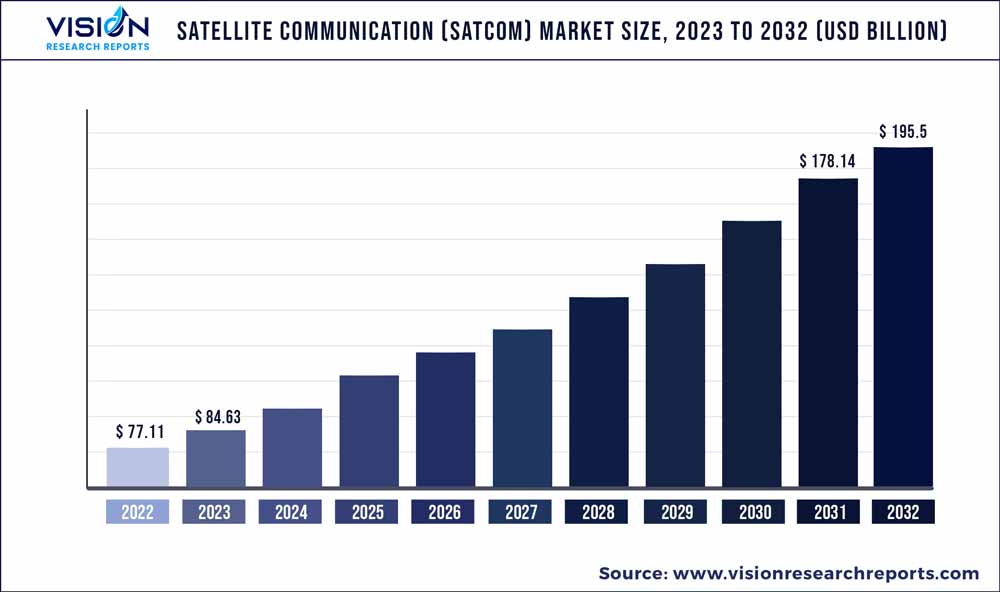

The global satellite communication (SATCOM) market was estimated at USD 77.11 billion in 2022 and it is expected to surpass around USD 195.5 billion by 2032, poised to grow at a CAGR of 9.75% from 2023 to 2032. The satellite communication (SATCOM) market in the United States was accounted for USD 19.7 billion in 2022.

Key Pointers

Report Scope of the Satellite Communication (SATCOM) Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 33% |

| Revenue Forecast by 2032 | USD 195.5 billion |

| Growth Rate from 2023 to 2032 | CAGR of 9.75% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Viasat, Inc.; SES S.A.; Intelsat; Telesat; EchoStar Corporation; L3Harris Technologies, Inc.; Thuraya Telecommunications Company; SKY Perfect JSAT Group; GILAT SATELLITE NETWORKS.; Cobham Limited |

The growth of the market can be attributed to the growing demand for High-throughput Satellite Systems (HTS), which provide significantly increased capacity and data speeds compared to traditional satellite systems. HTS enables faster and more efficient data transmission, making it ideal for bandwidth-intensive applications such as video streaming, remote sensing, and Internet of Things (IoT) connectivity.

At the same time, new frequency bands, such as high-frequency and very high-frequency bands, are expanding the available spectrum for satellite communication. These bands offer improved bandwidth and increased capacity, enabling higher data rates and supporting bandwidth-hungry applications.

Several satellite communication solution providers across the globe are focusing on developing solutions to offer better connectivity to a myriad of use cases. For instance, in June 2023, Get SAT, a provider of miniaturized satellite communication terminals, launched its latest product line, MoComm, featuring the innovative Multi Orbit Communication capability. This groundbreaking feature enables smooth and efficient switching between satellite constellations, ensuring uninterrupted connectivity.

MoComm operates seamlessly in both Ku and Ka-bands. The Ka-band functionality empowers users to seamlessly transfer data traffic between O3B Medium Earth Orbit (MEO) and any Geostationary Orbit (GEO) constellation. Additionally, the Ku-band has received certification for compatibility with LEO and any GEO constellation, further expanding its versatility and applicability.

Increasing use of satellite communications in the government & defense sector is also contributing to the growth of the market. Government sectors are actively transforming their operational environments, leading to an increasing dependence on sensor data and ISR platforms. These platforms facilitate the sharing of real-time HD video and other valuable information obtained from Remotely Piloted Air Systems (RPAS) or Unmanned Aerial Vehicles (UAVs). Consequently, the demand for HTS capacity continues to escalate for government and military applications. In addition, notable satellite communication service providers like Viasat, Inc. and SES S.A. are making significant investments to pioneer novel solutions tailored to various government and defense applications.

The increasing deployment of satellite constellations dedicated to IoT connectivity is also contributing to the growth of the market. These constellations consist of several small satellites working together to provide global coverage for IoT devices, enabling seamless communication and data exchange across vast geographic areas. This trend is driven by the growing demand for IoT applications in agriculture, logistics, environmental monitoring, and asset tracking sectors, where ubiquitous connectivity is essential.

Another emerging trend is the development of Low Earth Orbit (LEO) satellite networks specifically designed for IoT applications. LEO satellites offer advantages such as lower latency, improved signal strength, and higher data throughput, making them well-suited for IoT data transmission. These networks leverage advanced technologies like narrowband and low-power communication protocols to optimize IoT device connectivity, ensuring efficient utilization of satellite resources.

Furthermore, the satellite communication market is witnessing the adoption of advanced technologies like Artificial Intelligence (AI), which are driving the emergence of intelligent transport systems (ITS). These systems enable real-time vehicle tracking, facilitating the swift exchange of information for both users and freight operators. Satcom integration in transportation ensures continuous and seamless data transmission between vehicles and transport hubs, eliminating the reliance on terrestrial networks. As a result, the utilization of satellites in the transport and logistics network presents promising growth prospects for the satellite communication industry.

Component Insights

The services segment dominated the market in 2022 and accounted for more than 60% share of the global revenue. The segment growth can be attributed to the global expansion of the media and entertainment industries, coupled with the increasing demand for satellite television in emerging nations. Efforts to enable seamless data transmission to end-user locations also contribute to the growth.

However, the high upfront costs associated with satellite acquisition often make it financially challenging for many firms to purchase satellites outright. As a result, an increasing number of companies are opting for satellite services through leasing arrangements. Domestic direct-to-home (DTH) operators, for instance, are typically limited to using satellites ordered by their respective space agencies or leasing capacity from foreign satellites. Technological advancements play a crucial role in reducing the manufacturing costs of satellites, thereby lowering lease expenditure, and driving revenue growth in the market.

The equipment segment is projected to witness remarkable growth over the forecast period. The growth of this segment can be credited to the increasing need for uninterrupted communication in various industries, including energy and utilities, oil and gas, agriculture, defense, and the growing presence of connected and autonomous vehicles.

These industries rely on satellite communication systems for diverse applications such as telecommunications, navigation, weather monitoring, and surveillance systems, enabling effective communication with satellites orbiting the Earth. Moreover, the introduction of low earth orbit (LEO) satellites and satellite constellations for telecommunication purposes has led to a surge in the global demand for satellite equipment. These factors are expected to create promising opportunities for the growth of this segment throughout the forecast period.

Vertical Insights

The media & broadcasting segment dominated the market in 2022 and accounted for more than 16% share of the global revenue. The media & broadcasting segment can be considered one of the most significant segments that leverage satellite communication technology. Companies in this industry rely on satellite communication to transmit live news, sports events, concerts, and various other programs to their audience. This technology benefits consumers globally as satellites broadcast video channels that can be received by both broadcast networks and cable operators. In addition to broadcasting video channels, satellite communication offers other services, such as onsite live news reporting, satellite television, and satellite radio.

The government & defense segment is projected to grow at the highest CAGR over the forecast period. Increasing emphasis on secure and resilient satellite communication solutions to meet the evolving needs of government agencies and defense organizations is a significant factor contributing to the growth of the segment. This includes the adoption of advanced encryption techniques, anti-jamming capabilities, and robust cybersecurity measures to safeguard sensitive data and ensure uninterrupted communication in critical situations.

Secondly, there is a growing demand for satellite-based intelligence, surveillance, and reconnaissance (ISR) capabilities. Government and defense entities are leveraging satellite communication to gather real-time information, monitor remote areas, and enhance situational awareness. The integration of high-resolution imaging, video streaming, and advanced analytics technologies is enabling more effective ISR operations, facilitating rapid decision-making and response.

Application Insights

The broadcasting segment dominated the market in 2022 and accounted for more than 23% share of the global revenue. The expansion of the broadcasting sector has been influenced by the growing demand for satellite communications in pay-TV and radio applications. Direct-to-home (DTH) providers worldwide use satellite communication services to deliver services to customers and ensure seamless connectivity, even in remote and inaccessible areas.

The increasing consumer expectations for high-quality audio and video content have driven significant advancements in satellite communication equipment. The emergence of IP live-production technology has facilitated the production and transmission of Ultra-High Definition (UHD) and 4K content, enhancing the viewing experience. Furthermore, investments in the broadcasting and cable television industries, coupled with technological advancements and government incentives in emerging economies to transition to digital platforms, are significant factors contributing to the segment's growth.

The airtime segment is projected to witness significant growth over the forecast period. The rising demand for reliable and affordable communication services for flights and aircraft is fueling the growth of the segment. Additionally, the growing utilization of satellite communications for navigation purposes in aircraft is expected to further contribute to the segment's expansion.

Satellite communication solutions provide added value by offering seamless connectivity and high-speed internet access onboard aircraft, catering to the needs of both the crew and business applications. These solutions also support remote troubleshooting capabilities. Furthermore, satellite communication solutions enhance voice calls, enable accurate weather forecasting, and provide customizable dashboards that allow users to access real-time information on traffic for voice and data, along with associated costs.

Regional Insights

The North America region dominated the market in 2022 and accounted for more than 33% share of the global revenue. Growing demand for satellite broadband services, especially in remote and hard-to-reach areas, is anticipated to create lucrative growth opportunities for the segment over the forecast period. This trend presents significant revenue generation opportunities as satellite communication becomes essential for providing reliable connectivity in underserved regions of North America.

The North America region is also witnessing the emergence of key market players such as Viasat, Inc.; Intelsat; Telesat; and Harris Technologies, Inc. These companies are driving innovation and actively contributing to the growth of the satellite communication industry in North America. Their investments in research and development, advanced technologies, and strategic partnerships are fueling the expansion of the industry in the region.

The Asia Pacific region is projected to grow at the highest CAGR over the forecast period. The expansion of the satellite communication market in Asia Pacific can be attributed to the relentless pursuit of innovation, research and development, and strategic initiatives by prominent market players aiming to enhance their market presence. Furthermore, the increasing reliance on satellite communication-dependent services in sectors such as telecommunications, media and broadcasting, agriculture, and energy and utility within Asia Pacific is anticipated to be a significant driver of market growth. The region is home to numerous organizations dedicated to advancing satellite communications.

Satellite Communication (SATCOM) Market Segmentations:

By Component

By Application

By Vertical

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Component Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Satellite Communication (SATCOM) Market

5.1. COVID-19 Landscape: Satellite Communication (SATCOM) Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Satellite Communication (SATCOM) Market, By Component

8.1. Satellite Communication (SATCOM) Market, by Component, 2023-2032

8.1.1 Equipment

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Satellite Communication (SATCOM) Market, By Application

9.1. Satellite Communication (SATCOM) Market, by Application, 2023-2032

9.1.1. Asset Tracking/Monitoring

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Airtime

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Drones Connectivity

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Data Backup & Recovery

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Navigation & Monitoring

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Navigation & Monitoring

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Broadcasting

9.1.7.1. Market Revenue and Forecast (2020-2032)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Satellite Communication (SATCOM) Market, By Vertical

10.1. Satellite Communication (SATCOM) Market, by Vertical, 2023-2032

10.1.1. Energy & Utility

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Government & Defense

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Transport & Cargo

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Maritime

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Mining And Oil & Gas

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Agriculture

10.1.6.1. Market Revenue and Forecast (2020-2032)

10.1.7. Communication Companies

10.1.7.1. Market Revenue and Forecast (2020-2032)

10.1.8. Corporates/Enterprises

10.1.8.1. Market Revenue and Forecast (2020-2032)

10.1.9. Media & Broadcasting

10.1.9.1. Market Revenue and Forecast (2020-2032)

10.1.10. Events

10.1.10.1. Market Revenue and Forecast (2020-2032)

10.1.11. Aviation

10.1.11.1. Market Revenue and Forecast (2020-2032)

10.1.12. Environmental & Monitoring

10.1.12.1. Market Revenue and Forecast (2020-2032)

10.1.13. Forestry

10.1.13.1. Market Revenue and Forecast (2020-2032)

10.1.14. End User - Consumer

10.1.14.1. Market Revenue and Forecast (2020-2032)

10.1.15. Healthcare

10.1.15.1. Market Revenue and Forecast (2020-2032)

10.1.16. Others

10.1.16.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Satellite Communication (SATCOM) Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

Chapter 12. Company Profiles

12.1. Viasat, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. SES S.A..

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Intelsat.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Telesat.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. EchoStar Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. L3Harris Technologies, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Thuraya Telecommunications Company.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. SKY Perfect JSAT Group

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. GILAT SATELLITE NETWORKS..

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Cobham Limited

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others