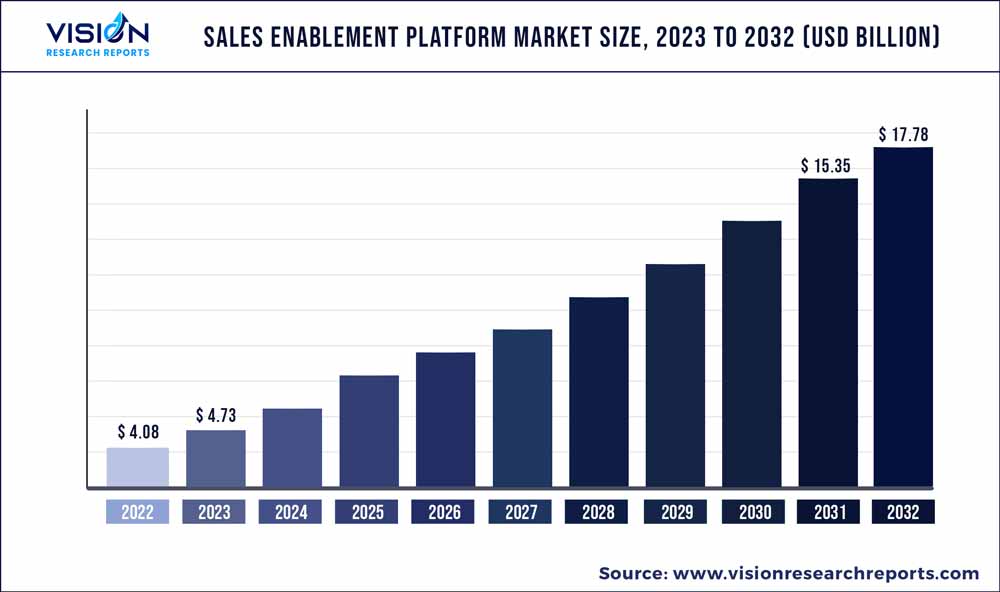

The global sales enablement platform market was surpassed at USD 4.08 billion in 2022 and is expected to hit around USD 17.78 billion by 2032, growing at a CAGR of 15.86% from 2023 to 2032. The sales enablement platform market in the United States was accounted for USD 904 million in 2022.

Key Pointers

Report Scope of the Sales Enablement Platform Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 30% |

| CAGR of Asia Pacific from 2023 to 2032 | 18.46% |

| Revenue Forecast by 2032 | USD 17.78 billion |

| Growth Rate from 2023 to 2032 | CAGR of 15.86% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Accent Technologies, Inc.; Bigtincan Holdings Ltd.; Bloomfire; Brainshark, Inc.; ClearSlide; Highspot; Mediafly; Mindtickle Inc.; Pitcher AG; QorusDocs Ltd.;Qstream Inc.; Rallyware Inc.; SAP; Seismic |

The rising need for real-time data and analytics, and the automated sales process is driving the demand for sales platforms as they work as an all-in-one platform for sales management and improve customer engagement between buyers and sellers. However, changing consumer preferences coupled with inconsistent user experience are likely to limit the growth of the market. In addition, the lack of optimized content and lack of coordination between marketing and sales teams is impacting the overall market.

The platform provides sales enablement solutions for the inbound sales teams to improve sales. The need for sales enablement platforms is driven by the need to streamline workflows and improve sales performance. The sales enablement platform provides customer-facing teams with insights on content performance and customer journey. Platform providers also provide sellers with insights on creating marketing material and create engaging content. This leads to informed decision-making and selling throughout organizations.

The COVID-19 pandemic positively impacted the sales enablement platform market. Businesses were shut down due to government-imposed regulations and travel restrictions, which compelled several companies to adopt a hybrid work environment. The industry witnessed a change owing to the adoption of digital sales rooms and the integration of video conferencing for sales teams. Several market players are setting up digital sales rooms (DSRs) to streamline the seller and buyer experience. DSRs provide a single location for access to content and communication related to a sales cycle. These can be used to collaborate with stakeholders. In addition, the digitization of industries and the rising adoption of connected devices have also promoted the demand for sales enablement platforms.

The use of AI in sales enablement during the pandemic also accelerated market growth. For instance, Allego, a sales enablement market player, reported that close to 50% of sales reps expressed a desire to be trained in virtual selling and AI. Call recordings and AI-based analysis can equip managers with insights necessary to coach sales reps. Further, the growing need to reduce the complexity involved while selling among both small and large enterprises is driving the need for sales enablement platforms among several industries. The end users include industries BFSI, retail & consumer goods, healthcare & life sciences, media & entertainment, among others. Market players operating in the industry.

However, the gap in content is a major factor affecting the demand for sales enablement platforms. The rise in number of informed consumers is increasing the demand for optimized content. Factors such as lack of coordination between the marketing and sales team are leading to gaps in content. The use of key performance indicators (KPIs) and ad campaigns can improve content creation. Collaboration between the sales and marketing teams can help reduce content gaps.

Component Insights

The platform segment accounted for the largest market share of over 75% in 2022 and is likely to continue dominating over the forecast period. The sales enablement platform helps organizations with a single platform to manage their sales team. Several organizations across different industries are adopting the use of a sales enablement platform to increase efficiency in aspects such as training, coaching, content management, and sales communication. The continuously changing buyer preferences have compelled companies to invest in the coaching and training of inbound sales teams. For example, as per Spotio, a sales enablement platform, 81% of sales executives stated utilization and content search as the top productivity improvement areas.

The service segment is expected to grow at the fastest CAGR of 16.43% over the forecast period. Sales enablement services include sales onboarding programs, sales communication, training programs, content creation, sales coaching, sales tools, and advanced analytics. Sales enablement services help companies channel legacy systems using advanced analytics and take care of implementation and training. Several vendors across different industry verticals are adopting the usage of sales enablement services to drive sales. For instance, Marketron, a software solution provider offers “Pitch by Marketron” to help media professionals succeed with integrated campaigns.

Organization Size Insights

The large organization segment accounted for a market share of 62% in 2022. Factors such as lack of resource utilization and legacy system constraints limit the growth of the segment. The lack of flexibility can limit large enterprises to limit their capacity of testing newer strategies. The use of a sales enablement platform can equip sales representatives to shorten the sales cycle and increase their win rates.

As per Highspot’s sales enablement study, organizations reporting more than USD 750 million have deployed a specialized enablement team for boosting sales. In addition, the rise in the usage of AI-powered sales enablement solutions has further increased the demand for sales enablement platforms among large enterprises. Seismic, a key player in the sales enablement industry, provides sales enablement solutions for large enterprises to improve efficiency and drive sales.

The small and medium organization segment is expected to grow at the highest CAGR of 16.13% during the forecast period. Small and medium enterprises (SMEs) play an important role in the economic landscape globally by contributing to job creation and economic development. Sales enablement for smaller businesses helps reduce the sales cycle and increase the company’s revenue. Sales enablement platforms for smaller businesses also help provide the sales team with adequate training, improve the consumer experience, reduce customer churn, and shorten the sales cycle.

Deployment Insights

The on-premise segment held the largest share of more than 64% in 2022. The rise in the number of security concerns over cloud storage is driving the demand for on-premise sales enablement platforms. On-premise software reduces the risk of a data breach as the data is locally stored on-premise and the organization has complete control over the data. The increase in the number of large enterprises adopting the use of sales enablement services is proliferating the demand for the on-premise segment. On-premises systems are particularly favored for companies that handle sensitive information, including financial information for large or long-term clients.

The cloud segment is expected to witness the fastest CAGR of 16.95% during the forecast period. Cloud enablement services provide a highly scalable platform that simplifies high-performance computation for both small and large enterprises. The adoption of cloud deployment reduces operating costs and streamlines delivery. During the COVID-19 pandemic, organizations have struggled with data center outages and applications. Cloud Component can help organizations build scalable and resilient IT infrastructure. Several companies operating in the space rely on the use of the cloud to reduce expenditure costs. For instance, Seismic provides a sales enablement cloud that provides end-to-end solutions for the sales team.

End-use Industry Insights

The consumer goods & retail segment accounts for the largest market share of 26% in 2022. Rise in challenges such as increasing competition from competitors, diverse sales networks and cost-sensitive consumers is driving the demand for sales enablement in the consumer goods and retail sector. Also, the rising digitalization of the retail sector is expected to drive the demand for sales enablement platforms. For instance, as per U.S. Census Bureau stated that sales through physical stores have decreased and sales of products through online retail stores have increased by 8.4%.

The IT & telecom segment is expected to grow at the fastest CAGR of 16.44% over the forecast period. Several tech companies and startups utilize sales enablement for lead generation as it reduces cross-department bottlenecks and improves workflow. The sales enablement platform for the telecom industry helps companies by increasing the capability to close sales deals at a quicker rate. The adoption of a sales enablement platform helps telecom companies to maximize their business value through a unique sales approach. The telecommunication industry primarily runs on sales through radio spots, subscriptions, and advertisement sales.

Regional Insights

North America dominated the sales enablement platform industry in 2022 and accounted for 30% of the revenue share. It is anticipated to retain its position over the forecast period. The growth is driven by the presence of sales enablement players in the region coupled with the rising adoption of connected devices. The entry of new players with an approach toward offering AI-based content management solutions and training of sales reps is driving the market’s growth in the region.

A rise in the number of sales enablement platforms that focus on providing personalized content and coaching depending on the type of industry is boding well for the market. The inclusion of microlearning, sales gamification, and AI-enabled sales metrics is anticipated to yield high revenue for the sales enablement platform. In January 2022, Highspot entered a partnership with Outreach, an intelligence platform provider. Through the partnership, the company will be able to conduct efficient and effective buyer engagement.

Asia Pacific is anticipated to rise as the fastest-developing regional market with a CAGR of 18.46% over the forecast period. The presence of numerous small and large enterprises acts as an opportunity for the sales enablement platform industry. According to Deskera, a CRM provider based in Asia, demand for sales tools such as CRM is attributed to the rising investments in analytics and BI and increased spending on cloud deployment and SaaS. In addition, supportive government policies to promote the digitalization of industries are driving growth. For instance, the Singapore government has allocated USD 2 billion since 2010 under the Smart Nation program for the digitalization of industries.

Sales Enablement Platform Market Segmentations:

By Component

By Organization Size

By Deployment

By End-use Industry

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Sales Enablement Platform Market

5.1. COVID-19 Landscape: Sales Enablement Platform Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Sales Enablement Platform Market, By Component

8.1. Sales Enablement Platform Market, by Component, 2023-2032

8.1.1. Platform

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Radiation

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Sales Enablement Platform Market, By Organization Size

9.1. Sales Enablement Platform Market, by Organization Size, 2023-2032

9.1.1. Large Organization

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Small and Medium Organization

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Sales Enablement Platform Market, By Deployment

10.1. Sales Enablement Platform Market, by Deployment, 2023-2032

10.1.1. On-premise

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Cloud

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Sales Enablement Platform Market, By End-use Industry

11.1. Sales Enablement Platform Market, by End-use Industry, 2023-2032

11.1.1. BFSI

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. IT & Telecom

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Consumer Goods & Retail

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Media & Entertainment

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Healthcare & Lifesciences

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Manufacturing

11.1.6.1. Market Revenue and Forecast (2020-2032)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2020-2032)

11.1.8. Cloud Management

11.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Sales Enablement Platform Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.1.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.5.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.6.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.2.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.5.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.6.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.7.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.8.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.3.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.5.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.6.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.7.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.8.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.4.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.5.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.6.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.7.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.8.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.5.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Organization Size (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.6.4. Market Revenue and Forecast, by End-use Industry (2020-2032)

Chapter 13. Company Profiles

13.1. Accent Technologies, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Bigtincan Holdings Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Bloomfire

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Brainshark, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. ClearSlide

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Highspot

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Mediafly

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Mindtickle Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Pitcher AG

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. QorusDocs Ltd.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others