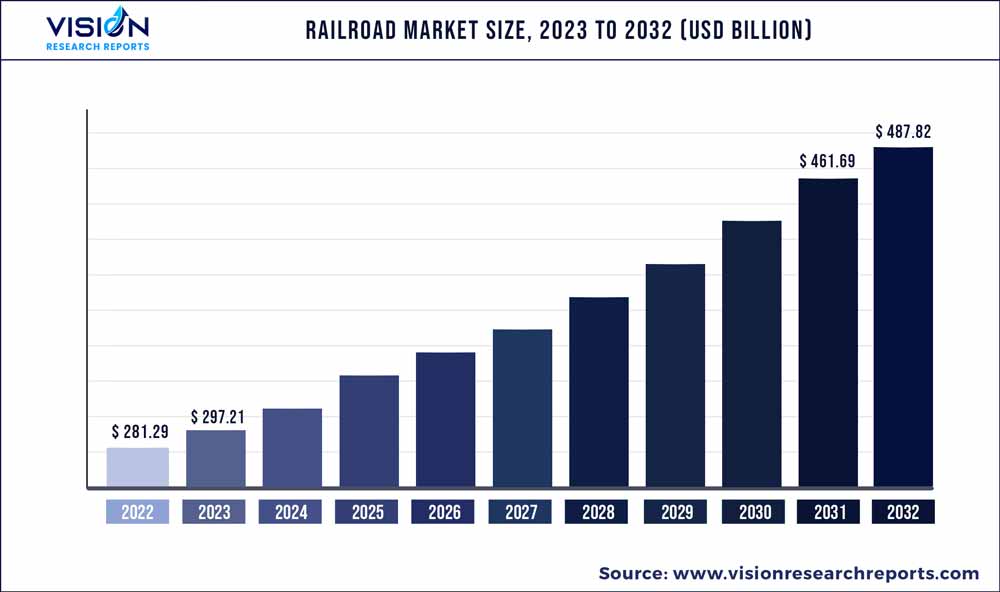

The global railroad market was surpassed at USD 281.29 billion in 2022 and is expected to hit around USD 487.82 billion by 2032, growing at a CAGR of 5.66% from 2023 to 2032.

Key Pointers

Report Scope of the Railroad Market

| Report Coverage | Details |

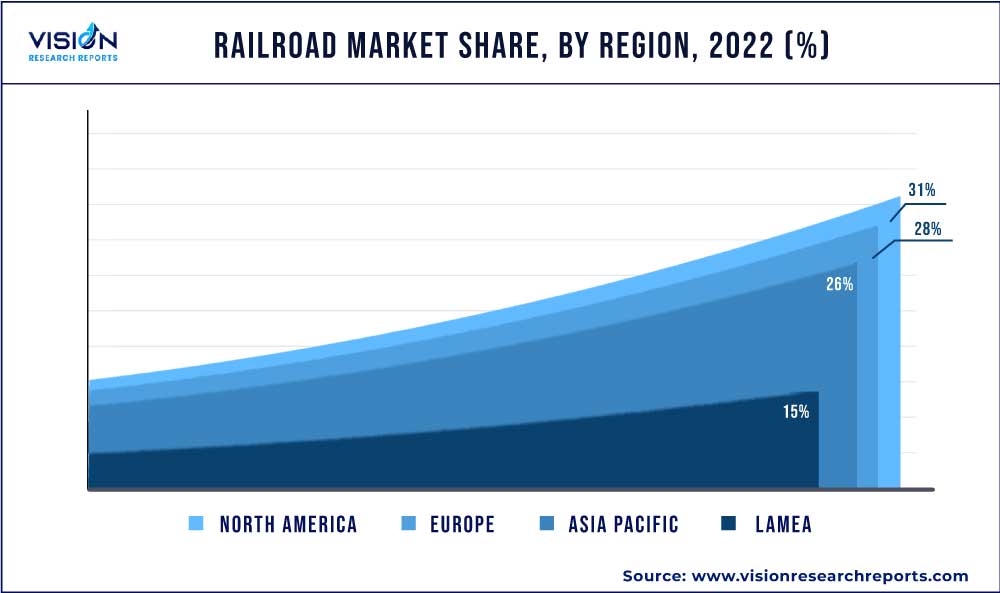

| Revenue Share of North America in 2022 | 31% |

| CAGR of Asia Pacific from 2023 to 2032 | 6.44% |

| Revenue Forecast by 2032 | USD 487.82 billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.66% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Central Japan Railway Company; SNCF Group; Union Pacific Corporation; OAO RZD (Russian Railways); BNSF Railway; Indian Railways; Deutsche Bahn; JSC Russian Railways; CSX Corporation |

The market is likely to be driven by continued investments in railway line projects and the expansion of railroad networks around the world. Several national and international railway projects, particularly in the Asia Pacific, are currently in the planning, development, or building stages, which bodes well for future market growth.

Railcar leasing has become a major trend around the world and this is predicted to have a favorable impact on railroad transportation. Depending on the nature of the cargo and the use of current technologies in railroad transportation, this mode of transporting goods is not only safer but also more cost-effective. Moreover, advancements in storage facilities and power sources, as well as improvements in transportation timings are likely to create new growth prospects for the railroad transportation industry.

The impact of the COVID-19 pandemic on the rail freight business has been mixed. North and South America saw a fall in rail freight traffic while Asia witnessed an increase. In April 2020, SNCF-France’s national state-owned railroad company-announced modifications to its operations in response to the low passenger and freight demand. It decreased TGV and Intercités services to about 10% of normal levels, while Transilien and TER services, as well as Keolis-operated transport networks, were lowered to an average of 15% to 20% of normal capacity. SNCF’s rail freight service was running at 65% of its normal capacity.

In many countries, COVID-19 led to a scarcity of truck drivers, as well as restrictions on sea and air transportation, which resulted in a dramatic increase in the cost of transportation by truck, sea, or air. The cost of rail freight, in comparison, was low, and switching to rail freight became a supply chain advantage. Over the forecast period, more investments, infrastructure expansions, and technology implementation to digitize rail freight are expected, translating to increased market growth.

Type Insights

The passenger rail segment led the market with a share of 59% of the global revenue in 2022. The segment is projected to witness growth over the coming years as the tourism industry picks up speed thanks to inexpensive passenger train fares. Furthermore, increased investments in the expansion of passenger railroad networks and the introduction of newer and faster trains, like bullet trains and metros, are likely to propel segment growth. The passenger rail segment is also expected to register the fastest growth in the forecast period.

The rail freight segment has been witnessing steady growth owing to the growing reliance on railroad routes for the transportation of goods and lower rail freight rates. Furthermore, the railroad network's strong connection facilitates the transportation of commodities in remote places that are otherwise impossible to reach by air. Even though global trade and cargo volumes were affected by the pandemic, the market is expected to recover over the projection period as freight and shipping volumes return to pre-pandemic levels.

End-use Insights

The agriculture segment held the largest share of 35% in the railroad market in terms of revenue in 2022. Stable and efficient railroad service is especially crucial for the agriculture industry. Rail transportation is essentially the only cost-effective shipping option available for low-value, bulk commodities in rural areas far from sea transit and end markets. These factors have driven the agriculture railroad segment in the past. In India, the robust Indian railway network connects small farmers from the remotest parts of the country to the mainstream market, where they can sell their agricultural produce.

The mining segment is expected to register the fastest CAGR of 5.93% over the forecast period to overtake the agriculture segment in terms of market size by 2032. Monorail systems are being increasingly employed in coal and ore mines because of their efficiency and cheap running costs. Monorail systems are quickly becoming essential components in all mining projects where transportation systems have been optimized and where road and rail transportation can be combined. Looking to capitalize on the opportunities in freight transportation, the Indian Railways has been mapping mining districts across the country to connect them with the railroad network.

Regional Insights

North America held the largest market share of just over 31% in 2022 and is expected to retain its lead throughout the forecast period. Freight rail is a pillar of the American economy, according to the Association of American Railroads, and the U.S. is home to a world-class freight rail network. The growth of freight rail in the country can be linked to continued investments in the enhancement of equipment, infrastructure, and technology. Passenger railroad services in the region are driven by rising consumer demand, increased passenger safety measures, and technological as well as operational advancements.

Asia Pacific is expected to register the fastest CAGR of 6.44% from 2023 to 2032 due to increased government investments in new railroad construction and the high reliance of the population on rail transport. For example, Timetric's Construction Intelligence Center (CIC) shows that the Asia Pacific leads the world in railroad investment. It is also the world's largest transport infrastructure market, with PwC forecasting annual spending of about USD 900 billion by 2025. Apart from this, increased imports and exports from Asian countries are predicted to boost market growth.

Railroad Market Segmentations:

By Type

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Railroad Market

5.1. COVID-19 Landscape: Railroad Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Railroad Market, By Railroad

8.1. Railroad Market, by Railroad, 2023-2032

8.1.1. Rail Freight

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Passenger Rail

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Railroad Market, By End-use

9.1. Railroad Market, by End-use, 2023-2032

9.1.1. Mining

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Construction

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Agriculture

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Railroad Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.1.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.1.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.1.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.2.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.2.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.2.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.2.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.2.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.3.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.3.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.3.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.3.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.4.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.4.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.4.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.4.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.5.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Railroad (2020-2032)

10.5.4.2. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 11. Company Profiles

11.1. Central Japan Railway Company

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. SNCF Group

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Union Pacific Corporation

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. OAO RZD (Russian Railways)

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. BNSF Railway

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Indian Railways

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Deutsche Bahn

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. JSC Russian Railways

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. CSX Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others