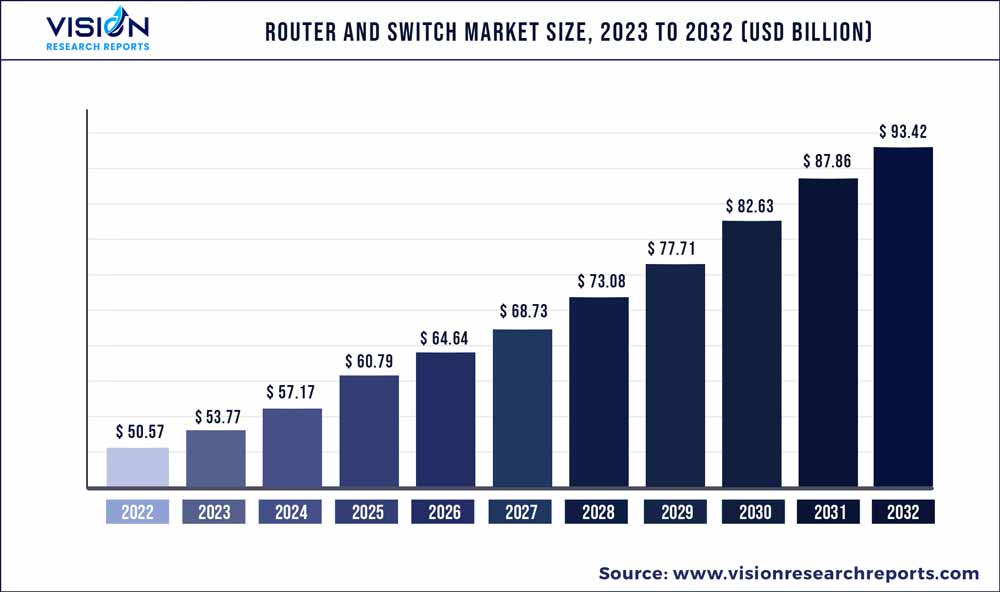

The global router and switch market was valued at USD 50.57 billion in 2022 and it is predicted to surpass around USD 93.42 billion by 2032 with a CAGR of 6.33% from 2023 to 2032.

Key Pointers

Report Scope of the Router And Switch Market

| Report Coverage | Details |

| Market Size in 2022 | USD 50.57 billion |

| Revenue Forecast by 2032 | USD 93.42 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.33% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Actelis Networks, Inc.; Adtran; ADVA Optical Networking; ALE International; Cisco Systems, Inc.; Ribbon Communications Operating Company, Inc.; Telefonaktiebolaget LM Ericsson; EXTREME NETWORKS, INC.; Dell Technologies Inc.; Huawei Technologies Co., Ltd. |

The market is expected to grow due to the rising demand for IoT, cloud services, connected devices, and high-speed internet. Additionally, with the advent of the pandemic, remote work adoption increased rapidly. It propelled businesses to invest in new or existing IT solutions. Organizations across all industries accelerated their cloud transformation due to remote work. For instance, in October 2022, Singapore announced that it would migrate 70% of workloads to the commercial cloud by 2023. Besides, in March 2022, Amazon Web Services Inc., and the Singapore government developed a cloud technology skilling program for Singaporeans across different demographics, including recent graduates and early career workers.

Moreover, the growth of cloud services has also led to increased network traffic and data transfer, which has put a strain on traditional networking infrastructure. It has fueled the demand for advanced routers and switches supporting higher bandwidth, increased security, and better network management capabilities. Therehas been a growth in recent years with internet access being switched to a high-speed internet connection and an increased number of internet-enabled devices per household. This trend is expected to continue router market growth as more devices are equipped with internet capabilities and networking. Growing demand for various solutions such as BYOD, IoT, surveillance, virtualization in networking, and traffic overloading are expected to drive the market.

North America is projected to hold a significant market share during the forecast period. The U.S. market is one of the largest and most developed markets in the world. The market is expected to continue to grow in the coming years with increasing demand for faster and more reliable networking solutions. The adoption of multi cloud environments, increasing number of connected devices in homes and businesses, and the growth of cloud computing and IoT is driving the demand for routers and switches in the U.S. There is also a growing demand for smaller, more agile switches and routers that can support the growing number of connected devices in the IoT and support the growing trend towards edge computing. The Canadian government's focus on digital transformation and investment in technology infrastructure is also contributing to the growth of the market. The market is expected to continue to grow in the coming years, with a focus on offering faster and more reliable networking solutions.

Product Insights

The ATM & ethernet switch segment led the market in 2022, accounting for over 67.03% share of the global revenue. The ATM (asynchronous transfer mode) and ethernet switch are a subset of the larger networking, market for router and switch. As more data-intensive applications and services emerge, demand for high-speed networking solutions is increasing, driving growth in the ATM & ethernet switch. Additionally, the convergence of ATM, ethernet, and other networking technologies is leading to the development of multi-protocol switch solutions, which offer greater flexibility and scalability to businesses. The ATM provides high-speed data transfer at up to gigabit speeds, making it suitable for demanding multimedia and video conferencing applications. It also allows for easy expansion as network requirements grow, making it an attractive choice for large networks.

The service provider core router segment is expected to showcase lucrative growth over the forecast period. These routers are the backbone of service provider networks and deliver high-speed, reliable internet connectivity to consumers and businesses. Service providers are investing in new service provider core routers to support the deployment of 5G networks, which require high-speed, low-latency connectivity. Besides, cybersecurity threats continue to increase, and service provider core routers are becoming increasingly sophisticated in their security features, including encryption, firewalls, and intrusion detection systems. Additionally, there is a growing demand for higher-bandwidth routers, with the emergence of 400G and 800G routers offering significantly higher speeds than current 100G routers.

Service Insights

The internet data center/collocation/hosting segment dominated the market and accounted for over 38.04% share of the global revenue in 2022. The growth is attributed to the increased demand for high-performance, scalable, and secure network solutions. With the growing number of connected devices and the increasing reliance on cloud-based services, there is a need for routers and switches that can handle large amounts of data traffic and provide advanced network security features. To meet these demands, many manufacturers focus on developing routers and switches that can support multi-gigabit and 10-gigabit ethernet, software-defined networking (SDN), and security features such as firewalls and VPNs. Additionally, the trend toward edge computing and the Internet of Things (IoT) is driving the need for smaller, more compact, and low-power routers and switches that can be deployed in remote locations.

The ethernet access segment is anticipated to register the highest CAGR over the forecast period as there has been an increase in the shift towards higher-speed ethernet connectivity. 10-gigabit ethernet (10GbE) has become increasingly popular for data centers, while multi-gigabit ethernet technologies such as 2.5GbE and 5GbE are gaining traction in the enterprise market for faster connectivity to devices such as wireless access points and network-attached storage. Additionally, there is a growing demand for 25-gigabit ethernet (25GbE) and 40-gigabit ethernet (40GbE) to meet the increasing bandwidth requirements of data centers. Besides, adopting software-defined networking (SDN) and network function virtualization (NFV), integrating IoT and AI/ML capabilities, drives the demand for ethernet access and network optimization. These technologies allow for greater network flexibility, efficiency, and intelligence, enabling organizations to manage their ethernet networks better.

Regional Insights

North America dominated the market and accounted for over 38.1% share of the global revenue in 2022, owing to the rapid adoption of advanced technologies across regional multinational companies. Rising fixed broadband traffic and increasing mobile data traffic propel service providers to upgrade their core networks, mobile backhaul, aggregation, and access in the North American regions. There has been a growing trend towards deploying software-defined networking (SDN) and network functions virtualization (NFV) technologies, creating a growing market for software-based routers and switches. The government has made significant investments in infrastructure to support the growth of technology, including developing high-speed networks and deploying new network infrastructure. For instance, in May 2021, the Government of Canada announced making triple spectrum available for Wi-Fi to support rural connectivity, competition, and deployment of 5G technologies in the country. Further, it will offer access to the 6GHz spectrum which will support higher speeds and higher user capacity for wireless devices connected to Wi-Fi routers.

The Asia Pacific region is anticipated to witness significant growth in the router & switch owing to factors such as the growth of the internet and mobile usage, increasing adoption of cloud computing, and the growth of the IT industry in countries such as China, India, and Japan. Operators in the Asia Pacific region are actively promoting the benefits of 5G technology, the services it can enable, and the use cases and services that will benefit consumers the most, such as virtual and augmented reality, autonomous vehicles, and smart cities. For instance, in October 2022, Cisco Systems Inc., a digital communication technology provider, will set up a new manufacturing facility in India. The new manufacturing facility will produce mobility, network, and data center products, including routers, switches, access points, endpoints, and controllers.

Router And Switch Market Segmentations:

By Product

By Service

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Router And Switch Market

5.1. COVID-19 Landscape: Router And Switch Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Router And Switch Market, By Product

8.1. Router And Switch Market, by Product, 2023-2032

8.1.1. Internet Exchange Router

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Service Provider Core Router

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Multiservice Edge Router

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Ethernet Service Edge Router

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. ATM & Ethernet Switch

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Router And Switch Market, By Service

9.1. Router And Switch Market, by Service, 2023-2032

9.1.1. BRAS

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Ethernet Aggregation

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Ethernet Access

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Internet Data Center/Collocation/ Hosting

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Router And Switch Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Service (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Service (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Service (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by Service (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Service (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Service (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Service (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Service (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by Service (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Service (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Service (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Service (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Service (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by Service (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Service (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Service (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Service (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Service (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by Service (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Service (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Service (2020-2032)

Chapter 11. Company Profiles

11.1. Actelis Networks, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Adtran

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. ADVA Optical Networking

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. ALE International

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Cisco Systems, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Ribbon Communications Operating Company, Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Telefonaktiebolaget LM Ericsson

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. EXTREME NETWORKS, INC.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Dell Technologies Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Huawei Technologies Co., Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others