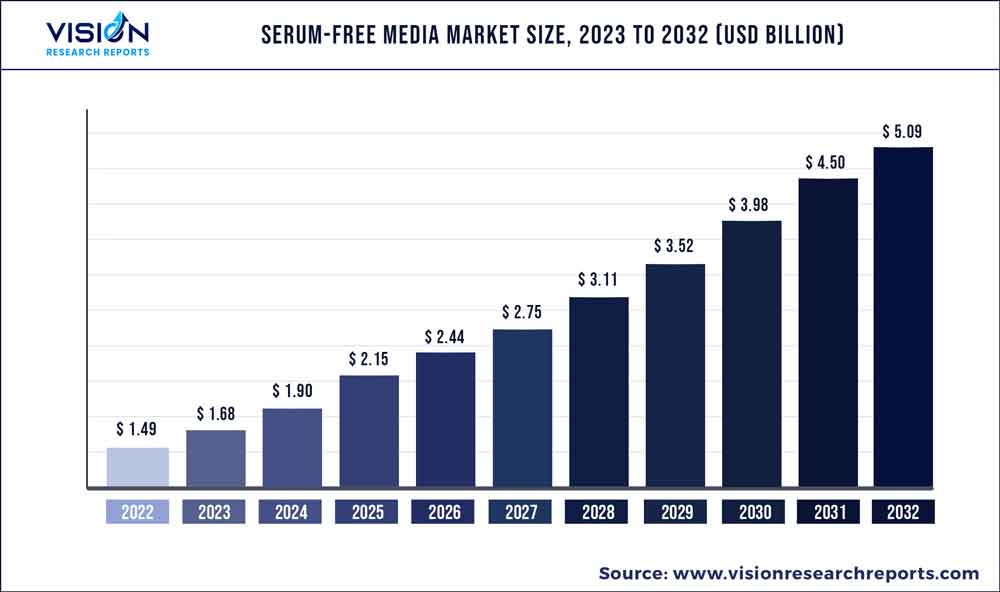

The global serum-free media market was surpassed at USD 1.49 billion in 2022 and is expected to hit around USD 5.09 billion by 2032, growing at a CAGR of 13.07% from 2023 to 2032. The serum-free media market in the United States was accounted for USD 457.9 million in 2022.

Key Pointers

Report Scope of the Serum-free Media Market

| Report Coverage | Details |

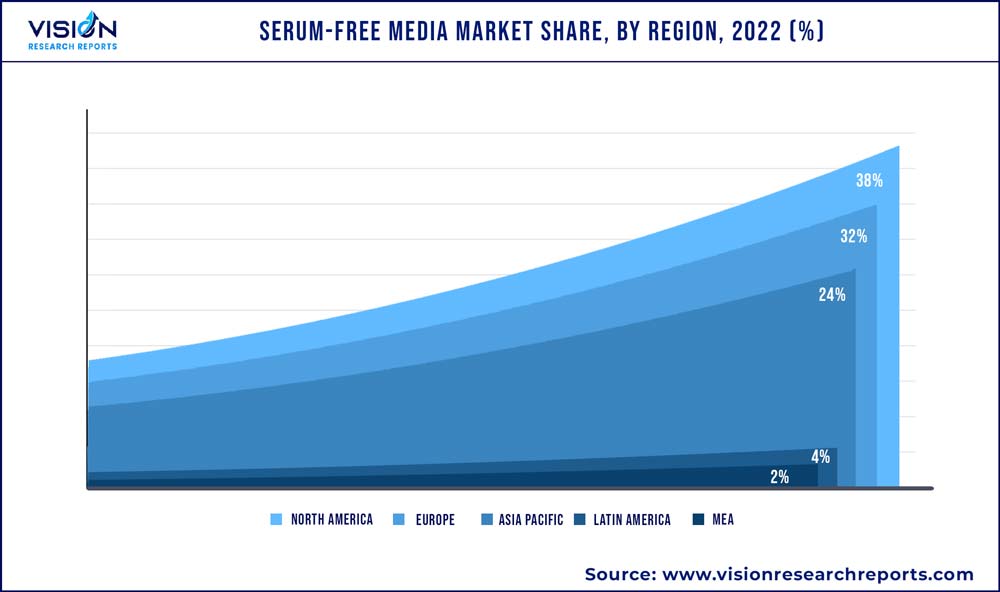

| Revenue Share of North America in 2022 | 38% |

| Revenue Forecast by 2032 | USD 5.09 billion |

| Growth Rate from 2023 to 2032 | CAGR of 13.07% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Thermo Fisher Scientific Inc.; Sartorius AG; Merck KgaA; Lonza Group AG; Danaher; FUJIFILM Holdings Corporation; MP Bio medicals; Corning Incorporated; PAN-Biotech; R&D Systems, Inc. |

Recent advancements in serum-free media technology have led to the availability of numerous serum free choices from industrial providers. In order to achieve optimal performance, serum elimination necessitates the use of the highest grade reagents and close monitoring of culture conditions due to its tendency to bind toxins and impurities. The use of serum-free medium (SFM) is a crucial tool that enables cell culture to be carried out under predetermined circumstances that are as devoid of confounding factors as feasible.

The outbreak of the COVID-19 led to an increase in the usage of serum-free media for drug discovery and treatment programs. Pharmaceutical companies and research laboratories are investigating protein based cures to fight the COVID-19 virus. This can be a monoclonal antibody, a bi-specific antibody or a protein. They can be produced in cell lines such as CHO, BHK, HEK293, NSO and Hybridoma. For instance, Lonza has several serum-free media options for reducing production variables.

Serum-free media, which don't require animal serum for cell growth, are made up of the right nutritional and hormonal compositions. Using serum-free media for cell culture has several benefits, including improved consistency and productivity plus simpler purification and downstream processing. In addition, combinations of selective growth factors for particular cell types can be included in serum-free media formulations.

For many primary cultures and cell lines, including recombinant protein-producing Chinese hamster ovary (CHO) lines, hybridoma cell lines, and cell lines serving as hosts for virus generation, serum-free media formulations are available (e.g., 293, VERO, MDCK, MDBK).

The rising focus on the development of cell-based therapeutics is accelerating the market growth. Increasing FDA approvals, clinical trials and strategic initiatives such as collaborations by the major market players are boosting the market growth. For instance, in March September 2022, Capstan Therapeutics, Inc. launched with USD 165.0 million in funding to build upon the fundamental understandings of well-known authorities in mRNA and cell treatment. The business intends to use the funds to further the therapeutic promise of cell-based medicines by enabling precision in vivo cell engineering to help patients with a numerous diseases.

Moreover, strategic activities by key market players will further offer lucrative opportunities in the review period. For instance, in November 2022, BioPharma Dynamics expanded their wide-ranging portfolio for the Gene & Cell Therapy market to offer a variety of serum-free and chemically defined cell media solutions. Suitable for the cell therapy applications, the range of cell media products includes cell cryopreservation solutions, stem cell media, and immune cell media.

Additionally, growing funding in stem cell research by several governments and operating players are likely to open new growth opportunities for the Serum-free Media Market. For instance, in September 2021, Stanford physician-researchers received nearly USD 31.0 million from the California Institute for Regenerative Medicine to launch the first-in-human trials of stem cells for the treatment of heart failure, stroke, and a type of spinal cord & brain tumor.

Product Insights

The CHO Media segment dominated the global industry in 2022 and secured the maximum share of more than 31% of the overall revenue. CHO media is a critical component of CHO cell line maintenance procedures involved in development and commercialization of several bio therapeutics.

Commercially available CHO media are chemically defined and animal component-free, which increases their applications in the biopharmaceutical industry. Furthermore, with increasing usage of CHO cell lines in toxicity screening and recombinant antibody technology, the market is expected to witness significant growth in the near future.

Application Insights

The biopharmaceutical production segment dominated the serum-free media market with a share of 74% in 2022. The biosimilars market is on the cusp of momentous growth. This growth is mainly due to the anticipated launch of several mAb biosimilars in the coming years as patents on significant drugs, such as trastuzumab (Herceptin from Roche), infliximab (Remicade from J& J), and Adalimumab (Humira from Abbott), are going to expire.

Furthermore, Opportunities for biosimilar monoclonal antibodies are being created by the extension of regulated approval pathways for biosimilars in developing markets. The availability of an approval pathway in the U.S. has led to new opportunities for biosimilar manufacturers to enter major markets around the globe.

Furthermore, Rise in burden of chronic diseases, such as cancer, autoimmune diseases, etc., has driven demand for the targeted treatment options, such as monoclonal antibodies (mAbs). In the U.S. alone, an estimated 1.9 million new cancer cases were recorded along with more than 608,000 cancer-related deaths in 2021. Such high caseload is expected to draw attention toward development of novel therapeutics and personalized options for the cancer treatment.

Furthermore, research efforts aimed at development of effective mAb-based assays for early detection and diagnosis of cancer are likely to increase the adoption of cell culture-based techniques for mAb production. Similarly, technological advancements in antibody therapeutics, such as development of bispecific antibodies, antibody fragments, and antibody derivatives are expanding the market prospects for the applications of serum-free media in mAb production.

Type Insights

The liquid media segment captured the highest revenue share of 63% in the market in 2022. Factors such as growing number of manufacturers of biosimilars and biologics coupled with increasing preferences from pre-mixed powders to liquid media to avoid rapid growth of mycobacteria are the major factors driving the growth. Liquid media also eliminates the need for mixing containers, scales, and the installation of Water for Injections (WFI) circuit required to mix the powder media owing to these advantages the adoption of liquid media is increasing.

Furthermore, certain strategic initiatives by key market players also are likely to boost market growth. For instance, in December 2021, Fujifilm Irvine Scientific, Inc. announced the beginning of operations at its Tilburg, Netherlands life-science manufacturing facility, strengthening European supply chain for the cell culture consumables. The facility manufactures both dry and liquid media, which is anticipated to increase competition for the existing players in the market due to the increase in local availability of cell culture consumables such as media from the new facility.

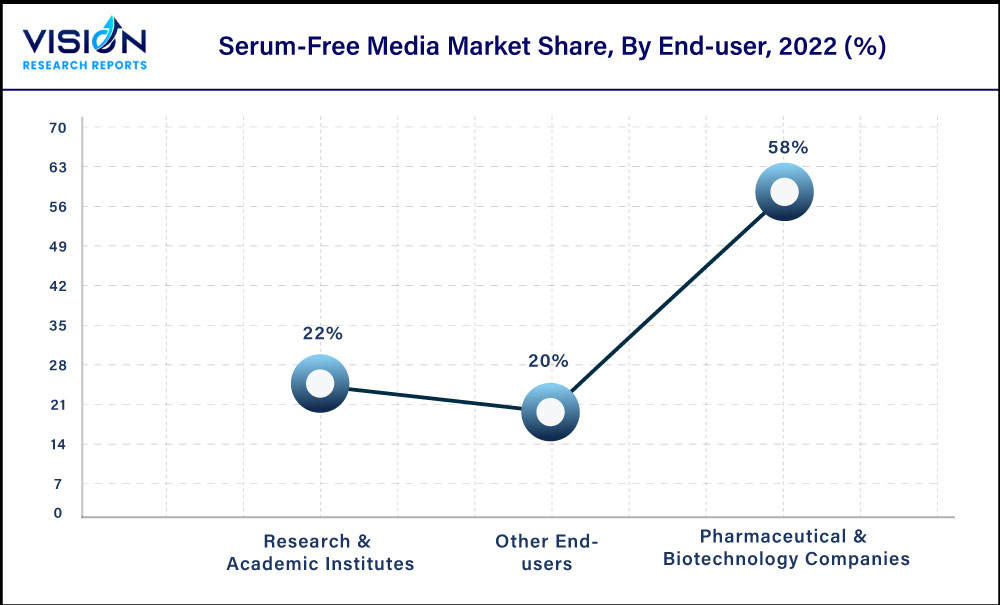

End-user Insights

The biopharmaceutical & pharmaceutical companies segment obtained the highest revenue share of 58% in the market in 2022. Serum-free media is one of the key drivers for bio production process, and can have significant impact on viability & cell growth and also enhance protein quality & production. Moreover, the biopharmaceutical industry is witnessing significant growth not only due to the introduction of innovative therapeutics, but also with the advent of biosimilars or generic.

An increase in the number of clinical trials on treatments for the life-threatening diseases by the pharmaceutical and biotechnology companies further drives demand for the serum-free media. Moreover, these companies are investing significantly in R&D activities, which are further boosting demand for the culture media. Thus, growth of the biopharmaceutical industry, rise in the number of clinical trials, and initiatives for the development of novel drugs are the factors expected to boost the market growth.

Regional Insights

North America dominated the overall serum-free media market with a share of 38% in 2022. This major share can be attributed to the presence of a well-established R&D infrastructure and favorable regulatory landscape, which is rapidly evolving to adapt to the ongoing research progress in this sector. Investments by the government and leading players of the market in pharmaceuticals and biotechnology industries are growing. For instance, in November 2022, FUJIFILM Holdings Corporation announced the launch of a serum-free media manufacturing facility with an investment of USD 188.0 million in Research Triangle Park (RTP), North Carolina.

Asia Pacific is estimated to witness the fastest growth of 16% due to the rising demand for novel therapeutics in the region. Furthermore, high prevalence of chronic diseases and the COVID-19 have led to an increase in R&D activities for the development of novel therapies and vaccines, thus creating high demand for the serum-free media solutions.

The market is also driven by increasing investments in cell culture domain. For instance, in June 2018, Japan-based Fujifilm announced an acquisition of IS Japan (ISJ) and Irvine Scientific Sales Company (ISUS) for USD 800.0 million, thereby expanding into serum-free media space. Such investments and expansion activities can lead to substantial revenue generation for the serum free media in the near future.

Serum-free Media Market Segmentations:

By Product

By Application

By Type

By End-user

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Serum-free Media Market

5.1. COVID-19 Landscape: Serum-free Media Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Serum-free Media Market, By Product

8.1. Serum-free Media Market, by Product, 2023-2032

8.1.1. CHO Media

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. HEK 293 Media

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. BHK Medium

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Vero Medium

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Stem Cell Medium

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Other Serum-free Media

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Serum-free Media Market, By Application

9.1. Serum-free Media Market, by Application, 2023-2032

9.1.1. Biopharmaceutical Production

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Tissue Engineering & Regenerative Medicine

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Serum-free Media Market, By Type

10.1. Serum-free Media Market, by Type, 2023-2032

10.1.1. Liquid Media

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Semi-solid & Solid Media

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Serum-free Media Market, By End-user

11.1. Serum-free Media Market, by End-user, 2023-2032

11.1.1. Pharmaceutical & Biotechnology Companies

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Research & Academic Institutes

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Other End-users

11.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Serum-free Media Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2020-2032)

12.1.2. Market Revenue and Forecast, by Application (2020-2032)

12.1.3. Market Revenue and Forecast, by Type (2020-2032)

12.1.4. Market Revenue and Forecast, by End-user (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Type (2020-2032)

12.1.5.4. Market Revenue and Forecast, by End-user (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Application (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Type (2020-2032)

12.1.6.4. Market Revenue and Forecast, by End-user (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.2. Market Revenue and Forecast, by Application (2020-2032)

12.2.3. Market Revenue and Forecast, by Type (2020-2032)

12.2.4. Market Revenue and Forecast, by End-user (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Type (2020-2032)

12.2.5.4. Market Revenue and Forecast, by End-user (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Type (2020-2032)

12.2.6.4. Market Revenue and Forecast, by End-user (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Type (2020-2032)

12.2.7.4. Market Revenue and Forecast, by End-user (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Application (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Type (2020-2032)

12.2.8.4. Market Revenue and Forecast, by End-user (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.2. Market Revenue and Forecast, by Application (2020-2032)

12.3.3. Market Revenue and Forecast, by Type (2020-2032)

12.3.4. Market Revenue and Forecast, by End-user (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Type (2020-2032)

12.3.5.4. Market Revenue and Forecast, by End-user (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Type (2020-2032)

12.3.6.4. Market Revenue and Forecast, by End-user (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Type (2020-2032)

12.3.7.4. Market Revenue and Forecast, by End-user (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Application (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Type (2020-2032)

12.3.8.4. Market Revenue and Forecast, by End-user (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.2. Market Revenue and Forecast, by Application (2020-2032)

12.4.3. Market Revenue and Forecast, by Type (2020-2032)

12.4.4. Market Revenue and Forecast, by End-user (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Type (2020-2032)

12.4.5.4. Market Revenue and Forecast, by End-user (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Type (2020-2032)

12.4.6.4. Market Revenue and Forecast, by End-user (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Type (2020-2032)

12.4.7.4. Market Revenue and Forecast, by End-user (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Application (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Type (2020-2032)

12.4.8.4. Market Revenue and Forecast, by End-user (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.5.2. Market Revenue and Forecast, by Application (2020-2032)

12.5.3. Market Revenue and Forecast, by Type (2020-2032)

12.5.4. Market Revenue and Forecast, by End-user (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Type (2020-2032)

12.5.5.4. Market Revenue and Forecast, by End-user (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Application (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Type (2020-2032)

12.5.6.4. Market Revenue and Forecast, by End-user (2020-2032)

Chapter 13. Company Profiles

13.1. Thermo Fisher Scientific Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Sartorius AG

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Merck KgaA

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Lonza Group AG

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Danaher

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. FUJIFILM Holdings Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. MP Bio medicals

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Corning Incorporated

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. PAN-Biotech

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. R&D Systems, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others