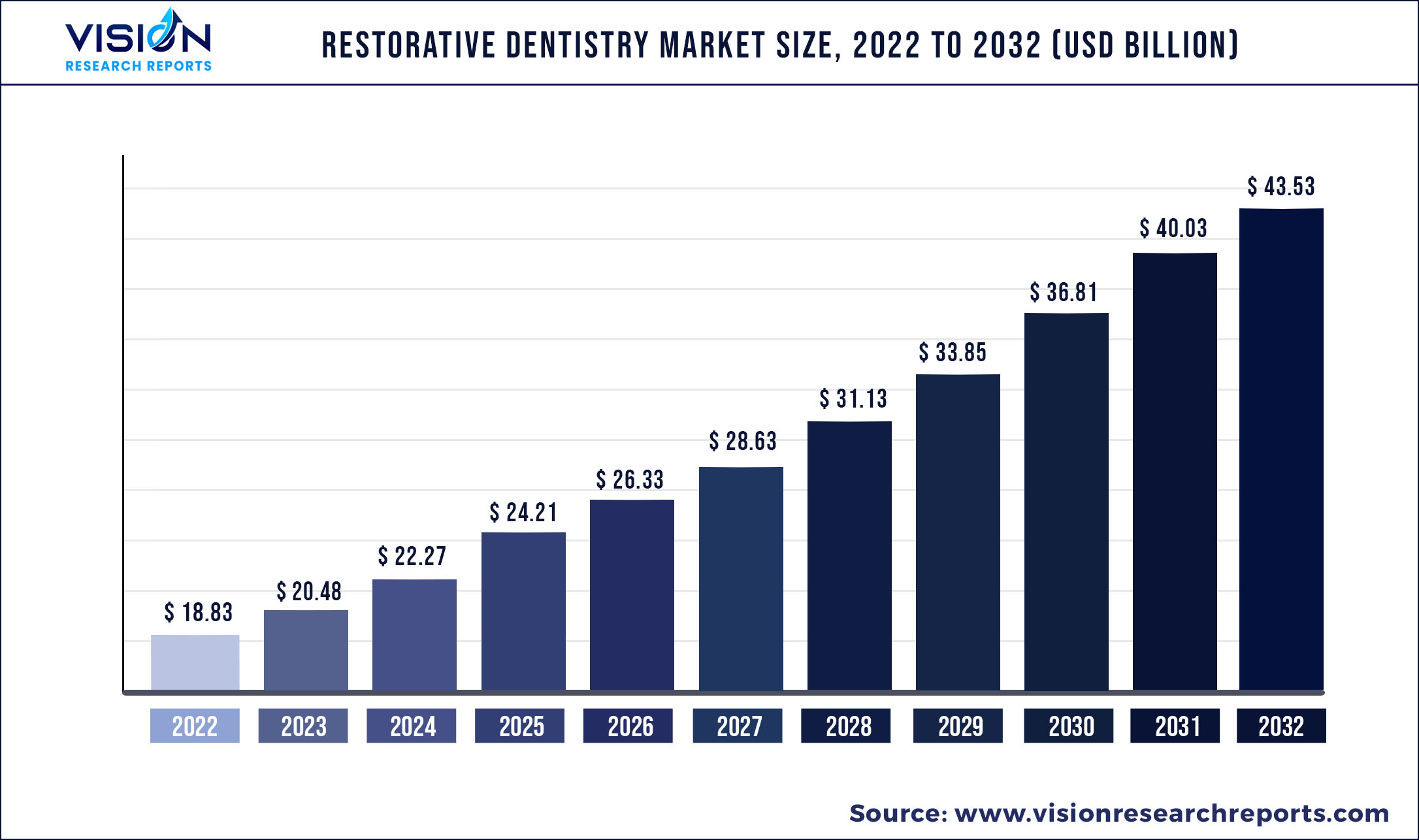

The global restorative dentistry market was valued at USD 18.83 billion in 2022 and it is predicted to surpass around USD 43.53 billion by 2032 with a CAGR of 8.74% from 2023 to 2032.

Key Pointers

| Report Coverage | Details |

| Market Size in 2022 | USD 18.83 billion |

| Revenue Forecast by 2032 | USD 43.53 billion |

| Growth rate from 2023 to 2032 | CAGR of 8.74% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | 3M company; Dentsply Sirona; Danaher Corporation; Septodont Holding; Ivoclar Vivadent AG; Coltene Holding Ag; GC Corporation; Mitsui Chemicals, Inc.; Institut Straumann AG; Zimmer Biomet Holdings, Inc. |

The growing demand for implants and cosmetic dentistry is the key factor driving the market growth. The growth is attributed to the increasing prevalence of oral health diseases, rising focus on aesthetics, and rising dental tourism in emerging markets. Furthermore, the development of advanced technological solutions will boost the growth of the restorative dentistry market. A rise in the use of restorative materials to fabricate dental restorations, increasing focus on aesthetics resulting in a large number of tooth repair and cosmetic dentistry procedures, and the growing adoption of biomaterials by dental practitioners further drive the market growth during the forecast period.

According to the WHO, as of May 2020, there were more than 42,48,389 COVID-19 reported cases. This has negatively affected the restorative dentistry market during the lockdown phase. Due to the outbreak of COVID-19, dentists avoided going to the clinic for practice, opting instead for prescribing antibiotics and consultations remotely. Dental clinics remained closed because dentists would have become the potential carriers of disease and posed a high risk for nosocomial infections. The risk is primarily due to dental interventions that include the generation of aerosols and the handling of sharps.

The increasing prevalence of dental caries across the globe is expected to boost the demand for dental treatments. As per statistics from The Global Burden of Disease Study 2019, dental diseases have affected 3.5 billion people with caries of permanent teeth. It is estimated that 520 million children suffer from caries of primary teeth and 2 billion people suffer from caries of permanent teeth. Thus, the growing prevalence of dental disorders is anticipated to boost the restorative dentistry market.

Regular dental checkups may drive the demand for dental procedures. As per statistics from the Centers for Disease Control and Prevention, over USD 45 billion in the U.S. productivity is lost each year due to untreated dental diseases, and approximately 34 million school hours are lost each year due to unplanned dental care. The routine checkups mainly include root canals, crowns, dental fillings, maxillofacial procedures, and bonding treatments. Thus, regular dental checkups are anticipated to boost the restorative dentistry market. Various initiatives by major key market players such as product launches, mergers, and acquisitions are anticipated to boost the market.

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Restorative Dentistry Market

5.1. COVID-19 Landscape: Restorative Dentistry Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Restorative Dentistry Market, By Product

8.1. Restorative Dentistry Market, by Product, 2023-2032

8.1.1. Restorative Materials

8.1.1.1. Market Revenue and Forecast (2019-2032)

8.1.2. Implants

8.1.2.1. Market Revenue and Forecast (2019-2032)

8.1.3. Prosthetics

8.1.3.1. Market Revenue and Forecast (2019-2032)

8.1.4. Restorative Equipment

8.1.4.1. Market Revenue and Forecast (2019-2032)

Chapter 9. Global Restorative Dentistry Market, By End-use

9.1. Restorative Dentistry Market, by End-use, 2023-2032

9.1.1. Dental Hospitals and Clinics

9.1.1.1. Market Revenue and Forecast (2019-2032)

9.1.2. Dental labs

9.1.2.1. Market Revenue and Forecast (2019-2032)

9.1.3. Research and Teaching Institutes

9.1.3.1. Market Revenue and Forecast (2019-2032)

Chapter 10. Global Restorative Dentistry Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2019-2032)

10.1.2. Market Revenue and Forecast, by End-use (2019-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2019-2032)

10.1.3.2. Market Revenue and Forecast, by End-use (2019-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2019-2032)

10.1.4.2. Market Revenue and Forecast, by End-use (2019-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2019-2032)

10.2.2. Market Revenue and Forecast, by End-use (2019-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2019-2032)

10.2.3.2. Market Revenue and Forecast, by End-use (2019-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2019-2032)

10.2.4.2. Market Revenue and Forecast, by End-use (2019-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2019-2032)

10.2.5.2. Market Revenue and Forecast, by End-use (2019-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2019-2032)

10.2.6.2. Market Revenue and Forecast, by End-use (2019-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2019-2032)

10.3.2. Market Revenue and Forecast, by End-use (2019-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2019-2032)

10.3.3.2. Market Revenue and Forecast, by End-use (2019-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2019-2032)

10.3.4.2. Market Revenue and Forecast, by End-use (2019-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2019-2032)

10.3.5.2. Market Revenue and Forecast, by End-use (2019-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2019-2032)

10.3.6.2. Market Revenue and Forecast, by End-use (2019-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2019-2032)

10.4.2. Market Revenue and Forecast, by End-use (2019-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2019-2032)

10.4.3.2. Market Revenue and Forecast, by End-use (2019-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2019-2032)

10.4.4.2. Market Revenue and Forecast, by End-use (2019-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2019-2032)

10.4.5.2. Market Revenue and Forecast, by End-use (2019-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2019-2032)

10.4.6.2. Market Revenue and Forecast, by End-use (2019-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2019-2032)

10.5.2. Market Revenue and Forecast, by End-use (2019-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2019-2032)

10.5.3.2. Market Revenue and Forecast, by End-use (2019-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2019-2032)

10.5.4.2. Market Revenue and Forecast, by End-use (2019-2032)

Chapter 11. Company Profiles

11.1. 3M company

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Dentsply Sirona

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Danaher Corporation

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Septodont Holding

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Ivoclar Vivadent AG

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Coltene Holding Ag

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. GC Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Mitsui Chemicals, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Institut Straumann AG

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Zimmer Biomet Holdings, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others