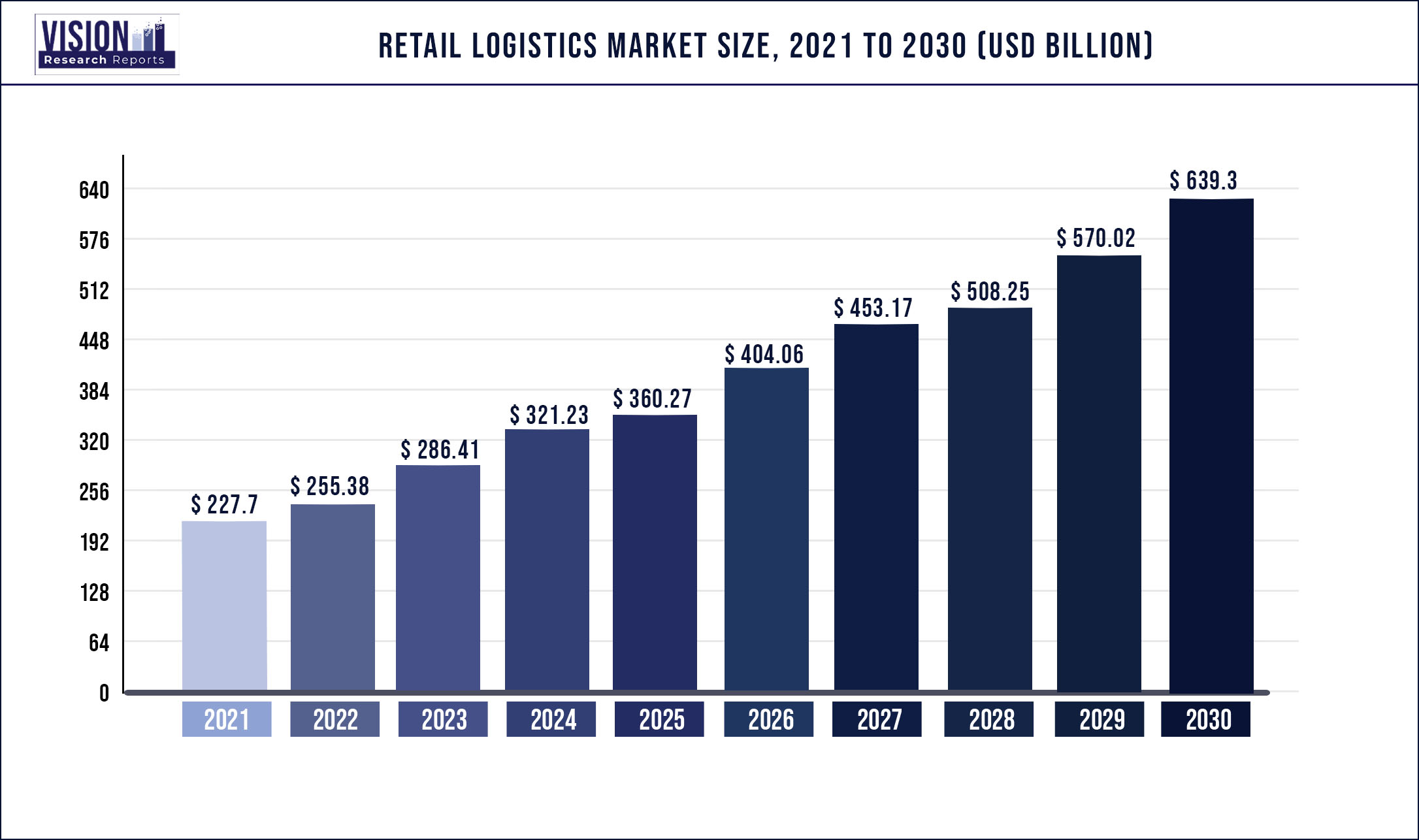

The global retail logistics market was estimated at USD 227.7 billion in 2021 and it is expected to surpass around USD 639.3 billion by 2030, poised to grow at a CAGR of 12.15% from 2022 to 2030.

The growth is likely to be fueled by new last-mile delivery methods in the retail e-commerce market and the introduction of IoT in the supply chain. An IoT-based supply chain links multiple technological devices with the help of sensors, allowing real-time data collection on various vital factors like filing rate and temperature.

Customers benefit from technological advancements such as intelligent distribution robots and autonomous items and sorting systems, which usher in a new era of smart logistics. Because most of the links in the new retail format have been digitalized and are available in real-time, combined with the use of new technologies such as big data and AI, companies can comprehend the genuine demands of customers faster and more accurately. It's also utilized to help with supply chain optimization and upgrades.

Furthermore, to upgrade existing retail formats, retail companies and traditional distribution channels must focus on B2B wholesale distribution, self-service vending machines, B2C e-commerce, and O2O. Additionally, factors including expanding globalization, an increase in international retailing, and an improvement in the economy due to increased tax revenue from goods exported and imported are predicted to help the retail logistics industry's growth in the forthcoming years.

The rapid expansion of retail e-commerce has created several opportunities for both new and established firms in the market. However, retail e-commerce has faced several operational and financial issues in recent years. Return shipments are becoming a significant element of logistics processes, posing operational issues and the potential to reduce logistical costs. Moreover, poor infrastructure can stifle market growth by making market participants hesitant to expand and spend.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 227.7 billion |

| Revenue Forecast by 2030 | USD 639.3 billion |

| Growth rate from 2022 to 2030 | CAGR of 12.15% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, solution, mode of transport, region |

| Companies Covered | XPO Logistics, Inc.; DSV; Kuehne + Nagel International; C.H. Robinson Worldwide, Inc.; Nippon Express; FedEx; Schneider; United Parcel Service; APL Logistics Ltd; DHL International GmbH; A.P. Moller - Maersk |

Type Insights

The conventional type segment held the largest revenue share of over 55% in 2021. The high percentage is due to the growing use of traditional retail logistics services by consumers who have limited reliance on the internet and hence prefer to shop in conventional retail establishments. It has been discovered that approximately 36% of shoppers prefer to purchase things from traditional retail outlets after researching them online. The buyers can pick up and check a product in a retail store. It also delivers immediate gratification because customers can purchase a thing without waiting for it to be delivered.

The e-commerce retail logistics segment is estimated to register the highest CAGR of 13.0% from 2022 to 2030. The growth is primarily attributable to the global spread of the coronavirus pandemic, which resulted in a surge in sales for e-commerce portals. Furthermore, rising internet penetration, combined with perks such as easy and free returns/exchanges, fast delivery, lower shipping costs, and a vast product selection, contribute to e-commerce retail's rapid rise.

As a result, logistics companies invest in enhancing and diversifying their services to meet the fast-rising e-commerce sector. FedEx, for example, announced the acquisition of ShopRunner, an e-commerce platform, in December 2020. The purchase was made to allow FedEx to utilize ShopRunner's e-commerce capabilities, allowing it to expand its e-commerce portfolio and client base.

Solution Insights

The supply chain solutions segment accounted for the largest revenue share of over 35% in 2021 and is expected to continue its dominance over the forecast period. The supply chain ensures on-time delivery, optimizes Omni channel operations, personalizes kitting and order fulfillment, and manages customer returns efficiently. It also allows for quick direct-to-consumer and direct-to-store shipment, boosting warehouse efficiency and inventory management. The segment is expected to register the fastest CAGR of over 13.8% from 2022 to 2030, owing to the growing usage of cloud-based supply chain systems, which assist track and optimize transportation and managing returns.

Over the projection period, the reverse logistics and liquidation segment is expected to witness significant growth. The booming e-commerce business, combined with an increase in the number of e-shoppers, is driving the demand for reliable reverse logistics services. Customers are increasingly favoring simple and quick returns/exchanges, so retailers aim to ease the process of replacing online goods that are simple and convenient for customers. This factor is expected to contribute to the growth of the segment in near future.

Mode of Transport Insights

The roadways mode of transport segment held the largest revenue share of over 52% in 2021 and is expected to dominate over the forecast period. Increasing demand for roadway vehicles to transport retail goods over long distances, especially in domestic regions, has increased the growth of the roadways segment. Trucks and cargos with large carrying capacities make a better choice for retail companies to opt for road transport. Several government measures encourage growth. For example, the Federal Motor Carrier Safety Administration's recent regulations promote the use of cameras to substitute rearview mirrors to increase the safety of truck drivers.

Furthermore, increased road connectivity in developing countries and excellent road connectivity across all developed countries is a crucial element driving the growth of the highway mode of the transportation segment. Most tier 2 and tier 3 cities in various nations are well connected by roadways, making delivery and pick-up of products accessible for retail logistics companies. Due to developments in road transportation systems and the improvement of highways around the world, this trend is projected to continue in the forthcoming years.

Regional Insights

Asia Pacific accounted for the largest revenue share of 26.3% in 2021. The region is home to a vast customer base and has witnessed significant adoption of e-commerce channels by individuals. China, Japan, Australia, and India are among the leading item exporters, accounting for a considerable share of worldwide retail e-commerce sales. As a result, the region's promising e-commerce growth prospects are the primary drivers of regional market expansion.

Other factors projected to fuel regional market expansion include a growing focus on transportation methods and ongoing logistics infrastructure upgrades in emerging countries. For example, the Ministry of Road Transport & Highways (MoRTH) is developing multimodal logistics parks to solve underdeveloped road and material handling infrastructure as part of the Indian Government's Logistics Efficiency Enhancement Program (LEEP).

North America held a significant revenue share of the market in 2021. The presence of numerous prominent competitors such as United Parcel Service of America, Inc., XPO Logistics, Inc., FedEx, Ryder System Inc., C.H. Robinson Worldwide, Inc., and Expeditors International of Washington, Inc. is helping to drive the growth of the regional market.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Retail Logistics Market

5.1. COVID-19 Landscape: Retail Logistics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Retail Logistics Market, By Type

8.1. Retail Logistics Market, by Type, 2022-2030

8.1.1 Conventional Retail Logistics

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. E-commerce Retail Logistics

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Retail Logistics Market, By Solution

9.1. Retail Logistics Market, by Solution, 2022-2030

9.1.1. Commerce Enablement

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Supply Chain Solutions

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Reverse Logistics & Liquidation

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Transportation Management

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Retail Logistics Market, By Mode of Transport

10.1. Retail Logistics Market, by Mode of Transport, 2022-2030

10.1.1. Railways

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Airways

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Roadways

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Waterways

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Retail Logistics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Solution (2017-2030)

11.1.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Solution (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Solution (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Solution (2017-2030)

11.2.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Solution (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Solution (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Solution (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Solution (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Solution (2017-2030)

11.3.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Solution (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Solution (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Solution (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Solution (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Solution (2017-2030)

11.4.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Solution (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Solution (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Solution (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Solution (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Solution (2017-2030)

11.5.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Solution (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Solution (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Mode of Transport (2017-2030)

Chapter 12. Company Profiles

12.1. XPO Logistics, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. DSV

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Kuehne + Nagel International

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. C.H. Robinson Worldwide, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Nippon Express

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. FedEx

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Schneider

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. United Parcel Service

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. APL Logistics Ltd

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. DHL International GmbH

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

12.11. A.P. Moller - Maersk

12.11.1. Company Overview

12. 11.2. Product Offerings

12. 11.3. Financial Performance

12. 11.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others