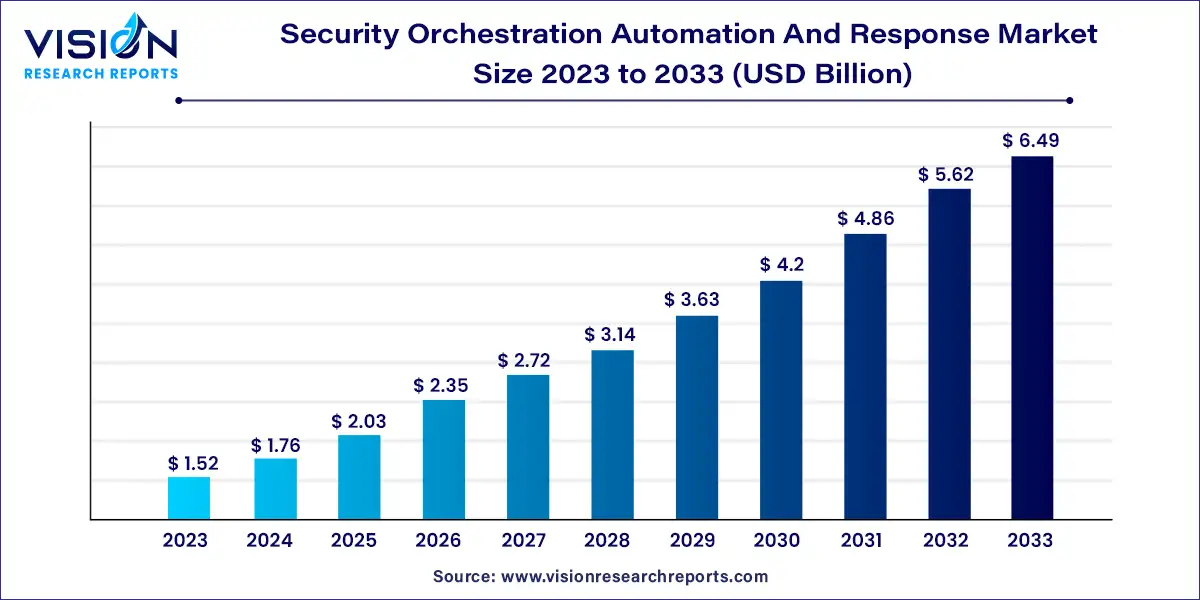

The global security orchestration automation and response market size was surpassed at USD 1.52 billion in 2023 and is expected to hit around USD 6.49 billion by 2033, growing at a CAGR of 15.63% from 2024 to 2033

The Security Orchestration, Automation, and Response (SOAR) market is witnessing significant growth driven by the increasing complexity and volume of cyber threats faced by organizations worldwide. SOAR platforms have emerged as essential tools for enhancing cybersecurity posture by streamlining incident response processes, automating repetitive tasks, and orchestrating workflows across security tools and systems.

The growth of the Security Orchestration, Automation, and Response (SOAR) market is propelled by an increasing sophistication and frequency of cyber threats worldwide are driving organizations to invest in robust cybersecurity solutions such as SOAR platforms to enhance their defense capabilities. Secondly, the need for efficient incident response is paramount, with organizations seeking to minimize the impact of security incidents through streamlined processes and automated workflows provided by SOAR solutions. Additionally, the integration of SOAR platforms with existing security technologies like SIEM and EDR enhances operational efficiency and effectiveness. Moreover, regulatory mandates and compliance requirements compel organizations to adopt SOAR solutions to ensure adherence to security standards and demonstrate effective incident management practices.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 36% |

| CAGR of Asia Pacific from 2024 to 2033 | 18.28% |

| Revenue Forecast by 2033 | USD 6.49 billion |

| Growth Rate from 2024 to 2033 | CAGR of 15.63% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The solution segment accounted for the largest share of 77% in 2023. The solution segment consists of the SOAR platform as a service and software solutions offered by key players operating in the market to assist customers in threat detection, workflow management, responding, and documenting this critical information on a single platform. The SOAR solutions help reduce the dependency on IT analysts with their inbuilt capabilities of orchestration, automation, and response to common threats and everyday cyber incidents. These are the key factors expected to drive the segment's growth.

The services segment is anticipated to grow at a CAGR of 19.45% during the forecast period. The SOAR services segment includes maintenance, deployment, consultation, customer support, and training services. The growing demand for SOAR solutions and software in various end-use industries, such as BFSI, IT & telecommunications, retail, and healthcare, to strengthen their security capabilities are the primary factors expected to support the segment growth over the forecast period.

The cloud-based segment accounted for a market share of 63% in 2023. Cloud-based SOAR can be termed a platform as a service solution. It offers organizations a flexible product offering allowing them to choose offerings based on their usage demand, budget, time, and business objectives. It is a cost-effective, flexible way of threat-identifying, unmasking vulnerabilities, alert sharing, and handling routine security tasks across servers, endpoint devices, and networks. These are the primary factors expected to drive the growth of this segment.

The on-premise segment is expected to grow at a CAGR of 13.24% during the forecast period. On-premise security orchestration, automation, & response provide in-house SOAR software and solution offerings that ensure better control and security assurance across their networks, applications, and devices. Furthermore, it offers organizations the utmost flexibility in adopting workflows, forming & managing integrations, or building processes from scratch, based on their focus areas and dynamic security environment. Thus, the defined factors are expected to strengthen the growth of the on-premise segment.

The large enterprise segment accounted for the largest share of 54% in 2023. The demand for SOAR is constantly rising among large organizations owing to the increasing cybersecurity threats, privacy breaches, and hacking incidences. The primary factor responsible for growing cyber threats is the increased use of connected devices, unsecured networks, and lack of security solutions among traditional organizations. Furthermore, the lack of skilled workforce is encouraging largeorganizations to automate and standardize routine security operations, which is the demand for SOAR solutions.

The SMEs segment is expected to grow at the fastest CAGR of 16.25% during the forecast period. The demand for SOAR is growing among SMEs as it helps organizations with limited budgets and resources effectively handle their security postures. SOAR offers a sophisticated approach and automated processes requiring limited human interventions, effectively conserving time and money. These capabilities assist SMEs in saving costs and resources along with enhancing security awareness, thereby driving segment growth.

The incident response segment accounted for the largest market share of 39% in 2023. SOAR helps security teams, and analysts respond to critical security threats and remediate incidents faster by gathering alerts from various sources, automating case prioritizations, and efficiently responding to privacy breaches. It offers a single dashboard representing the ongoing security posture of devices and applications, the planning and designing security tasks, monitoring real-time status, and reporting information related to specific security tasks for future reference. This platform enables smooth collaboration and threat intelligence sharing across the organizational network and teams. Thus, the abovementioned factors are expected to drive the market demand over the forecast period.

The threat intelligence segment is expected to grow at the highest CAGR of 17.37% during the forecast period. SOAR helps organizations in bridging the gap between threat intelligence and response-sharing processes. It collects security alert information and metrics from integrated security tools and external feeds, allowing a centralized representation in the SOAR platform. The SOAR security solution allows analysts to correlate information from different sources, prioritize alerts, filter out false positives, and help identify the critical security tasks that require more effort and time. Thus, the application of SOAR in areas of threat intelligence is expected to drive segment growth.

The IT and telecommunication segment accounted for the largest share of 19% in 2023. The IT and telecommunication sector experiences higher amounts of data loss, security breaches, and hacking due to highly confidential customer and organizational data, widely spread servers, complex networks, and connected devices. These industries face and tackle various cyberattacks ranging from common threats to undiscovered ones. SOAR helps security analysts automatically identify and handle common vulnerabilities by performing actions, such as threat detection, enrichment, investigation, response, and dissemination to security tools, such as threat intelligence platforms, SIEMs, firewalls, and incident response platforms.

The BFSI segment is expected to grow at a CAGR of 19.17% during the forecast period. The BFSI industries are investing large capital to build connected technology infrastructure to keep up with the growing trends and market demand. On the other hand, these technologies also make them highly vulnerable and prone to security breaches, data theft, and vulnerabilities. The application of SOAR assists these industries in identifying, handling, documenting, and responding to cyber threats more effectively.

North America held the major share of 36% of the target market in 2023. The market is expected to witness lucrative growth opportunities in the region owing to the fast-paced adoption of cybersecurity solutions by key industrial sectors, such as healthcare, BFSI, and IT &telecommunications. Furthermore, according to IBM Data Breach Report 2023, the average cost of data breaches in the U.S. is USD 9.44 million, the highest compared to other countries globally. SOAR solution helps organizations reduce the average time required to identify and respond to vulnerabilities, which helps in saving cost, effort, and time are the key factors expected to drive the demand for SOAR in the North America region.

Asia Pacific is anticipated to grow at the fastest CAGR of 18.28% from 2024 to 2033. The rising technology adoption, including connected web applications, IoT devices, and interface technologies across industries, such as BFSI, IT &telecom, and retail, is increasing the demand for robust security solutions in the region. SOAR ensures cost-effectiveness by reducing dependency on security analysts and helping emerging & small players in the region handle security challenges more effectively.

By Component

By Deployment

By Enterprise Size

By Application

By Vertical

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Security Orchestration Automation and Response Market

5.1. COVID-19 Landscape: Security Orchestration Automation and Response Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Security Orchestration Automation and Response Market, By Component

8.1. Security Orchestration Automation and Response Market, by Component, 2024-2033

8.1.1. Solution

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Security Orchestration Automation and Response Market, By Deployment

9.1. Security Orchestration Automation and Response Market, by Deployment, 2024-2033

9.1.1. On-premise

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Cloud

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Security Orchestration Automation and Response Market, By Enterprise Size

10.1. Security Orchestration Automation and Response Market, by Enterprise Size, 2024-2033

10.1.1. Large Enterprise

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Small & Medium Enterprises

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Security Orchestration Automation and Response Market, By Application

11.1. Security Orchestration Automation and Response Market, by Application, 2024-2033

11.1.1. Threat Intelligence

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Network Forensics

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Incident Response

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Compliance

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Others

11.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Security Orchestration Automation and Response Market, By Vertical

12.1. Security Orchestration Automation and Response Market, by Vertical, 2024-2033

12.1.1. BFSI

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. IT & Telecom

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Retail & E-commerce

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Healthcare

12.1.4.1. Market Revenue and Forecast (2021-2033)

12.1.5. Manufacturing

12.1.5.1. Market Revenue and Forecast (2021-2033)

12.1.6. Government

12.1.6.1. Market Revenue and Forecast (2021-2033)

12.1.7. Education

12.1.7.1. Market Revenue and Forecast (2021-2033)

12.1.8. Others

12.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Security Orchestration Automation and Response Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.1.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.1.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.5. Market Revenue and Forecast, by Vertical (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.7. Market Revenue and Forecast, by Vertical (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.8.5. Market Revenue and Forecast, by Vertical (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.2.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.5. Market Revenue and Forecast, by Vertical (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.2.7. Market Revenue and Forecast, by Application (2021-2033)

13.2.8. Market Revenue and Forecast, by Vertical (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.2.10. Market Revenue and Forecast, by Application (2021-2033)

13.2.11. Market Revenue and Forecast, by Vertical (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.13. Market Revenue and Forecast, by Vertical (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.15. Market Revenue and Forecast, by Vertical (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.3.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.5. Market Revenue and Forecast, by Vertical (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.7. Market Revenue and Forecast, by Vertical (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.9. Market Revenue and Forecast, by Vertical (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.10.5. Market Revenue and Forecast, by Vertical (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.11.5. Market Revenue and Forecast, by Vertical (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.4.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.5. Market Revenue and Forecast, by Vertical (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.7. Market Revenue and Forecast, by Vertical (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.9. Market Revenue and Forecast, by Vertical (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.10.5. Market Revenue and Forecast, by Vertical (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.11.5. Market Revenue and Forecast, by Vertical (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.5.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.5. Market Revenue and Forecast, by Vertical (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.7. Market Revenue and Forecast, by Vertical (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.8.5. Market Revenue and Forecast, by Vertical (2021-2033)

Chapter 14. Company Profiles

14.1. IBM Corp.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Splunk Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Palo Alto Networks

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Microsoft Corp.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Logpoint

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Rapid7

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. ServiceNow

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Siemplify

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Fortinet, Inc.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Swimlane SOAR

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others