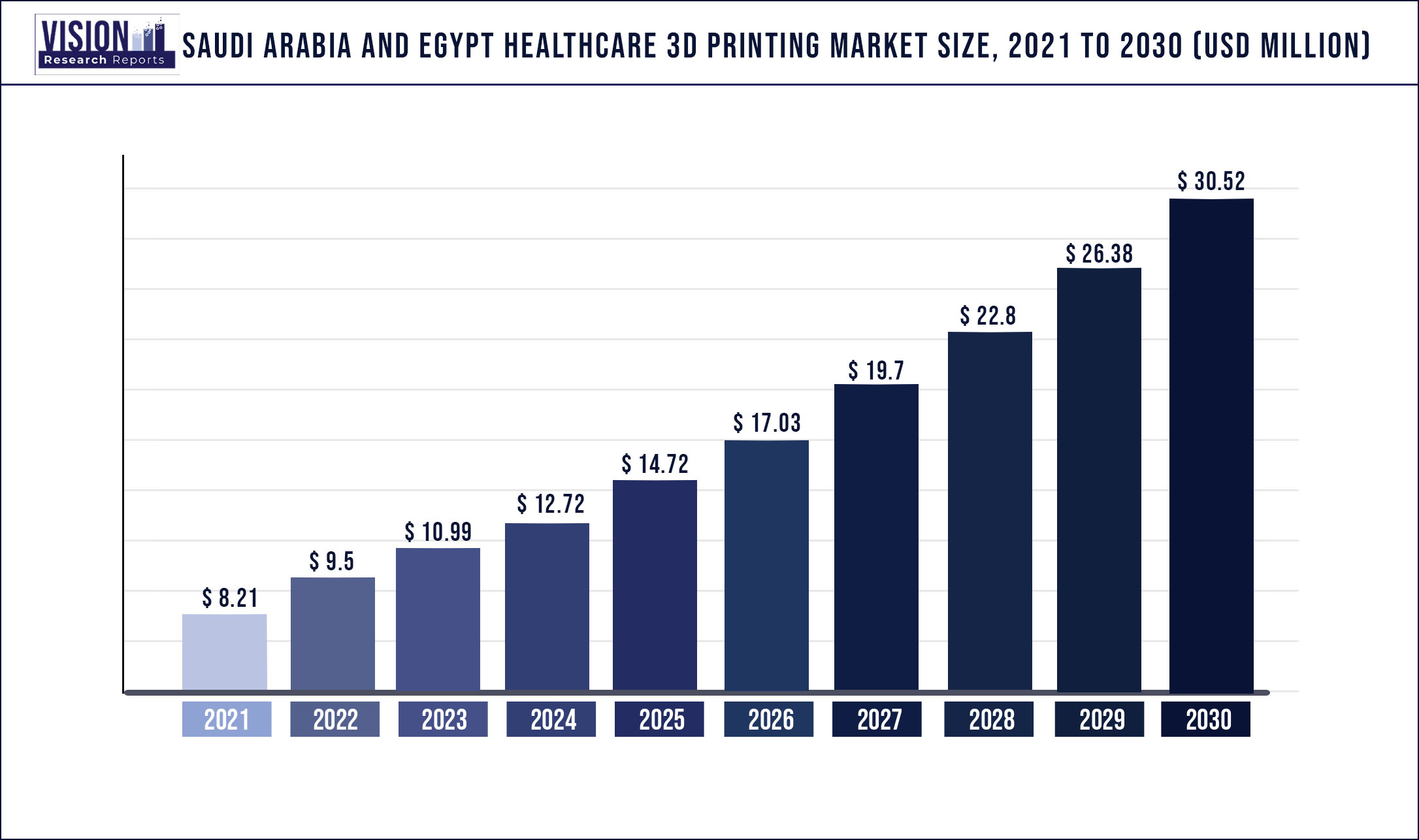

The Saudi Arabia and Egypt healthcare 3D printing market was valued at USD 8.21 million in 2021 and it is predicted to surpass around USD 30.52 million by 2030 with a CAGR of 15.72% from 2022 to 2030.

Report Highlights

An increase in the number of surgeries and implantation and growing demand for 3D printing are anticipated to aid in the growth of the market.

The high burden of diseases in KSA and Egypt is leading to the growing need for surgeries, which is a key factor driving the market. For instance, the research published by NCBI in June 2021 states that the rate of total knee replacement surgeries has increased in Saudi Arabia, and the success rate of these surgeries is more than 90%. The growing number of orthopedic replacement surgeries in the country is expected to create opportunities for market growth.

The pandemic resulted in significant losses across markets in terms of sales, revenue, and operations, driving countries into financial crises. The government and health authorities ordered all laboratories, clinics, manufacturers, and suppliers to immediately stop operations, with the exception of emergencies, resulting in office closures and unprecedented revenue decline across sectors.

3D printing technology has been utilized to address critical shortages of crucial elements, ranging from Personal Protective Equipment (PPE) to crucial ventilator component shortages due to supply chain disruptions. The high flexibility of 3D printing makes it potentially one of the most important technologies to aid healthcare after COVID-19.

Saudi Arabia accounted for the largest revenue share of over 68.97% in 2021. This is because the country is one of the fastest-growing tech hubs globally and is investing heavily in 3D printing across its scientific and medical faculties to promote innovation in the area of medicine.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 8.21 million |

| Revenue Forecast by 2030 | USD 30.52 million |

| Growth rate from 2022 to 2030 | CAGR of 15.72% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Application, technology, material, end-use |

| Companies Covered |

Covestro AG; Stratasys Ltd.; 3D Systems, Inc.; General Electric; Organovo Holdings Inc.; 3DVinci Creations; AddUp; SLM Solutions; Envisiontec US LLC; Cellink |

Application Insights

The implants segment led the market in 2021 with a revenue share of more than 58% as 3D implants are in high demand and have been quietly revolutionized by additive manufacturing. This expansion in the implant industry is happening in numerous implant areas such as hip, spinal, knee, and other types of implants. Porous metal implants are a popular choice as they have similar mechanical properties to human bone, with enough stability and strength.

The implants segment is also estimated to register the highest growth rate over the forecast years due to the high accuracy and cost-effectiveness of 3D printing technology in the implant industry. For instance, Health Canada has approved the first Canadian-made 3D printed medical implant, which is a customizable mandibular plate that is used in facial reconstruction surgery for patients with oral cancer.

3D printing techniques for medical device (orthopedic and cranial implants, surgical instruments, dental restorations) manufacturing such as stereolithography (SLA), selective laser sintering (SLS), fused deposition modeling (FDM) for plastic parts, and direct metal laser sintering (DMLS), and selective laser melting (SLM) for metals are gaining high popularity and is expected to significantly penetrate Saudi Arabian and Egypt healthcare market.

Technology Insights

The photopolymerization segment accounted for the largest revenue share of over 33.02% in 2021. Photopolymerization is a method of solidifying photosensitive resin. This technique is used to produce micrometer-sized 3D structures. Photopolymerization is further segmented into Digital Light Processing (DLP), Stereolithography, and Two-Photon Polymerization (TPP). Photopolymers are very versatile and can be used to create objects that adhere to a wide range of benefits, such as flexibility, transparency, and strength. Stereolithography is one of the first employed mechanisms for 3D-printing wherein three-dimensional objects are made by curing a photo-hardening polymer with UV light.

The droplet deposition segment is expected to register a significant growth rate of 16.12% over the forecast period. Droplet deposition is segmented into Inkjet Printing (IJP), FDM, and Multiphase Jet Solidification (MJS). It uses a liquid-phase rapid prototyping technology to create 3D parts. It is a quick, adaptable, and affordable technique that enables the construction of both simple and complex 3D objects.

Material Insights

The polymers segment dominated the market and accounted for a revenue share of more than 49.78% in 2021. Polymer 3D printing is being highly used to manufacture 3D printed replicas of human organs, in preoperative planning, and for surgical guidance. Apart from this, polymer 3D printing is also being utilized to create personalized medical items on-demand, including affordable prosthetics and dental tools such as bridges and aligners. On the basis of material, the market has been divided into metals, polymers, biological cells, and ceramics.

The biological cells segment is expected to register the highest growth rate of 17.42% during the forecast period as the technology has the potential to completely transform the way diseases are treated by replacing animal testing and reducing the organ transplant waiting list. The geometry of a 3D bioprinted tissue is similar to that of naturally occurring tissue. Other than 3D bioprinting, no other technology enables the simulation of the level of geometric complexity in tissue engineering. As per Frontiers pen Access Journal, Additive manufacturing is currently among the most advanced techniques that have been utilized in this area of tissue engineering by building complex tissue in a layer-by-layer fashion, thereby producing precise geometries.

End-use Insights

The medical and surgical centers segment dominated the market and accounted for a revenue share of more than 70.02% in 2021. The high burden of diseases in the Kingdom of Saudi Arabia (KSA) and Egypt requiring surgeries is one of the key factors driving the segment. For instance, in July 2019, the Frontiers published research stating that the severity and prevalence of dental caries in Saudi Arabia are high. On the basis of end-user, the market has been divided into medical and surgical centers, pharma and biotech companies, and academic institutions.

Pharma and biotech companies are expected to register a lucrative growth rate of 15.3% during the forecast period due to the high demand for 3D printing technology in the pharma industry for developing and manufacturing the products. In March 2021, Leap, a publishing news company, reported that Saudi Arabia is making significant investments across its scientific and medical universities in bioprinting that includes optimization of a 3D?bioprinting?process using ultrashort peptide bioinks.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Saudi Arabia And Egypt Healthcare 3D Printing Market

5.1. COVID-19 Landscape: Saudi Arabia And Egypt Healthcare 3D Printing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Saudi Arabia And Egypt Healthcare 3D Printing Market, By Application

8.1. Saudi Arabia And Egypt Healthcare 3D Printing Market, by Application, 2022-2030

8.1.1. Surgical Guide

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Surgical Instrument

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Implants

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Bioengineering

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Saudi Arabia And Egypt Healthcare 3D Printing Market, By Technology

9.1. Saudi Arabia And Egypt Healthcare 3D Printing Market, by Technology, 2022-2030

9.1.1. Electron Beam Melting

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Laser Beam Melting

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Photopolymerization

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Droplet Deposition

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Multiphase Jet Solidification (MJS)

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Saudi Arabia And Egypt Healthcare 3D Printing Market, By Material

10.1. Saudi Arabia And Egypt Healthcare 3D Printing Market, by Material, 2022-2030

10.1.1. Metals

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Polymers

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Biological Cells

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Ceramics

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Saudi Arabia And Egypt Healthcare 3D Printing Market, By End-use

11.1. Saudi Arabia And Egypt Healthcare 3D Printing Market, by End-use, 2022-2030

11.1.1. Medical & Surgical Centers

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Pharma & Biotech Companies

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Academic Institutions

11.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Saudi Arabia And Egypt Healthcare 3D Printing Market, Regional Estimates and Trend Forecast

12.1. Saudi Arabia And Egypt

12.1.1. Market Revenue and Forecast, by Application (2017-2030)

12.1.2. Market Revenue and Forecast, by Technology (2017-2030)

12.1.3. Market Revenue and Forecast, by Material (2017-2030)

12.1.4. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 13. Company Profiles

13.1. Covestro AG

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Stratasys Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. 3D Systems, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. General Electric

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Organovo Holdings Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. 3DVinci Creations

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. AddUp

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. SLM Solutions

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Envisiontec US LLC

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Cellink

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others