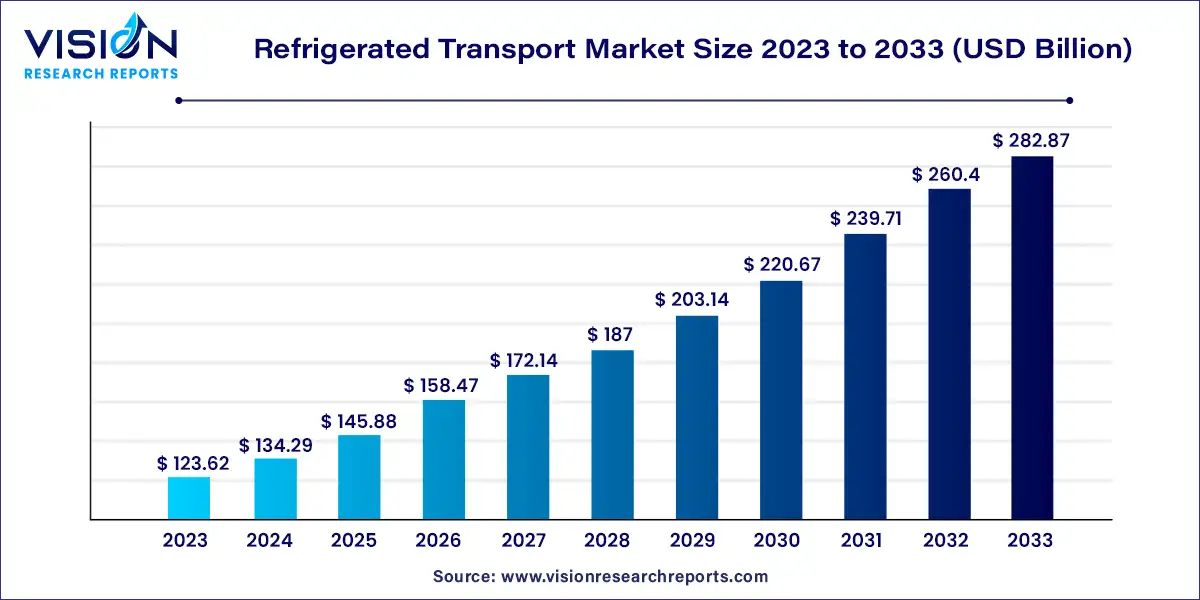

The global refrigerated transport market size was estimated at USD 123.62 billion in 2023 and it is expected to surpass around USD 282.87 billion by 2033, poised to grow at a CAGR of 8.63% from 2024 to 2033.

The growth of the refrigerated transport market is propelled by an investment in cold chain infrastructure have significantly widened the market's reach, catering to the escalating demand for temperature-controlled logistics services. Technological advancements, including innovations in refrigeration technology and real-time temperature monitoring devices, have enhanced the efficiency and reliability of refrigerated transport operations. Moreover, stringent regulatory compliance requirements, particularly in the food and pharmaceutical sectors, have driven the adoption of refrigerated transport solutions to ensure adherence to quality and safety standards. These growth factors collectively contribute to the sustained expansion of the refrigerated transport market, meeting the increasing demand for the safe and efficient transportation of perishable goods worldwide.

The market segmentation is based on technology, categorizing it into air-blown evaporators, eutectic, hybrid, and fully electrified. As of 2023, the air-blown segment held the largest market share at 41%. This dominance is attributed to the escalating demand for frozen foods like meat, seafood, and dairy items, driving the need for efficient refrigeration systems. Air-blown evaporators are integral to refrigerated transport setups, crucial for maintaining consistent temperatures within cargo spaces. These systems utilize forced air circulation over refrigerant-filled coils to extract heat from the cargo area, ensuring efficient cooling and uniform temperatures throughout. Their functionality is paramount in preserving the quality and freshness of perishable goods during transit.

Over the forecast period, the fully electrified segment is anticipated to experience significant growth due to mounting concerns regarding environmental impact and greenhouse gas emissions. Fully electrified refrigeration systems in transport vehicles offer a solution to address these concerns. Adoption of such systems aids businesses in adhering to environmental regulations while enhancing their brand reputation. Fully electrified refrigerated transport systems rely entirely on electric power for cooling operations. These systems typically integrate electrically driven compressors and other components powered by batteries, grid electricity, or alternative electric sources. Their design emphasizes minimizing environmental impact, improving energy efficiency, and aligning with sustainability objectives.

The market segmentation by mode of transport includes road, air, sea, and railway. In 2023, the road transportation segment held the largest market share. The surge in online shopping and the demand for prompt delivery of goods, especially perishables, have driven the necessity for a versatile and efficient transportation network. The road segment, with its ability for door-to-door delivery, plays a pivotal role in meeting the time-sensitive demands of e-commerce platforms, ensuring that temperature-sensitive products reach consumers promptly while maintaining their quality.

The sea segment is projected to witness rapid growth during the forecast period, with a significant compound annual growth rate (CAGR). This growth is propelled by the escalating exports and imports, particularly in the global food trade sector. As international trade expands, the demand for dependable transportation of perishable goods by sea rises. Highly perishable items like fruits, vegetables, meat, and seafood necessitate specialized refrigerated transport to preserve their quality throughout the shipping journey. Consequently, there's a growing reliance on the sea segment within cold chain logistics, ensuring the secure and timely delivery of temperature-sensitive products across borders. According to the International Trade Center (ITC), the world's import and export values have exhibited a notable increase from 2018 to 2022, underscoring the significance of sea transport in facilitating global trade.

The temperature range segment comprises chilled, frozen, and deep frozen categories. In 2023, the frozen segment dominated the market and is anticipated to experience the swiftest growth throughout the forecast period. Addressing food waste has emerged as a pressing global concern, with frozen food emerging as a viable solution. Frozen food offers numerous advantages, including prolonged shelf life, portion control, reduced transport emissions, potential for seasonal availability, and enhanced packaging. These advantages collectively contribute to minimizing food wastage at both the retail and consumer levels, thereby propelling the growth of the frozen food segment.

The chilled segment is poised to grow substantially during the forecast period, driven by the expansion of niche markets. Increasing demand for specialty food items like craft beers, artisan cheeses, and premium meats necessitates the implementation of temperature-controlled storage and transportation systems to uphold product quality and freshness. With temperature control emerging as a paramount focus, there's a surge in the development of innovative packaging materials and transportation techniques aimed at preserving the quality of these upscale food products throughout the distribution process.

In 2023, the food and beverages segment claimed the largest market share, driven significantly by the growth of the e-commerce industry. The surge in online grocery shopping has prompted food and beverage manufacturers to prioritize direct delivery to consumers' doorsteps. Consequently, there's been a surge in demand for refrigerated transport services to ensure the safe and timely delivery of goods, thereby fueling the growth of the refrigerated transport market.

The pharmaceuticals segment is anticipated to witness rapid growth with a notable compound annual growth rate (CAGR) over the forecast period. The increasing demand for temperature-controlled drugs and vaccines serves as a major catalyst for this segment. As chronic illnesses escalate and advanced medical treatments become more prevalent, there's a heightened need for transporting pharmaceutical products under refrigerated conditions. This is primarily due to the heightened sensitivity of these products and their requirement for specific temperature ranges to maintain their efficacy.

In 2023, the North America region emerged as the market leader, commanding a significant share of 35%. The surge in e-commerce and the increasing trend towards online grocery shopping are key drivers behind this growth. With the proliferation of e-commerce platforms, there's a notable increase in the shipment of temperature-sensitive goods directly to consumers' homes. Refrigerated transport plays a critical role in maintaining the quality of these products throughout the supply chain, from warehouses to the final delivery destination. The convenience and accessibility of online grocery shopping have spurred a heightened demand for refrigerated transport services, ensuring the prompt and secure delivery of perishable goods.

On the other hand, the Asia Pacific region is poised to experience the most rapid growth in the market. Rapid industrialization, fueled by economic expansion, urbanization, and population growth, is propelling the region's market growth. These factors collectively contribute to the escalating demand for refrigerated transport services, catering to the evolving needs of the region's dynamic economy and population.

By Technology

By Mode of Transport

By Temperature Range

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others