The global self-testing market was estimated at USD 10.65 billion in 2023 and it is expected to surpass around USD 21.01 billion by 2033, poised to grow at a CAGR of 7.03% from 2024 to 2033.

The self-testing market has experienced significant growth, fueled by technological advancements, changing consumer behavior, and the increasing emphasis on personal health and wellness.

The growth of the self-testing market is propelled an advancements in technology have led to the development of increasingly sophisticated self-testing devices, enhancing accuracy and user-friendliness. Additionally, the rising trend of consumer empowerment in healthcare is driving individuals to take control of their own health through self-testing, fostering a proactive approach to wellness. Moreover, the convenience and accessibility of over-the-counter and online self-testing kits cater to the needs of busy individuals and those seeking privacy. Lastly, the personalization of healthcare, facilitated by self-testing, allows for tailored health monitoring and interventions based on individual needs and preferences. These factors collectively contribute to the expansion of the self-testing market, meeting the growing demand for cost-effective, convenient, and personalized health solutions.

| Report Coverage | Details |

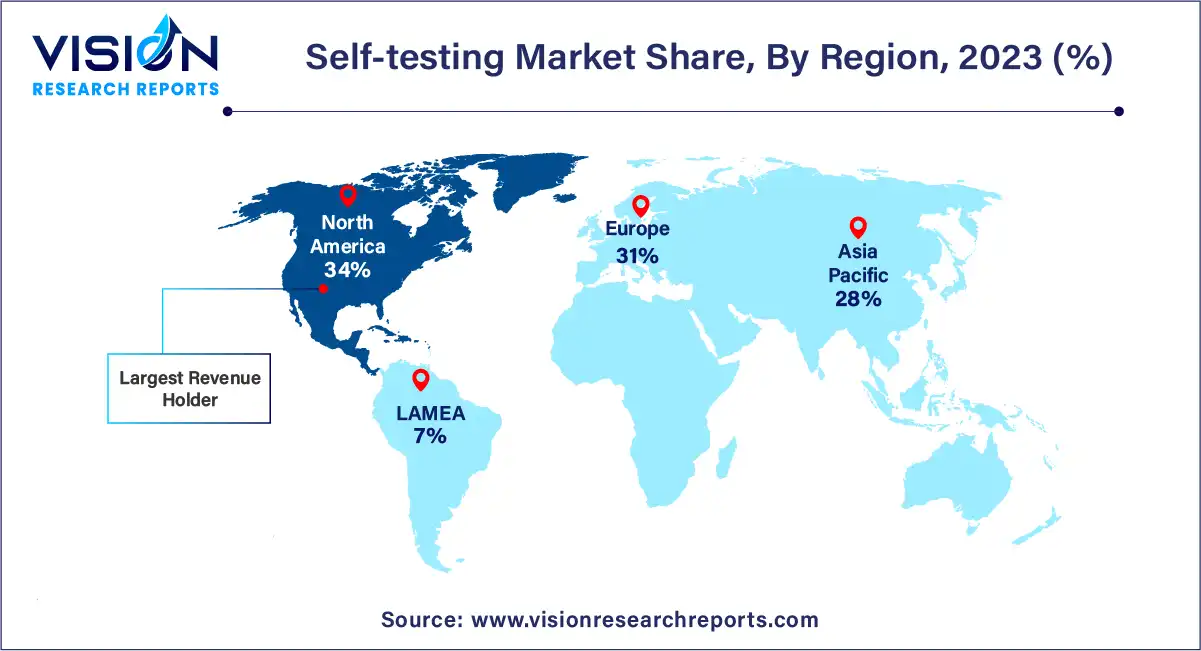

| Revenue Share of North America in 2023 | 34% |

| Revenue Forecast by 2033 | USD 21.01 billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.03% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The blood sample segment dominated the overall market with the largest revenue share of 37% in 2023. The dominance of the segment can be attributed to the increasing use of blood samples for diagnostics due to their non-invasiveness, ability to provide comprehensive insights into various health conditions, as well as advancements in diagnostic technologies. Moreover, increasing product launches with advanced mechanisms are also projected to offer favourable opportunities for segment growth. For instance, in May 2023, Laboratory Corporation of America Holdings announced the launch of its very first at-home blood sample collection device for diabetes diagnostics.

The urine sample segment is expected to witness the fastest growth rate over the forecast period, owing to the increasing use of urinalysis for various disease diagnostics. Besides, the rising capabilities of kits & devices to offer a range of diagnostics insights are also projected to accelerate urine sample segment growth by 2033. In November 2021, Vivoo received USD 6.0 million through series A funding for the development of at-home urine test kits. The kits are integrated with an app and provide hassle-free real-time insights.

The kits product segment dominated the self-testing market with a revenue share of 49% in 2023. The segment is also projected to register the fastest CAGR over the forecast period. The growth is attributed to the rising focus of key players on investing in the research & development of new products. For instance, in May 2021, Zoe, a personalized nutrition startup, raised USD 20 million for its at-home testing kits. Moreover, in February 2023, Abingdon Health plc entered into a distribution agreement with Sali Gnostics to extend sales of the latter’s saliva-based pregnancy test kits in Ireland.

The testing strips segment held a considerable market share in 2023, owing to the high usage of strips and their affordability. The increasing geriatric population, growing cases of chronic diseases, and technological advancements in the medical sector are projected to boost the revenue share of the segment.

The allergy test application segment held the largest revenue share of 19% in 2023 in the market. The increasing incidence of allergic conditions is one of the key factors contributing to market growth over the forecast period. As per data published by the Asthma and Allergy Foundation of America, in 2021, an estimated 81 million people were detected with hay fever in the U.S. Increasing number of product launches further boosts the market growth. In June 2023, Everly well launched affordable home tests for food allergy and celiac disease along with virtual follow-up care.

The cancer tests segment is projected to showcase the fastest CAGR over the forecast period. The rising number of cancer cases is a key reason for segment growth. The increasing focus of companies to launch new products further boosts market growth. For instance, in August 2023, Viome Life Sciences launched a self-testing throat cancer test for consumers. The saliva-based tests have shown 95% specificity and 90% sensitivity.

On the basis of distribution channel, the offline segment dominated the market for self-testing with a revenue share of 64% in 2023. Significant investments by companies in building their own distribution networks are projected to accelerate segment growth. In addition, the increasing number of distribution agreements within companies is also estimated to have a positive impact on segment growth by 2033.

Online channels are projected to expand at the fastest CAGR over the forecast period, as online retailers offer a greater accessibility of self-testing products, allowing easier access to consumers regardless of their location. Online channels offer wider options regarding self-testing products than offline channels and also provide access to niche products, driving their appeal.

The disposable segment held the largest revenue share of 84% of the market in 2023. The segment is further projected to expand at the fastest CAGR over the forecast period. Self-testing is providing new opportunities to detect, diagnose, and address patients and their treatment process. Disposable kits offer exceptional usability due to their convenient and user-friendly nature. They eliminate the need for complex preparation or cleaning, ensuring a hygienic and hassle-free experience. Such advantages of disposable kits along with improved safety are likely to accelerate segment growth during the forecast period.

Reusable kits are expected to hold a considerable market share during the forecast period. Manufacturers are producing testing kits for wellness and preventative measures, including chronic disease treatment and acute infection diagnoses to detect the possible dangers of ailments. Increased cost benefits are likely to offer favorable opportunities for segment growth by 2033.

North America dominated the overall market in 2023 with a revenue share of 34%. The growth of the North American market for self-testing is attributed to rising cases of chronic conditions that require quick diagnosis, technological advancements in the healthcare sector, and the availability of key players. These factors are projected to boost the revenue growth in the region. The increasing number of FDA approvals for new products also boosts the market growth. For instance, in May 2023, empowerDX announced the launch of an at-home celiac disease genetic risk test. The kit performs molecular testing and provides accurate results.

The Asia Pacific region is projected to expand at the fastest CAGR over the forecast period. The rising number of activities related to research & development of novel therapeutics for infections, the improving healthcare sector, and government initiatives to reduce disease burden are the key factors driving regional market growth. Other factors, such as increasing healthcare reforms, expanding healthcare infrastructure, growing population, rising incidence of chronic diseases, and the growing number of local companies entering the market are also estimated to drive the Asia Pacific market for self-testing during the forecast period.

By Product

By Sample Type

By Application

By Distribution Channel

By Usage

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Self-testing Market

5.1. COVID-19 Landscape: Self-testing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Self-testing Market, By Product

8.1. Self-testing Market, by Product, 2024-20332

8.1.1. Kits

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Devices

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Strips

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Self-testing Market, By Sample Type

9.1. Self-testing Market, by Sample Type, 2024-20332

9.1.1. Blood

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Urine

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Stool

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Self-testing Market, By Application

10.1. Self-testing Market, by Application, 2024-20332

10.1.1. Blood Pressure Test

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Diabetes and Glucose Tests

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Cholesterol and Triglycerides Tests

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Pregnancy Test

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. STD /STI Test

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Urinary Tract Infection Test

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Cancer Test

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Celiac disease Test

10.1.8.1. Market Revenue and Forecast (2021-2033)

10.1.9. Thyroid Test

10.1.9.1. Market Revenue and Forecast (2021-2033)

10.1.10. Transaminase Test

10.1.10.1. Market Revenue and Forecast (2021-2033)

10.1.11. Anemia Test

10.1.11.1. Market Revenue and Forecast (2021-2033)

10.1.12. Allergy Test

10.1.12.1. Market Revenue and Forecast (2021-2033)

10.1.13. Others

10.1.13.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Self-testing Market, By Distribution Channel

11.1. Self-testing Market, by Distribution Channel, 2024-20332

11.1.1. Online

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Offline

Chapter 12. Global Self-testing Market, By Usage

12.1. Self-testing Market, by Usage, 2024-20332

12.1.1. Disposable

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Reusable

12.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Self-testing Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Product (2021-2033)

13.1.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.1.3. Market Revenue and Forecast, by Application (2021-2033)

13.1.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.1.5. Market Revenue and Forecast, by Usage (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Product (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.1.7. Market Revenue and Forecast, by Usage (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Product (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Application (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.1.8.5. Market Revenue and Forecast, by Usage (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Product (2021-2033)

13.2.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.2.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.2.5. Market Revenue and Forecast, by Usage (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.7. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.2.8. Market Revenue and Forecast, by Usage (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Product (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.10. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.2.11. Market Revenue and Forecast, by Usage (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Product (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.2.13. Market Revenue and Forecast, by Usage (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Product (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.2.15. Market Revenue and Forecast, by Usage (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Product (2021-2033)

13.3.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.3.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.3.5. Market Revenue and Forecast, by Usage (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.3.7. Market Revenue and Forecast, by Usage (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Product (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.3.9. Market Revenue and Forecast, by Usage (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Product (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.3.10.5. Market Revenue and Forecast, by Usage (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Product (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.3.11.5. Market Revenue and Forecast, by Usage (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Product (2021-2033)

13.4.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.4.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.4.5. Market Revenue and Forecast, by Usage (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.4.7. Market Revenue and Forecast, by Usage (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Product (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.4.9. Market Revenue and Forecast, by Usage (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Product (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.4.10.5. Market Revenue and Forecast, by Usage (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Product (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.4.11.5. Market Revenue and Forecast, by Usage (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Product (2021-2033)

13.5.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.5.3. Market Revenue and Forecast, by Application (2021-2033)

13.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.5.5. Market Revenue and Forecast, by Usage (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Product (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.5.7. Market Revenue and Forecast, by Usage (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Product (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Sample Type (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Application (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

13.5.8.5. Market Revenue and Forecast, by Usage (2021-2033)

Chapter 14. Company Profiles

14.1. Johnson & Johnson Services, Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Geratherm Medical AG

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. B. Braun Holding GmbH

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Piramal Enterprises

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Cardinal Health

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. OraSure Technologies, Inc.

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. bioLytical Laboratories Inc.

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. PRIMA Lab SA

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. BD

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. F. Hoffmann-La Roche Ltd.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others