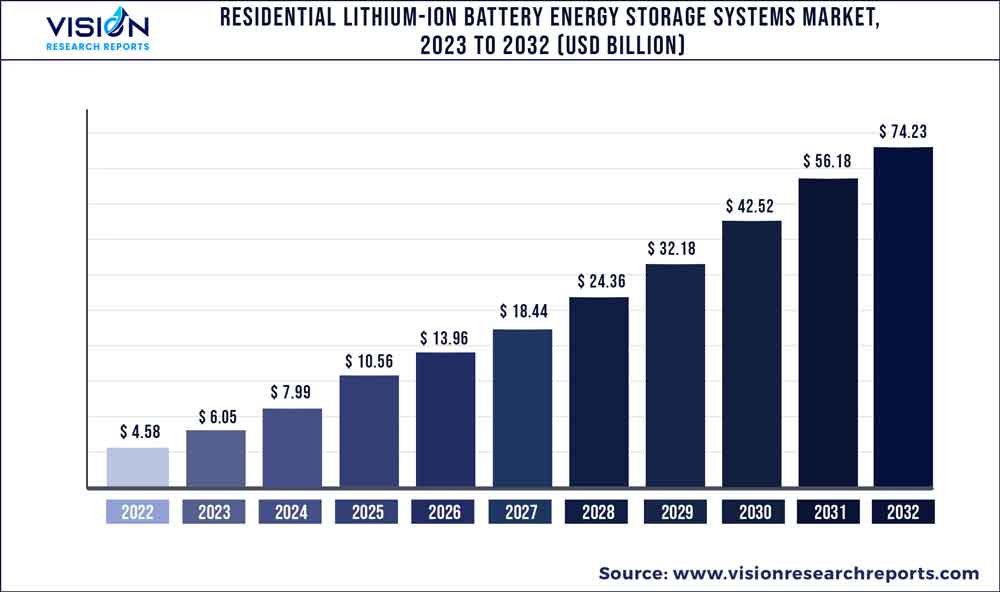

The global residential lithium-ion battery energy storage systems market was estimated at USD 4.58 billion in 2022 and it is expected to surpass around USD 74.23 billion by 2032, poised to grow at a CAGR of 32.12% from 2023 to 2032.

Key Pointers

Report Scope of the Residential Lithium-ion Battery Energy Storage Systems Market

| Report Coverage | Details |

| Market Size in 2022 | USD 4.58 billion |

| Revenue Forecast by 2032 | USD 74.23 billion |

| Growth rate from 2023 to 2032 | CAGR of 32.12% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | HAIKAI; Enphase Energy; E3/DC; Panasonic; sonnen Holding GmbH; Tesla; Pylon Technologies Co., Ltd.; LG Chem; AlphaESS; Generac Power Systems; Hitachi Energy; GOODWE |

The market here refers to the home energy storage systems that use lithium-ion batteries. These systems are designed to store excess energy produced by residential solar panels or other renewable energy sources so that the energy can be used at a later time when energy demand is high or when sunlight is unavailable.

The U.S. is one of the largest regional segments globally in terms of the adoption of battery energy storage systems owing to the rising demand for renewable energy in the country. The market in the country is projected to grow at a significant CAGR over the forecast period. Factors such positive government initiatives and increasing efficiency of residential battery energy storage analysis is expected to increase the market for residential lithium ion battery storage systems over the forecast period.

For instance, the Inflation Reduction Act of 2022 introduced a tax credit for the installation of solar PV panels as well as battery energy storage systems for residential and commercial industries. The government planned to provide a tax credit worth 30% of the installation cost of the battery energy storage system. This is expected to incentivize homeowners to install battery storage systems along with solar PV installation driving demand in the market.

3 kW to 5 kW dominated the global residential lithium-ion battery energy storage systems industry in the power rating segment and accounted for more than 54.0% overall revenue share in 2022. Residential lithium-ion battery energy storage systems with a capacity of between 3 kW to 5 kW, can store enough energy to power a household for several hours, even at peak hours of energy demand. This can help to reduce energy bills and provide greater control over energy consumption. Another advantage of these battery storage systems is their scalability. They can be easily installed in a variety of residential settings, from residential buildings for multiple apartments to larger homes, and can be scaled up or down depending on the energy needs of the household. Battery energy storage systems with a capacity between 3kW to 5kW are generally more expensive owing to their higher capacity leading to higher production and installation costs.

The off-grid segment dominated the global market in the connectivity segment and accounted for more than 56.0% overall revenue share in 2022. The demand for residential lithium-ion battery energy storage systems for on-grid applications is on the rise as it provides homeowners with reliable access to energy even in remote places. These systems are designed to store excess energy generated by solar panels or wind turbines, which can then be used to power homes during periods of low energy production or when energy generation is offline.

One of the key benefits of these systems is their ability to provide greater energy independence and security for homeowners living in remote areas. By storing excess energy from solar panels or wind turbines, homeowners can ensure that they have a reliable source of energy at all times.

Asia Pacific dominated the regional segment and accounted for the overall revenue share of more than 40.0% in 2022. The residential lithium-ion battery energy storage system industry in the Asia Pacific is expected to witness significant growth over the forecast period. This can be attributed to the increasing demand for clean energy and the increasing adoption of solar power systems in the residential sector.

Power Rating Insights

The 3 kW to 5 kW segment dominated the global residential lithium-ion battery energy storage systems market in the power rating segment and accounted for more than 54.03% overall revenue share in 2022. Residential lithium-ion battery energy storage systems with a capacity of between 3 kW to 5 kW is capable of storing sufficient energy to power a household for several hours, even during periods of peak energy demand. This can help reduce energy bills and provide greater control to consumers over energy consumption. Another advantage of these battery storage systems is their scalability. They can be easily installed in a variety of residential settings, including residential buildings for multiple apartments to larger homes. Furthermore, these can be scaled up or down depending on the energy needs of the household. Battery energy storage systems with a capacity between 3kW to 5kW are generally more expensive owing to their higher capacity, leading to higher production and installation costs.

Connectivity Insights

The off-grid segment dominated the global residential lithium-ion battery energy storage systems market in the connectivity segment and accounted for more than 56.05% overall revenue share in 2022. The demand for residential lithium-ion battery energy storage systems for on-grid applications is on the rise as it provides homeowners with reliable access to energy even in remote locations.

These systems are designed to store excess energy generated by solar panels or wind turbines, which can then be used to power homes during periods of low energy production or when energy generation is offline. One of the key benefits of these systems is their ability to provide greater energy independence and security for homeowners living in remote areas. By storing excess energy from solar panels or wind turbines, homeowners can ensure that they have reliable access to energy at all times. These systems can be easily installed in a variety of residential settings and can be scaled up or down depending on the energy needs of the household.

Residential lithium-ion battery energy storage systems for off-grid applications offer a promising solution for homeowners who are looking for a reliable and sustainable source of energy in remote locations. Off-grid battery energy storage systems are generally slightly cheaper than on-grid solutions as they do not need to be connected to the national grid and can operate at generally lower power ratings.

Regional Insights

Asia Pacific dominated the regional segment and accounted for the overall revenue share of more than 40.02% in 2022. The market in Asia Pacific is expected to witness significant growth over the forecast period. This can be attributed to the increasing demand for clean energy and the increasing adoption of solar power systems in the residential sector.

Countries such as Japan, Australia, and South Korea lead the market growth in the region, owing to favorable government initiatives and policies promoting the adoption of renewable energy. Furthermore, decreasing the cost of lithium-ion batteries and rising awareness of energy efficiency are driving the growth of this market.

Residential Lithium-ion Battery Energy Storage Systems Market Segmentations:

By Power Rating

By Connectivity

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Residential Lithium-ion Battery Energy Storage Systems Market

5.1. COVID-19 Landscape: Residential Lithium-ion Battery Energy Storage Systems Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Residential Lithium-ion Battery Energy Storage Systems Market, By Power Rating

8.1. Residential Lithium-ion Battery Energy Storage Systems Market, by Power Rating, 2023-2032

8.1.1. Less than 3kW

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. 3 kW to 5 kW

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Residential Lithium-ion Battery Energy Storage Systems Market, By Connectivity

9.1. Residential Lithium-ion Battery Energy Storage Systems Market, by Connectivity, 2023-2032

9.1.1. On-Grid

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Off-Grid

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Residential Lithium-ion Battery Energy Storage Systems Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.1.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.2.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.3.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.4.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.5.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Connectivity (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Power Rating (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Connectivity (2020-2032)

Chapter 11. Company Profiles

11.1. HAIKAI

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Enphase Energy

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. E3/DC

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Panasonic

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. sonnen Holding GmbH

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Tesla

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Pylon Technologies Co., Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. LG Chem

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. AlphaESS

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Generac Power Systems

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others