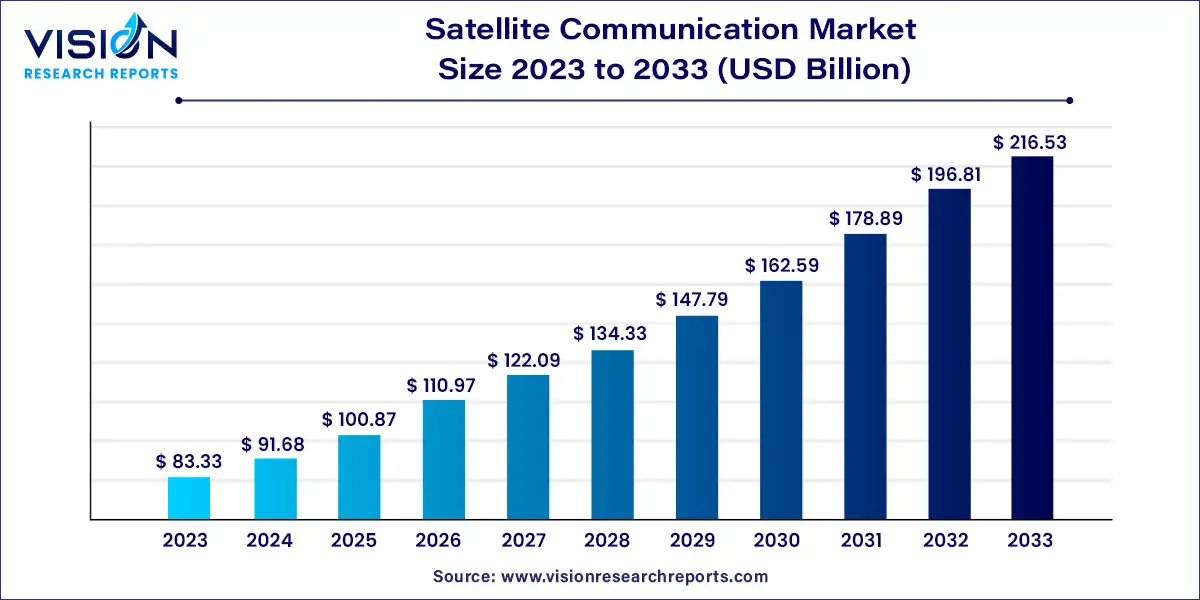

The global satellite communication market size was estimated at USD 83.33 billion in 2023 and it is expected to surpass around USD 216.53 billion by 2033, poised to grow at a CAGR of 10.02% from 2024 to 2033. Satellite communication is a pivotal technology in the modern telecommunications landscape, providing critical services that span various sectors including broadcasting, data transmission, and global internet connectivity. The market for satellite communication has evolved significantly, driven by advancements in satellite technology, increasing demand for high-speed internet, and the expanding applications of satellite-based services.

The expansion of the satellite communication market is primarily driven by the technological advancements play a crucial role, with innovations such as High Throughput Satellites (HTS) and Low Earth Orbit (LEO) constellations significantly enhancing data transmission speeds and reducing latency. These developments enable more reliable and efficient communication services. Additionally, the increasing demand for global connectivity, particularly in remote and underserved regions, is fueling market growth. As the need for high-speed internet and seamless communication continues to rise, satellite solutions offer a vital means of bridging connectivity gaps. Moreover, the growing adoption of satellite communication in emerging sectors, including telemedicine, autonomous vehicles, and disaster response, further stimulates market expansion. The combination of these technological and demand-driven factors underscores the dynamic growth trajectory of the satellite communication industry.

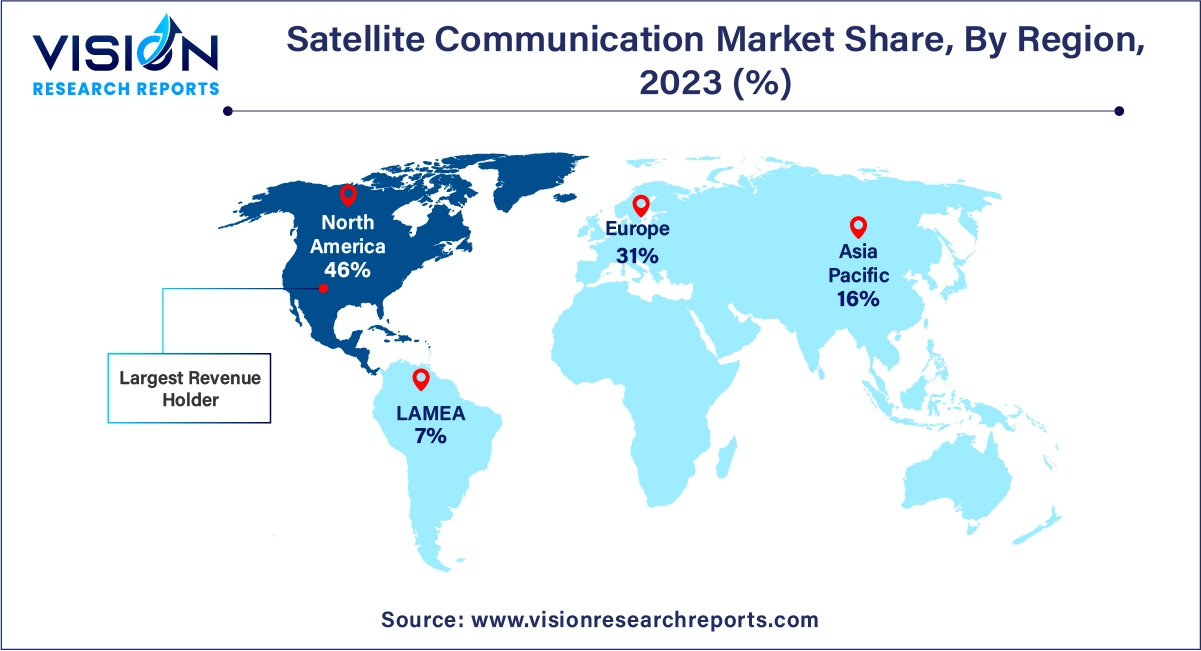

In 2023, North America led the market with a 46% revenue share. The region's growth is attributed to the rising demand for satellite broadband services, especially in remote and underserved areas. North America also hosts major industry players such as Viasat, Inc.; Intelsat; Telesat; and Harris Technologies, Inc., whose focus on innovation, research and development, and strategic partnerships is driving regional market expansion.

| Attribute | North America |

| Market Value | USD 38.33 Billion |

| Growth Rate | 10.03% CAGR |

| Projected Value | USD 99.06 Billion |

The European market is anticipated to grow at a CAGR of 10.33% from 2024 to 2033. The region is shifting towards self-reliance and sustainability, with ambitious plans for satellite constellations and substantial funding reflecting a strategic emphasis on enhancing market capabilities and reducing reliance on external entities.

The Asia Pacific region is expected to register the highest CAGR during the forecast period. This growth is driven by ongoing innovation, research and development, and strategic initiatives by key market players aiming to enhance their presence. The increasing dependence on satellite communication services in telecommunications, media and broadcasting, agriculture, and energy sectors is also contributing to the market's expansion. Additionally, the region is home to numerous organizations dedicated to advancing satellite communication technologies.

In 2023, the services segment led the market with a commanding 60% share of global revenue. This dominance is primarily due to the expanding global media and entertainment sectors and the increasing demand for satellite television in developing countries. The push for seamless data transmission to end-user locations further drives the demand for satellite communication services worldwide.

However, the high initial costs associated with acquiring satellites present financial challenges for many companies. Consequently, many firms are opting for satellite services through leasing arrangements. For example, Domestic Direct-to-Home (DTH) operators typically rely on satellites ordered by space agencies or lease capacity from international satellites. Technological advancements are crucial in reducing manufacturing costs, which in turn lowers lease expenses and stimulates market revenue growth.

The equipment segment is expected to grow significantly in the coming years due to the rising need for uninterrupted communication across various industries and the increasing use of connected and autonomous vehicles. Satellite communication equipment supports diverse applications, including telecommunications, navigation, weather monitoring, and surveillance, by facilitating effective communication with Earth-orbiting satellites. The advent of LEO satellites and satellite constellations for telecommunications is also likely to boost the equipment segment's growth.

In 2023, the media and broadcasting segment was the leading market contributor. This sector is a major consumer of satellite communication technology, using it to transmit live news, satellite television, radio, sports events, concerts, and other programming to global audiences. Satellites also enable video channel broadcasting for both broadcast networks and cable operators, benefiting viewers worldwide.

The government and defense segment is projected to experience the highest growth rate during the forecast period. This growth is driven by the increasing demand for secure and resilient satellite communication solutions that meet the evolving needs of government and defense organizations. Key factors include the adoption of advanced encryption, anti-jamming technologies, and robust cybersecurity measures to protect sensitive data and ensure reliable communication during critical situations.

Additionally, the demand for satellite-based Intelligence, Surveillance, and Reconnaissance (ISR) capabilities is fueling segment growth. Government and defense entities use satellite communication to gather real-time information, monitor remote areas, and improve situational awareness. The integration of high-resolution imaging, video streaming, and advanced analytics enhances ISR operations, facilitating swift decision-making and responses.

In 2023, the broadcasting segment was the largest market segment. This growth is driven by the increasing demand for satellite communications in pay-TV and radio applications. Direct-to-Home (DTH) providers use satellite communication to deliver services and ensure consistent connectivity, even in remote and hard-to-reach areas. Rising consumer expectations for high-quality audio and video content have led to significant advancements in satellite communication equipment.

For example, the development of IP live-production technology has enabled the production and transmission of Ultra-High Definition (UHD) and 4K content, greatly enhancing the viewing experience. Investments in broadcasting and cable television, along with technological advancements and government incentives for digital platform transitions in emerging economies, are key factors contributing to this segment's growth.

The airtime segment is anticipated to experience substantial growth over the forecast period, driven by increasing demand for reliable and cost-effective communication services for aircraft. Satellite communication solutions provide seamless connectivity and high-speed internet access onboard, catering to the needs of both crew members and business applications. The growing use of satellite communication for aircraft navigation and remote troubleshooting is expected to further drive this segment's growth.

By Component

By Satellite Constellations

By Frequency Band

By Application

By Vertical

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Satellite Communication Market

5.1. COVID-19 Landscape: Satellite Communication Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Satellite Communication Market, By Component

8.1. Satellite Communication Market, by Component

8.1.1. Equipment

8.1.1.1. Market Revenue and Forecast

8.1.2. Services

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Satellite Communication Market, By Satellite Constellations

9.1. Satellite Communication Market, by Satellite Constellations

9.1.1. Low Earth Orbit (LEO) Satellites

9.1.1.1. Market Revenue and Forecast

9.1.2. Medium Earth Orbit (MEO) Satellites

9.1.2.1. Market Revenue and Forecast

9.1.3. Geostationary Equatorial Orbit (GEO) Satellites

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Satellite Communication Market, By Frequency Band

10.1. Satellite Communication Market, by Frequency Band

10.1.1. L-band

10.1.1.1. Market Revenue and Forecast

10.1.2. S-band

10.1.2.1. Market Revenue and Forecast

10.1.3. C-band

10.1.3.1. Market Revenue and Forecast

10.1.4. X-band

10.1.4.1. Market Revenue and Forecast

10.1.5. Ku-band

10.1.5.1. Market Revenue and Forecast

10.1.6. Ka-band

10.1.6.1. Market Revenue and Forecast

Chapter 11. Global Satellite Communication Market, By Application

11.1. Satellite Communication Market, by April

11.1.1. Asset Tracking/Monitoring

11.1.1.1. Market Revenue and Forecast

11.1.2. Airtime

11.1.2.1. Market Revenue and Forecast

11.1.3. Drones Connectivity

11.1.3.1. Market Revenue and Forecast

11.1.4. Data Backup and Recovery

11.1.4.1. Market Revenue and Forecast

11.1.5. Navigation and Monitoring

11.1.5.1. Market Revenue and Forecast

11.1.6. Tele-medicine

11.1.6.1. Market Revenue and Forecast

11.1.7. Broadcasting

11.1.7.1. Market Revenue and Forecast

11.1.8. Others

11.1.8.1. Market Revenue and Forecast

Chapter 12. Global Satellite Communication Market, By Vertical

12.1. Satellite Communication Market, by Vertical

12.1.1. Energy & Utility

12.1.1.1. Market Revenue and Forecast

12.1.2. Government & Defense

12.1.2.1. Market Revenue and Forecast

12.1.3. Transport & Cargo

12.1.3.1. Market Revenue and Forecast

12.1.4. Maritime

12.1.4.1. Market Revenue and Forecast

12.1.5. Mining and Oil & Gas

12.1.5.1. Market Revenue and Forecast

12.1.5. Agriculture

12.1.5.1. Market Revenue and Forecast

12.1.5. Communication Companies

12.1.5.1. Market Revenue and Forecast

12.1.5. Corporates/Enterprises

12.1.5.1. Market Revenue and Forecast

12.1.5. Media & Broadcasting

12.1.5.1. Market Revenue and Forecast

12.1.5. Eventsaa

12.1.5.1. Market Revenue and Forecast

12.1.5. Aviation

12.1.5.1. Market Revenue and Forecast

12.1.5. Environmental & Monitoring

12.1.5.1. Market Revenue and Forecast

12.1.5. Forestry

12.1.5.1. Market Revenue and Forecast

12.1.5. End User - Consumer

12.1.5.1. Market Revenue and Forecast

12.1.5. Healthcare

12.1.5.1. Market Revenue and Forecast

12.1.5. Others

12.1.5.1. Market Revenue and Forecast

Chapter 13. Global Satellite Communication Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Component

13.1.2. Market Revenue and Forecast, by Satellite Constellations

13.1.3. Market Revenue and Forecast, by Frequency Band

13.1.4. Market Revenue and Forecast, by April

13.1.5. Market Revenue and Forecast, by Vertical

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Component

13.1.6.2. Market Revenue and Forecast, by Satellite Constellations

13.1.6.3. Market Revenue and Forecast, by Frequency Band

13.1.6.4. Market Revenue and Forecast, by April

13.1.7. Market Revenue and Forecast, by Vertical

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Component

13.1.8.2. Market Revenue and Forecast, by Satellite Constellations

13.1.8.3. Market Revenue and Forecast, by Frequency Band

13.1.8.4. Market Revenue and Forecast, by April

13.1.8.5. Market Revenue and Forecast, by Vertical

13.2. Europe

13.2.1. Market Revenue and Forecast, by Component

13.2.2. Market Revenue and Forecast, by Satellite Constellations

13.2.3. Market Revenue and Forecast, by Frequency Band

13.2.4. Market Revenue and Forecast, by April

13.2.5. Market Revenue and Forecast, by Vertical

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Component

13.2.6.2. Market Revenue and Forecast, by Satellite Constellations

13.2.6.3. Market Revenue and Forecast, by Frequency Band

13.2.7. Market Revenue and Forecast, by April

13.2.8. Market Revenue and Forecast, by Vertical

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Component

13.2.9.2. Market Revenue and Forecast, by Satellite Constellations

13.2.9.3. Market Revenue and Forecast, by Frequency Band

13.2.10. Market Revenue and Forecast, by April

13.2.11. Market Revenue and Forecast, by Vertical

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Component

13.2.12.2. Market Revenue and Forecast, by Satellite Constellations

13.2.12.3. Market Revenue and Forecast, by Frequency Band

13.2.12.4. Market Revenue and Forecast, by April

13.2.13. Market Revenue and Forecast, by Vertical

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Component

13.2.14.2. Market Revenue and Forecast, by Satellite Constellations

13.2.14.3. Market Revenue and Forecast, by Frequency Band

13.2.14.4. Market Revenue and Forecast, by April

13.2.15. Market Revenue and Forecast, by Vertical

13.3. APAC

13.3.1. Market Revenue and Forecast, by Component

13.3.2. Market Revenue and Forecast, by Satellite Constellations

13.3.3. Market Revenue and Forecast, by Frequency Band

13.3.4. Market Revenue and Forecast, by April

13.3.5. Market Revenue and Forecast, by Vertical

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Component

13.3.6.2. Market Revenue and Forecast, by Satellite Constellations

13.3.6.3. Market Revenue and Forecast, by Frequency Band

13.3.6.4. Market Revenue and Forecast, by April

13.3.7. Market Revenue and Forecast, by Vertical

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Component

13.3.8.2. Market Revenue and Forecast, by Satellite Constellations

13.3.8.3. Market Revenue and Forecast, by Frequency Band

13.3.8.4. Market Revenue and Forecast, by April

13.3.9. Market Revenue and Forecast, by Vertical

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Component

13.3.10.2. Market Revenue and Forecast, by Satellite Constellations

13.3.10.3. Market Revenue and Forecast, by Frequency Band

13.3.10.4. Market Revenue and Forecast, by April

13.3.10.5. Market Revenue and Forecast, by Vertical

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Component

13.3.11.2. Market Revenue and Forecast, by Satellite Constellations

13.3.11.3. Market Revenue and Forecast, by Frequency Band

13.3.11.4. Market Revenue and Forecast, by April

13.3.11.5. Market Revenue and Forecast, by Vertical

13.4. MEA

13.4.1. Market Revenue and Forecast, by Component

13.4.2. Market Revenue and Forecast, by Satellite Constellations

13.4.3. Market Revenue and Forecast, by Frequency Band

13.4.4. Market Revenue and Forecast, by April

13.4.5. Market Revenue and Forecast, by Vertical

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Component

13.4.6.2. Market Revenue and Forecast, by Satellite Constellations

13.4.6.3. Market Revenue and Forecast, by Frequency Band

13.4.6.4. Market Revenue and Forecast, by April

13.4.7. Market Revenue and Forecast, by Vertical

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Component

13.4.8.2. Market Revenue and Forecast, by Satellite Constellations

13.4.8.3. Market Revenue and Forecast, by Frequency Band

13.4.8.4. Market Revenue and Forecast, by April

13.4.9. Market Revenue and Forecast, by Vertical

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Component

13.4.10.2. Market Revenue and Forecast, by Satellite Constellations

13.4.10.3. Market Revenue and Forecast, by Frequency Band

13.4.10.4. Market Revenue and Forecast, by April

13.4.10.5. Market Revenue and Forecast, by Vertical

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Component

13.4.11.2. Market Revenue and Forecast, by Satellite Constellations

13.4.11.3. Market Revenue and Forecast, by Frequency Band

13.4.11.4. Market Revenue and Forecast, by April

13.4.11.5. Market Revenue and Forecast, by Vertical

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Component

13.5.2. Market Revenue and Forecast, by Satellite Constellations

13.5.3. Market Revenue and Forecast, by Frequency Band

13.5.4. Market Revenue and Forecast, by April

13.5.5. Market Revenue and Forecast, by Vertical

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Component

13.5.6.2. Market Revenue and Forecast, by Satellite Constellations

13.5.6.3. Market Revenue and Forecast, by Frequency Band

13.5.6.4. Market Revenue and Forecast, by April

13.5.7. Market Revenue and Forecast, by Vertical

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Component

13.5.8.2. Market Revenue and Forecast, by Satellite Constellations

13.5.8.3. Market Revenue and Forecast, by Frequency Band

13.5.8.4. Market Revenue and Forecast, by April

13.5.8.5. Market Revenue and Forecast, by Vertical

Chapter 14. Company Profiles

14.1. Viasat, Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. SES S.A

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Intelsat S.A.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Telesat Corporation

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. EchoStar Corporation

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. L3Harris Technologies, Inc

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Thuraya Telecommunications Company (Yashat)

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. SKY Perfect JSAT Holdings Inc.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Gilat Satellite Networks Ltd.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Cobham Limited

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others