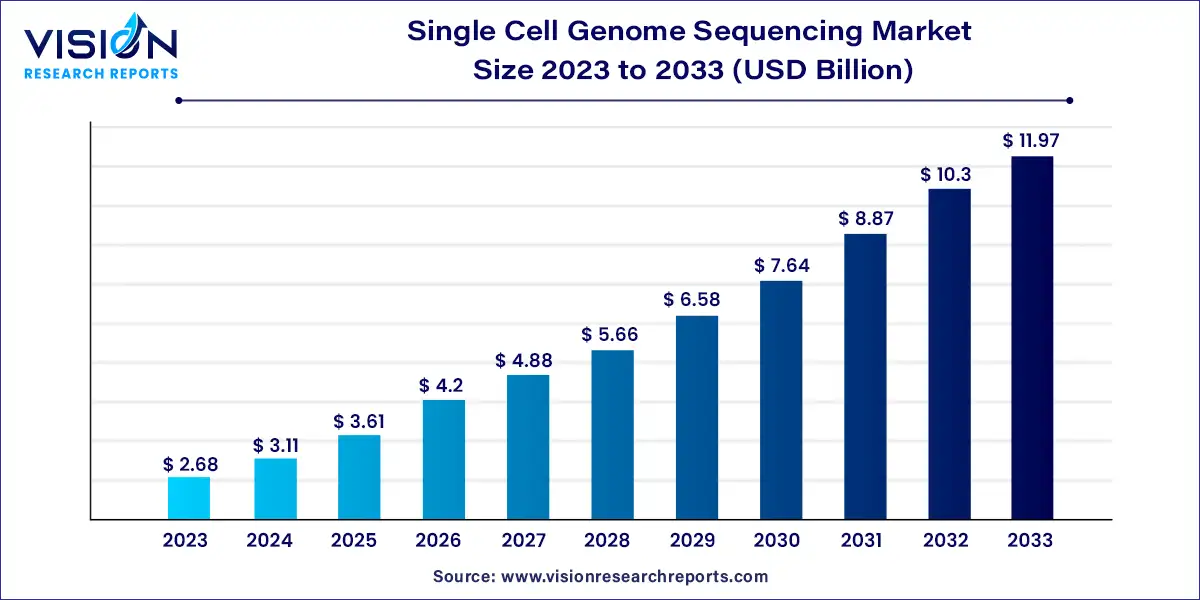

The global single cell genome sequencing market size was estimated at around USD 2.68 billion in 2023 and it is projected to hit around USD 11.97 billion by 2033, growing at a CAGR of 16.14% from 2024 to 2033.

Single-cell genome sequencing has emerged as a revolutionary technology in the field of genomics, offering unparalleled insights into the genetic makeup and heterogeneity of individual cells. This cutting-edge technique allows researchers to analyze the genome of individual cells, enabling a deeper understanding of cellular diversity, dynamics, and function.

The growth of the single-cell genome sequencing market is driven by the technological advancements in sequencing platforms, including next-generation sequencing (NGS) and single-cell multiomics technologies, have significantly enhanced the efficiency and accuracy of single-cell genome sequencing, fostering market growth. Moreover, the rising demand for precision medicine has fueled interest in single-cell sequencing as it enables the identification of rare cell populations and genetic variations, facilitating targeted therapeutic interventions. Additionally, the broadening applications of single-cell genome sequencing across diverse research areas such as cancer research, stem cell biology, and immunology contribute to market growth.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 48% |

| CAGR of Asia Pacific from 2024 to 2033 | 17.47% |

| Revenue Forecast by 2033 | USD 11.97 billion |

| Growth Rate from 2024 to 2033 | CAGR of 16.14% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In terms of product, the instruments segment dominated the market in 2023, with a revenue share of 59%. This dominance can be primarily attributed to the accelerated development and adoption of technologically advanced instruments and solutions, specifically designed to keep pace with the dynamic changes in healthcare technological advancements. This segment is expected to witness the fastest CAGR of 16.23% over the forecast period due to the increased focus of market players on developing and manufacturing these instruments. Such efforts aim to expand their market presence and seize opportunities to enter new markets.

In terms of technology, the PCR segment dominated the market in 2023 with a revenue share of 29%. Due to heavy investments in R&D, PCR is a widely recognized technology when it comes to genome sequencing, highly coveted by market leaders and research institutes. NGS is poised to emerge as the fastest-growing technology segment with a CAGR of 17.14% over the forecast period. This remarkable growth can be attributed to extensive R&D activities and its diverse applications in cancer-related investigations.

Genome sequencing has evolved significantly over the past few years due to constant technological advancements. For instance, in March 2023, researchers at ETH Zurich used a new approach using single-cell genome sequencing to analyze the DNA from two different T-cells that were obtained from the same period. This sequencing data revealed 28 somatic mutations that differentiated the two T-cells and identified any mitochondrial DNA changes. It was inferred that this new method could potentially allow scientists to study various impacts of somatic mutations in a host of diseases.

The workflow segment is divided into genomic analysis, single cell isolation, and sample preparation. The genomic analysis segment dominated the market in 2023, with a market size of 71%. This dominance can be attributed to the recent surge in funding for research and development capabilities and the widespread adoption of genomic analysis products. As a result, this segment is projected to experience the fastest CAGR of 16.82% during the forecast period.

These recent developments have also created new opportunities for mutation rate quantification, rare cell type identification, and other diagnoses and treatments. Genomic analysis allows comprehensive identification, measurement, and comparison of genomic features like DNA sequence, gene expression, and other regulatory and functional annotations. This analysis allows companies to study cells in depth, ensuring lucrative growth for this segment. For instance, a research publication released on 30th May 2023, showcased how genomic analysis studies have revealed candidate genes associated with milk production and adaptive traits in goat breeds. These findings exemplify the potential and significance of genomic analysis in uncovering valuable insights in diverse fields of research.

The disease area segment is divided into cancer, immunology, prenatal diagnosis, neurobiology, microbiology, and others. The cancer segment dominated the market in 2023 with a revenue share of 36%. The increasing prevalence of prostate, colorectal, and breast cancer is projected to generate lucrative opportunities for market growth. Notably, according to the American Cancer Society, cancer ranks as the second leading cause of mortality in the U.S.

With an increase in cancer incidences, there has been a complementary increase in the number of research studies and experiments being conducted. Therefore, rise in cancer incidences is also causing a growth in the SCGS market. For instance, in October 2023, researchers from UBC and the BC Cancer Research Institute conducted cancer-related research, which showed that single cell genome sequencing provided new insights into deadly cancers. The researchers were able to sequence the genomes of individual cells from the biopsies of 158 BC Cancer patients, allowing them to observe the processes of evolution within each individual cell.

The application segment is divided into circulating cells, cell differentiation/reprogramming, genomic variation, subpopulation characterization, and others. The circulating cells segment dominated the market in 2023, with a revenue share of 30%. This is due to an increase in clinical application of circulating tumor cells (CTCs) as biomarkers for cancer detection, used as genomic profilers for sequence mutations and other such applications.

CTCs allow blood circulation within the primary tumor and regulate tumor metastasis to fight cancer. Due to increasing R&D opportunities and growing number of research, studies, and clinical trials, the circulating cells segment is forecasted to grow at a significant CAGR of 16.26% over the coming years. For instance, in January 2023, researchers at IIT Delhi worked in collaboration with Fluidigm Corporation, US, to develop an innovative and deep dictionary learning to detect circulating cells in the bloodstream, called unCTC.

The prenatal diagnosis segment is anticipated to grow at the fastest CAGR of 17.15% over the forecast period owing to the increasing number of medical tests and procedures that are performed during pregnancy to detect potential health issues or abnormalities in the developing fetus coupled with higher resolution and accuracy of SCGS compared to traditional sequencing methods.

The end-use segment is divided into academic & research laboratories, biotechnology & biopharmaceutical companies, clinics, and others. The academic & research laboratories segment dominated the market in 2023, with a revenue share of 73%. This growth is attributed to the rise in genomic centers, increase in life science research funding, and growing number of medical colleges and institutions in major regions.

The biotechnology & biopharmaceutical companies segment is anticipated to grow at the fastest CAGR over the forecast period. This is due to the increasing dependency of medical institutions and hospitals on these companies for research access, results, and other equipment and related contingencies. Due to their strong market presence and desire to enter the single-cell genome sequencing market, many biotechnology companies are pursuing different competitive strategies to stretch their lead. As a result, this segment is anticipated to grow significantly.

North America dominated the regional market in 2023, with a revenue share of 48%. This dominance can be attributed to several factors, including the increasing incidence of cancer and other chronic diseases in the region. In addition, the continuous advancements in technology and research and development efforts by companies in North America have contributed to this lead. Moreover, the rise in the number of genomic clinics in the region has further boosted its position in the market.

Asia Pacific is anticipated to grow at the fastest CAGR of 17.47% over the forecast period. One of the primary drivers of the growth is the rising geriatric population, leading to an increased prevalence of chronic diseases among patients. In addition, the region is anticipated to witness significant advancements in healthcare infrastructure, driven by developing countries' efforts to boost their economies.

By Product Type

By Technology

By Workflow

By Disease Area

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. End-use Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Single Cell Genome Sequencing Market

5.1. COVID-19 Landscape: Single Cell Genome Sequencing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Single Cell Genome Sequencing Market, By Product Type

8.1. Single Cell Genome Sequencing Market, by Product Type, 2024-2033

8.1.1. Instruments

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Reagents

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Single Cell Genome Sequencing Market, By Technology

9.1. Single Cell Genome Sequencing Market, by Technology, 2024-2033

9.1.1. NGS

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. PCR

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. qPCR

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Microarray

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. MDA

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Single Cell Genome Sequencing Market, By Workflow

10.1. Single Cell Genome Sequencing Market, by Workflow, 2024-2033

10.1.1. Genomic Analysis

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Single Cell Isolation

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Sample Preparation

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Single Cell Genome Sequencing Market, By Disease Area

11.1. Single Cell Genome Sequencing Market, by Disease Area, 2024-2033

11.1.1. Cancer

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Immunology

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Prenatal Diagnosis

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Prenatal Diagnosis

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Microbiology

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Application

11.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Single Cell Genome Sequencing Market, By Application

12.1. Single Cell Genome Sequencing Market, by Application, 2024-2033

12.1.1. Circulating Cells

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Cell Differentiation/Reprogramming

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Genomic Variation

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Subpopulation Characterization

12.1.4.1. Market Revenue and Forecast (2021-2033)

12.1.5. Others

12.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Single Cell Genome Sequencing Market, By End-use

13.1. Single Cell Genome Sequencing Market, by End-use, 2024-2033

13.1.1. Academic & Research Laboratories

13.1.1.1. Market Revenue and Forecast (2021-2033)

13.1.2. Biotechnology & Biopharmaceutical Companies

13.1.2.1. Market Revenue and Forecast (2021-2033)

13.1.3. Clinics

13.1.3.1. Market Revenue and Forecast (2021-2033)

13.1.4. Others

13.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 14. Global Single Cell Genome Sequencing Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.1.2. Market Revenue and Forecast, by Technology (2021-2033)

14.1.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.1.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.1.5. Market Revenue and Forecast, by Application (2021-2033)

14.1.6. Market Revenue and Forecast, by End-use (2021-2033)

14.1.7. U.S.

14.1.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.1.7.2. Market Revenue and Forecast, by Technology (2021-2033)

14.1.7.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.1.7.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.1.8. Market Revenue and Forecast, by Application (2021-2033)

14.1.8.1. Market Revenue and Forecast, by End-use (2021-2033)

14.1.9. Rest of North America

14.1.9.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.1.9.2. Market Revenue and Forecast, by Technology (2021-2033)

14.1.9.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.1.9.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.1.10. Market Revenue and Forecast, by Application (2021-2033)

14.1.11. Market Revenue and Forecast, by End-use (2021-2033)

14.1.11.1.

14.2. Europe

14.2.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.2.2. Market Revenue and Forecast, by Technology (2021-2033)

14.2.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.2.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.2.5. Market Revenue and Forecast, by Application (2021-2033)

14.2.6. Market Revenue and Forecast, by End-use (2021-2033)

14.2.7.

14.2.8. UK

14.2.8.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.2.8.2. Market Revenue and Forecast, by Technology (2021-2033)

14.2.8.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.2.9. Market Revenue and Forecast, by Disease Area (2021-2033)

14.2.10. Market Revenue and Forecast, by Application (2021-2033)

14.2.10.1. Market Revenue and Forecast, by End-use (2021-2033)

14.2.11. Germany

14.2.11.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.2.11.2. Market Revenue and Forecast, by Technology (2021-2033)

14.2.11.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.2.12. Market Revenue and Forecast, by Disease Area (2021-2033)

14.2.13. Market Revenue and Forecast, by Application (2021-2033)

14.2.14. Market Revenue and Forecast, by End-use (2021-2033)

14.2.14.1.

14.2.15. France

14.2.15.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.2.15.2. Market Revenue and Forecast, by Technology (2021-2033)

14.2.15.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.2.15.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.2.16. Market Revenue and Forecast, by Application (2021-2033)

14.2.16.1. Market Revenue and Forecast, by End-use (2021-2033)

14.2.17. Rest of Europe

14.2.17.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.2.17.2. Market Revenue and Forecast, by Technology (2021-2033)

14.2.17.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.2.17.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.2.18. Market Revenue and Forecast, by Application (2021-2033)

14.2.18.1. Market Revenue and Forecast, by End-use (2021-2033)

14.3. APAC

14.3.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.3.2. Market Revenue and Forecast, by Technology (2021-2033)

14.3.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.3.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.3.5. Market Revenue and Forecast, by Application (2021-2033)

14.3.6. Market Revenue and Forecast, by End-use (2021-2033)

14.3.7. India

14.3.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.3.7.2. Market Revenue and Forecast, by Technology (2021-2033)

14.3.7.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.3.7.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.3.8. Market Revenue and Forecast, by Application (2021-2033)

14.3.9. Market Revenue and Forecast, by End-use (2021-2033)

14.3.10. China

14.3.10.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.3.10.2. Market Revenue and Forecast, by Technology (2021-2033)

14.3.10.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.3.10.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.3.11. Market Revenue and Forecast, by Application (2021-2033)

14.3.11.1. Market Revenue and Forecast, by End-use (2021-2033)

14.3.12. Japan

14.3.12.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.3.12.2. Market Revenue and Forecast, by Technology (2021-2033)

14.3.12.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.3.12.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.3.12.5. Market Revenue and Forecast, by Application (2021-2033)

14.3.12.6. Market Revenue and Forecast, by End-use (2021-2033)

14.3.13. Rest of APAC

14.3.13.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.3.13.2. Market Revenue and Forecast, by Technology (2021-2033)

14.3.13.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.3.13.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.3.13.5. Market Revenue and Forecast, by Application (2021-2033)

14.3.13.6. Market Revenue and Forecast, by End-use (2021-2033)

14.4. MEA

14.4.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.4.2. Market Revenue and Forecast, by Technology (2021-2033)

14.4.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.4.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.4.5. Market Revenue and Forecast, by Application (2021-2033)

14.4.6. Market Revenue and Forecast, by End-use (2021-2033)

14.4.7. GCC

14.4.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.4.7.2. Market Revenue and Forecast, by Technology (2021-2033)

14.4.7.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.4.7.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.4.8. Market Revenue and Forecast, by Application (2021-2033)

14.4.9. Market Revenue and Forecast, by End-use (2021-2033)

14.4.10. North Africa

14.4.10.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.4.10.2. Market Revenue and Forecast, by Technology (2021-2033)

14.4.10.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.4.10.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.4.11. Market Revenue and Forecast, by Application (2021-2033)

14.4.12. Market Revenue and Forecast, by End-use (2021-2033)

14.4.13. South Africa

14.4.13.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.4.13.2. Market Revenue and Forecast, by Technology (2021-2033)

14.4.13.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.4.13.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.4.13.5. Market Revenue and Forecast, by Application (2021-2033)

14.4.13.6. Market Revenue and Forecast, by End-use (2021-2033)

14.4.14. Rest of MEA

14.4.14.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.4.14.2. Market Revenue and Forecast, by Technology (2021-2033)

14.4.14.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.4.14.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.4.14.5. Market Revenue and Forecast, by Application (2021-2033)

14.4.14.6. Market Revenue and Forecast, by End-use (2021-2033)

14.5. Latin America

14.5.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.5.2. Market Revenue and Forecast, by Technology (2021-2033)

14.5.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.5.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.5.5. Market Revenue and Forecast, by Application (2021-2033)

14.5.6. Market Revenue and Forecast, by End-use (2021-2033)

14.5.7. Brazil

14.5.7.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.5.7.2. Market Revenue and Forecast, by Technology (2021-2033)

14.5.7.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.5.7.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.5.8. Market Revenue and Forecast, by Application (2021-2033)

14.5.8.1. Market Revenue and Forecast, by End-use (2021-2033)

14.5.9. Rest of LATAM

14.5.9.1. Market Revenue and Forecast, by Product Type (2021-2033)

14.5.9.2. Market Revenue and Forecast, by Technology (2021-2033)

14.5.9.3. Market Revenue and Forecast, by Workflow (2021-2033)

14.5.9.4. Market Revenue and Forecast, by Disease Area (2021-2033)

14.5.9.5. Market Revenue and Forecast, by Application (2021-2033)

14.5.9.6. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 15. Company Profiles

15.1. Bio-Rad Laboratories

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. 10x Genomics

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Novogene

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Fluidigm

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. BGI

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. Illumina, Inc.

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Oxford Nanopore Technologies

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. Pacific Biosciences

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. Thermo Fisher Scientific, Inc.

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. QIAGEN

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others