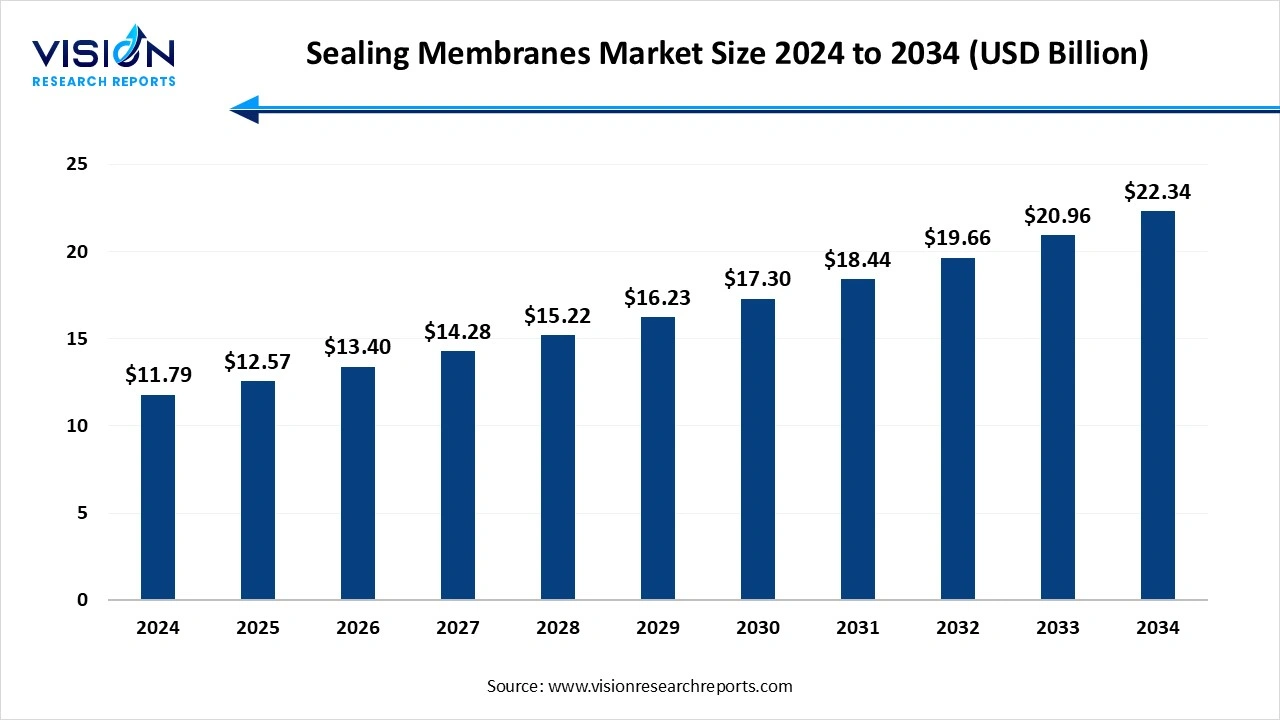

The global sealing membranes market size was reached at around USD 11.79 Billion in 2024 and it is projected to hit around USD 22.34 Billion by 2034, growing at a CAGR of 6.60% from 2025 to 2034.

The sealing membranes market plays a crucial role in modern construction, infrastructure, and industrial applications, offering critical protection against water, chemicals, and environmental damage. These membranes are extensively used for waterproofing roofs, basements, bridges, tunnels, and other structures, ensuring long-term durability and structural integrity. As construction standards evolve and demand for sustainable, energy-efficient buildings grows, the market for high-performance sealing solutions continues to expand. Innovations in material science, particularly in polymer-modified bitumen, PVC, EPDM, and liquid-applied membranes, are further driving adoption across diverse end-use sectors.

The growth of the sealing membranes market is primarily driven by the increasing demand for durable waterproofing solutions in residential, commercial, and industrial construction. Urbanization, particularly in emerging economies, has led to a surge in infrastructure development, including roads, bridges, tunnels, and public buildings, where sealing membranes are essential for preventing water ingress and structural degradation. Additionally, rising awareness about building safety and moisture-related damage has prompted stricter building codes and regulations, which mandate the use of high-performance waterproofing systems.

Another key growth factor is the advancement in membrane technologies, including self-adhesive, spray-applied, and eco-friendly variants, which offer ease of application and improved sustainability. Manufacturers are investing heavily in R&D to develop innovative products that meet both performance and environmental standards. Moreover, the growing focus on energy efficiency and green building certifications like LEED is encouraging the adoption of sealing membranes that contribute to thermal insulation and long-term operational efficiency of buildings.

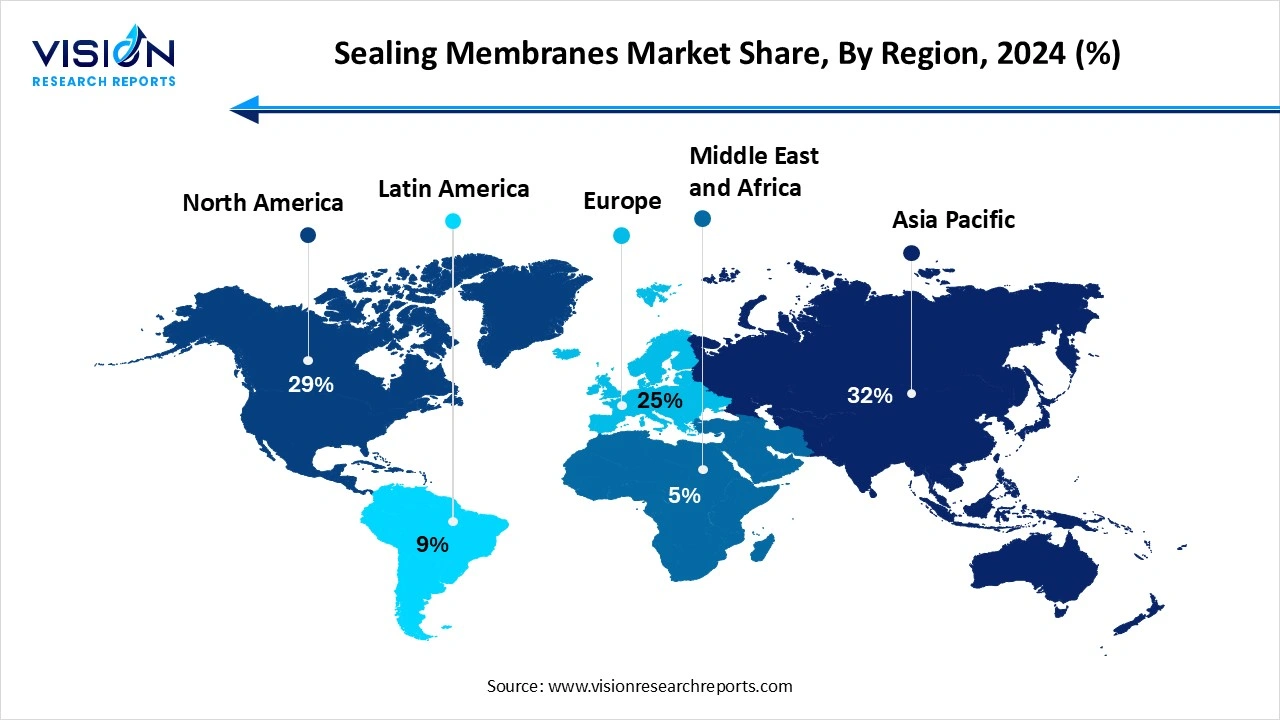

Asia Pacific region led the global sealing membranes market, capturing the largest revenue share of approximately 32% in 2024. This dominance is fueled by rapid urbanization, expansive construction activities, and heightened infrastructure investments in countries such as China, India, and those in Southeast Asia. The surge in residential and commercial building projects, combined with increasing awareness of waterproofing and structural durability, has substantially driven demand in the region. Additionally, government initiatives aimed at promoting sustainable construction practices and strengthening building regulations have further accelerated market growth. The coexistence of numerous local manufacturers alongside international companies contributes to a vibrant and competitive market landscape across Asia Pacific.

North America is a well-established but steadily expanding market for sealing membranes, driven by rigorous construction standards and extensive renovation activities. The United States leads the region, supported by strict building regulations and a growing demand for sustainable, energy-efficient waterproofing solutions. The commercial construction sector particularly in healthcare, education, and retail plays a significant role in driving the need for advanced membrane products. Ongoing innovation and technological progress by key industry players further support consistent growth in this market.

North America is a well-established but steadily expanding market for sealing membranes, driven by rigorous construction standards and extensive renovation activities. The United States leads the region, supported by strict building regulations and a growing demand for sustainable, energy-efficient waterproofing solutions. The commercial construction sector particularly in healthcare, education, and retail plays a significant role in driving the need for advanced membrane products. Ongoing innovation and technological progress by key industry players further support consistent growth in this market.

The liquid-applied membranes segment dominated the market, capturing the highest revenue share of 66%in 2024. Let me know if you’d like a version tailored for a [report summary](f), [presentation slide](f), or [social media post](f). These membranes are typically applied in a fluid state and cure to form a continuous, elastomeric barrier that prevents water ingress. Their adaptability, ease of application, and superior adhesion properties make them ideal for challenging substrates and irregular surfaces. Moreover, advancements in polymer formulations have significantly improved the performance of liquid-applied membranes, enhancing their resistance to UV rays, chemicals, and weathering, which has further increased their adoption in both commercial and residential construction projects.

Sheet membranes are pre-formed products that are rolled out and applied to surfaces using adhesives, mechanical fasteners, or heat welding techniques. These membranes offer consistent thickness and strong resistance to tearing and punctures, making them suitable for high-traffic areas and large-scale waterproofing projects such as tunnels, basements, and bridge decks. Sheet membranes are valued for their durability, ease of quality control during installation, and long-term performance under demanding environmental conditions. Innovations in materials such as modified bitumen, PVC, and EPDM have broadened the applicability of sheet membranes across different climatic zones and structural types.

The residential sector dominated the market and accounted for the largest revenue share of 45% in 2024. Residential buildings require reliable sealing membranes to protect foundations, basements, roofs, and balconies from water damage, mold growth, and structural deterioration. As urbanization accelerates and housing developments expand, there is increased demand for membranes that offer ease of application, durability, and compatibility with various construction materials. Homeowners and builders are also increasingly prioritizing products that contribute to energy efficiency and sustainability, driving the adoption of advanced sealing technologies tailored to residential requirements.

The commercial sector, particularly involving the use of sheet membranes, demands robust and long-lasting solutions for large-scale structures such as office buildings, shopping malls, hospitals, and industrial facilities. Sheet membranes are favored in commercial construction due to their uniform thickness, high tensile strength, and resistance to mechanical damage, making them suitable for extensive waterproofing applications. The ability of sheet membranes to withstand heavy foot traffic, harsh weather conditions, and chemical exposure makes them an ideal choice for protecting critical commercial infrastructure.

By Product Type

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Sealing Membranes Market

5.1. COVID-19 Landscape: Sealing Membranes Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Sealing Membranes Market, By Product Type

8.1. Sealing Membranes Market, by Product Type

8.1.1. Sheet Membranes

8.1.1.1. Market Revenue and Forecast

8.1.2. Liquid-Applied Membranes

8.1.2.1. Market Revenue and Forecast

Chapter 9. Sealing Membranes Market, By End Use

9.1. Sealing Membranes Market, by End Use

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast

9.1.3. Industrial

9.1.3.1. Market Revenue and Forecast

Chapter 10. Sealing Membranes Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product Type

10.1.2. Market Revenue and Forecast, by End Use

Chapter 11. Company Profiles

11.1. Sika AG

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. GCP Applied Technologies Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. RPM International Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Carlisle Companies Incorporated

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. BASF SE

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Henry Company

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Tremco Incorporated

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. AGRU Kunststofftechnik GmbH

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Koster Bauchemie AG

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Firestone Building Products

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others