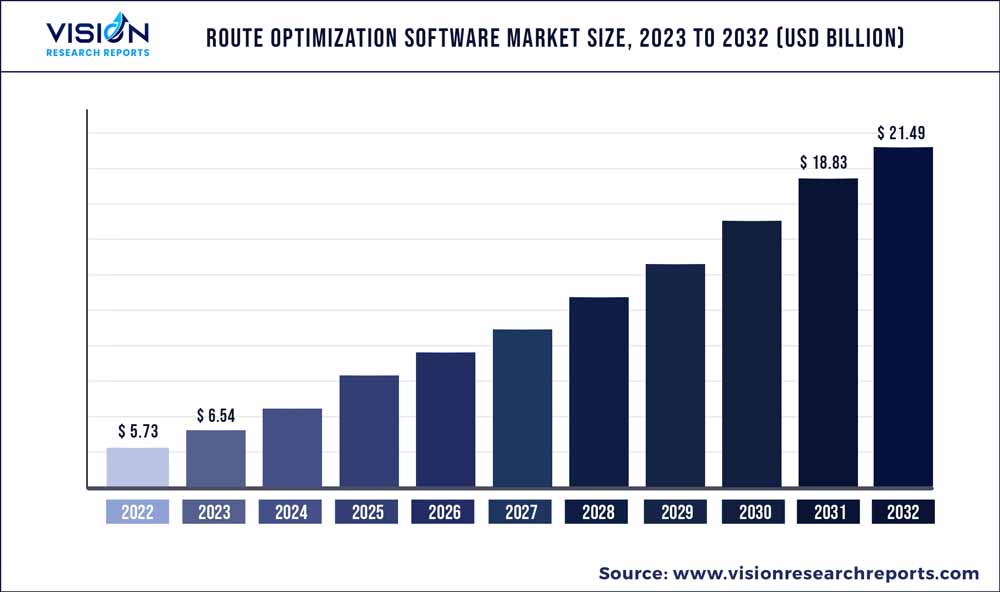

The global route optimization software market was valued at USD 5.73 billion in 2022 and it is predicted to surpass around USD 21.49 billion by 2032 with a CAGR of 14.13% from 2023 to 2032. The route optimization software market in the United States was accounted for USD 1041.2 million in 2022.

Key Pointers

Report Scope of the Route Optimization Software Market

| Report Coverage | Details |

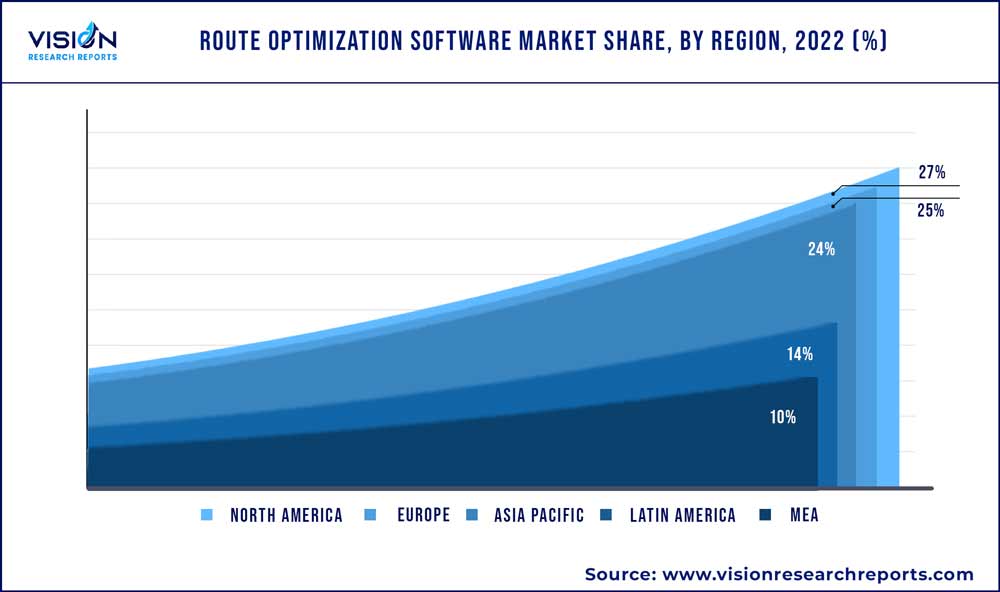

| Revenue Share of North America in 2022 | 27% |

| CAGR of Asia Pacific from 2023 to 2032 | 14.72% |

| Revenue Forecast by 2032 | USD 21.49 billion |

| Growth Rate from 2023 to 2032 | CAGR of 14.13% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Trimble MAPS; Caliper Corporation; Descartes Systems Group; ESRI; Google LLC; Llamasoft; Microlise; Omnitracs, LLC; Paragon Software Systems plc; Route4Me, Inc.; Routific; Verizon Connect; WorkWave LLC; Mara Labs Inc |

The growth is expected to be propelled by the increasing need for efficient transportation management. As the global population grows and urbanization continues to accelerate, transportation systems face significant challenges in congestion, delays, and inefficiencies. Route optimization software offers a solution to these challenges by providing the shortest and fastest route and thus optimizing delivery timeline, reducing travel time, and improving overall transportation efficiency.

Furthermore, rapid technological advancements are also a significant factor boosting the market's growth. The development of new technologies, such as the Internet of Things (IoT), big data analytics, and cloud computing, has enabled real-time insights and analytics. These technologies enable route optimization software to learn from historical data and predict future traffic patterns, road closures, and weather conditions. This allows for more accurate and efficient routing decisions. Additionally, these technological advancements are helping businesses to optimize their transportation operations and reduce costs, making route optimization an increasingly important tool for companies in the logistics and transportation industries.

The growing importance of sustainability also drives the target market. As consumers and businesses become more aware of the environmental impact of transportation, there is increasing demand for transportation solutions that are more sustainable. Route optimization can help companies reduce their carbon footprint by minimizing the distance traveled and optimizing the use of vehicles. For instance, with real-time updates, route optimization software can help companies respond to traffic or weather conditions and adjust routes accordingly. This can help avoid unnecessary idling and fuel consumption.

The route optimization software market is anticipated to be hindered by the reluctance of end-user businesses to invest in new technologies such as route optimization due to the associated costs. However, to overcome this, market players could offer potential customers free trials or demonstrations of their applications. Moreover, key players could also offer flexible pricing models, such as pay-per-use or subscription-based services, allowing businesses to try out the software without committing to a large upfront investment.

Additionally, companies could provide case studies and testimonials from satisfied customers to demonstrate the benefits and ROI of their tools. By addressing such concerns and showcasing the value of their products, companies in the market can encourage businesses to adopt their technology and offer a potential opportunity for market growth.

Solution Insights

In terms of solution, the market is segmented into software and services. The software segment dominated with a revenue share of 63% in 2022. Dominance can be related to the associated benefits, such as optimizing fleet routing, automating carrier operations, and getting online access to path schedules with real-time delivery status tracking. This solution increases market demand by ensuring correct pickup and delivery, improving driver efficiency and dispatcher productivity, and lowering fuel costs.

The services segment is expected to gain a significant CAGR of 14.33% over the forecast period. The service segment is sub-segmented into consulting, map integration & software deployment, and support & maintenance. The route optimization software is a complex technology that requires expertise to install, configure, and maintain. Many companies prefer to outsource these tasks to specialized service providers who can ensure smooth and efficient software deployment.

As a result, the demand for services such as consulting, training, and support is increasing rapidly. Furthermore, service providers offer businesses the expertise, support, and customization they need to get the most out of their investment in route optimization software.

Deployment Insights

In terms of deployment, the market is segmented into on-premises and cloud. The on-premises segment dominated in 2022 with a revenue share of more than 54%. Several businesses prefer premise deployment as it gives them complete control over their software and data. This is particularly important for businesses that handle sensitive data or operate in regulated industries that require strict data privacy and security measures. On-premises deployment also allows businesses to customize the application to their specific needs and integrate it with other business systems more easily.

The cloud segment is anticipated to emerge as the fastest-growing segment, with a CAGR of 14.44% over the forecast period. Cloud-based deployment provides a centralized method for securing sensitive data throughout an enterprise, including a delivery route optimization algorithm. Cloud-deployed software lowers the cost of software upgrades and updates. Furthermore, organizations are increasingly adopting cloud-based deployment because it is simple to implement and offers more scalability than on-premises software at a lower cost. Such factors as mentioned above are fueling the segment growth.

Enterprise Size Insights

In terms of enterprise size, the market is segmented into large enterprises and small & medium-sized enterprise segments. Among these, the large enterprises segment accounted for the largest revenue share of 52% in 2022. Large enterprises use route optimization software to streamline operations, reduce costs, and improve customer satisfaction. Furthermore, large enterprises with field service operations, such as utilities, telecommunications, and healthcare providers, use such software to optimize their service schedules. These tools can help them dispatch field technicians to the correct location at the right time while reducing travel time and fuel costs and improving response time.

The SME segment is expected to grow at the fastest CAGR over the forecast period. As these businesses have restricted resources, maximum production, and cost reduction are critical aspects. As a result, these businesses demand cost-effective solutions to assist them in optimizing their business operations. route optimization software assists local companies in managing several delivery stops, which, if not done correctly, can increase expenses and result in delayed deliveries. Additionally, the need to raise revenue, remain competitive, and protect the security of mission-critical data is driving these businesses to implement cutting-edge route optimization software.

Industry Vertical Insights

In terms of industry vertical, the market is segmented into retail & FMCG, on-demand food & grocery delivery, ride-hailing & taxi services, homecare & field services, logistics & transportation, and others. Among these, the on-demand food & grocery delivery segment dominated the market in 2022 with a revenue share of 20% and is projected to retain its dominance over the forecast period.

Route optimization tools help on-demand food and grocery companies optimize their delivery time, which is critical in the sector as faster deliveries provide an edge to the companies. The route analytics provided by the route optimization software can help companies ensure that the company can provide faster deliveries as compared to their competitors.

The ride-hailing & taxi services segment is expected to grow at a considerable CAGR during the forecast period. Route optimization software help ride-hailing and taxi services companies provide each customer with the fastest and most efficient routes. Estimated time of arrival (ETA) is a key metric in the ride-hailing and taxi service industry, and consumers prefer companies that provide the best ETA. The software helps companies avoid traffic congestion and other delays and helps improve customer satisfaction by providing real-time tracking information to customers.

Regional Insights

North America dominated the overall market in 2022, with a revenue share of 27%. The regional growth can be attributed to the presence of prominent route optimization software providers in North America, including ALK Technologies, Caliper, Descartes, ESRI, Google, LLamasoft, Omnitracs, Route4Me, Routific, and Verizon Connect. North America is a technologically advanced region and was among the first to use route optimization applications. Additionally, the region’s increased usage of SaaS-based route optimization solutions is also a significant growth potential for vendors looking to expand their company share in this region.

The Asia Pacific region is anticipated to grow at the fastest CAGR of 14.72% throughout the forecast period. The APAC region is home to some of the world's fastest-growing e-commerce markets, such as China and India. As e-commerce continues to grow, the demand for efficient and cost-effective logistics solutions, including route optimization software, is increasing. For instance, as per the Federation of Indian Chambers of Commerce & Industry (FICCI), by 2026, the Indian e-commerce sector is estimated to reach USD 120 billion.

Route Optimization Software Market Segmentations:

By Solution

By Deployment

By Enterprise Size

By Industry Vertical

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Route Optimization Software Market

5.1. COVID-19 Landscape: Route Optimization Software Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Route Optimization Software Market, By Solution

8.1. Route Optimization Software Market, by Solution, 2023-2032

8.1.1. Software

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Route Optimization Software Market, By Deployment

9.1. Route Optimization Software Market, by Deployment, 2023-2032

9.1.1. On-premise

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Cloud

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Route Optimization Software Market, By Enterprise Size

10.1. Route Optimization Software Market, by Enterprise Size, 2023-2032

10.1.1. Large Enterprises

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Small & Medium Enterprises

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Route Optimization Software Market, By Industry Vertical

11.1. Route Optimization Software Market, by Industry Vertical, 2023-2032

11.1.1. Retail & FMCG

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. On-Demand Food & Grocery Delivery

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Ride Hailing & Taxi Services

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Homecare & Field Services

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Logistics & Transportation

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Others

11.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Route Optimization Software Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Solution (2020-2032)

12.1.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Solution (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Solution (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Solution (2020-2032)

12.2.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Solution (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Solution (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Solution (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Solution (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Solution (2020-2032)

12.3.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Solution (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Solution (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Solution (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Solution (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Solution (2020-2032)

12.4.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Solution (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Solution (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Solution (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Solution (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Solution (2020-2032)

12.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Solution (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Solution (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Industry Vertical (2020-2032)

Chapter 13. Company Profiles

13.1. Trimble MAPS

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Caliper Corporation

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Descartes Systems Group

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. ESRI

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Google LLC

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Llamasoft

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Microlise

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Omnitracs, LLC

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Paragon Software Systems plc

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Route4Me, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others