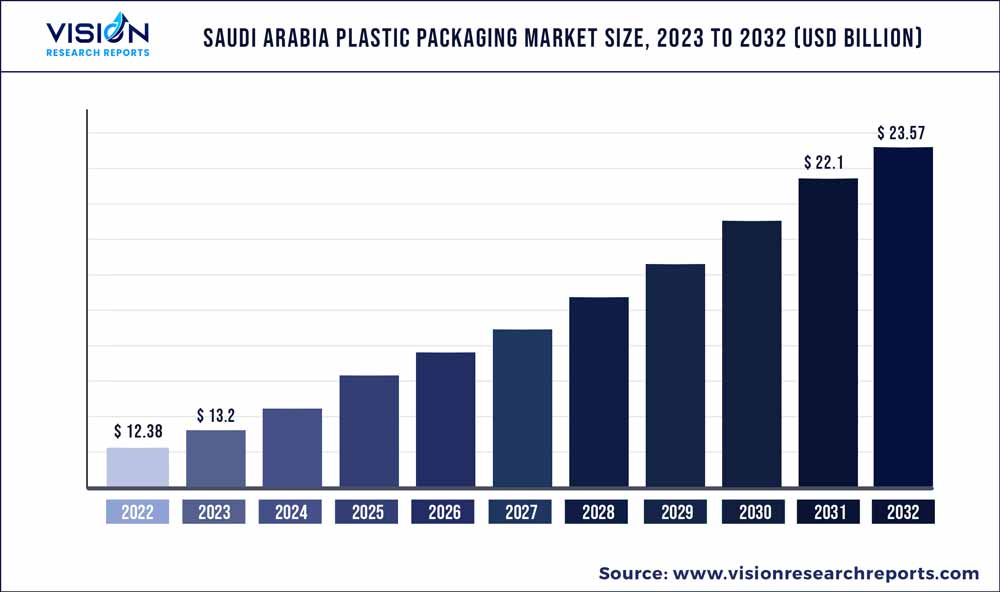

The Saudi Arabia plastic packaging market was estimated at USD 12.38 billion in 2022 and it is expected to surpass around USD 23.57 billion by 2032, poised to grow at a CAGR of 6.65% from 2023 to 2032.

Key Pointers

Report Scope of the Saudi Arabia Plastic Packaging Market

| Report Coverage | Details |

| Market Size in 2022 | USD 12.38 billion |

| Revenue Forecast by 2032 | USD 23.57 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.65% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Sealed Air; National Plastic Factory;Obeikan Investment Group; ASPCO; Napco National; Flex Pack;Saudi Plastic Factory Co. (SPF); Zamil Plastic Corporation; Pacman CCL; Advanced Flexible Packaging Co.; Arabian Plastic Industrial Company Limited; Gulf Packaging Industries Limited; OCTAL; Takween Advanced Industries; Middle East Mold & Plastic Factory Co., Ltd. (MEMPF) |

The market growth is attributed to the increased consumption of consumer goods and growth in industrial activities such as oil & gas, construction, and others. This has created a demand for plastic packaging for industrial products in the country. In addition, the market is driven by the country’s strong economy from oil and non-oil sectors, leading to increased consumer spending and rising demand for packaged goods.

The country is witnessing a rising demand for halal cosmetic products owing to the rising awareness among consumers of the benefits offered by halal cosmetics such as being free from harmful chemicals, being safer and gentler on the skin, and their cruelty-free nature, which has a positive impact on the market, as these cosmetic products are packed in plastic pouches, tubes, jars, and bottles.

The COVID-19 pandemic impacted the market and led to the sealing of national borders, and the temporary closing of industries and markets in 2020, which caused a huge supply chain gap. However, there was a significant growth in the demand from the pharmaceutical and food & beverage industries that led to an increase in demand for packaging products in these sectors.

Saudi Arabia is a high-income economy with reliance on oil & gas, pharmaceutical & healthcare, personal & household items, and food & beverage industries. Consumers have a high standard of living and increased disposable income, which gives rise to the consumption of various consumer goods that are mainly packed in plastic packaging products. Moreover, the country has the presence of several local and international market players, such as Sealed Air, Exxon Mobil Corporation, Saudi Modern Packaging Co. Ltd., and others, further contributing to its plastic packaging market growth.

Material Insights

Polyethylene terephthalate (PET) accounted for the largest market share of almost 35% in the material segment in 2022. This is attributed to the growing demand for PET bottles in the food and beverage industry. PET bottles have a wide application in the packaging of carbonated soft drinks, salad dressings, sauces, vegetable oils, and others. The sector growth has a positive impact on the country’s plastic packaging market. Based on material, the Saudi Arabia plastic packaging market is further segmented into PET, polyethylene (PE), polystyrene (PS), polypropylene (PP), and polyvinyl chloride (PVC).

On the other hand, the polypropylene (PP) segment is anticipated to expand at the fastest CAGR of 6.93% over the forecast period due to its wide application in various industries such as food & beverage, pharmaceutical, personal care & household, and others. In the food & beverages industry, PP is used in the packaging of microwavable packets and containers owing to its ability to resist high temperatures.

The polyethylene (PE) material segment is also expected to advance at a substantial CAGR of 6.83% during the forecast period, owing to its low cost and chemical-resistant properties. PE is mainly used for packaging products such as pouches, bags, and containers, among others, which have a high demand in various end-user industries such as personal care, food & beverage, pharmaceutical products, and others.

Application Insights

The food & beverage segment recorded the highest market share of over 31% in 2022 and is anticipated to retain its dominance over the forecast period. The huge population and high consumer income in Saudi Arabia drive the growth of the food manufacturing industry, thus boosting the demand for packaged foods. The consumer demand for eco-friendly packaging is increasing, leading to food & beverage products such as sauces, vegetable oils, carbonated soft drinks, and others being packed in PET bags, containers, bottles, pouches, and other packaging products, due to the recyclable nature of PET.

Furthermore, the trend of online food delivery has been increasing in the country, owing to the increased urbanization and busy life schedule of the population, which has a positive impact on the plastic packaging market. For instance, HungerStation is one of the leading food delivery apps that home delivers food and groceries in over 80 cities in Saudi Arabia.

The pharmaceutical & healthcare industry is expected to expand at a CAGR of 6.75% over the forecast period, owing to the increased government spending on healthcare and its infrastructure, and generic drugs. Plastic packaging is used for packaging medicines such as cough syrups, vaccines, injectable medications, and other pharmaceutical products. The use of plastic packaging in this sector is driven by its ability to act as a barrier against various external factors such as moisture, light, and air, which directly affect the stability and shelf life of pharmaceutical products.

The industrial packaging segment is expected to advance at a CAGR of 6.53% from 2023 to 2032. Saudi Arabia is home to several manufacturing, oil & gas, and construction industries, which require industrial packaging products such as plastic drums, jerry cans, crates, and others to ship and store industrial products. Moreover, the increase in trade activities also necessitates the presence of efficient and secure packaging solutions to store and transport products worldwide.

The personal care & household products application segment is expected to witness significant growth during the forecast period. Saudi Arabia is one of the largest countries for cosmetic consumption, as regional consumers spend more on their appearance, which further has a positive impact on the plastic packaging market. Plastic packaging has a wide application in the regional cosmetic industry, such as in packaging shampoos, conditioners, moisturizers, and body wash in PET bottles and jars. Skin care products such as gels, creams, and lip balms are packed in plastic tubes with caps or pumps.

Saudi Arabia Plastic Packaging Market Segmentations:

By Material

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Saudi Arabia Plastic Packaging Market

5.1. COVID-19 Landscape: Saudi Arabia Plastic Packaging Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Saudi Arabia Plastic Packaging Market, By Material

8.1. Saudi Arabia Plastic Packaging Market, by Material, 2023-2032

8.1.1. Polyethylene Terephthalate (PET)

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Polyethylene (PE)

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Polystyrene (PS)

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Polypropylene (PP)

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Polyvinyl Chloride (PVC)

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Saudi Arabia Plastic Packaging Market, By Application

9.1. Saudi Arabia Plastic Packaging Market, by Application, 2023-2032

9.1.1. Food & Beverage

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Personal & Household

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Industrial Packaging

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Pharmaceutical/Healthcare

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Saudi Arabia Plastic Packaging Market, Regional Estimates and Trend Forecast

10.1. Saudi Arabia

10.1.1. Market Revenue and Forecast, by Material (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Sealed Air

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. National Plastic Factory

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Obeikan Investment Group

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. ASPCO

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Napco National

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Flex Pack

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Saudi Plastic Factory Co. (SPF)

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Zamil Plastic Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Pacman CCL

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Advanced Flexible Packaging Co.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others