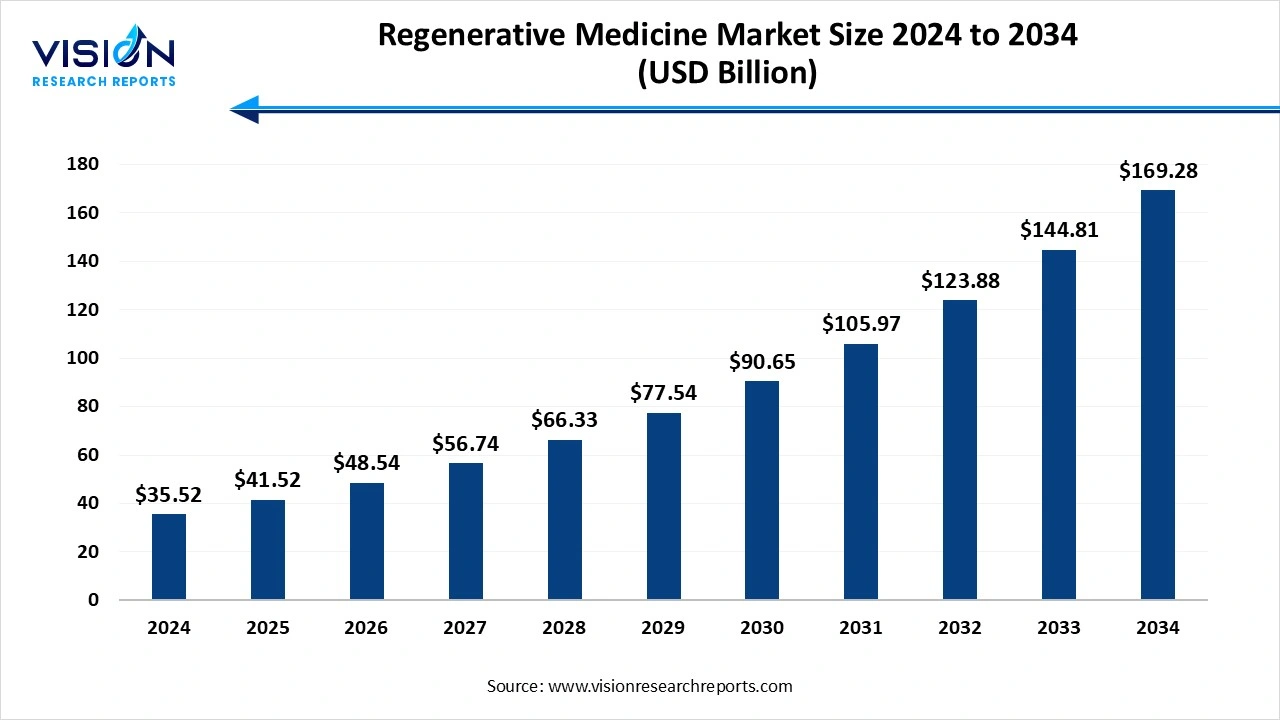

The global regenerative medicine market size was valued at around USD 35.52 billion in 2024 and it is projected to hit around USD 169.28 billion by 2034, growing at a CAGR of 16.90% from 2025 to 2034.

The regenerative medicine market represents one of the most promising and rapidly evolving sectors within the life sciences industry. This field focuses on repairing, replacing, or regenerating human cells, tissues, or organs to restore normal function, often using stem cells, gene therapy, tissue engineering, and biologics. With its potential to treat conditions that were previously deemed incurable such as spinal cord injuries, degenerative diseases, and certain forms of cancer regenerative medicine is transforming patient care and long-term health outcomes. Growing investment in biotechnology research, advancements in cellular and molecular biology, and rising awareness of personalized medicine are propelling the growth of this market. Additionally, increased collaboration between research institutions and pharmaceutical companies has accelerated the development and commercialization of regenerative therapies.

One of the primary growth factors driving the regenerative medicine market is the increasing prevalence of chronic and degenerative diseases such as diabetes, cardiovascular conditions, neurodegenerative disorders, and osteoarthritis. As the global population ages and the burden of these diseases rises, there is a growing demand for innovative and long-lasting treatment solutions that go beyond symptom management. Regenerative medicine offers the potential to restore damaged tissues and organs, positioning it as a breakthrough approach in modern healthcare. The surge in stem cell research, advancements in tissue engineering, and successful clinical trials are further boosting the adoption of regenerative therapies across a variety of medical specialties.

Another key factor is the rise in government and private sector investment in biotechnology and life sciences. Funding for research and development, combined with supportive regulatory pathways in regions like North America and Europe, has encouraged the growth of clinical pipelines and accelerated product approvals.

One of the primary challenges facing the regenerative medicine market is the complex and evolving regulatory landscape. Due to the innovative nature of cell-based and gene therapies, existing regulatory frameworks are often not fully equipped to address the unique risks and requirements these treatments pose. Gaining approval for regenerative therapies can be a lengthy and uncertain process, involving rigorous clinical trials, safety evaluations, and quality control measures. This regulatory complexity can delay product launches and increase development costs, posing a barrier especially for smaller biotech firms.

Another major challenge is the high cost associated with regenerative treatments, which limits accessibility for many patients and healthcare systems. The production of personalized therapies, such as autologous stem cell treatments, often requires sophisticated technology, specialized infrastructure, and skilled personnel, all of which contribute to high prices. Additionally, reimbursement mechanisms for regenerative medicine remain underdeveloped in many regions, making it difficult for providers to cover costs and for patients to afford treatment.

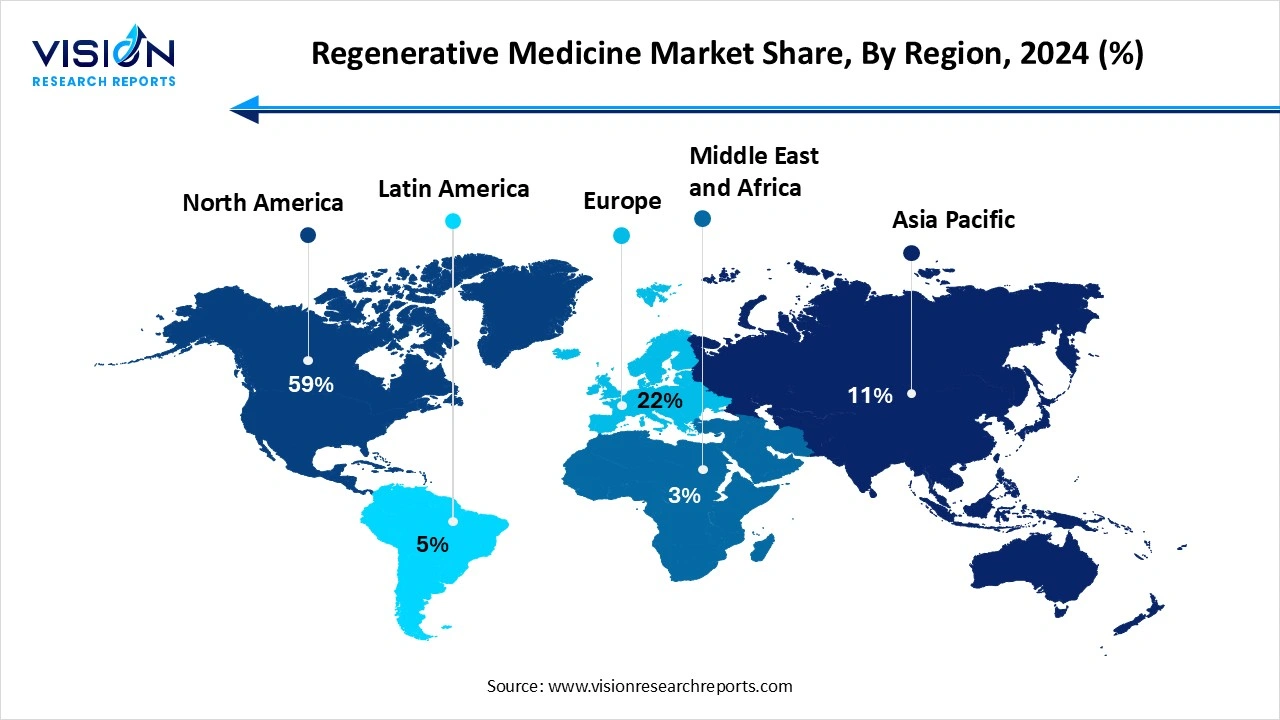

North America accounted for the largest share of the regenerative medicine market, capturing 59% of the total market in 2024. The global regenerative medicine market exhibits strong regional dynamics, with North America leading in terms of market share due to its advanced healthcare infrastructure, significant investment in research and development, and favorable regulatory environment. The United States, in particular, is at the forefront of regenerative medicine innovation, supported by numerous clinical trials, a robust pipeline of cell and gene therapy products, and the presence of major biotechnology companies and research institutions.

The Asia Pacific region is expected to experience the fastest growth over the coming years, fueled by increasing healthcare expenditure, growing prevalence of chronic diseases, and expanding biopharmaceutical industries in countries like China, Japan, South Korea, and India. Government support for stem cell research and infrastructure development is further enhancing the region’s potential in regenerative medicine.

The Asia Pacific region is expected to experience the fastest growth over the coming years, fueled by increasing healthcare expenditure, growing prevalence of chronic diseases, and expanding biopharmaceutical industries in countries like China, Japan, South Korea, and India. Government support for stem cell research and infrastructure development is further enhancing the region’s potential in regenerative medicine.

The therapeutics segment accounted for the highest revenue share of 77% in 2024. Cell-based therapies, particularly those using stem cells, are at the forefront due to their ability to repair and regenerate damaged tissues in conditions such as cardiovascular diseases, neurodegenerative disorders, and orthopedic injuries. Gene therapy is also gaining momentum, offering potential cures by correcting genetic defects at the source. Tissue-engineered products, which combine scaffolds, cells, and bioactive molecules, are being developed to repair or replace damaged organs and tissues, further contributing to the expansion of this segment.

The banks segment is projected to grow at the fastest CAGR of 17.39% between 2025 and 2034. Stem cell banks and tissue banks serve as essential infrastructure in the regenerative medicine ecosystem, enabling the availability of high-quality, preserved cellular materials for both research and clinical applications. These facilities follow stringent quality standards to ensure the viability and safety of stored samples, which are increasingly being utilized in a variety of treatments and investigational studies.

The oncology segment captured the largest market share at 32% in 2024. Regenerative medicine in oncology focuses primarily on immunotherapies, gene therapies, and stem cell-based treatments that aim to restore or enhance the body’s immune response against cancer cells. Stem cell transplants, especially hematopoietic stem cell transplants, have become a cornerstone in treating blood cancers like leukemia, lymphoma, and multiple myeloma.

The cardiovascular segment is expected to experience substantial growth over the forecast period. Regenerative therapies in this space are focused on repairing damaged heart tissues, improving blood vessel function, and restoring cardiac performance following events like myocardial infarction. Stem cell therapy, in particular, shows promise in regenerating cardiac muscle and promoting vascular regeneration. Researchers are also exploring tissue-engineered vascular grafts and bioengineered patches as potential treatments for heart failure and congenital heart defects.

By Product

By Therapeutic Category

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Regenerative Medicine Market

5.1. COVID-19 Landscape: Regenerative Medicine r Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Regenerative Medicine Market, By Product

8.1. Regenerative Medicine Market, by Product, 2024-2033

8.1.1. Therapeutics

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Stem Cell & Progenitor Cell-based therapeutics

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Tool

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Banks

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Services

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Regenerative Medicine Market, By Therapeutic Category

9.1. Regenerative Medicine Market, by Therapeutic Category, 2024-2033

9.1.1. Dermatology

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Musculoskeletal

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Immunology & Inflammation

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Oncology

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Cardiovascular

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Ophthalmology

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Pharmaceutical Water Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Therapeutic Category (2021-2033)

Chapter 11. Company Profiles

11.1. Organogenesis Holdings Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Astellas Pharma Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Smith & Nephew plc

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Vericel Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Baxter International Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Integra LifeSciences Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Stryker Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. MiMedx Group, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. B. Braun Melsungen AG

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Athersys, Inc.

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others