The global retail banking market was estimated at USD 1.87 trillion in 2022 and it is expected to surpass around USD 3.23 trillion by 2032, poised to grow at a CAGR of 5.63% from 2023 to 2032. The retail banking market in the United States was accounted for USD 417.5 billion in 2022.

Key Pointers

Report Scope of the Retail Banking Market

| Report Coverage | Details |

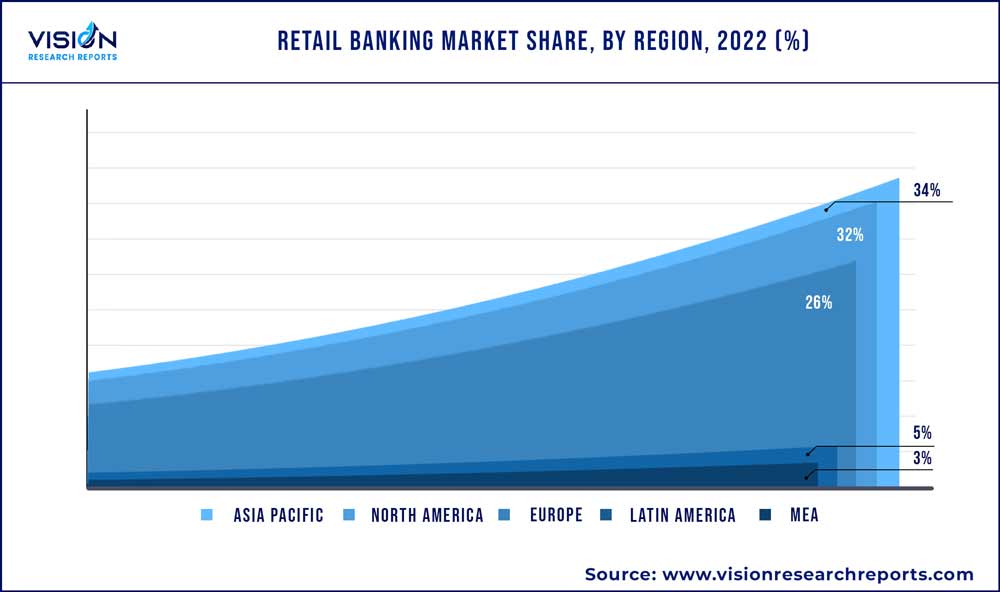

| Revenue Share of Asia Pacific in 2022 | 34% |

| Revenue Forecast by 2032 | USD 3.23 trillion |

| Growth Rate from 2023 to 2032 | CAGR of 5.63% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | BNP Paribas; Citigroup, Inc.; HSBC Group; ICBC; JP Morgan Chase & Co.; Bank of America Corporation; Barclays; China Construction Bank; Deutsche Bank AG, Mitsubishi UFJ Financial Group, Inc., Wells Fargo |

The growth is driven by rapid technological advancements shaping the market’s dynamics and growth potential. The progress in digital technologies has transformed the way customers interact with banks. The rise of online and mobile banking has made banking services more accessible and convenient for customers, allowing them to conduct transactions, check balances, and access a wide range of services at their fingertips.

Another significant driver is changing customer expectations. Customers nowadays expect personalized and tailored banking experiences. They demand seamless integration across various channels, including online, mobile, and physical branches. Banks that can adapt and provide a superior customer experience through personalized services, innovative products, and efficient processes are likely to thrive in the competitive market. Moreover, demographic shifts are impacting the retail banking market. The growing middle class in emerging economies creates new opportunities for banks to create customer’s banking requirements.

In addition, competition within the retail banking sector is intensifying. Traditional banks face competition from fintech startups and technology players entering the financial services space. These new players leverage technological innovations, such as deep learning and blockchain, to offer disruptive products and services. Traditional banks are focusing on embracing digital transformation, collaborating with fintech firms, or developing innovative solutions to stay competitive.

Regulatory changes also play a crucial role in shaping the retail banking landscape. Governments and regulatory bodies worldwide impose strict regulations to enhance consumer protection, ensure financial stability, and promote fair practices in the banking industry. Compliance with these regulations requires banks to invest in robust risk management systems, data protection measures, and regulatory reporting capabilities. Moreover, transparency, security, and ethical practices can gain a competitive advantage for the market players, and foster long-term customer relationships, driving the market further.

However, the market growth is obstructed by the threat of increasing cybersecurity risks. As digitalization expands, banks face a growing number of cyber threats, including data breaches, identity theft, and fraudulent activities. These risks not only harm the customers but also damage the reputation of the banks. To overcome this challenge, banks need to prioritize cybersecurity measures and invest in robust systems to protect customer data. Implementing multi-factor authentication, encryption techniques, and continuous monitoring can help mitigate risks.

Type Insights

The private sector banks segment dominated the market in 2022 and accounted for a revenue share of more than 30%. The private sector banks have leveraged their agility and flexibility to adapt to changing market conditions and customer preferences. Unlike public sector banks, they are not burdened by bureaucratic processes and enjoy greater autonomy in decision-making, enabling them to respond swiftly to market demands and introduce innovative products and services.

Moreover, private sector banks have been successful in creating a customer-centric approach. They prioritize delivering a superior customer experience by offering personalized services, convenient banking channels, and quick turnaround times.

The public sector banks segment is anticipated to register significant growth over the forecast period. The public sector banks enjoy a vast network and presence across various regions, including rural and semi-urban areas. This extensive branch network enables them to tap into a large customer base and reach underserved markets, contributing to their growth.

Moreover, public sector banks often prioritize financial inclusion and social objectives. They are committed to serving the unbanked and underprivileged sections of society, promoting inclusive banking practices. By offering affordable and accessible banking services, such as basic savings accounts and government welfare schemes, public sector banks are expanding their customer base and deepening their penetration in previously untapped segments.

Service Insights

The saving and checking account segment dominated the market in 2022 and accounted for a revenue share of more than 21%. Saving and checking accounts are the foundation of personal banking. They provide customers with a secure place to deposit and manage their funds, making them essential for everyday financial transactions and savings goals.

As a result, the demand for saving and checking accounts remains consistently high among individuals and businesses. Moreover, saving and checking accounts offer liquidity and accessibility. Customers can easily deposit and withdraw funds as needed, making them highly convenient for day-to-day financial activities. The ability to access funds through ATMs, online banking, and mobile apps has further enhanced the appeal and popularity of these accounts.

The debit and credit cards segment is anticipated to register the fastest growth over the forecast period. Debit and credit cards offer convenience and flexibility in making transactions. They eliminate the need for carrying cash, allowing customers to make purchases easily and securely. The widespread acceptance of debit and credit cards by merchants and the integration of contactless payment technology have further propelled the growth of this segment.

Moreover, debit and credit cards provide users with various benefits and rewards programs. Banks offer cashback, loyalty points, airline miles, and other incentives to encourage card usage. These rewards attract customers and incentivize them to choose cards as their preferred payment method, driving the growth of this segment.

Regional Insights

Asia Pacific dominated the retail banking market in 2022 and accounted for a revenue share of more than 34%. The region has a large and rapidly growing population, with a rising middle class and increasing disposable income. This demographic trend has led to a higher demand for banking services, including savings accounts, loans, and investment products.

Moreover, the region has experienced significant economic growth and urbanization, leading to the expansion of businesses and increased financial activity. As a result, there is a greater need for banking services to support commercial and personal transactions.

Middle East & Africa is expected to emerge as the fastest-growing market over the forecast period. The region has a large and rapidly expanding population, with a significant portion of the population being young and tech-savvy. This demographic dividend presents a tremendous growth opportunity for retail banking, as these individuals seek convenient and accessible banking solutions to meet their financial needs.

Moreover, there is a growing emphasis on financial inclusion in the MEA region. Governments and regulatory authorities are actively promoting initiatives to improve access to banking services for underserved populations, including those in rural areas and low-income segments. This focus on financial inclusion is driving the adoption of retail banking and contributing to the region's rapid growth.

Retail Banking Market Segmentations:

By Type

By Service

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Retail Banking Market

5.1. COVID-19 Landscape: Retail Banking Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Retail Banking Market, By Type

8.1. Retail Banking Market, by Type, 2023-2032

8.1.1. Public Sector Banks

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Private Sector Banks

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Foreign Banks

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Community Development Banks

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Non-banking Financial Companies (NBFC)

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Retail Banking Market, By Service

9.1. Retail Banking Market, by Service, 2023-2032

9.1.1. Saving and Checking Account

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Transactional Account

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Personal Loan

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Home Loan

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Home Loan

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Debit and Credit Cards

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. ATM Cards

9.1.7.1. Market Revenue and Forecast (2020-2032)

9.1.8. Certificates of Deposits

9.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Retail Banking Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.2. Market Revenue and Forecast, by Service (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Service (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Service (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.2. Market Revenue and Forecast, by Service (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Service (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Service (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Service (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Service (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.2. Market Revenue and Forecast, by Service (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Service (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Service (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Service (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Service (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.2. Market Revenue and Forecast, by Service (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Service (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Service (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Service (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Service (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.5.2. Market Revenue and Forecast, by Service (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Service (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Service (2020-2032)

Chapter 11. Company Profiles

11.1. BNP Paribas

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Citigroup, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. HSBC Group

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. ICBC

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. JP Morgan Chase & Co.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Bank of America Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Barclays

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. China Construction Bank

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Deutsche Bank AG, Mitsubishi UFJ Financial Group, Inc., Wells Fargo

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others