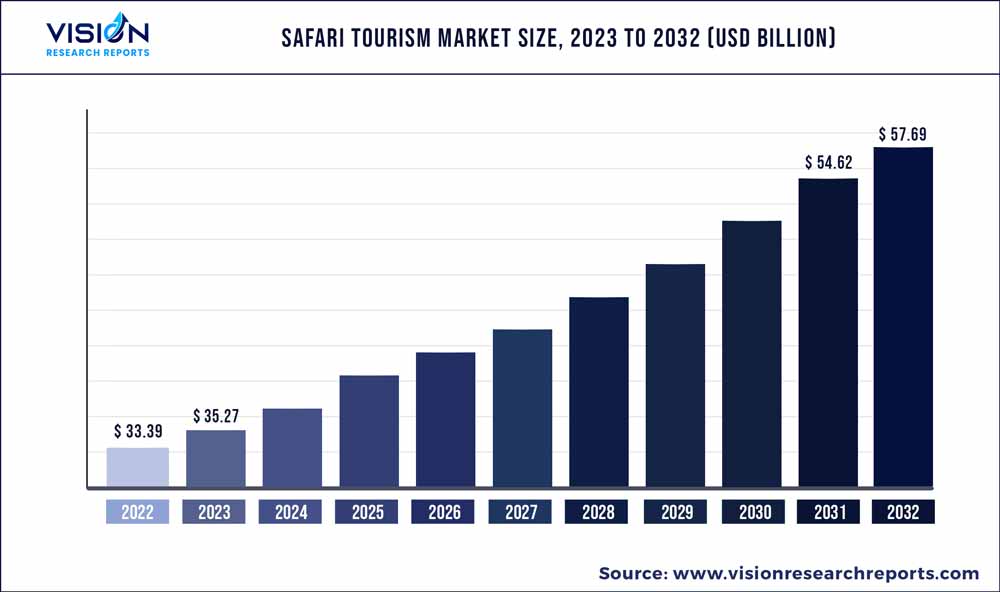

The global safari tourism market was valued at USD 33.39 billion in 2022 and it is predicted to surpass around USD 57.69 billion by 2032 with a CAGR of 5.62% from 2023 to 2032. The safari tourism market in the United States was accounted for USD 2.38 billion in 2022.

Key Pointers

Report Scope of the Safari Tourism Market

| Report Coverage | Details |

| Revenue Share of Middle East and Africa in 2022 | 52% |

| CAGR of Asia Pacific from 2023 to 2032 | 6.06% |

| Revenue Forecast by 2032 | USD 57.69 billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.62% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Wilderness; Thomas Cook Group; Singita; Scott Dunn Ltd.; Rothschild Safaris; &Beyond; Travcoa Tours & Safaris; Abercrombie & Kent USA, LLC; Gamewatchers Safaris Ltd.; Backroads; TUI Group |

The increasing interest of bloggers and influencers in safari travel is the key factor fueling the growth of safari tourism. There are many travel bloggers and influencers on social networking sites, with a large follower base. These people post their travel content on social media platforms. The increasing preference of people for unique as well as exotic holiday experiences, growth in middle and upper-middle-class expenditure, and the growing impact of social media on the travel industry are the major factors that drive the growth over the forecast period.

The COVID-19 outbreaks had a large negative impact on industry growth. As of June 2021, almost 60% of safari tour operators lost 75% or more bookings. About 18% of businesses recorded 50% of cancellations. The safari tourism industry's post-COVID recovery was fueled by economic rebound, increased interest in sustainable travel, the allure of wildlife destinations, enhanced health and hygiene measures, and the expansion of air transportation.

According to a United Nations World Tourism Organization (UNWTO) report titled 'Towards Measuring the Economic Value of Wildlife Watching Tourism in Africa,' wildlife tourism constitutes 7% of global tourism and experiences an annual growth rate of approximately 3%. The report further highlights that 14 African countries collectively generate around USD 142 million through entrance fees for protected sites and areas. This number is expected to grow in the coming years as more travelers, especially millennials, seek tourism activities that allow them to immerse themselves in pristine natural environments and witness wildlife in their natural habitats.

Safari tourism promotes economic growth and sustainable development by creating jobs, revitalizing wildlife areas and sites, and preserving natural habitats. Governments and local businesses worldwide leverage this unique combination of wildlife conservation and sustainable tourism. For instance, in October 2022, the Development Fund of Protected Areas (DFPA) of Georgia and UNESCO collaborated to support heritage conservation and sustainable tourism in the Wetlands World Heritage site and Colchic Rainforests. The partnership, valued at approximately USD 150,000, aims to enhance visitor management, raise awareness of the site's universal value, and aid Georgia's tourism recovery.

There's a growing focus on sustainability and responsible tourism in safaris. Travelers now prioritize minimizing environmental impact, supporting local communities, and contributing to wildlife conservation. They choose eco-friendly accommodations, engage in conservation initiatives, and prefer sustainable operators. For instance, according to the 2023 Sustainable Travel Research Report published by Booking.com, around 66% of Indians believe sustainable travel options are expensive; yet, over 80% are willing to pay more for sustainable travel options.

Similarly, almost 67% of Gen Zers and 64% of millennial travelers in the U.S. were more likely to consider sustainable travel options, according to Expedia Group’s Travel Outlook in 2021. Similarly, almost 67% of Gen Zers and 64% of millennial travelers in the U.S. were more likely to consider sustainable travel options, according to Expedia Group’s Travel Outlook in 2021.

Travelers are increasingly looking for tailor-made safari experiences that cater to their specific interests, preferences, and travel styles. They desire flexibility in itinerary planning, accommodation choices, and activities, allowing them to create personalized and unique safari adventures. As a result, market players such as Scott Dunn Ltd., &Beyond, and Abercrombie & Kent USA, LLC are adapting to this trend by offering a wide range of options and allowing travelers to curate their itineraries to match their preferences. This customization enhances the overall satisfaction of safari tourists.

Global governments and tourism organizations are promoting wildlife and safari tourism, fostering market growth. The Indian government, for example, has implemented initiatives to boost and enhance safari tourism. These efforts focus on wildlife conservation, visitor experiences, infrastructure development, and community involvement. For instance, The Ministry of Environment, Forests and Climate Change (MoEFCC) implemented the Integrated Development of Wildlife Habitats (IDWH) scheme to support the conservation and management of wildlife and their habitats. The scheme focuses on improving infrastructure, protection measures, and capacity building to promote sustainable wildlife tourism.

Group Insights

The couples segment dominated the market for safari tourism and accounted for a revenue share of over 43% in 2022. The opportunity to explore stunning landscapes, encounter wildlife together, and enjoy intimate moments in nature appeals to couples seeking unique and memorable experiences. Moreover, safari destinations are frequently chosen as honeymoon destinations by couples. According to the CBI, in 2021, 42% of millennials in Europe preferred traveling with their partners. Safari tourism is often considered a romantic and adventurous getaway for couples.

The friends segment is expected to register a lucrative CAGR of 6.03% during the forecast period. Group travel, including trips with friends, is a popular choice among travelers, particularly for adventure safari tourism. Millennials, in particular, show a strong interest in group travel experiences. According to the Centre for the Promotion of Imports from developing countries (CBI), part of the Ministry of Foreign Affairs of the Netherlands, in 2021, 37% of millennials in Europe preferred to travel with friends. This trend is expected to boost the growth of the segment over the forecast period.

Booking Mode Insights

The direct booking segment dominated the market for safari tourism and accounted for a revenue share of over 64% in 2022. With advancements in technology, like card scanners & mobile payments, voice recognition search, and artificial intelligence (AI) and the availability of online booking platforms, more travelers are opting to book their safari experiences directly with lodges, camps, or tour operators. According to the 2022 Adventure Travel Industry Snapshot by the Adventure Travel Trade Association (ATTA), globally, roughly 62% of bookings are directly made with the service provider.

The marketplace booking mode is expected to register a CAGR of about 7.14% during the forecast period. This mode providestravelers with a convenient and accessible platform to search, compare, and book safari experiences. Marketplace booking platforms typically offer customer support services, including help with booking, itinerary changes, and addressing concerns or issues before, during, or after the safari. SafariBookings, for instance, is a reputable online marketplace for organizing African safaris. It allows users to compare safari options from highly-rated travel operators, providing reliable assistance throughout the process.

Type Insights

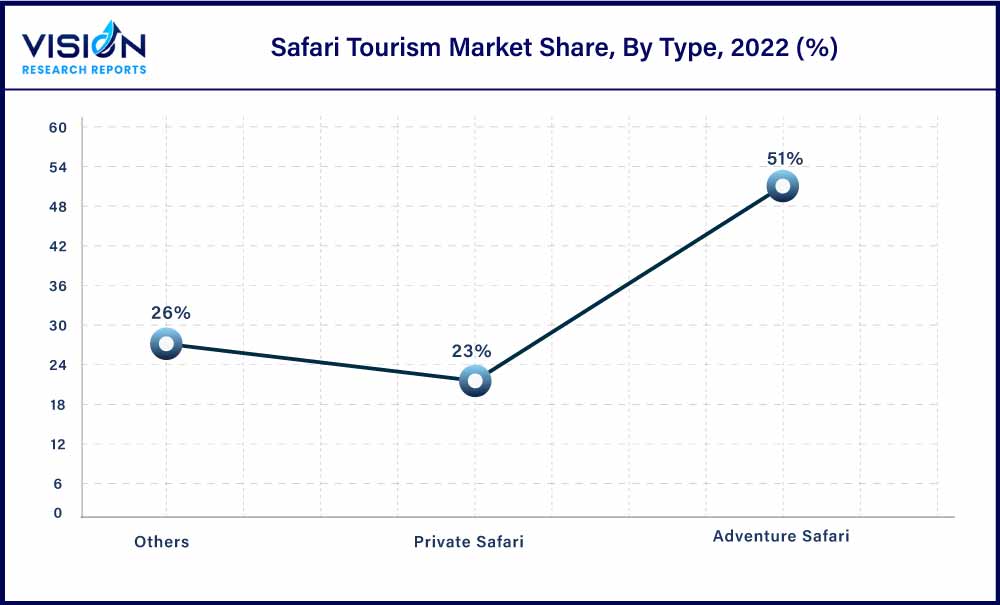

The adventure segment dominated the market and accounted for a revenue share of over 51% in 2022. A survey conducted by the Adventure Travel Trade Association (ATTA) in 2020 found that adventure tourism is becoming increasingly popular. The survey found that 72% of adventure travelers took at least one international trip in the past three years, and 63% of U.S. adventure travelers were planning on traveling domestically on their next planned trip.

The private safari type is anticipated to expand at a CAGR of 5.65% during the forecast period. The growth of this segment is driven by travelers seeking exclusive and personalized experiences. Customization and personalization, exclusivity and privacy, luxury and high-end accommodations, personalized services, and expert guides are the driving factors for private safari tourism, which is expected to boost the market growth over the forecast period.

Regional Insights

Middle East and Africa held over 52% revenue share of the safari tourism market in 2022. Strong purchasing power and increasing preference for family vacations have driven the demand for safari tourism in the region. Moreover, Africa is gaining popularity as a sought-after destination for international travelers, drawn to its sunny beaches, national parks, ecotourism offerings, and unique culture and cuisine.

The addition of diverse tourism activities is expected to increase tourist numbers in the region. For example, in March 2022, Sharjah Emirate unveiled Sharjah Safari, the largest safari park outside Africa. The park is a habitat for 1,000 bird species, including rare ones like the Northern Bald Ibis, and houses 50,000 animals from 120 different species found in South Africa.

Asia Pacific is expected to expand at the fastest CAGR of about 6.06% during the forecast period. According to the World Travel & Tourism Council, the travel and tourism sector, which is a crucial source of revenue in the Asia Pacific region, experienced a 7.5% GDP growth from 2021 to 2022. Factors such as economic growth, increased disposable income and leisure time, improving political stability, and a growing emphasis on promoting active tourism are driving the rapid expansion of tourism in Asia Pacific.

Safari Tourism Market Segmentations:

By Type

By Group

By Booking Mode

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Safari Tourism Market

5.1. COVID-19 Landscape: Safari Tourism Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Safari Tourism Market, By Type

8.1. Safari Tourism Market, by Type, 2023-2032

8.1.1 Adventure Safari

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Private Safari

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Safari Tourism Market, By Group

9.1. Safari Tourism Market, by Group, 2023-2032

9.1.1. Friends

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Families

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Couples

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Solos

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Safari Tourism Market, By Booking Mode

10.1. Safari Tourism Market, by Booking Mode, 2023-2032

10.1.1. Direct Booking

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Agents And Affiliates Account

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Marketplace Booking

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Safari Tourism Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Group (2020-2032)

11.1.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Group (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Group (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Group (2020-2032)

11.2.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Group (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Group (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Group (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Group (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Group (2020-2032)

11.3.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Group (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Group (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Group (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Group (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Group (2020-2032)

11.4.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Group (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Group (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Group (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Group (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Group (2020-2032)

11.5.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Group (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Group (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Booking Mode (2020-2032)

Chapter 12. Company Profiles

12.1. Wilderness

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Thomas Cook Group.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Singita

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Scott Dunn Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Rothschild Safaris

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Travcoa Tours & Safaris

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Abercrombie & Kent USA, LLC.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Gamewatchers Safaris Ltd.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Backroads.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. TUI Group

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others