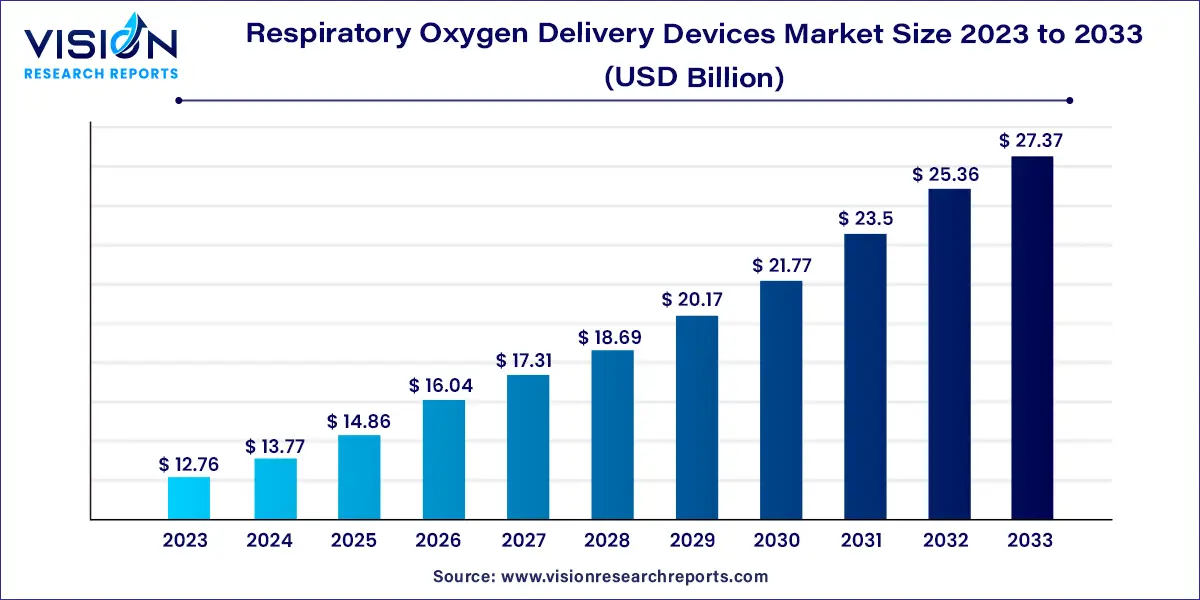

The global respiratory oxygen delivery devices market was estimated at USD 12.76 billion in 2023 and it is expected to surpass around USD 27.37 billion by 2033, poised to grow at a CAGR of 7.93% from 2024 to 2033.

The respiratory oxygen delivery devices market is a critical sector within the global healthcare industry, driven by the escalating prevalence of respiratory disorders and the increasing demand for advanced medical solutions. Respiratory oxygen delivery devices are designed to provide supplemental oxygen to patients suffering from respiratory insufficiencies, enabling them to breathe more comfortably and effectively. This market encompasses a wide range of devices, each tailored to specific medical requirements, thereby offering diverse options for both healthcare providers and patients.

The growth of the respiratory oxygen delivery devices market is propelled by several key factors. The aging global population, coupled with the increasing prevalence of respiratory disorders such as chronic obstructive pulmonary disease (COPD) and asthma, has significantly boosted the demand for these devices. Technological advancements have led to the development of portable and user-friendly oxygen delivery systems, enhancing patient mobility and convenience. Furthermore, the COVID-19 pandemic has emphasized the crucial role of oxygen therapy, driving the demand for efficient and reliable respiratory oxygen delivery devices. The market is also witnessing a trend towards home-based healthcare solutions, with the development of compact and easy-to-use oxygen concentrators, catering to the growing needs of patients for in-home oxygen therapy. These factors, combined, are contributing to the continuous expansion of the Respiratory Oxygen Delivery Devices Market, ensuring that patients have access to advanced and convenient solutions for managing respiratory insufficiencies effectively.

| Report Coverage | Details |

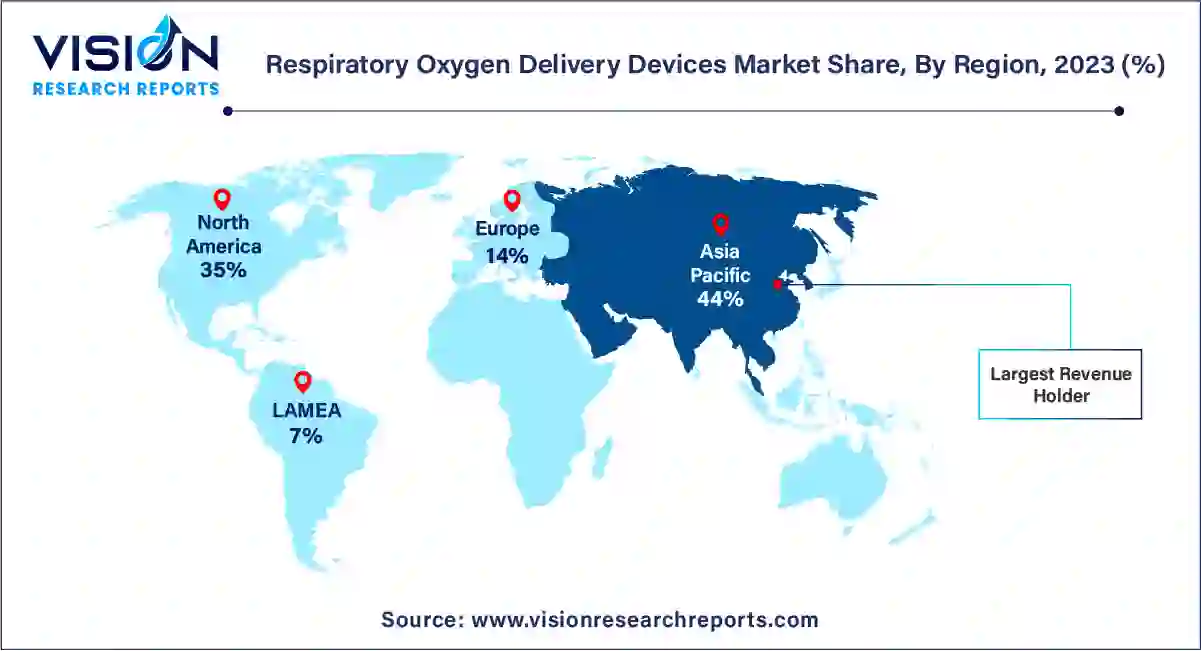

| Revenue Share of Asia Pacific in 2023 | 44% |

| Revenue Forecast by 2033 | USD 27.37 billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.93% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The Oxygen Masks segment contributed the largest market share of 37% in 2023. Oxygen masks are essential devices used to deliver a controlled flow of oxygen to patients with breathing difficulties. They cover the nose and mouth, ensuring that patients receive an adequate supply of oxygen as they breathe naturally. These masks are widely used in hospitals, clinics, and emergency medical situations. The masks come in various designs, such as simple face masks, partial rebreather masks, and non-rebreather masks. Each type serves specific purposes, allowing healthcare professionals to tailor oxygen delivery according to the patient's needs and medical condition. Oxygen masks are particularly useful for patients requiring higher oxygen concentrations and are an integral part of respiratory care protocols.

The venturi masks segment is expected to grow at the fastest growth rate of 8.64% over the forecast period. Venturi masks are specialized oxygen delivery devices that allow precise control of the oxygen concentration delivered to the patient. These masks operate on the principle of air entrainment, where room air is mixed with a specific concentration of oxygen through a venturi system. By adjusting the size of the venturi opening, healthcare providers can regulate the oxygen flow rate and concentration, ensuring accurate delivery to the patient. Venturi masks are especially valuable in situations where precise oxygen titration is crucial, such as in cases of chronic respiratory diseases and post-surgical care. They are preferred in scenarios where maintaining a targeted oxygen level is vital for patient safety and recovery.

The hospitals segment held the largest revenue share of 53% in 2023. Hospitals are the cornerstone of respiratory healthcare, serving as primary centers for diagnosing and treating patients with respiratory disorders. Within hospital settings, respiratory oxygen delivery devices are extensively utilized in diverse departments, including emergency rooms, intensive care units (ICUs), general wards, and specialized respiratory care units. Oxygen therapy is a fundamental intervention for patients with acute respiratory distress, chronic obstructive pulmonary disease (COPD), pneumonia, and other conditions. Hospitals require a range of oxygen delivery devices, from masks and nasal cannulas to advanced ventilators, to cater to the varied needs of patients. Respiratory therapists and healthcare professionals in hospitals rely on these devices to stabilize patients' oxygen levels, ensuring their respiratory functions are adequately supported during critical periods.

Outpatient facilities, including clinics and specialized respiratory care centers, play a vital role in managing chronic respiratory conditions and providing follow-up care for patients. These facilities are essential for patients requiring ongoing oxygen therapy outside the hospital environment. Respiratory oxygen delivery devices in outpatient settings are often tailored to accommodate patients' specific needs, promoting mobility and enabling them to maintain their daily activities while receiving necessary treatment. Oxygen therapy in outpatient facilities is particularly prevalent among individuals with conditions such as asthma, bronchitis, and sleep apnea. Portable oxygen concentrators and lightweight oxygen masks are commonly used, allowing patients to visit outpatient facilities for regular check-ups and consultations while ensuring continuous respiratory support.

Asia Pacific held the largest revenue share of 44% in 2023. The Asia-Pacific region is witnessing rapid growth in the respiratory oxygen delivery devices market. Countries like China, India, and Japan are major contributors, driven by improving healthcare infrastructure, rising healthcare expenditure, and a growing awareness of respiratory health. The prevalence of air pollution and smoking-related respiratory issues also amplifies the demand for oxygen therapy devices in this region. Furthermore, government initiatives to enhance healthcare facilities and the availability of cost-effective products foster market expansion.

North America also held a significant revenue share of the market in 2023. North America, particularly the United States, holds a significant share in the global respiratory oxygen delivery devices market. The region benefits from well-established healthcare infrastructure and high healthcare expenditure. Technological advancements and a proactive approach to adopting innovative medical devices contribute to the growth of the market in this region. Moreover, the prevalence of chronic respiratory diseases and the aging population further drive the demand for respiratory oxygen delivery devices.

By Product

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Respiratory Oxygen Delivery Devices Market

5.1. COVID-19 Landscape: Respiratory Oxygen Delivery Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Respiratory Oxygen Delivery Devices Market, By Product

8.1. Respiratory Oxygen Delivery Devices Market, by Product, 2024-2033

8.1.1. Oxygen Masks

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Nasal Cannula

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Venturi Masks

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Non-rebreather Masks

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Bag Valve Masks

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. CPAP Masks

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Respiratory Oxygen Delivery Devices Market, By End-use

9.1. Respiratory Oxygen Delivery Devices Market, by End-use, 2024-2033

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Outpatient Facilities

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Home Care

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Respiratory Oxygen Delivery Devices Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. GE Healthcare

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Koninklijke Philips N.V.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. ICU Medical (Smiths Medical)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Invacare Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Medtronic

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Fisher & Paykel Healthcare

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. ResMed

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Linde

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Mindray

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Chart Industries

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others