheranostics products in space. In addition, evolving demand for developing advanced imaging tools and therapeutics solutions, recent product approvals, and anticipated product launches are expected to drive segment growth. Some of the oncology theranostics include, Pluvicto, LUTATHERA, AZEDRA, and others. The higher preference by healthcare professionals to nuclear medicine has escalated the performance of oncology radiotheranostic agents.

Moreover, increasing investment in research of novel nuclear medicine for oncology diseases is projected to contribute industry expansion. For instance, in September 2022 ITM Isotope Technologies started phase III trial of 177lu-edotreotide to evaluate the viability of the product for managing patients with neuroendocrine tumors.

The non-oncology segment is likely to grow fast during the coming years. Disease such as neurological conditions, arthritis is on the rise in recent years, so managing such conditions is creating a huge opportunity for precision diagnostic and imaging solutions. For instance, Life Molecular Imaging developed Neuraceq- a radioactive tracer to be used during PET scan of neurological conditions such as Alzheimer’s disease.

Regional Insights

North America held the largest revenue share of 45.46% in 2022 and is anticipated to capture highest revenue share in the forecast period. Rising adoption of efficient imaging technologies coupled with rising inclination towards precision medicine and robust demand for therapeutic radiopharmaceuticals are the factors driving North America radiotheranostics market. In addition, presence of large number of market players and various strategic initiatives undertaken by them is further pushing the industry in the region. For instance, in March 2023 Ratio Therapeutics Inc. announced licensing of a targeted agent used for PET imaging from Merck.

Asia Pacific is likely to exhibit a lucrative CAGR throughout the forecast period. High prevalence of cancer in the region and increasing investment in nuclear medicine space are the key factors supporting regional market growth. For instance, in March 2021 Global Medical Solutions, Ltd and BWXT Medical Ltd. announced a joint venture to produce and distribute radiopharmaceuticals and radioisotopes in the APAC region. Furthermore, an increase in procedural volumes for nuclear imaging in the region is further escalating market uptake in APAC.

Radiotheranostics Market Segmentations:

By Radioisotope

By Approach

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Radioisotope Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Radiotheranostics Market

5.1. COVID-19 Landscape: Radiotheranostics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Radiotheranostics Market, By Radioisotope

8.1. Radiotheranostics Market, by Radioisotope, 2023-2032

8.1.1 Iodine-131

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Iodine-123

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Gallium-68

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Lutetium-177

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. 18F with Y-90

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Radiotheranostics Market, By Approach

9.1. Radiotheranostics Market, by Approach, 2023-2032

9.1.1. Targeted Therapeutic

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Targeted Diagnostic

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Radiotheranostics Market, By Application

10.1. Radiotheranostics Market, by Application, 2023-2032

10.1.1. Oncology

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Non-oncology

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Radiotheranostics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.1.2. Market Revenue and Forecast, by Approach (2020-2032)

11.1.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Approach (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Approach (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.2.2. Market Revenue and Forecast, by Approach (2020-2032)

11.2.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Approach (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Approach (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Approach (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Approach (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.3.2. Market Revenue and Forecast, by Approach (2020-2032)

11.3.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Approach (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Approach (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Approach (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Approach (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.4.2. Market Revenue and Forecast, by Approach (2020-2032)

11.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Approach (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Approach (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Approach (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Approach (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.5.2. Market Revenue and Forecast, by Approach (2020-2032)

11.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Approach (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Radioisotope (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Approach (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Application (2020-2032)

Chapter 12. Company Profiles

12.1. Novartis AG

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Bayer AG

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Progenics Pharmaceuticals, Inc.( Lantheus)

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Telix Pharmaceuticals Limited.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. ITM Radiopharma

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Life Molecular Imaging.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. RadioMedix

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. IsoTherapeutics Group, LLC

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Q BioMed Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Nordic Nanovector ASA

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others