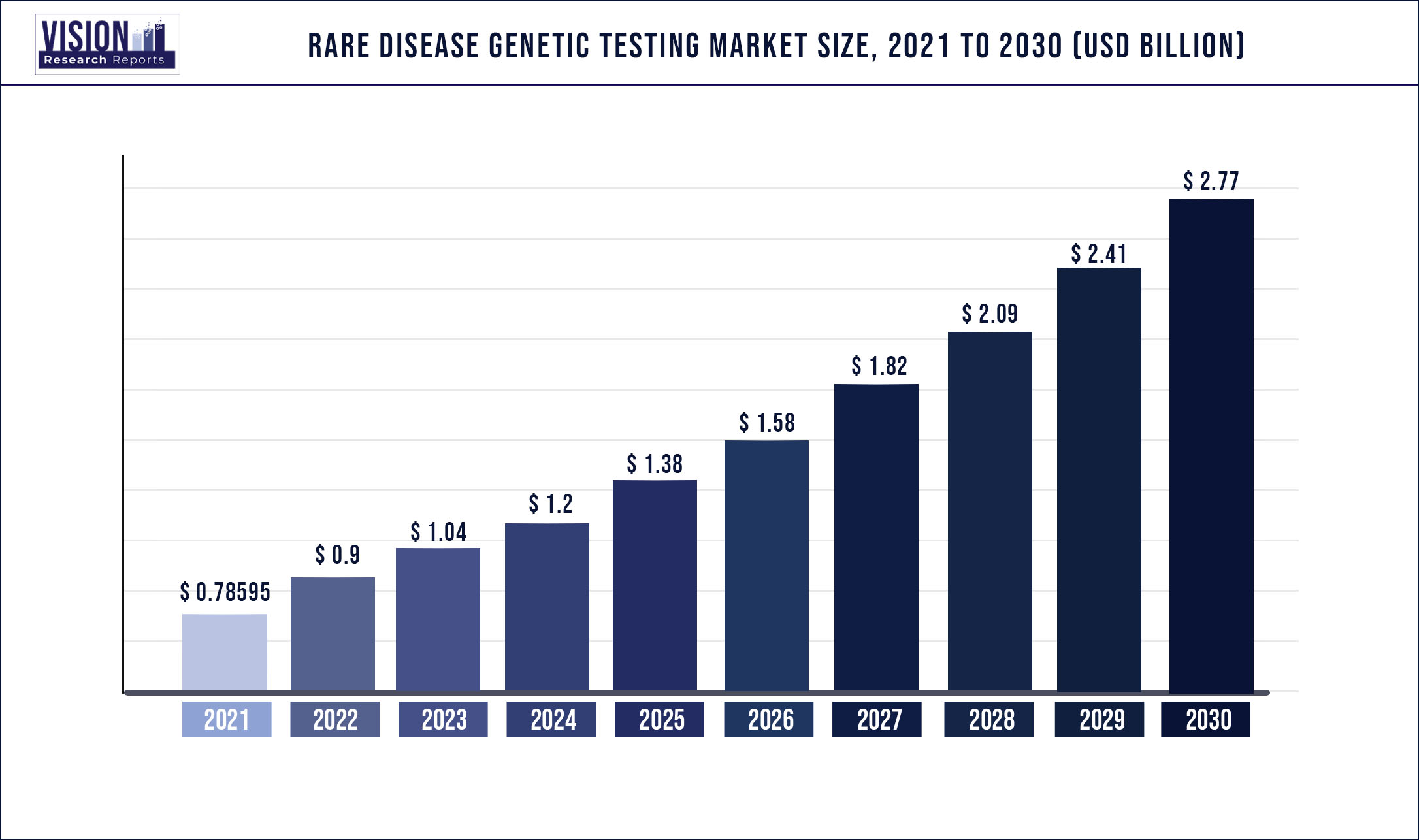

The global rare disease genetic testing market was valued at USD 785.95 million in 2021 and it is predicted to surpass around USD 2.77 billion by 2030 with a CAGR of 15.02% from 2022 to 2030

Report Highlights

Effective regulatory plans to combat rare disease is one of the key drivers of the industry. Furthermore, the presence of a substantial number of registries that provide data and relevant information about related diseases has aided in revenue growth over the past years. Ongoing conferences to raise awareness about rare and ultra-rare conditions are anticipated to boost the adoption of diagnostic kits and services. For instance, Ergomed and PSR Orphan Experts, with their offices in the U.K., Germany, the Netherlands, Poland, and other countries, participate in various activities that are aimed at raising awareness in this area.

Moreover, the Canadian Organization for Rare Disorders (CORD) offers a strong platform to streamline health policy and a healthcare system that is dedicated to the management of patients with disorders. The agency works with clinicians, researchers, governments, and the diagnostic industry to advance R&D, diagnosis, treatment, and service availability for all rare conditions in the country. As per the National Institutes of Health (NIH), around 30 million Americans have been identified with one of 7,000+ known rare diseases. The number of patients undergoing disease testing is expected to increase in the coming years with growing awareness. The U.S. celebrates Rare Disease Day and promotes developments in this area by raising awareness.

In addition, the presence of the Rare Diseases Clinical Research Network (RDCRN), an NIH-funded research network of 23 active consortia or research groups that includes patients, researchers, and clinicians who are focused on the diagnosis & treatment of disorders is anticipated to positively impact the industry. Amidst the COVID-19 pandemic, patients with undiagnosed and rare diseases have been facing significant health challenges. According to a study published in January 2021 by a group of researchers from the U.S., there is an urgent need for the development of approaches that can reduce the serious challenges affecting Rare & Undiagnosed diseases (RUD) patients and families. The challenges include diagnostic and/or prognostic uncertainty coupled with medical complexity leading to poor health outcomes.

In response to the challenges created by the pandemic, patient support groups and professional societies are actively involved in addressing these challenges. For instance, the Rare Chromosome Support Group (Unique), the British Society for Genomic Medicine, and Genetic Alliance U.K. are actively involved in supporting, advocating, and providing information to patients with diseases. Several rare conditions remain unclassified. The charity SWAN U.K. estimated that around 6,000 children are born each year with genetic conditions in the U.K. As per the agency, the conditions are extremely rare and cannot be named. Thus, there is a lack of proper diagnosis and prognosis for evidence-based treatment. At present, around 50% of the children who undergo genetic testing in the U.K. would not receive a confirmed diagnosis.

Around 50% of the children with learning disabilities and approximately 60% of children with congenital conditions do not receive a definitive diagnosis to identify the cause of their disabilities. Furthermore, the lack of awareness among patients and families about diagnosis and genetic testing has further impeded the industry's growth. North America dominated the industry in 2021 due to the high incidence of rare diseases, a large number of registries, the presence of substantial numbers of R&D facilities in this area, and extensive investments in diagnosis. Asia Pacific is expected to register the fastest CAGR during the forecast years owing to the presence of a substantial number of organizations that are focusing on disease management.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 785.95 million |

| Revenue Forecast by 2030 | USD 2.77 billion |

| Growth rate from 2022 to 2030 | CAGR of 15.02% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Disease type, specialty, technology, end-use, region |

| Companies Covered | Quest Diagnostics, Inc.; Centogene N.V.; Invitae Corp.; 3billion, Inc.; Arup Laboratories; Eurofins Scientific; Strand Life Sciences; Ambry Genetics; Perkin Elmer, Inc.; Macrogen, Inc.; Baylor Genetics; Color Genomics, Inc.; Health Network Laboratories; PreventionGenetics; Progenity, Inc.; Coopersurgical, Inc.; Fulgent Genetics Inc.; Myriad Genetics, Inc.; Laboratory Corporation Of America Holdings; Opko Health, Inc.; Artemis DNA |

Disease Type Insights

The endocrine & metabolism diseases segment is expected to register the fastest growth rate of more than 19.9% during the forecast period. In recent years, the understanding of molecular and genetic causes of endocrine diseases, such as Cushing’s syndrome, has increased considerably. This boosts the adoption of genetic testing for endocrine diseases. Furthermore, the identification of inherited mutations in patients with the primary pigmented nodular adrenocortical disease and bilateral macronodular adrenal hyperplasia is anticipated to accelerate advancements in tools for genetic testing for early disease detection. The immunological disorders segment accounted for the second-highest revenue share.

Immunologic disorders, such as Multiple Sclerosis (MS), are among the most prevalent rare diseases. The genetic profile of MS is one of the key focus areas among researchers operating in this area. This is primarily to obtain relevant insights into the causes and underlying physiology of diseases. Furthermore, organizations, such as the Australian and New Zealand MS Genetics Consortium (ANZGene) that bring together molecular biologists, neurologists, geneticists, and bioinformaticians operating in this space to collaborate on research projects are anticipated to positively influence the segment growth.

Technology Insights

The Next-Generation Sequencing (NGS) technology segment dominated the global industry in 2021 and accounted for the maximum share of more than 35.51% of the overall revenue. Wide availability and adoption of NGS-based gene panels for cancer, neurologic disease, cardiovascular disease, pediatric conditions, psychiatric disorders, and other related disease testing have driven the segment. Strategic activities by key players are estimated to further drive the segment over the forecast period. For instance, in June 2022, Avesthagen Ltd. formed a strategic alliance with Wipro Ltd. for the commercialization of its genetic testing offerings.

The portfolio comprises genome panels providing highly précised, disease-centric analysis for diseases including autoimmune disorders, neurodegenerative diseases cancers, and rare diseases.WES is considered a high-potential genetic testing method in the case where the genetic cause of a rare disease is unknown and difficult to identify. WES is becoming the standard of care for patients with undiagnosed rare diseases. Exons make up around 1.5% of an individual’s genome and contain 85% of all known disease-causing mutations. Thus, WES plays a crucial role in obtaining insights into protein making and disease physiology.

Specialty Insights

Based on specialties, the global industry has been further categorized into molecular genetic tests, chromosomal genetic tests, and biochemical genetic tests. The molecular genetic tests specialty segment dominated the global industry in 2021 and accounted for the highest share of more than 41.03% of the global revenue. The segment will retain its dominant position growing at the fastest CAGR during the forecast period. Rapid technological advancements and expertise in handling & managing high throughput technologies within clinical settings are factors expected to boost the segment growth.

Molecular genetic tests enable investigating single genes or short lengths of DNA for the detection of mutations or variations leading to genetic disorders. Molecular testing is not only limited to rare diseases but also covers testing of ultra-rare diseases. Genome sequencing is the most advanced unbiased testing method and is readily available for both research and clinical settings. This is primarily on account of the declining costs of sequencing tests along with the continuous development of next-generation sequencing-based new tests.

End-use Insights

The research laboratories & CROs segment led the global industry in 2021 and accounted for the highest share of more than 46.93% of the overall revenue. Laboratories are the key end-users; in the majority of cases, blood samples collected from patients are sent to a laboratory for testing. Laboratories offer testing based on various specialties, including molecular genetic tests, chromosomal genetic tests, and biochemical genetic tests. Moreover, molecular genetic testing-based laboratory testing is rapidly increasing worldwide. Genetic tests are conducted by multiple laboratories, including those that are accredited with CLIA for clinical cytogenetics, pathology, and chemistry among other specialties.

The diagnostic laboratories segment is expected to register the fastest CAGR over the study period. The reason for its growth is the rising number of partnership and collaboration activities of diagnostic laboratories with genetic testing companies. In November 2021, Genomenon and Alexion, AstraZeneca Rare Disease announced a strategic collaboration projected to make important information for the treatment and diagnosis of rare diseases more readily available. The goal of the collaboration is to empower the genetic testing laboratories with the data they need for the diagnosis of rare diseases.

Regional Insights

Based on geographies, the industry has been further categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America dominated the global industry with a share of more than 47.43% in 2021. The major share of the region can be attributed to the high incidence of rare diseases, a large number of disease registries, the presence of a substantial number of R&D facilities for ultra-rare diseases, and extensive investments in the diagnosis of disease. On the other hand, Asia Pacific is estimated to be the fastest-growing region during the forecast years.

This is mainly owing to the increase in awareness and diagnosis abilities. Furthermore, the introduction of policies and frameworks to promote disease management will offer lucrative opportunities in this region. For instance, in India, in March 2021, an inclusive National Policy for Rare Diseases was permitted by the Ministry of Health & Family Welfare. In addition, in 2017, a hospital-based National Registry for Rare Diseases was originated by the Indian Council of Medical Research by involving the centers across the country, which are involved in the management and diagnosis of rare diseases.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Rare Disease Genetic Testing Market

5.1. COVID-19 Landscape: Rare Disease Genetic Testing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Rare Disease Genetic Testing Market, By Disease Type

8.1. Rare Disease Genetic Testing Market, by Disease Type, 2022-2030

8.1.1. Neurological Disease

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Immunological Disorders

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Hematology Diseases

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Endocrine & Metabolism Diseases

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Cancer

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Musculoskeletal Disorders

8.1.6.1. Market Revenue and Forecast (2017-2030)

8.1.7. Cardiovascular Disorders (CVDs)

8.1.7.1. Market Revenue and Forecast (2017-2030)

8.1.8. Dermatology Disease

8.1.8.1. Market Revenue and Forecast (2017-2030)

8.1.9. Others

8.1.9.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Rare Disease Genetic Testing Market, By Technology

9.1. Rare Disease Genetic Testing Market, by Technology e, 2022-2030

9.1.1. Next-Generation Sequencing (NGS)

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Array Technology

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. PCR-based Testing

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. FISH

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Sanger Sequencing

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Karyotyping

9.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Rare Disease Genetic Testing Market, By Specialty

10.1. Rare Disease Genetic Testing Market, by Specialty, 2022-2030

10.1.1. Molecular Genetic Tests

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Chromosomal Genetic Tests

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Biochemical Genetic Tests

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Rare Disease Genetic Testing Market, By End-Use

11.1. Rare Disease Genetic Testing Market, by End-Use, 2022-2030

11.1.1. Research Laboratories & CROs

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Hospitals & Clinics

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Diagnostic Laboratories

11.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Rare Disease Genetic Testing Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.1.2. Market Revenue and Forecast, by Technology (2017-2030)

12.1.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.1.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.1.5.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.1.6.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.2.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.2.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.2.5.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.2.6.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.2.7.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.2.8.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.3.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.3.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.3.5.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.3.6.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.3.7.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.3.8.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.4.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.4.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.4.5.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.4.6.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.4.7.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.4.8.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.5.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.5.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.5.5.4. Market Revenue and Forecast, by End-Use (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Disease Type (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Specialty (2017-2030)

12.5.6.4. Market Revenue and Forecast, by End-Use (2017-2030)

Chapter 13. Company Profiles

13.1. Quest Diagnostics Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Centogene N.V.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Invitae Corp.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. 3billion, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Arup Laboratories

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Eurofins Scientific

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Strand Life Sciences

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Ambry Genetics

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Perkin Elmer, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Realm IDX, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others