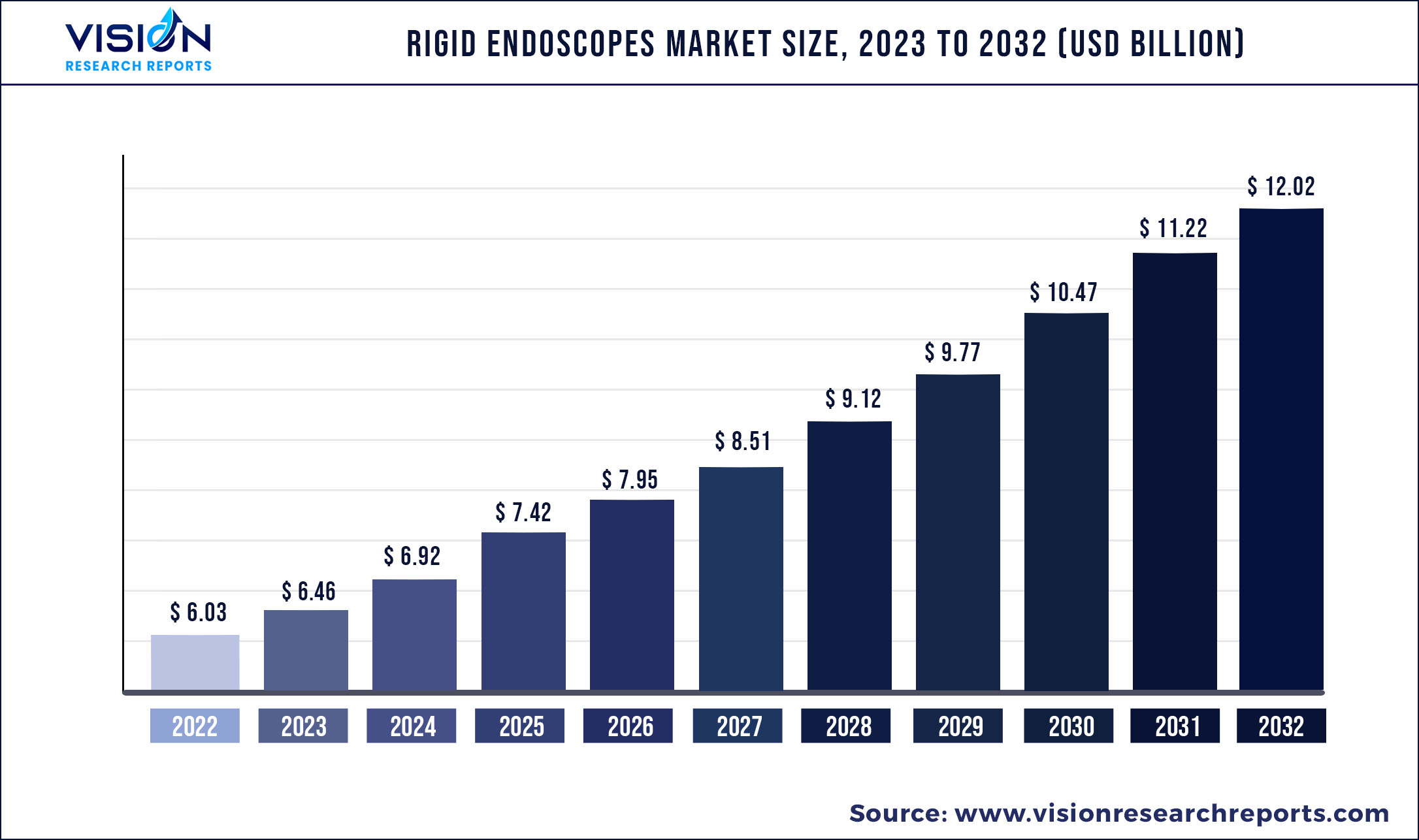

The global rigid endoscopes market was valued at USD 6.03 billion in 2022 and it is predicted to surpass around USD 12.02 billion by 2032 with a CAGR of 7.14% from 2023 to 2032.

Key Pointers

Report Scope of the Rigid Endoscopes Market

| Report Coverage | Details |

| Market Size in 2022 | USD 6.03 billion |

| Revenue Forecast by 2032 | USD 12.02 billion |

| Growth rate from 2023 to 2032 | CAGR of 7.14% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Olympus Corporation; Ethicon U.S., LLC; Boston Scientific Corporation; Karl Storz GmbH & Co. KG; Stryker; PENTAX Medical; Richard Wolf; Medtronic |

The growing demand for minimally invasive surgical procedures, especially laparoscopy, cystoscopy, and others, is boosting the market growth. High preference among endoscopists to obtain better visualization of organs in surgery and the high number of surgeries related to chronic diseases conducted worldwide, which is leading to the demand for rigid endoscopes, are driving the growth of the overall market. The COVID-19 pandemic is expected to have affected the demand for rigid endoscopes, as during the pandemic, the majority of elective surgeries were postponed as physicians gave preference to COVID-19-infected patients. In the post-pandemic period, this scenario is changing as many elective surgeries have resumed owing to the rising burden of chronic diseases worldwide. For instance, according to Cancer Tomorrow, the incidence of cancer accounted for 13.3 million in 2020 and this number is expected to rise to 30.3 million in 2040. This is expected to increase the rate of surgeries in the post-pandemic period and thus support market growth.

There is a growing demand for minimally invasive surgeries worldwide. Smaller incisions help in the faster healing of wounds and owing to this reason, patients don't need to visit hospitals frequently, because there are not many cuts or stitches. In contrast, traditional open surgeries require long incisions through the muscles and take more time to heal. This is one of the major factors supporting the demand for endoscopy procedures. Furthermore, rigid endoscopes provide high-definition images of organs; owing to this reason, there is a wide demand for rigid endoscopes for minimally invasive surgeries, which is promoting the market growth.

A significant number of people worldwide suffer from chronic diseases such as liver cancer, endometriosis, and others. As per 2021 factsheets provided by WHO, around 190 million women of reproductive age suffer from endometriosis globally. Similarly, uterine fibroids (UFs), which are also referred to as uterine leiomyoma (UL), fibroma, or leiomyoma, are among the most common tumors found in the female reproductive system. For instance, a recent study in 2022 showed that the likelihood of having UFs is estimated to be between 20-77%, and the chances of having this condition are estimated to be between 40-60% among women under the age of 35, and 70-80% among women over the age of 50. Additionally, a previous study reported that black women in the United States are more prone to this condition, with an occurrence rate of 59%. All these diseases are treated through laparoscopic surgery. The high burden of these diseases is expected to improve laparoscopic procedures in the future and thus support the demand for rigid endoscopes.

Rigid Endoscopes Market Segmentations:

| By Product | By End-use |

|

Laparoscopes Arthroscopes Ureteroscopes Cystoscopes Gynecology Endoscopes Neuroendoscopes Bronchoscopes Hysteroscopes Laryngoscopes Sinuscopes Otoscopes Sigmoidoscopes Pharygnoscopes Duodenoscopes Nasopharygnoscopes Rhinoscopes |

Hospitals Outpatient Facilities |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Rigid Endoscopes Market

5.1. COVID-19 Landscape: Rigid Endoscopes Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Rigid Endoscopes Market, By Product

8.1. Rigid Endoscopes Market, by Product, 2023-2032

8.1.1. Laparoscopes

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Arthroscopes

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Ureteroscopes

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Cystoscopes

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Gynecology Endoscopes

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Neuroendoscopes

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Bronchoscopes

8.1.7.1. Market Revenue and Forecast (2020-2032)

8.1.8. Hysteroscopes

8.1.8.1. Market Revenue and Forecast (2020-2032)

8.1.9. Laryngoscopes

8.1.9.1. Market Revenue and Forecast (2020-2032)

8.1.10. Sinuscopes

8.1.10.1. Market Revenue and Forecast (2020-2032)

8.1.11. Otoscopes

8.1.11.1. Market Revenue and Forecast (2020-2032)

8.1.12. Sigmoidoscopes

8.1.12.1. Market Revenue and Forecast (2020-2032)

8.1.13. Pharygnoscopes

8.1.13.1. Market Revenue and Forecast (2020-2032)

8.1.14. Duodenoscopes

8.1.14.1. Market Revenue and Forecast (2020-2032)

8.1.15. Nasopharygnoscopes

8.1.15.1. Market Revenue and Forecast (2020-2032)

8.1.16. Rhinoscopes

8.1.16.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Rigid Endoscopes Market, By End-use

9.1. Rigid Endoscopes Market, by End-use, 2023-2032

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Outpatient Facilities

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Rigid Endoscopes Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 11. Company Profiles

11.1. Olympus Corporation

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Ethicon U.S., LLC

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Karl Storz GmbH & Co. KG

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Stryker

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. PENTAX Medical

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Richard Wolf

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Medtronic

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others