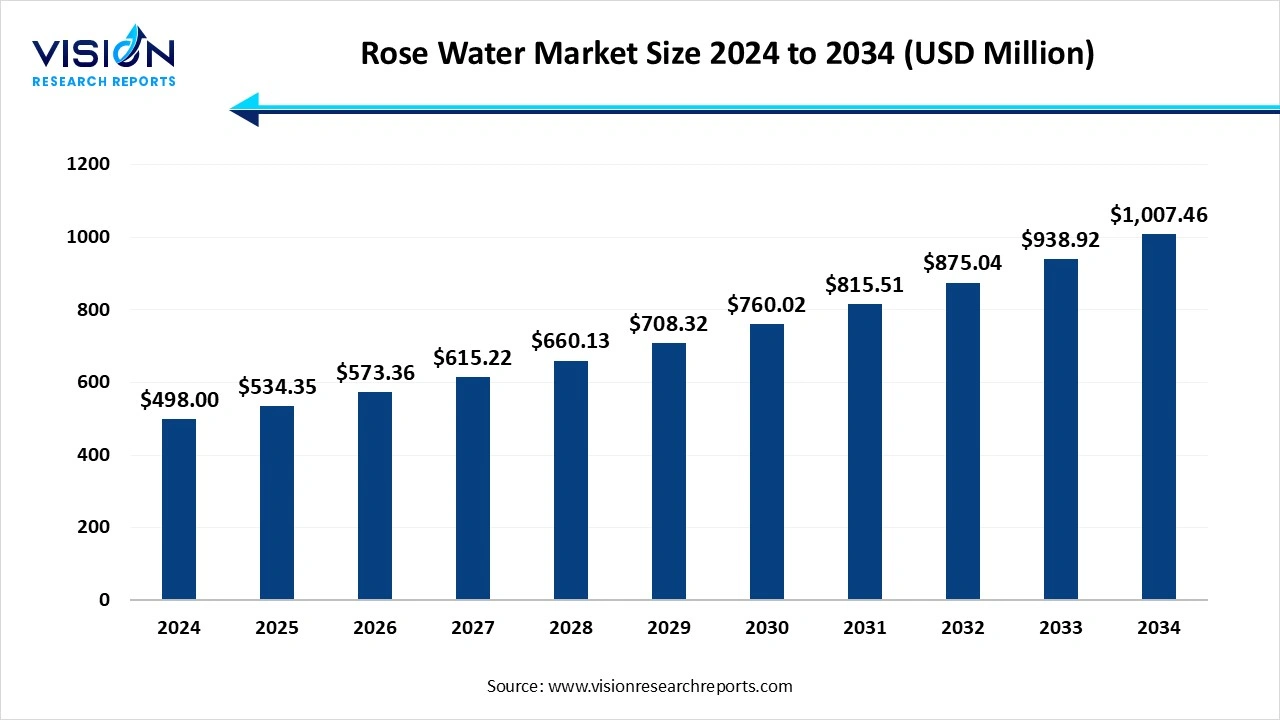

The global rose water market size is calculated at USD 534.35 million in 2025 and is forecasted to reach around USD 1,007.46 million by 2034, accelerating at a CAGR of 7.30% from 2025 to 2034.

The global rose water market is experiencing significant growth, driven by rising consumer demand for natural and organic skincare solutions. Rose water, known for its soothing, anti-inflammatory, and antioxidant properties, is widely used in cosmetics, personal care, and culinary applications. Key factors propelling market expansion include increasing awareness of herbal beauty products, the growing popularity of aromatherapy, and the rising trend of clean-label products. Asia-Pacific and the Middle East lead the market due to their rich cultural history of rose cultivation, while North America and Europe witness rapid adoption driven by wellness-conscious consumers.

The growth of the rose water market is significantly driven by the increasing consumer preference for natural and organic skincare products. As consumers become more health-conscious and aware of the potential harm of synthetic chemicals in personal care items, there has been a notable shift towards using plant-based, chemical-free products like rose water. Rose water’s natural astringent, anti-inflammatory, and hydrating properties make it highly appealing to consumers seeking gentle and effective skincare solutions.

Another key growth factor for the rose water market is the rising demand for wellness and self-care products, including those used in aromatherapy and relaxation. Rose water’s calming and soothing effects have made it an integral part of wellness routines worldwide, particularly in the form of facial mists, toners, and bath additives. The increasing awareness about mental health and stress management has fueled interest in products that promote relaxation, such as rose water-based items. Furthermore, its widespread use in culinary applications, particularly in the Middle East, Asia, and parts of Europe, continues to drive growth, as consumers explore new and exotic flavors in gourmet foods and beverages

Europe region dominated the global rose water market with highest share of 42% in 2024. The region's strong cosmetic and personal care industry, coupled with consumer demand for clean and sustainable products, drives market expansion. Countries like France, Germany, and the United Kingdom are the leading contributors, with manufacturers focusing on product innovations and premium formulations to cater to evolving consumer preferences.

The rose water market in the Asia Pacific region is projected to experience a compound annual growth rate (CAGR) of 8.4% between 2025 and 2034. India, as a significant producer of roses, plays a vital role in the market, supplying high-quality rose water both domestically and internationally. Other countries, such as China and Japan, are witnessing increased demand due to the rising popularity of natural and herbal beauty products.

Rosa Gallica rose water, derived from the French rose, is known for its potent fragrance and strong astringent properties, making it an ideal ingredient in skincare products targeting oily or acne-prone skin. Its natural anti-inflammatory and antibacterial qualities also make it a preferred choice in medicinal and therapeutic formulations. Widely used in European herbal medicine, Rosa Gallica rose water is celebrated for its calming and healing effects on the skin, contributing to its sustained demand in global markets.

Rosa Centifolia rose water, commonly referred to as cabbage rose water, is prized for its delicate, sweet aroma and soothing properties. With a rich history of use in perfumery and luxury skincare products, Rosa Centifolia rose water is a popular choice for consumers seeking gentle, hydrating, and rejuvenating skincare solutions. This variety is frequently used in premium facial mists, toners, and anti-aging products, where its moisturizing and calming effects are highly valued. The growing demand for natural and organic skincare has further fueled the popularity of Rosa Centifolia rose water in global markets.

Rosa Damascena rose water, derived from the renowned Damask rose, is the most valuable and widely recognized type in the global rose water market. Known for its rich, complex fragrance and exceptional therapeutic benefits, Rosa Damascena rose water is extensively used in high-end cosmetics, aromatherapy, and culinary applications. Its superior antioxidant and anti-aging properties make it a sought-after ingredient in luxury skincare products, such as serums, creams, and facial mists. Regions such as Bulgaria, Turkey, and Iran are the largest producers of Rosa Damascena rose water, and their traditional cultivation practices further enhance the premium appeal of this product.

Personal care and cosmetics emerged as the largest application for rose water, holding more than 46% of the market share in 2024. Its natural astringent and anti-inflammatory properties make it an ideal choice for maintaining skin balance, reducing redness, and providing a refreshing glow. The growing demand for organic and chemical-free skincare solutions has further propelled the use of rose water in this segment.

The food and beverage industry also represents a significant application segment for rose water. It is widely used as a natural flavoring agent in Middle Eastern, Persian, Indian, and Mediterranean cuisines. From delicately scented desserts, such as Turkish delight and rose-flavored ice cream, to aromatic beverages like rose milk and herbal teas, rose water imparts a distinct floral aroma and flavor to various culinary creations. Its increasing adoption in gourmet recipes and craft beverages further contributes to market growth.

Indirect sales of rose water are expected to grow at a CAGR of 7.2% from 2025 to 2034. This channel offers convenience and accessibility to consumers, allowing them to purchase rose water products along with their regular shopping needs. E-commerce has emerged as a particularly significant indirect sales channel, driven by the increasing popularity of online shopping and the availability of a diverse range of rose water products from global and regional brands. Online platforms enable consumers to compare prices, read reviews, and access exclusive discounts, further boosting sales.

Direct sales involve the direct purchase of rose water products from manufacturers or authorized sellers, typically through brand-owned retail stores, official websites, or dedicated sales representatives. This channel allows manufacturers to maintain complete control over product quality, branding, and customer experience. Direct sales are particularly effective for premium rose water products, where consumers seek authenticity and are willing to pay a higher price for guaranteed quality. Luxury skincare and cosmetic brands specializing in rose water-based products often leverage direct sales to provide personalized services, including product customization and customer support.

By Product

By Application

By Distribution

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Rose Water Market

5.1. COVID-19 Landscape: Rose Water Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Rose Water Market, By Product

8.1. Rose Water Market, by Product

8.1.1 Rosa Gallica

8.1.1.1. Market Revenue and Forecast

8.1.2. Rosa Damascene

8.1.2.1. Market Revenue and Forecast

8.1.3. Rosa Centifolia

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Rose Water Market, By Application

9.1. Rose Water Market, by Application

9.1.1. Personal Care & Cosmetics

9.1.1.1. Market Revenue and Forecast

9.1.2. Medicinal Use

9.1.2.1. Market Revenue and Forecast

9.1.3. Food & Personal Care & Cosmetics

9.1.3.1. Market Revenue and Forecast

9.1.4. Others

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Rose Water Market, By Distribution

10.1. Rose Water Market, by Distribution

10.1.1. Indirect Sales

10.1.1.1. Market Revenue and Forecast

10.1.2. Direct Sales

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Rose Water Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product

11.1.2. Market Revenue and Forecast, by Application

11.1.3. Market Revenue and Forecast, by Distribution

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product

11.1.4.2. Market Revenue and Forecast, by Application

11.1.4.3. Market Revenue and Forecast, by Distribution

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product

11.1.5.2. Market Revenue and Forecast, by Application

11.1.5.3. Market Revenue and Forecast, by Distribution

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product

11.2.2. Market Revenue and Forecast, by Application

11.2.3. Market Revenue and Forecast, by Distribution

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product

11.2.4.2. Market Revenue and Forecast, by Application

11.2.4.3. Market Revenue and Forecast, by Distribution

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product

11.2.5.2. Market Revenue and Forecast, by Application

11.2.5.3. Market Revenue and Forecast, by Distribution

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product

11.2.6.2. Market Revenue and Forecast, by Application

11.2.6.3. Market Revenue and Forecast, by Distribution

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product

11.2.7.2. Market Revenue and Forecast, by Application

11.2.7.3. Market Revenue and Forecast, by Distribution

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product

11.3.2. Market Revenue and Forecast, by Application

11.3.3. Market Revenue and Forecast, by Distribution

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product

11.3.4.2. Market Revenue and Forecast, by Application

11.3.4.3. Market Revenue and Forecast, by Distribution

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product

11.3.5.2. Market Revenue and Forecast, by Application

11.3.5.3. Market Revenue and Forecast, by Distribution

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product

11.3.6.2. Market Revenue and Forecast, by Application

11.3.6.3. Market Revenue and Forecast, by Distribution

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product

11.3.7.2. Market Revenue and Forecast, by Application

11.3.7.3. Market Revenue and Forecast, by Distribution

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product

11.4.2. Market Revenue and Forecast, by Application

11.4.3. Market Revenue and Forecast, by Distribution

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product

11.4.4.2. Market Revenue and Forecast, by Application

11.4.4.3. Market Revenue and Forecast, by Distribution

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product

11.4.5.2. Market Revenue and Forecast, by Application

11.4.5.3. Market Revenue and Forecast, by Distribution

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product

11.4.6.2. Market Revenue and Forecast, by Application

11.4.6.3. Market Revenue and Forecast, by Distribution

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product

11.4.7.2. Market Revenue and Forecast, by Application

11.4.7.3. Market Revenue and Forecast, by Distribution

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product

11.5.2. Market Revenue and Forecast, by Application

11.5.3. Market Revenue and Forecast, by Distribution

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product

11.5.4.2. Market Revenue and Forecast, by Application

11.5.4.3. Market Revenue and Forecast, by Distribution

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product

11.5.5.2. Market Revenue and Forecast, by Application

11.5.5.3. Market Revenue and Forecast, by Distribution

Chapter 12. Company Profiles

12.1. Herbivore Botanicals

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Gulab Singh Johrimal

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Rosa Damascena (Bulgarian Rose).

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Mountain Rose Herbs

e.12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Shahnaz Husain.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Kama Ayurveda

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Leven Rose

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Tata Harper

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9 Aromaaz International

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. The Rose Hydrosol Company

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others