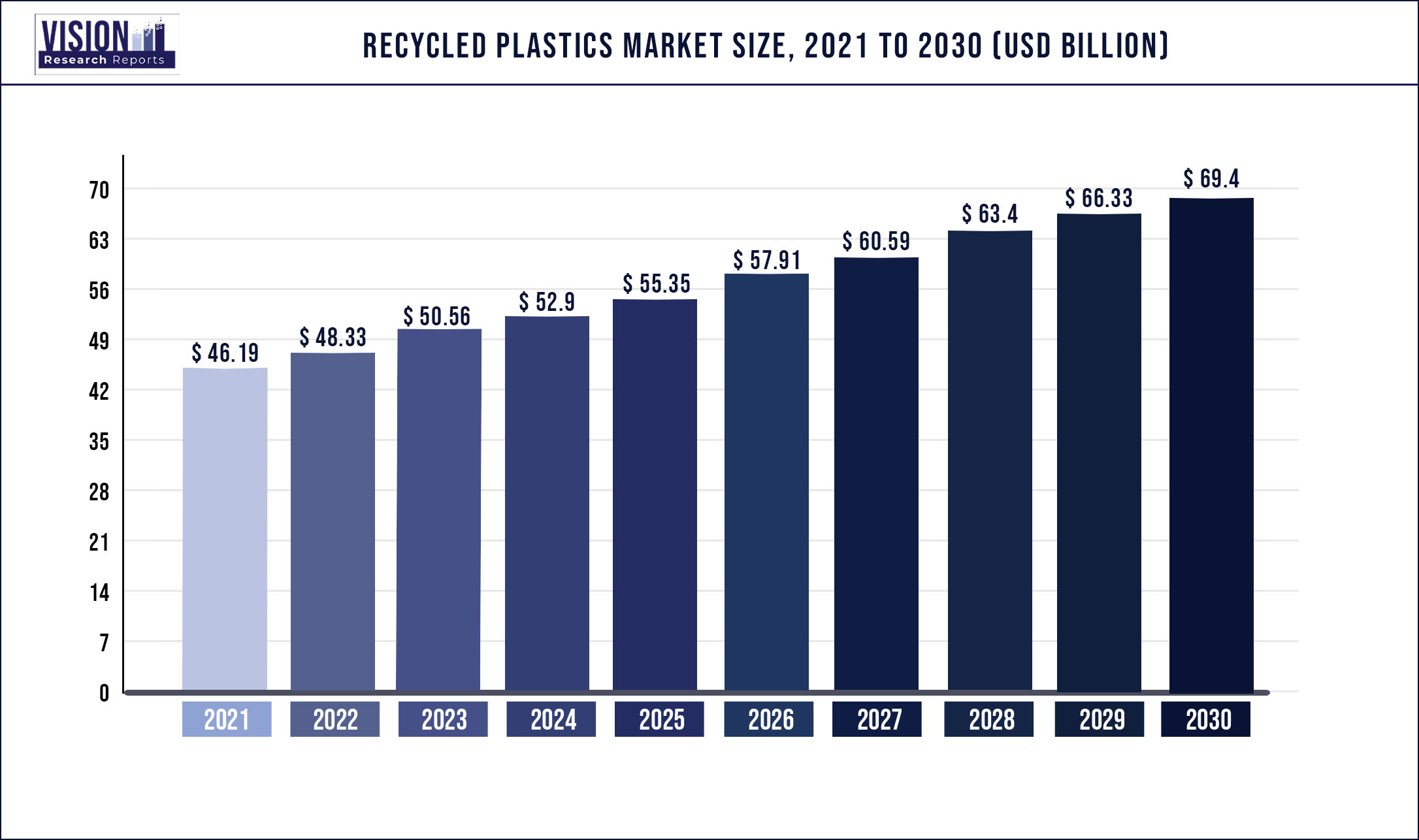

The global recycled plastics market was estimated at USD 46.19 billion in 2021 and it is expected to surpass around USD 69.4 billion by 2030, poised to grow at a CAGR of 4.63% from 2022 to 2030.

Report Highlights

Increasing environmental concerns, rapid urbanization & industrialization, and the rising need to reduce the carbon footprint in the manufacturing of virgin plastic resin are expected to drive the demand for recycled plastics over the forecast period. The demand for recycled plastics is expected to increase mainly in the packaging application, which includes packaging of processed food & beverages, medical, electronics, and various other products, owing to the growing number of COVID-19 positive cases.

The demand for medical & healthcare products has increased owing to the safety and hygiene required to tackle the pandemic situation. Amid the global COVID-19 pandemic, the demand for electrical & electronic products, such as laptops and mobiles, has increased as companies are following the work-from-home model and educational institutions have shifted from classroom learning to online classes. Thus, the growth in the demand for electrical & electronic products is expected to drive the market over the forecast period. The regional market of Asia Pacific is anticipated to register the fastest growth rate during the forecast period.

This growth can be attributed to various factors, such as the presence of supportive government initiatives like Make in India, Atmanirbhar Bharat (self-dependent India), rising number of manufacturers operating in the electrical & electronics, automotive, and textile industries, and increasing R&D investments by private as well as public organizations for the development of new applications for recycled plastics. In addition, various electronic products and automotive components manufacturing companies have started looking toward India for establishing their manufacturing facilities post-COVID-19 pandemic. This will also provide tremendous growth opportunities to the regional market in the years to come.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 46.19 billion |

| Revenue Forecast by 2030 | USD 69.4 billion |

| Growth rate from 2022 to 2030 | CAGR of 4.63% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, source, application, region |

| Companies Covered | REMONDIS SE & Co. KG; Biffa; Stericycle; Republic Services, Inc.; WM Intellectual Property Holdings, LLC; Veolia; Shell International BV; Waste Connections; Clean Harbors, Inc.; Covetsro AG |

Product Insights

Based on products, the market has been divided into Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), and others. The Polyethylene (PE) product segment led the market and accounted for more than 31.2% share of the global revenue in 2021. This high share is attributed to the rising demand for packaging material in consumer goods, food & beverage, industrial, and various other industries. In addition, it is commonly used in laundry detergent packaging, milk cartons, cutting boards, and garbage bins, among various other applications.

Polypropylene (PP) is extensively used in manufacturing automotive components, packaging & labeling, medical devices, and diverse laboratory equipment owing to its excellent chemical and mechanical properties. It is resistant to several chemical solvents, acids, and bases and has excellent mechanical strength. It is also among the most widely formulated plastics across the globe. In addition, components produced using PP are fatigue resistant, which is beneficial in the building & construction industry for producing plastic hinges, piping systems, consumer-grade daily-use products, manufacturing mats, and carpets & rugs among various other applications. The growth of the automotive, packaging, building & construction industries is expected to drive the demand for recycled PP over the forecast period.

Source Insights

Based on sources, the global market has been further segmented into plastic bottles, plastic films, polymer foam, and others. The plastic bottles source segment led the market and accounted for more than 74.15% share of the global revenue in 2021. Plastic bottles are the major source of recycled products. Plastic bottles are used in various applications across several industries, such as in the packaging of water, oils, pharmaceuticals, and carbonated drinks. SKS Bottle & Packaging, Inc., CABKA Group, Maynard & Harris Plastics, and Placon are some of the key recycled plastic bottle manufacturers. The polymer foam source segment includes packaging foam and sheets, which are widely used in impact-resistant packaging solutions.

Expanded Polystyrene (EPS) is the most commonly used polymer foam in the packaging industry. A number of automobile and electrical & electronics manufacturers, such as Panasonic Corporation, SONY Electronics Inc., Ltd.; Hitachi, Ltd.; and Honda Motor Company Ltd., are moving towards the adoption of recycled plastics foam over virgin polymer foam.

Application Insights

The packaging application segment led the market in 2021 and accounted for more than a 36.2% share of the global revenue. This high share is attributable to the rising demand for packaged foods & beverages, electrical & electronics, and textiles. Personal hygiene products, such as electric trimmers and shavers, along with automotive components and clothing products manufactured from recycled plastics are the major application areas that are driving the segment growth. Asia Pacific is characterized by the growing packaging industry and technological advancements in the industry. The growth of the packaging industry in the region is driven by the high demand for building & construction products, consumer goods, and electrical & electronics, especially from China, India, and Southeast Asia.

In addition, a flexible regulatory environment is expected to offset constraints that are usually evident in the Western markets. Asia Pacific will witness immense growth owing to the rising electronics expenditure in countries, such as China, India, and Japan. In addition, the presence of various electronic product manufacturers, including ASE Electronics Malaysia, Foxconn Technology Group, Honeywell International Inc., SAMSUNG, Lenovo, and Bajaj Electronics, which are involved in R&D activities will propel the industry growth over the forecast period. Rising environmental concerns among consumers coupled with the government policies, such as the “Swachh Bharat Mission” are anticipated to fuel the demand for recycled plastics in the country.

Growing packaging, automotive, and construction industries in the country are further propelling the product demand. According to the Organisation Internationale des Constructeurs d’Automobiles (OICA), the automobile production in India was 4.5 million units in 2019, a decline of 12.2% as compared to that in 2018. The drop in the production of automobiles was due to the global economic slowdown and decline in demand from other countries, which is now recovering at a significant rate. Moreover, the growing production of Electric Vehicles (EVs) in the country is anticipated to generate high product demand over the forecast period.

According to the Plastic Waste Management Institute (PMMI), the country’s plastic recycling rate is 84%, the highest in Asia Pacific. The most common plastic waste generated in the country includes Polyethylene (PE), Polypropylene (PP), Polystyrene (PS), and Polyvinyl Chloride (PVC). The country recycles 23% of the plastic waste through mechanical recycling, 4% through chemical recycling, and the rest through thermal recycling by burning the plastic to produce energy.

Regional Insights

Asia Pacific dominated the market and accounted for over 47.3% share of global revenue in 2021. The Asia Pacific construction industry is expected to witness considerable growth owing to the increasing demand for non-residential construction projects, such as hospitals, schools, and colleges. This will drive the product demand for the roofing tiles, insulation, fences, floor tiles, carpets, and various other construction applications. Europe ranks second in terms of revenue after Asia Pacific. The market is driven by the adoption of a circular economy to reduce the carbon footprint associated with the conventional method of plastic production.

Landfill bans have resulted in the positive growth of plastic recycling in European countries. As landfill taxes in some European countries are extremely high, dumping sometimes becomes more expensive than plastic recycling. This scenario is encouraging plastic recycling. North America ranks third in terms of revenue. The market is driven by the growth of the major end-use industries, such as electrical & electronics, construction, and packaging. The rising demand for packaged & processed foods and the rapidly growing construction industry in the U.S., Mexico, and Canada are also anticipated to augment the market growth over the forecast period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Recycled Plastics Market

5.1. COVID-19 Landscape: Recycled Plastics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Recycled Plastics Market, By Product

8.1. Recycled Plastics Market, by Product, 2022-2030

8.1.1 Polyethylene (PE)

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Polyethylene Terephthalate (PET)

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Polypropylene (PP)

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Polyvinyl Chloride (PVC)

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Polystyrene (PS)

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Recycled Plastics Market, By Source

9.1. Recycled Plastics Market, by Source, 2022-2030

9.1.1. Plastic Bottles

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Plastic Films

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Polymer Foam

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Recycled Plastics Market, By Application

10.1. Recycled Plastics Market, by Application, 2022-2030

10.1.1. Building & Construction

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Packaging

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Electrical & Electronics

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Textiles

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Automotive

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Recycled Plastics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.2. Market Revenue and Forecast, by Source (2017-2030)

11.1.3. Market Revenue and Forecast, by Application (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Source (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Source (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.2. Market Revenue and Forecast, by Source (2017-2030)

11.2.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Source (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Source (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Source (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Source (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.2. Market Revenue and Forecast, by Source (2017-2030)

11.3.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Source (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Source (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Source (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Source (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.2. Market Revenue and Forecast, by Source (2017-2030)

11.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Source (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Source (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Source (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Source (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.2. Market Revenue and Forecast, by Source (2017-2030)

11.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Source (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Source (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Application (2017-2030)

Chapter 12. Company Profiles

12.1. REMONDIS SE & Co. KG

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Biffa

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Stericycle

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Republic Services, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. WM Intellectual Property Holdings, LLC

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Veolia

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Shell International BV

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Waste Connections

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Clean Harbors, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Covetsro AG

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others