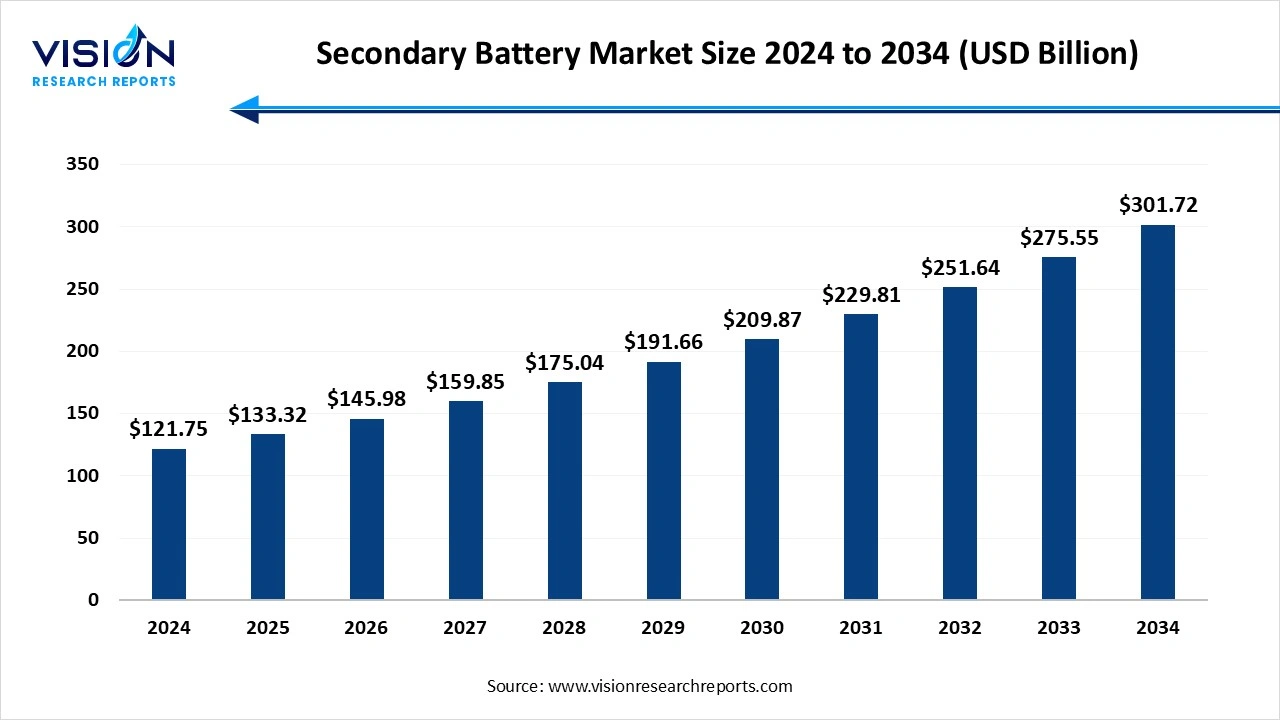

The global secondary battery market size was valued at USD 121.75 billion in 2024 and it is predicted to surpass around USD 301.72 billion by 2034 with a CAGR of 9.50% from 2025 to 2034.

The secondary battery market, also known as the rechargeable battery market, is experiencing significant growth, driven by rising demand for energy storage solutions across diverse sectors such as consumer electronics, electric vehicles (EVs), and renewable energy systems. These batteries, including lithium-ion, nickel-metal hydride, and lead-acid types, offer the advantage of multiple charge-discharge cycles, making them economically and environmentally favorable. As global efforts intensify toward sustainability and carbon neutrality, secondary batteries are becoming essential components in supporting clean energy infrastructure and mobile power needs.

The rapid adoption of electric vehicles (EVs) is one of the primary growth drivers of the secondary battery market. With global initiatives focused on reducing carbon emissions and phasing out internal combustion engines, major automotive manufacturers are investing heavily in EV production. This surge in demand for efficient, high-capacity batteries, particularly lithium-ion, has led to significant advancements in battery technology, energy density, and cost efficiency. Government policies, subsidies, and the expansion of charging infrastructure are also playing a crucial role in accelerating market adoption worldwide.

Beyond transportation, the rise in renewable energy deployment is fueling demand for energy storage systems that rely on secondary batteries. As solar and wind power generation increase, the need for stable, scalable storage solutions becomes essential to balance grid reliability and energy availability. The proliferation of smart devices, consumer electronics, and industrial automation continues to bolster the market, while ongoing R&D investments are leading to the development of safer, longer-lasting, and more sustainable battery chemistries.

Asia-Pacific holds a dominant position in this market due to the presence of major battery manufacturers and high demand from automotive and consumer electronics sectors. Countries like China, Japan, and South Korea are at the forefront of innovation and production capacity, benefiting from substantial government support and extensive research activities. The rapid adoption of electric vehicles (EVs) and renewable energy storage solutions further propels market growth in this region.

The secondary battery market in Europe is propelled by the region's vigorous commitment to electric vehicle (EV) adoption, backed by strict emission standards and government incentives like subsidies and tax breaks. The European Union’s ambitious climate targets and the Green Deal initiative are driving substantial investments in renewable energy storage, significantly boosting demand for secondary batteries. Moreover, the strong presence of leading portable device manufacturers and battery producers, combined with growing consumer awareness of sustainability, is further accelerating the growth of Europe’s secondary battery market.

The lithium-ion segment holds a dominant position in the global secondary battery market, primarily due to its superior performance characteristics, including high energy density, long cycle life, and lightweight design. This battery type is widely adopted across various industries such as consumer electronics, electric vehicles (EVs), and renewable energy storage systems. The increasing penetration of electric mobility and the growing demand for portable electronic devices have significantly boosted the adoption of lithium-ion batteries. Moreover, advancements in battery chemistry, such as lithium iron phosphate (LFP) and nickel manganese cobalt (NMC), have enhanced safety, efficiency, and cost-effectiveness, further solidifying the market position of lithium-ion technology.

The widespread adoption of consumer electronics such as smartphones, laptops, and wearable devices continues to drive demand for lithium-ion batteries, as users increasingly prioritize extended battery life and rapid charging capabilities. These evolving consumer expectations, combined with technological advancements, reinforce the role of lithium-ion batteries as a pivotal component in the global shift toward sustainable energy solutions and next-generation technologies.

Governments around the world are enforcing strict emission regulations and providing various incentives to encourage the adoption of clean transportation, which is significantly boosting the demand for high-performance batteries, especially lithium-ion types. At the same time, ongoing advancements in battery technology—such as higher energy density and reduced charging times—are enhancing the appeal of electric vehicles among consumers. The expansion of EV charging infrastructure, along with substantial investments by portable device manufacturers in electrification and energy efficiency, is further reinforcing this upward trend.

Portable devices represent a significant application segment within the global secondary battery market, driven by the increasing reliance on mobile technology in daily life. Devices such as smartphones, tablets, laptops, digital cameras, and wearable technology require compact, lightweight, and long-lasting power sources, making secondary batteries, particularly lithium-ion, an ideal solution. The demand for enhanced battery performance, including longer usage time and faster recharging, continues to grow as consumers seek more convenience and efficiency from their portable electronics.

By Type

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Secondary Battery Market

5.1. COVID-19 Landscape: Secondary Battery Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Secondary Battery Market, By Type

8.1. Secondary Battery Market, by Type

8.1.1. Lithium-ion

8.1.1.1. Market Revenue and Forecast

8.1.2. Lead Acid

8.1.2.1. Market Revenue and Forecast

8.1.3. Nickel Metal Hydride

8.1.3.1. Market Revenue and Forecast

8.1.4. Others

8.1.4.1. Market Revenue and Forecast

Chapter 9. Secondary Battery Market, By Application

9.1. Secondary Battery Market, by Application

9.1.1. Motor Vehicles

9.1.1.1. Market Revenue and Forecast

9.1.2. Industrial Batteries

9.1.2.1. Market Revenue and Forecast

9.1.3. Portable Devices

9.1.3.1. Market Revenue and Forecast

9.1.4. Electronics

9.1.4.1. Market Revenue and Forecast

9.1.5. Others

9.1.5.1. Market Revenue and Forecast

Chapter 10. Secondary Battery Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type

10.1.2. Market Revenue and Forecast, by Application

Chapter 11. Company Profiles

11.1. LG Energy Solution Ltd. (South Korea)

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Contemporary Amperex Technology Co. Ltd. (CATL) (China)

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Panasonic Holdings Corporation (Japan)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Samsung SDI Co., Ltd. (South Korea)

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. BYD Company Ltd. (China)

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. SK On Co., Ltd. (South Korea)

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Toshiba Corporation (Japan)

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. GS Yuasa Corporation (Japan)

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Envision AESC Group Ltd. (China/Japan)

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Hitachi Chemical Co. Ltd

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others