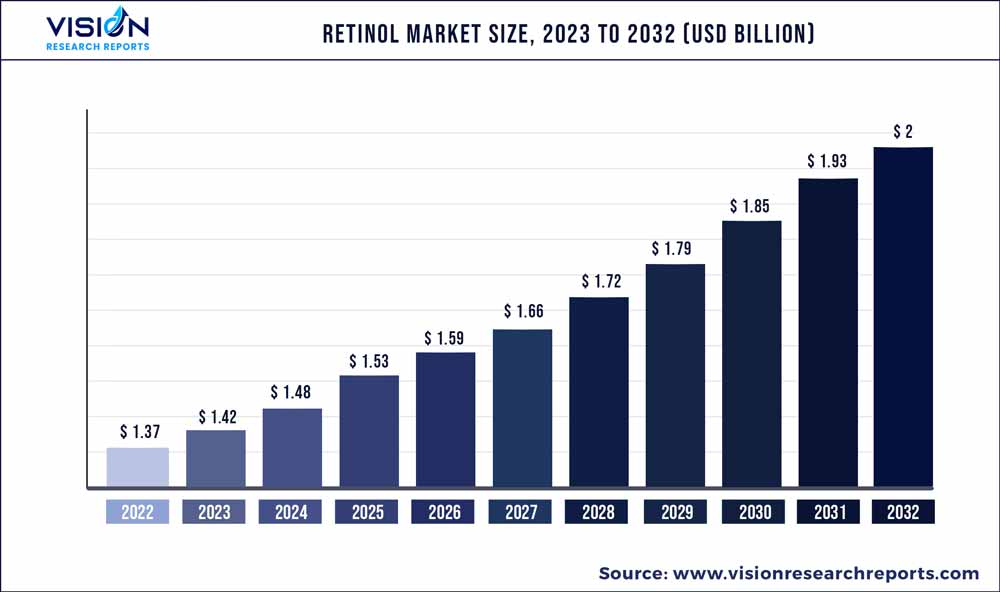

The global retinol market was surpassed at USD 1.37 billion in 2022 and is expected to hit around USD 2 billion by 2032, growing at a CAGR of 3.86% from 2023 to 2032.

Key Pointers

Report Scope of the Retinol Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.37 billion |

| Revenue Forecast by 2032 | USD 2 billion |

| Growth rate from 2023 to 2032 | CAGR of 3.86% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | BASF SE; Beauty Solutions LTD; Biotics Research Corporation; Divi’s Laboratories Limited; DRUNK ELEPHANT; Eluminex Biosciences; Guangzhou ZIO Chemical Co., Ltd; DSM |

Rising demand for synthetic retinol from the cosmetics sector is expected to drive the global market. Increasing usage of the product in the formulation of skincare creams which leads to the removal of dead skin cells and the formation of healthy and new skin cells is projected to provide ample opportunities to key manufacturers in the near future.

Manufacturers are developing new formulations and delivery methods to make retinol-based products more effective and user-friendly. For instance, in 2021, Paula's Choice launched a product called "Clinical 0.3% Retinol + 2% Bakuchiol Treatment" that combines retinol with bakuchiol. The product promises to be gentle on the skin while still providing anti-aging benefits.

The food & beverage segment is also growing and making its mark. One of the key trends driving the growth of this segment is the increasing demand for functional foods and beverages that provide health benefits. Retinol is a nutrient that is essential for maintaining healthy skin, eyesight, and immune function, which has led to an increase in demand for fortified food and beverages. For instance, in 2020, the company Bössi introduced a line of vitamin-infused sparkling water that included a retinol-fortified option.

Manufacturers are developing new formulations and delivery methods to make fortified products more effective and appealing to consumers. For instance, in 2021, the company Lycored launched a retinol-fortified gummy supplement that is targeted toward children. The gummies are designed to be fun and easy to consume, making it more likely that children will receive the health benefits of the product.

Europe emerged as the largest consumer of the market due to its increasing demand for personal care & cosmetics applications. The personal care & cosmetics industry is one of the prominent consumers in Europe because of increasing concerns among people towards skin cancer, and exposure to harmful rays, which has led to increased production of nutricosmetic products. However, stringent government regulations related to limiting the concentration of retinol in personal care & cosmetics products are likely to become a challenge for market growth.

Type Insights

The synthetic type segment dominated the market with the highest revenue share of more than 82.04% in 2022. This can be attributed to several factors. Firstly, synthetic retinol is generally less expensive to produce than natural, making it a more cost-effective option for manufacturers. Additionally, it is more readily available, stable, and consistent in terms of potency and purity, which ensures consistent product quality for consumers.

One of the most commonly used synthetic retinoids is tretinoin (also known as retinoic acid). It is a prescription medication used for the treatment of acne and photoaging. Tretinoin works by increasing cellular turnover, which leads to the sloughing off the dead skin cells and the formation of new, healthy skin cells. This process helps unclog pores and reduces the appearance of fine lines and wrinkles.

The natural type segment is another significant type and continues to register growth. Natural retinol is often considered a gentler alternative to synthetic retinoids as it is generally less irritating to the skin. However, its efficacy can vary depending on the concentration of the compound, the method of extraction, the skin type of users, and their requirements. In addition to its skincare benefits, natural retinol also offers other health benefits. It supports the immune system and promotes healthy vision among its consumers. However, it is important to consult a healthcare professional before incorporating natural retinol into a routine with any supplement or skincare ingredient.

Application Insights

The personal care & cosmetics segment dominated the market with the highest revenue share of 50.96% in 2022. This can be attributed to the increasing demand for anti-aging products. Consumers are becoming more aware of the benefits of retinol in reducing the appearance of fine lines and wrinkles, which has led to an increase in demand for retinol-based skincare products. For instance, in 2021, L'Oreal Paris launched a retinol-based serum called Revitalift Derm Intensives Night Serum that promises to reduce wrinkles in just one week.

Moreover, the growth of the personal care & cosmetics segment is due to the increasing popularity of natural and organic products. Many consumers are becoming more conscious about the ingredients in their skincare products and are looking for products that are free from harmful chemicals. This has led to an increase in demand for natural and organic products. For example, in 2021, Biossance launched a retinol-based serum called Squalane + Phyto-Retinol Serum that is made with plant-based retinol alternatives.

Additionally, the growth of the food & beverage segment is the increasing popularity of vegan and plant-based diets. Many consumers are looking for plant-based types of retinol, which has led to an increase in demand for plant-based fortified foods and beverages. For example, in 2021, the company Just Egg launched a plant-based egg alternative that contains retinol derived from algae.

Regional Insights

The Europe region dominated the market with the highest revenue share of 32.04% in 2022. The growth is driven by the growth of the cosmetics industry in Europe which is driven by the advent of new colour pallets for skincare products and the introduction of various skin-specific treatment methods. Surging concerns among the masses in various countries of Europe about conditions like skin cancer and exposure to harmful rays have contributed to the usage of different skin care products.

The increasing number of chains for the distribution of various cosmetics and the broadening consumer demand for natural cosmetics in the region are some additional factors supplementing the growth of the cosmetics industry in Europe. Moreover, the increasing spending power of the population, ongoing urbanization, and surging awareness among the masses regarding grooming and enhancing their appearance are expected to propel the growth of the skincare industry in the region in the coming years, thereby augmenting the demand for the market in Europe.

North America region is estimated to grow at a CAGR of 4.3% by 2032. The growth of the market in North America is driven by the surging utilization of retinol in the formulation of personal care products & cosmetics. Countries such as the U.S. and Canada are among the largest consumers of personal care products & cosmetics in the world.

According to Automat report 2021, the sales of skin care products in the U.S. grew by approximately 13% in 2020. With the increase in health awareness and skin problems among consumers, skin care products are anticipated to witness a notable rise in their consumption in North America. This is further anticipated to drive the growth of the market in the region. Additionally, the presence of personal care product manufacturers such as L’Oréal Paris; Procter & Gamble; and Johnson & Johnson is also contributing to the growth of the market in the region.

The U.S. holds a significant position in global animal feed production. The impact of animal nutrition professionals based in the country who continue to advocate for retinol-based products, the advancements in feed production, and promising changes in feeding patterns related to the animal nutrition industry have a significant global impact. Retinol products offering Vitamin A is an essential nutrients for animals. It plays an important role in ensuring their healthy vision, immune system, and reproduction system. Owing to such factors there is an increase in the consumption of animal feed in North America which is further anticipated to impact the demand for the retinol products used in animal feed in the region in the coming years.

Retinol Market Segmentations:

By Type

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Retinol Market

5.1. COVID-19 Landscape: Retinol Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Retinol Market, By Type

8.1. Retinol Market, by Type, 2023-2032

8.1.1. Natural

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Synthetic

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Retinol Market, By Application

9.1. Retinol Market, by Application, 2023-2032

9.1.1. Personal Care & Cosmetics

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Dietary Supplements

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Food & Beverage

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Animal Feed

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Retinol Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. BASF SE

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Beauty Solutions LTD

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Biotics Research Corporation

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Divi’s Laboratories Limited

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. DRUNK ELEPHANT

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Eluminex Biosciences

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Guangzhou ZIO Chemical Co., Ltd

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. DSM

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others