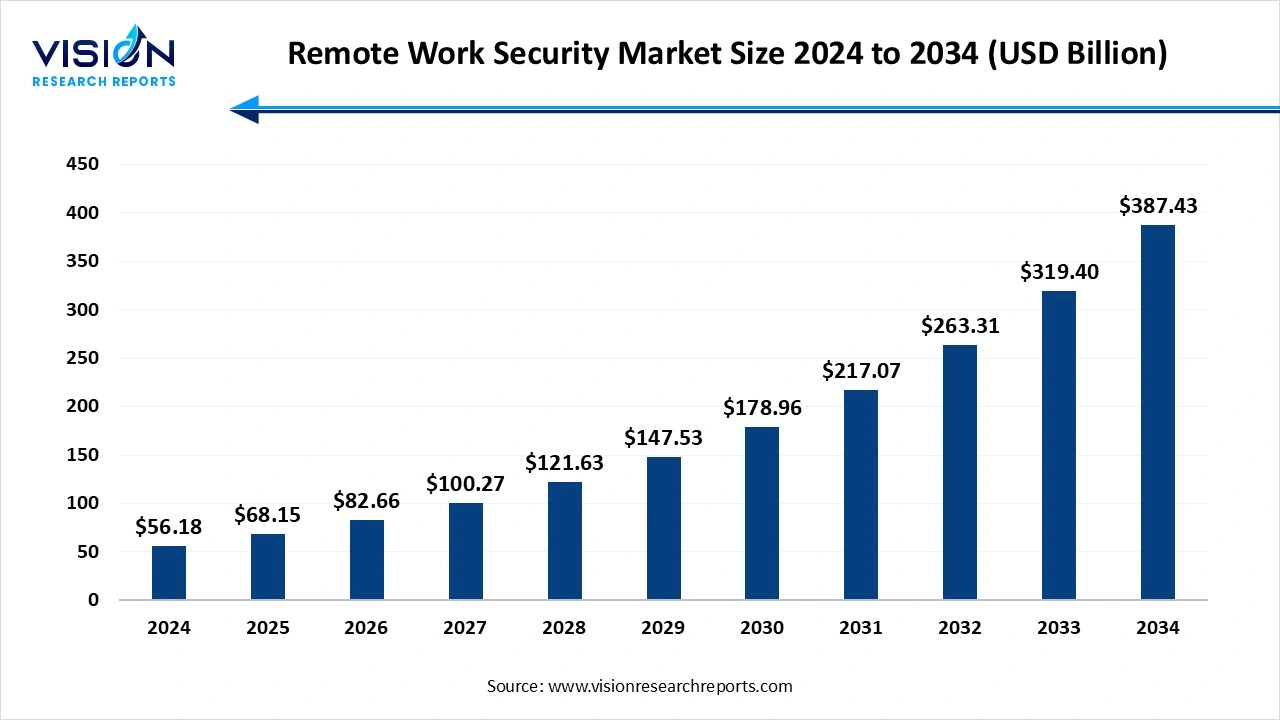

The global remote work security market size was estimated at around USD 56.18 billion in 2024 and it is projected to hit around USD 387.43 billion by 2034, growing at a CAGR of 21.30% from 2025 to 2034.

The remote work security market has experienced significant growth in recent years, driven by the global shift toward hybrid and fully remote workforce models. As organizations adapt to decentralized operations, the demand for robust cybersecurity solutions such as secure access tools, endpoint protection, cloud security, and identity and access management has surged. Companies across industries are prioritizing zero-trust architectures and multi-factor authentication to safeguard sensitive data outside traditional corporate networks. With cyber threats becoming more sophisticated and regulatory pressures intensifying, the remote work security market is projected to maintain strong momentum, creating opportunities for innovation and investment in scalable, adaptive security frameworks.

One of the primary growth drivers of the remote work security market is the widespread adoption of hybrid and remote work models, accelerated by the COVID-19 pandemic. As businesses continue to support flexible working arrangements, the need to secure off-premises endpoints, cloud-based platforms, and remote access channels has intensified. This shift has compelled organizations to invest in advanced cybersecurity tools such as VPNs, endpoint detection and response (EDR), identity and access management (IAM), and zero-trust security frameworks.

The rise in sophisticated cyber threats such as phishing, ransomware, and supply chain attacks has heightened awareness of remote work vulnerabilities. Regulatory compliance requirements, such as GDPR, HIPAA, and industry-specific standards, are also pressuring organizations to implement secure infrastructures that ensure data integrity and privacy. Furthermore, technological advancements in AI-driven threat detection, behavioral analytics, and secure access service edge (SASE) solutions are enabling companies to adopt more proactive and scalable security strategies.

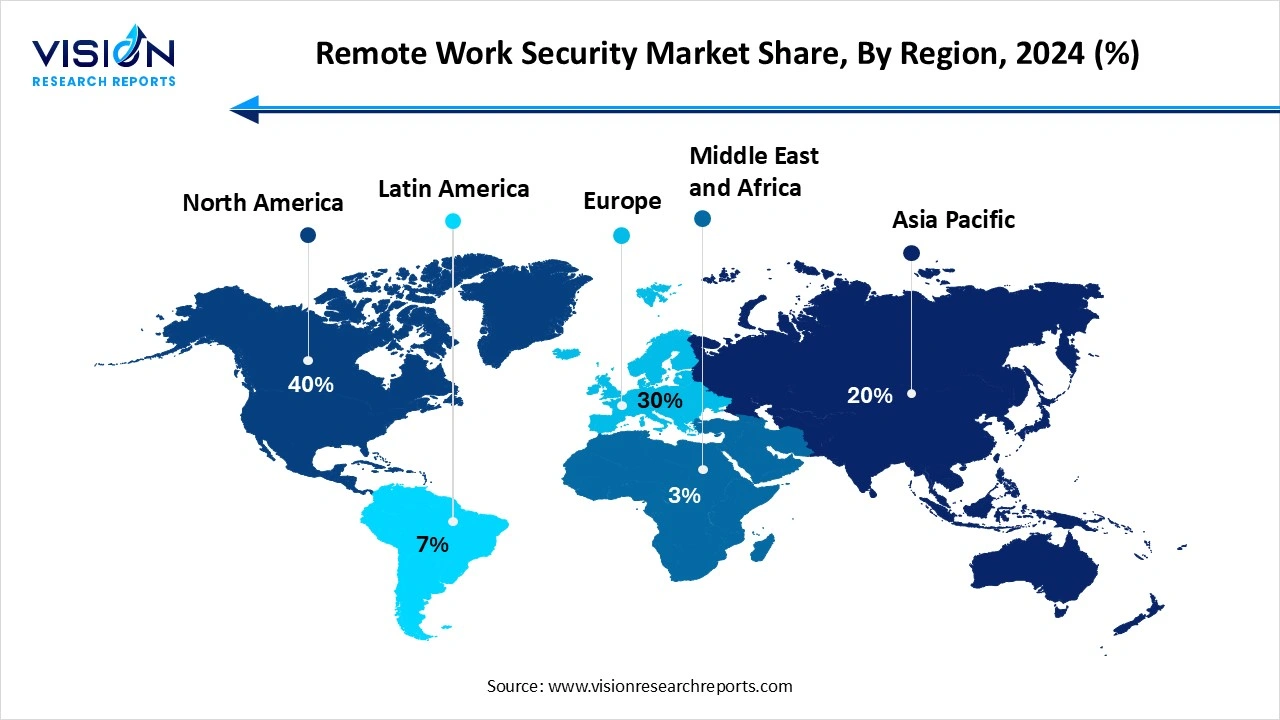

North America accounted for a substantial portion of the remote work security market, capturing more than 40% of the total revenue in 2024. The region’s enterprises prioritize investments in cutting-edge security solutions to protect remote workforces from sophisticated cyber threats. Additionally, the presence of major cybersecurity vendors and the early adoption of zero trust architectures contribute to North America’s leadership in the market.

In the Asia-Pacific region, rapid digital transformation and expanding remote workforce models are driving significant market growth. Emerging economies such as India, China, Japan, and Australia are investing in remote work security to support their growing IT sectors and increasingly mobile workforces. Although challenges remain around cybersecurity maturity and regulatory enforcement, rising cyber threats and increased cloud adoption are pushing organizations to adopt scalable security solutions tailored for diverse and geographically dispersed teams.

In the Asia-Pacific region, rapid digital transformation and expanding remote workforce models are driving significant market growth. Emerging economies such as India, China, Japan, and Australia are investing in remote work security to support their growing IT sectors and increasingly mobile workforces. Although challenges remain around cybersecurity maturity and regulatory enforcement, rising cyber threats and increased cloud adoption are pushing organizations to adopt scalable security solutions tailored for diverse and geographically dispersed teams.

The solutions segment held the dominant market share, exceeding 66% in 2024. the solution side, organizations are increasingly adopting a diverse range of cybersecurity technologies tailored to safeguard remote work environments. These include endpoint protection platforms, virtual private networks (VPNs), identity and access management (IAM), cloud security solutions, and unified threat management systems. With the rapid expansion of cloud computing and collaboration tools, businesses are investing heavily in solutions that provide real-time threat detection, secure data access, and multi-factor authentication to protect sensitive enterprise information outside traditional network perimeters.

The services segment is expected to experience substantial growth at a notable CAGR throughout the forecast period. Managed security services, consulting, risk assessment, integration, and training services are in high demand, especially as companies strive to maintain compliance with global data protection regulations. Service providers assist organizations in customizing security strategies, conducting vulnerability assessments, and managing complex security ecosystems that span multiple locations and devices.

The endpoint and IoT security segment held the largest share of the market in 2024. The global remote work security market, endpoint and IoT security represent a critical component due to the widespread use of personal and mobile devices for accessing corporate networks. As remote employees increasingly rely on laptops, smartphones, tablets, and IoT-enabled tools to perform daily operations, the potential attack surface has grown significantly. This has compelled organizations to prioritize endpoint protection solutions that offer real-time monitoring, device management, and threat detection capabilities. Additionally, the rise of IoT in remote work setups ranging from smart home devices to connected peripherals introduces new vulnerabilities.

The cloud security market is projected to grow at a compound annual growth rate CAGR of 22.1% over the forecast period. With sensitive data frequently stored and exchanged in the cloud, enterprises are implementing robust security measures to safeguard against unauthorized access, data breaches, and configuration vulnerabilities. Cloud security solutions now encompass identity and access management, encryption, secure file sharing, and compliance tools designed to meet industry-specific regulations. As organizations increasingly migrate workloads to public and hybrid cloud environments, the demand for scalable, resilient, and policy-driven cloud security solutions continues to surge.

The hybrid segment led the market in 2024, capturing more than 57% of the total revenue share. The hybrid work model, which combines in-office and remote work, presents unique security challenges as employees frequently transition between secured corporate environments and less controlled home or public networks. This dynamic necessitates comprehensive security solutions that can seamlessly protect data and devices regardless of location. Organizations adopting hybrid models are increasingly investing in adaptive security frameworks, including zero trust access, endpoint protection, and secure cloud connectivity to maintain consistent security policies and mitigate risks associated with frequent network changes.

The fully remote segment is projected to expand at a compound annual growth rate (CAGR) of 21.4% over the forecast period. In fully remote environments, securing communication channels, enforcing strict authentication protocols, and monitoring user activity become paramount to preventing data breaches and unauthorized access. This model drives higher adoption rates of cloud security solutions and managed security services to ensure continuous protection of sensitive information across dispersed workforces. The growing preference for fully remote work, accelerated by technological advancements and changing workforce expectations, continues to propel demand for scalable, reliable, and flexible remote work security solutions in the global market.

The BFSI segment held the largest share of the market in 2024. The Banking, Financial Services, and Insurance (BFSI) sector represents one of the most critical verticals driving the growth of the global remote work security market. Given the highly sensitive nature of financial data and the stringent regulatory environment governing this sector, BFSI organizations prioritize robust security measures to protect customer information and maintain trust. The rise of remote work within BFSI has accelerated the adoption of advanced security solutions such as multi-factor authentication, encryption, and continuous monitoring to safeguard transactions and prevent cyber fraud.

The telecommunications segment is projected to grow at a compound annual growth rate CAGR of 21.7% throughout the forecast period. Telecom companies face unique challenges due to the vast amount of data flowing through their networks and the need to secure both their own operations and the services they provide to customers. As remote work expands within this sector, telecommunications firms are investing in secure network architectures, identity and access management solutions, and threat intelligence platforms to defend against sophisticated cyberattacks.

By Component

By Security Type

By Remote Work Model

By Vertical

By Remote Work Security Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Remote Work Security Market

5.1. COVID-19 Landscape: Remote Work Security Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Remote Work Security Market, By Component

8.1. Remote Work Security Market, by Component

8.1.1. Solution

8.1.1.1. Market Revenue and Forecast

8.1.2. Services

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Remote Work Security Market, By Security Type

9.1. Remote Work Security Market, by Security Type

9.1.1. Endpoint & IoT Security

9.1.1.1. Market Revenue and Forecast

9.1.2. Network Security

9.1.2.1. Market Revenue and Forecast

9.1.3. Cloud Security

9.1.3.1. Market Revenue and Forecast

9.1.4. Application Security

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Remote Work Security Market, By Remote Work Model

10.1. Remote Work Security Market, by Remote Work Model

10.1.1. Fully Remote

10.1.1.1. Market Revenue and Forecast

10.1.2. Hybrid

10.1.2.1. Market Revenue and Forecast

10.1.3. Temporary Remote

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Remote Work Security Market, By Vertical

11.1. Remote Work Security Market, by Vertical

11.1.1. Government

11.1.1.1. Market Revenue and Forecast

11.1.2. Telecommunications

11.1.2.1. Market Revenue and Forecast

11.1.3. Retail & eCommerce

11.1.3.1. Market Revenue and Forecast

11.1.4. Education

11.1.4.1. Market Revenue and Forecast

11.1.5. Media & Entertainment

11.1.5.1. Market Revenue and Forecast

11.1.6. Banking, Financial Services, and Insurance (BFSI)

11.1.6.1. Market Revenue and Forecast

11.1.7. IT & ITeS

11.1.7.1. Market Revenue and Forecast

11.1.8. Others

11.1.8.1. Market Revenue and Forecast

Chapter 12. Global Remote Work Security Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component

12.1.2. Market Revenue and Forecast, by Security Type

12.1.3. Market Revenue and Forecast, by Remote Work Model

12.1.4. Market Revenue and Forecast, by Vertical

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component

12.1.5.2. Market Revenue and Forecast, by Security Type

12.1.5.3. Market Revenue and Forecast, by Remote Work Model

12.1.5.4. Market Revenue and Forecast, by Vertical

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component

12.1.6.2. Market Revenue and Forecast, by Security Type

12.1.6.3. Market Revenue and Forecast, by Remote Work Model

12.1.6.4. Market Revenue and Forecast, by Vertical

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component

12.2.2. Market Revenue and Forecast, by Security Type

12.2.3. Market Revenue and Forecast, by Remote Work Model

12.2.4. Market Revenue and Forecast, by Vertical

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component

12.2.5.2. Market Revenue and Forecast, by Security Type

12.2.5.3. Market Revenue and Forecast, by Remote Work Model

12.2.5.4. Market Revenue and Forecast, by Vertical

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component

12.2.6.2. Market Revenue and Forecast, by Security Type

12.2.6.3. Market Revenue and Forecast, by Remote Work Model

12.2.6.4. Market Revenue and Forecast, by Vertical

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component

12.2.7.2. Market Revenue and Forecast, by Security Type

12.2.7.3. Market Revenue and Forecast, by Remote Work Model

12.2.7.4. Market Revenue and Forecast, by Vertical

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component

12.2.8.2. Market Revenue and Forecast, by Security Type

12.2.8.3. Market Revenue and Forecast, by Remote Work Model

12.2.8.4. Market Revenue and Forecast, by Vertical

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component

12.3.2. Market Revenue and Forecast, by Security Type

12.3.3. Market Revenue and Forecast, by Remote Work Model

12.3.4. Market Revenue and Forecast, by Vertical

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component

12.3.5.2. Market Revenue and Forecast, by Security Type

12.3.5.3. Market Revenue and Forecast, by Remote Work Model

12.3.5.4. Market Revenue and Forecast, by Vertical

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component

12.3.6.2. Market Revenue and Forecast, by Security Type

12.3.6.3. Market Revenue and Forecast, by Remote Work Model

12.3.6.4. Market Revenue and Forecast, by Vertical

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component

12.3.7.2. Market Revenue and Forecast, by Security Type

12.3.7.3. Market Revenue and Forecast, by Remote Work Model

12.3.7.4. Market Revenue and Forecast, by Vertical

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component

12.3.8.2. Market Revenue and Forecast, by Security Type

12.3.8.3. Market Revenue and Forecast, by Remote Work Model

12.3.8.4. Market Revenue and Forecast, by Vertical

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component

12.4.2. Market Revenue and Forecast, by Security Type

12.4.3. Market Revenue and Forecast, by Remote Work Model

12.4.4. Market Revenue and Forecast, by Vertical

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component

12.4.5.2. Market Revenue and Forecast, by Security Type

12.4.5.3. Market Revenue and Forecast, by Remote Work Model

12.4.5.4. Market Revenue and Forecast, by Vertical

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component

12.4.6.2. Market Revenue and Forecast, by Security Type

12.4.6.3. Market Revenue and Forecast, by Remote Work Model

12.4.6.4. Market Revenue and Forecast, by Vertical

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component

12.4.7.2. Market Revenue and Forecast, by Security Type

12.4.7.3. Market Revenue and Forecast, by Remote Work Model

12.4.7.4. Market Revenue and Forecast, by Vertical

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component

12.4.8.2. Market Revenue and Forecast, by Security Type

12.4.8.3. Market Revenue and Forecast, by Remote Work Model

12.4.8.4. Market Revenue and Forecast, by Vertical

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component

12.5.2. Market Revenue and Forecast, by Security Type

12.5.3. Market Revenue and Forecast, by Remote Work Model

12.5.4. Market Revenue and Forecast, by Vertical

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component

12.5.5.2. Market Revenue and Forecast, by Security Type

12.5.5.3. Market Revenue and Forecast, by Remote Work Model

12.5.5.4. Market Revenue and Forecast, by Vertical

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component

12.5.6.2. Market Revenue and Forecast, by Security Type

12.5.6.3. Market Revenue and Forecast, by Remote Work Model

12.5.6.4. Market Revenue and Forecast, by Vertical

Chapter 13. Company Profiles

13.1. Cisco Systems, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Fortinet, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Check Point Software Technologies Ltd.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4 Trend Micro Incorporated

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Symantec Corporation (a division of Broadcom Inc.)

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. McAfee, LLC

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Microsoft Corporation

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. CrowdStrike Holdings, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Okta, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Zscaler, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others