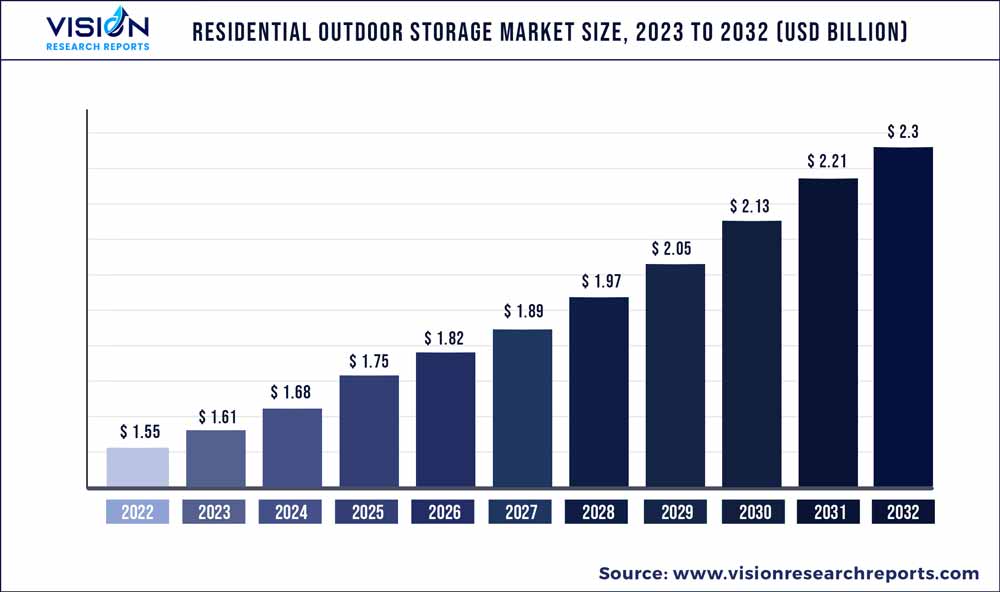

The global residential outdoor storage market was surpassed at USD 1.55 billion in 2022 and is expected to hit around USD 2.3 billion by 2032, growing at a CAGR of 4.04% from 2023 to 2032.

Key Pointers

Report Scope of the Residential Outdoor Storage Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.55 billion |

| Revenue Forecast by 2032 | USD 2.3 billion |

| Growth rate from 2023 to 2032 | CAGR of 4.04% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | ShelterLogic Group; Lifetime Products; Suncast Corporation; CEDARSHED USA; Tuff Shed Inc.; Backyard Buildings & More; Keter; Rubbermaid; Leisure Season Ltd; Barnyard Utility Buildings |

The rising demand for comfortable, well-furnished, and enhanced outdoor spaces is driving the demand for residential outdoor storage.

The major residential outdoor storage application includes storage of items that are found in residential spaces including home maintenance supplies & equipment, home furnishing, gardening tools & equipment, refuse containers, vehicles, and canopies. The residential outdoor storage products improve the item's assortment and subsequently, undertake the management of space in the residential property efficiently.

The presence of a highly organized network in the retail sector is one of the most important factors driving product demand as the consumer has a wide product assortment and higher visibility of the products through the same. This offline mode of product distribution system includes various departmental stores, convenience stores, hypermarkets, and supermarkets that offer every possible storage product that can be used in the residential premise.

In addition, the rapidly increasing penetration of e-commerce platforms coupled with the increasing tie-up and collaboration of various retailers with online distributors is further expected to facilitate the consumer with the desired storage product thereby adding to the market growth on a positive note.

Rapidly changing consumer preference toward maintaining separate vehicles for office use and traveling, is expected to drive demand for extra parking space, such as sheds made from steel and wood, over the forecast period. Increasing preference for all-weather shade and carports in residential spaces owing to their sturdy open-style structure and low maintenance are expected to drive product (shed or carports) demand for the vehicle covering in residential spaces.

Rising demand for comfortable, well-furnished, and enhanced outdoor spaces is expected to drive the residential outdoor storage industry over the forecast period. Increasing spending on lawn and garden equipment for lawn maintenance, especially in countries such as the U.S., Canada, Italy, the UK, France, and Germany, is expected to boost the need for storing items such as lawn/garden equipment, swimming pool hygiene products, lighting repair tools, and outdoor sports equipment, which, in turn, is expected to drive the demand for outdoor storage products.

Residential outdoor storage equipment such as sheds, carports, and deck boxes are primarily used in large houses with big lawns and backyards. These are often used for storing gardening equipment, parking vehicles, and accommodating extra furniture. The construction of these storages is limited to multifamily housing units and apartments owing to the unavailability of space and the high costs involved in developing them. The global shift from single-family housing units to multifamily housing units owing to the affordability of the family homes and insufficient space in urban areas is expected to result in a surged demand for apartment housing units. This, in turn, is anticipated to result in reduced demand for residential outdoor storage across the world.

Material Insights

Based on material, the plastic segment account led to a market size of USD 621.04 million in 2022. It is expected to grow at a CAGR of 4.25% from 2023 to 2032. Residential outdoor storage products made from plastic material are anticipated to witness high demand over the forecast period. Plastics remain popular in the market among consumers due to their availability in a wide variety of shapes and sizes along with their water-resistant properties. Various outdoor products made up of plastics such as patio storage containers, bench deck boxes, storage sheds, and outdoor shelves keep the storage items dry and mold-free in all seasons.

The high impact and tear resistance offered by plastic material are due to their long and chained polymer structure, which provide the material with its elasticity and high tensile strength against brittle fracture and cracking. The rising adoption of high-density polyethylene (HDPE) in making cabinets, shelves, and deck boxes, owing to their cost-effectiveness, high quality, and water & chemical resistance, is anticipated to increase the adoption of plastic materials.

Wood is used to make different types of sheds in residential spaces, such as bike or bicycle sheds, car sheds, garden sheds, tool sheds, and firewood storage sheds. Various shed construction techniques, such as building on a solid foundation, roof trusses, and implementation of sturdy frame & weather-resistant exterior grade plywood, are prevalent in different countries including the U.S., New Zealand, and Australia.

Outdoor residential storage products such as shelves and sheds made from metal materials are expected to gain a prominent market share owing to their high usage in the form of racks. These can store heavy items including automotive spare parts and hand and powertools in outdoor conditions. Steel is one of the most widely used materials used to produce outdoor shelves and storage racks owing to its robustness and durability. Steel storage products are easy to maneuver and construct for both normal and heavy product storage including hand tools and power tools.

Product Insights

The outdoor storage benches & cabinets product segment is projected to grow at the fastest CAGR of 6.31% from 2023 to 2032. Cedar, pine, and teak are the best types of wood to manufacture outdoor benches due to their high strength and water-resistant properties. However, cedar and teak are expensive compared to pine and as a result, pine is highly used to design and produce storage benches and cabinets. Metal is another material used to produce storage benches owing to its high durability and low price. However, metal benches lack comfort, which is likely to slow down the market growth for outdoor storage benches made from metal.

The shipping container segment accounted for a revenue share of 21.46% in 2022. The segment is further expected to grow at a CAGR of 4.21% over the coming years. This is due to the rising consumer preference for customized and durable backyard storage options outside the residential premises. Safe and secure storage for repair & maintenance equipment such as hand & power tools, lawnmowers, and hedge clippers are expected to boost the demand for shipping containers. These containers present a strong and highly spacious storage option for various essential items for lawn & garden maintenance.

The shed product segment accounted for the largest revenue share of 58.14% in 2022. Sheds in residential premises are primarily used for storage and as covering for various items including bicycles, vehicles, and garden items. Storage and garden sheds are the most-used applications made. These are usually made from wood, plastic, or metal. Storage sheds are used for the storage of residential equipment such as mechanical & electrical tools & equipment, extra furniture, cleaning items, wooden logs, and stoves.

Distribution Channel Insights

The retail distribution channel segment led the market with the largest revenue share of 49.31% in 2022. Retail is the most common distribution channel in the market. Consumers procure these products including deck boxes, bins, totes, outdoor shelves, outdoor benches, cabinets, and sheds directly from shop owners as it is convenient, and often comes pre-equipped with transportation, & installation services.

Products including deck boxes, cabinets, storage benches, and outdoor shelves are smaller storage items that can be directly sold even by a smaller retailer. However, large products including sheds and shipping containers are primarily sold by larger retailers that have a strong market presence, in turn, displaying their dominance in the retail distribution channel.

The wholesale segment was valued at USD 343.54 million in 2022 and is expected to reach USD 463.83 million by 2032. The wholesale distribution channel undertakes more financial risk when compared to the retailers, since wholesalers purchase the product in bulk from the manufacturers, thereby taking full legal responsibility for the same. As a result, the pivotal role of wholesalers includes the procurement of products in bulk and their storage until it is required by the retailer or by the customer in the market.

E-commerce is anticipated to become the fastest-growing distribution channel for the residential outdoor storage industry over the forecast period. The growth in the said segment is attributed to the increased proliferation of e-commerce platforms, and tie-ups with product manufacturers, wholesalers, and retailers. In addition, the adoption of product storage and distribution operations through retail fulfillment methods including drop shipping, self-management, and third-party fulfillment services are further expected to add growth prospects to the market.

Regional Insights

The North America regional segment dominated the market and accounted for the largest revenue share of 56.82% in 2022. The prevailing trend of constructing patios or pergolas outside residential premises for recreational and leisure activities is further contributing to the demand for residential outdoor storage, including deck boxes, bins, totes, outdoor shelves, outdoor storage benches, cabinets, etc.

The rising consumer emphasis on outdoor activities in North America, coupled with the increasing demand for outdoor storage due to the changing lifestyle of the masses, is expected to fuel the demand for outside stowing various items such as log woods, cleaning fabrics, pillows, and towels that are used for dining and partying outdoors, as well as in pool activities.

Moreover, the easy availability of wood in the U.S. and Canada is expected to lead to large-scale production of residential outdoor storage made from wood in these countries. Wood is used for developing sheds, outdoor shelves, cabinets, and deck boxes. These storages are anticipated to witness an increased demand in North America due to the increasing number of residential buildings, especially in suburban areas owing to the easy availability of adequate land for developing them.

The Europe segment is forecasted to grow at a compound annual growth rate of 4.06% from 2023 to 2032. The rising consumer concerns about improving storage facilities in their residential spaces to enhance the indoor appearance of their homes is anticipated to drive the demand for outdoor storage in Europe over the coming years.

The growing number of new residential construction activities and ongoing renovations of existing residential premises in Europe are expected to fuel the use of various tools and equipment such as wood-cutting tools; paint and polish cans; handheld and power tools; lawnmowers; and house windows glass cleaners in the region. As these tools and equipment take a significant space inside residential buildings, outdoor sheds, garages, and residential shipping containers can be used to store them for proper management of space, and product stowing; the European region is expected to witness promising growth during the forecast period.

Residential Outdoor Storage Market Segmentations:

By Material

By Product

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Material Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Residential Outdoor Storage Market

5.1. COVID-19 Landscape: Residential Outdoor Storage Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Residential Outdoor Storage Market, By Material

8.1. Residential Outdoor Storage Market, by Material, 2023-2032

8.1.1 Wood

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Plastic

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Metal

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Residential Outdoor Storage Market, By Product

9.1. Residential Outdoor Storage Market, by Product, 2023-2032

9.1.1. Shipping Containers

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Sheds

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Deck Boxes, Bins & Totes

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Outdoor Shelves

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Outdoor Storage Benches & Cabinets

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Residential Outdoor Storage Market, By Distribution Channel

10.1. Residential Outdoor Storage Market, by Distribution Channel, 2023-2032

10.1.1. Retail

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Wholesale

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. E-Commerce

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Residential Outdoor Storage Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Material (2020-2032)

11.1.2. Market Revenue and Forecast, by Product (2020-2032)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Material (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Material (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Material (2020-2032)

11.2.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Material (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Material (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Material (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Material (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Material (2020-2032)

11.3.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Material (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Material (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Material (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Material (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Material (2020-2032)

11.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Material (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Material (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Material (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Material (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Material (2020-2032)

11.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Material (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Material (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 12. Company Profiles

12.1. ShelterLogic Group

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Lifetime Products

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Suncast Corporation

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. CEDARSHED USA

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Tuff Shed Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Backyard Buildings & More

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Keter

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Rubbermaid

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Leisure Season Ltd

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Barnyard Utility Buildings

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others