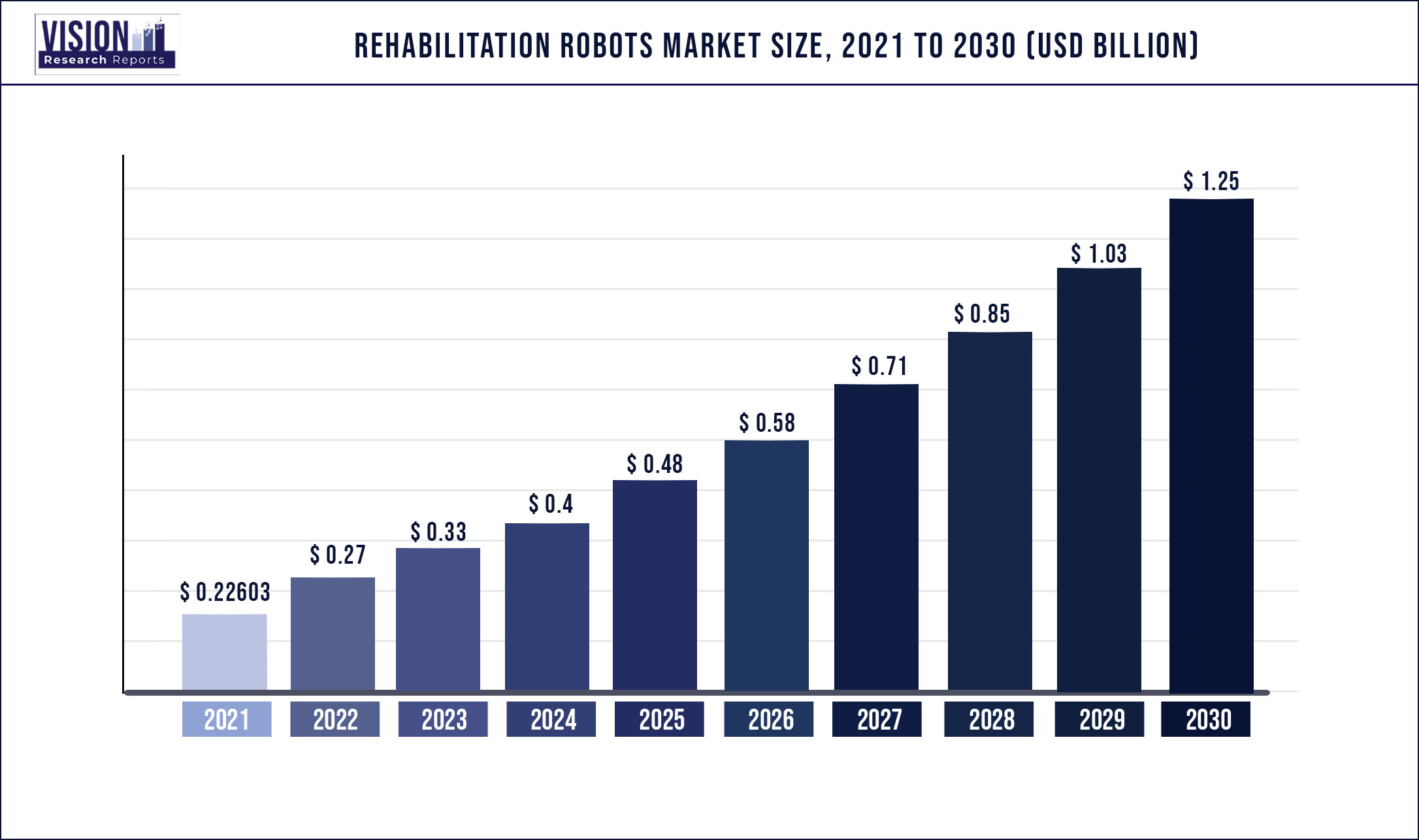

The global rehabilitation robots market was valued at USD 226.03 million in 2021 and it is predicted to surpass around USD 1.25 billion by 2030 with a CAGR of 20.93% from 2022 to 2030.

Report Highlights

The major factors driving the industry growth are the high per capita healthcare spending and rapid adoption of technologically advanced instruments. The demand for rehabilitation robots is increasing, as these are beneficial in improving the quality of life of individuals with conditions such as spinal cord injury, paralysis, and others. The rising number of product approvals by regulatory bodies such as the FDA is expected to further propel the growth in the forecast period. Increasing incidence of spinal cord injury and musculoskeletal disorders are driving the adoption of robots for rehabilitation purposes.

The high purchasing and maintenance costs of rehabilitation robots along with stringent approval procedures are some factors that may hamper the market growth in the coming future. Furthermore, COVID 19 also significantly impacted the industry growth. However, constant strategic initiatives in the form of product launches, partnerships, and acquisitions have increased the competition in the industry, thereby supporting growth. In addition, growing technological advancements and increasing expenditure by key players in R&D processes are one of the major factors boosting the market growth.

The lower body extremity held the largest revenue share of 59.6% in 2021. An increase in the prevalence of lower body disabilities, a rapidly aging population, and paralyzed patients are anticipated to boost the adoption, penetration, & growth of the lower-body exoskeleton market. Although, the upper body extremity is expected to have the fastest CAGR of 17.6% over the forecast period.

Hospitals & clinics held the largest market share of 47.0% in 2021. The growth is majorly attributed due to growing healthcare expenditure, and rapid adoption of advanced technology in healthcare facilities. However, senior care facilities are expected to grow with the fastest CAGR over the forecast period. The growth can be attributed to the growing demand for better healthcare facilities for senior citizens and the rising geriatric population.

North America held the largest share in the year 2021. The increasing prevalence of spinal cord injury in the region is fueling the market growth. The rising geriatric population and growing disabled population are among the factors boosting the adoption of rehabilitation robots. However, Asia Pacific is expected to grow with the fastest CAGR of 24.4% over the forecast period due to growing healthcare expenditure within the region.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 226.03 million |

| Revenue Forecast by 2030 | USD 1.25 billion |

| Growth rate from 2022 to 2030 | CAGR of 20.93% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, extremity, end-use, region |

| Companies Covered | TYROMOTION GMBH; Life Science Robotics ApS; Hocoma AG (DIH International Ltd.); Rex Bionics Ltd; Kinova Inc.; Rehab-Robotics Company Limited; ReWalk Robotics Ltd; Ekso Bionics Holdings Inc.; Cyberdyne Inc.; Bionik Laboratories Corporation |

Type Insights

Exoskeleton held the largest revenue share of 58.64% in 2021. The growing elderly population is expected to contribute to an increase in the usage of exoskeletons. For instance, according to data published by European Commission in 2020, around 20.6% of the population in Europe was aged over 65. In addition, the prevalence of cerebral palsy, the most common childhood disability, is expected to increase the usage rate of exoskeleton robots.

The growing incidence of paralysis, spinal cord injury, and stroke is a key factor driving the growth of the segment. Increasing awareness and growing adoption of these exoskeletons in medical care are among the key factors boosting the market growth. Spinal cord injuries are among the major causes of impairments and disabilities in patients. Exoskeletons play a vital role in facilitating rehabilitation efforts in patients with spinal trauma and thus, driving industry growth.

However, therapy robots are expected to grow with the fastest CAGR of 18.7%. The growth can be attributed to the growing adoption of therapy robots by the healthcare sector, growing investment in R&D to build technologically advanced products and growing awareness about therapy robots.

End-use Insights

Based on end-use, the hospitals & clinics segment held the largest revenue share 47.11% in 2021. The growth is majorly attributed to growing healthcare expenditure and rapid adoption of advanced technology in healthcare facilities. Moreover, a large population with musculoskeletal disorders, spinal cord injury, and others tend to move to hospitals for rehabilitation services, thereby boosting the growth of the segment.

In addition, surging awareness regarding technologically advanced systems, along with a rise in the number of FDA approvals on medical exoskeletons, is anticipated to drive the segmental growth. The expansion of line up by key players for improving robotic technology to empower people to let people get back to their daily activities is one of the critical factors expected to drive the market over the forecast period.

However, senior care facilities are expected to grow with the fastest CAGR due to the rising population of older adults. Furthermore, growing government initiatives to build senior care facilities all over the world and increasing demand to provide better healthcare facilities for senior citizens further boost the market growth.

Extremity Insights

The lower body extremity held the largest share of 59.77% in 2021. An increase in the prevalence of lower body disabilities, a rapidly aging population, and paralyzed patients are anticipated to boost the adoption, penetration, & growth of the lower-body segment. The robotic lower-body exoskeleton is used as an assistance for paralysis of lower limbs and encourages muscle activity in the lower body. These are majorly used by frail elderly & and those suffering from multiple sclerosis, stroke victims, and people with severe gait impairments.

However, the upper body extremity is expected to show the fastest CAGR of 17.6% over the forecast period. This can be attributed to advantages associated with the utilization and adoption of robotic technologies for upper extremities, including neurological impairments, post-stroke rehabilitation, & musculoskeletal issues. In addition, upper body exoskeletons and robots support people with disability and help them manage their daily activities. Thus, driving the segment’s growth.

Regional Insights

North America dominated the rehabilitation robots industry in 2021 and accounted for the largest revenue share of 47.21%. The increasing prevalence of spinal cord injury in the region is fueling the market growth. The rising geriatric population and growing disabled population are among the factors boosting the adoption of rehabilitation robots. According to the 2020 datasheet published by CDC, around one in four persons in the country has some or the other form of disability.

Such statistics indicate the presence of a larger population that would benefit from the adoption of rehabilitation robots, thereby propelling regional growth. Furthermore, continuous development in technology and high research expenditure in the healthcare sector by government agencies are boosting the market growth in North America. The presence of private entities offering funds for R&D to develop technologically advanced products is further fueling the growth.

Asia Pacific is anticipated to register the fastest CAGR of 24.6% over the forecast period. The growing elderly population in the Asia Pacific is the leading cause for the adoption of rehabilitation robots. According to a report by World Bank, the geriatric population is expected to reach approximately 1.3 billion by the end of 2050. Moreover, the growing strategic initiatives, such as mergers & acquisitions, the launch of new products, and collaborations, are anticipated to boost the growth of the regional industry. Hence, these factors are anticipated to propel growth in the forthcoming years.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Rehabilitation Robots Market

5.1. COVID-19 Landscape: Rehabilitation Robots Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Rehabilitation Robots Market, By Type

8.1. Rehabilitation Robots Market, by Type, 2022-2030

8.1.1 Therapy Robots

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Exoskeleton

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Rehabilitation Robots Market, By Extremity

9.1. Rehabilitation Robots Market, by Extremity, 2022-2030

9.1.1. Upper Body

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Lower Body

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Rehabilitation Robots Market, By End-use

10.1. Rehabilitation Robots Market, by End-use, 2022-2030

10.1.1. Hospitals & Clinics

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Senior care facilities

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Homecare Settings

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Rehabilitation Robots Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.1.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.2.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.3.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Extremity (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. Tyromotion GmbH

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Life Science Robotics ApS

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Hocoma AG (DIH International Ltd.)

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Rex Bionics Ltd

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Kinova Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Rehab-Robotics Company Limited

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. ReWalk Robotics Ltd

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. ReWalk Robotics Ltd

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Cyberdyne Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Bionik Laboratories Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others