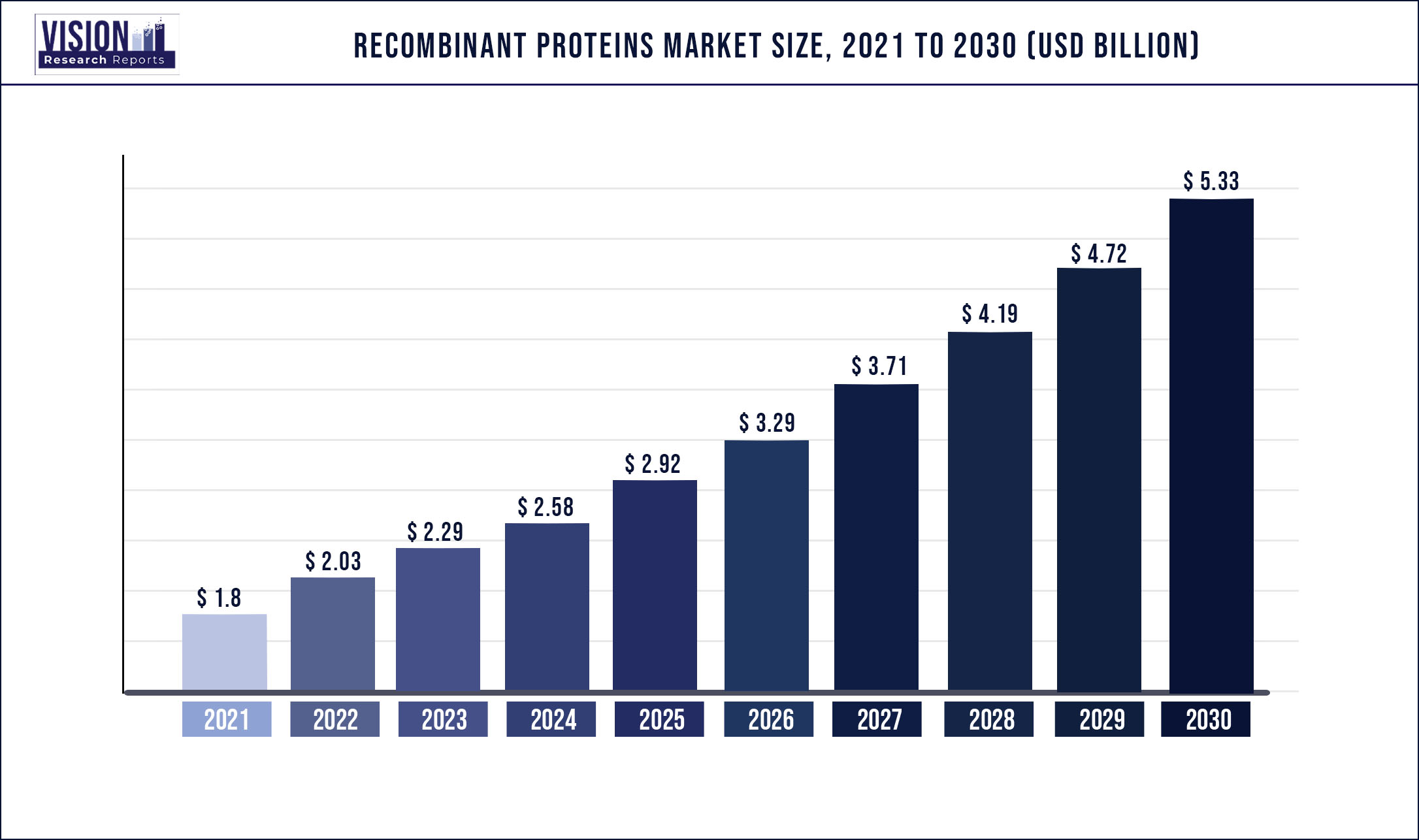

The global recombinant proteins market size was estimated at around USD 1.8 billion in 2021 and it is projected to hit around USD 5.33 billion by 2030, growing at a CAGR of 12.82% from 2022 to 2030.

Report Highlights

Diseases like multiple sclerosis, neutropenia, cerebral apoplexy, anemia, and others, as well as dwarfism, are becoming more common, which is driving up the demand for recombinant protein drugs. Furthermore, the industry is anticipated to expand due to the increased development and research on biologics, which, in turn, are significantly boosting global industry growth. The focus on the development of biosimilars, biologics, and recombinant proteins has increased owing to a rise in the incidence and prevalence of cancer and the expansion of research & development activity.

According to the American Cancer Society, in 2022, there will be 1.9 million new cancer cases and 609,360 cancer-related deaths. In addition, the expanding application of recombinant proteins in clinical diagnostic methods including ELISA, Western Blotting, and Immunohistochemistry (IHC) is anticipated to fuel market expansion. Due to factors including rising R&D spending, an increase in the number of cancer patients, and the desire for novel & tailored therapies, the global industry is anticipated to expand significantly during the forecast period. Research activity in recombinant protein space has increased in response to the COVID-19 pandemic as a result of efforts to comprehend the dynamics of the virus. The production of recombinant proteins has increased significantly, along with tailored treatment.

In addition, research funding is predicted to become more readily available along with an increase in demand for and production of recombinant proteins, particularly those immune response proteins associated with COVID-19. Therefore, positive effects have been seen for the companies offering products specifically made for COVID-19. Recombinant protein is viewed as a modified version of natural protein that can be produced in a number of ways to improve protein output, create useful commercial goods, and alter gene sequences. The main drivers of the global industry are the rise in pharmaceutical firms’ R&D expenditures, high incidence of chronic illnesses, an increase in the number of regulatory requirements, and the ongoing need to reduce viral infections.

Over the projected period, the global industry is anticipated to be driven by technological advancements in the synthesis of recombinant proteins. For instance, in June 2022, according to the data produced by the National Center for Biotechnology Information, new breeding techniques, such as CRISPR/Cas9, TALEN, and Zinc Finger mediated, as well as transgenic or cis-genic techniques, are emerging technologies that may make it easier for in vitro genetic editing or manipulation of the genes to be approved. In addition, industry participants are anticipated to invest in the region due to the aging population, rising income levels, better healthcare infrastructure, rising healthcare spending, and the advantages of low-cost manufacturing in developing nations, thereby propelling market growth.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1.8 billion |

| Revenue Forecast by 2030 | USD 5.33 billion |

| Growth rate from 2022 to 2030 | CAGR of 12.82% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product & services, application, end-user, host cell, region |

| Companies Covered |

Abcam plc; Sino Biological, Inc.; R&D Systems, Inc.; GenScript; Bio-Rad Laboratories, Inc.; Merck KGaA; Thermo Fisher Scientific; Proteintech Group, Inc.; Enzo Life Sciences, Inc.; Abnova Corp.; RayBiotech Life Inc.; STEMCELL Technologies Inc. |

Product & Services Insights

The product segment dominated the global industry in 2021. The segment accounted for the highest share of more than 65.8% of the overall revenue in the same year. The segment is anticipated to expand further at the second-fastest growth rate maintaining the leading position throughout the forecast period. The growth of this segment is a result of the extensive product usage in the fields of cancer, HIV/AIDS, COVID-19, immunology, and neuroscience, among others. Furthermore, growth factors and cytokines play a significant role in cancer research.

Study regarding the usage of growth factors in the treatment of cancer has improved the understanding and has given rise to new goals for chemotherapy. In addition, the need for recombinant protein products in regenerative medicine as well as rising financing for research & development in the fight against cancer are driving up the demand across the globe. On the other hand, the services segment has been estimated to register the fastest growth rate during the forecast period.

Application Insights

The therapeutics segment dominated the global industry in 2021 and accounted for the maximum share of more than 33.95% of the overall revenue. The segment is also estimated to register the fastest growth rate during the forecast period. The demand for protein-based treatment is anticipated to rise as the prevalence of diseases, such as metabolic disorders, cancer, genetic disorders, and immune diseases rises. In addition, cancer is one of the leading causes of mortality globally, and the World Health Organization (WHO) predicts a significant rise in cancer cases in the coming years.

As a result, it is projected that the industry for therapeutics would experience growth. On the other hand, protein therapeutics offer highly effective treatments for illnesses like diabetes, cancer, infectious disorders, hemophilia, and anemia. As per the International Diabetes Federation, 537 million persons (20-79 years old) are estimated to have diabetes in 2021. According to projections, there would be 643 million diabetics worldwide by 2030 and 783 million by 2045. With such growth in the diabetic population, the demand for recombinant proteins in the therapeutics segment is likely to show lucrative growth in the coming years.

Host Cell Insights

On the host cells, the global industry has been further categorized into mammalian systems, insect cells, yeast & fungi, bacterial cells, and others. The mammalian host cell segment dominated the global industry in 2021 and accounted for the highest revenue share of more than 41.8% of the overall revenue. The segment is estimated to expand further at the fastest growth rate maintaining its leading industry position throughout the forecast period. Mammalian protein expression is becoming increasingly popular as the market for proteomics & biologics expands.

Since they are provided easily, protein expression systems are simple to include in high throughput systems for effective biologics and proteomics investigations. Moreover, the focus on producing biopharmaceutical goods has increased as a result of factors, such as the rising incidence and prevalence of cancer and rising research & development (R&D) efforts, which are driving the industry expansion. The bacterial cells segment is estimated to register the second-fastest growth rate during the forecast period.

End-user Insights

The pharma & biotech companies segment captured the highest revenue share in 2021. The segment is estimated to expand further at the fastest CAGR during the forecast period retaining its leading position. The inclination toward biologics and biosimilars has resulted in a cascade of multi-million investments by the bio-manufacturers in R&D for growing the pipeline of products, devising new technologies, and advancing bioprocessing tools. The increasing demand, rising competition among players, and various applications by end-users have also attributed to the advancements in recombinant protein products.

In addition, the R&D sector also witnessed increased investments in terms of collaboration & partnerships between academia and industries. For example, Pfizer’s Center for Therapeutic Innovation (CTI) is a platform for collaboration within the healthcare ecosystem. CTI actively collaborates with academic institutes and investigators to tackle the challenges using Pfizer’s concepts. Collaborations like these fuel the drug development research and potential therapies for patients eventually propelling the industry growth.

Regional Insights

North America dominated the global industry in 2021 and accounted for the maximum share of more than 33.9% due to the rising research spending, availability of healthcare infrastructure, and presence of a number of industry players. In addition, recombinant proteins are one of the tested treatments for such disorders, therefore the chronic diseases that are spreading throughout the region are producing high demand for recombinant protein therapies. As per the GLOBOCAN estimates, in Mexico, in 2020, there were 90,222 cancer-related deaths and 1,95,499 newly diagnosed cancer cases.

To combat the pandemic, a number of major pharmaceutical companies in the U.S. have made investments in recombinant DNA technology and proteins. In April 2020, Sanofi & GSK collaborated on the development of vaccines using GSK’s additive technique as well as Sanofi’s recombinant S-protein COVID-19 antigens. In addition, several acquisitions are taking place to advance R&D for the production of recombinant proteins. The Asia Pacific region is also expanding due to an increase in public and private funding for research and development for recombinant protein studies, favorable government regulations, and the rising prevalence of target diseases with an aging population. In addition, the development of advanced techniques in proteomic and genomic research is propelling the region’s growth.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Recombinant Proteins Market

5.1. COVID-19 Landscape: Recombinant Proteins Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Recombinant Proteins Market, By Product & Services Scope

8.1. Recombinant Proteins Market, by Product & Services Scope, 2022-2030

8.1.1. Product

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Production Services

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Recombinant Proteins Market, By Application Scope

9.1. Recombinant Proteins Market, by Application Scope, 2022-2030

9.1.1. Drug Discovery & Development

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Therapeutics

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Research

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Recombinant Proteins Market, By End-user Scope

10.1. Recombinant Proteins Market, by End-user Scope, 2022-2030

10.1.1. Pharma & Biotechnology Companies

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Academic & Research Institutes

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Diagnostic Laboratories

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Recombinant Proteins Market, By Host Cell Scope

11.1. Recombinant Proteins Market, by Host Cell Scope, 2022-2030

11.1.1. Mammalian Systems

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Insect Cells

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Yeast & Fungi

11.1.3.1. Market Revenue and Forecast (2017-2030)

11.1.4. Bacterial Cells

11.1.4.1. Market Revenue and Forecast (2017-2030)

11.1.5. Others

11.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Recombinant Proteins Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.1.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.1.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.1.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.1.5.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.1.5.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.1.6.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.1.6.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.2.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.2.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.2.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.2.5.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.2.5.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.2.6.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.2.6.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.2.7.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.2.7.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.2.8.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.2.8.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.3.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.3.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.3.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.3.5.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.3.5.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.3.6.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.3.6.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.3.7.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.3.7.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.3.8.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.3.8.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.4.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.4.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.4.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.4.5.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.4.5.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.4.6.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.4.6.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.4.7.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.4.7.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.4.8.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.4.8.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.5.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.5.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.5.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.5.5.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.5.5.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product & Services Scope (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Application Scope (2017-2030)

12.5.6.3. Market Revenue and Forecast, by End-user Scope (2017-2030)

12.5.6.4. Market Revenue and Forecast, by Host Cell Scope (2017-2030)

Chapter 13. Company Profiles

13.1. Abcam plc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Sino Biological, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. R&D Systems, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. GenScript

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Bio-Rad Laboratories, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Merck KGaA

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Thermo Fisher Scientific

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Proteintech Group, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Enzo Life Sciences, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Abnova Corp.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others