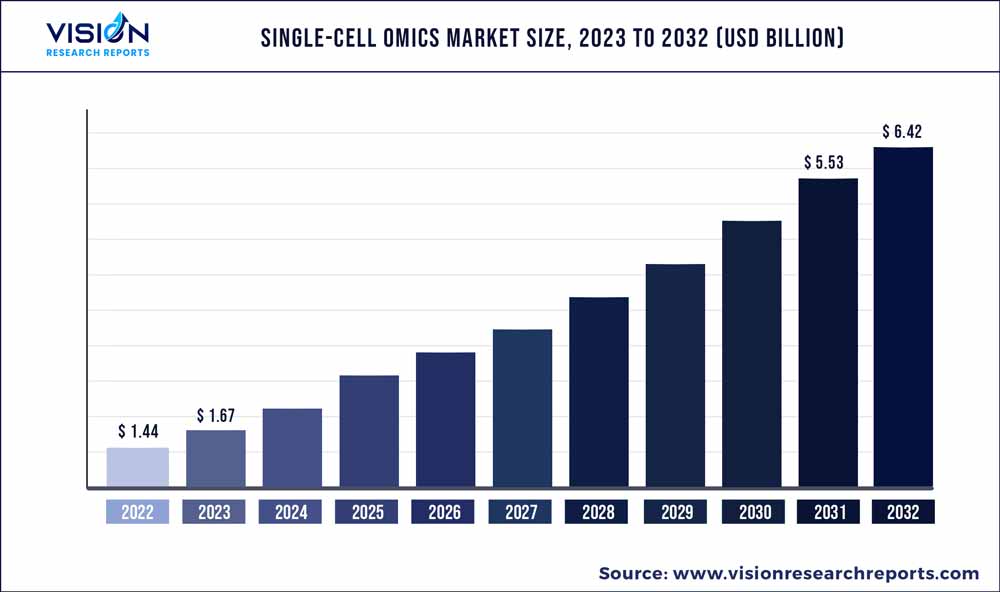

The global single-cell omics market was valued at USD 1.44 billion in 2022 and it is predicted to surpass around USD 6.42 billion by 2032 with a CAGR of 16.13% from 2023 to 2032. The single-cell omics market in the United States was accounted for USD 556.9 million in 2022.

Key Pointers

Report Scope of the Single-cell Omics Market

| Report Coverage | Details |

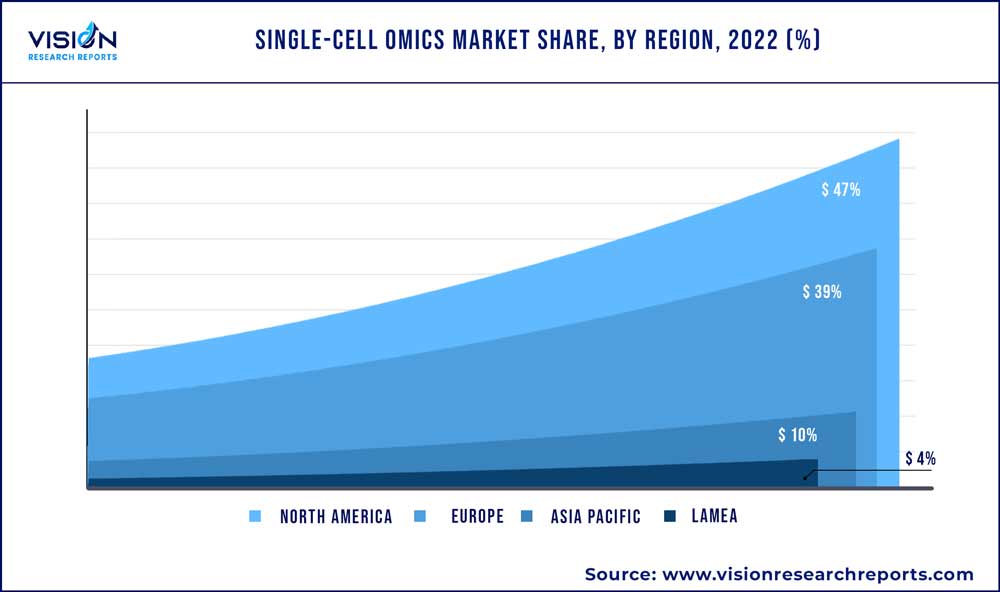

| Revenue Share of North America in 2022 | 47% |

| CAGR of Asia Pacific from 2023 to 2032 | 17.86% |

| Revenue Forecast by 2032 | USD 6.42 billion |

| Growth Rate from 2023 to 2032 | CAGR of 16.13% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | CYTENA GmbH; 10x Genomics; BD; CELLENION; PerkinElmer Inc.; ANGLE plc; Illumina, Inc.; Bio-Rad Laboratories, Inc.; Mission Bio; Standard BioTools Inc. |

The market is mainly driven by technological advancements in single-cell analysis & increase in large-scale genomics studies leveraging single-cell RNA sequencing. In addition, the rapidly growing biotechnology and biopharmaceutical industries and increasing demand for biologics are other factors propelling market growth forward. Also, the surge in the prevalence of life-threatening conditions has propelled the demand for personalized medicine.

COVID-19 had a positive impact on the market as this technology was in high demand to investigate the viral-host interactions, immune response, and the effects of the virus on various cell types. In addition, technology has been used in developing precision diagnostics by studying specific markers. The technology is projected to witness more growth opportunities owing to the rising burden of chronic diseases and rising demand for novel therapeutics.

The increasing prevalence of cancer and rising applications of single-cell analysis in studying cancer progression is projected to fuel the demand for omics technology in understanding the cell biology of cancer. According to the Canadian government, cancer is the leading cause of death in the country. Furthermore, according to the Canadian Cancer Society, about 2 in 5 Canadians are expected to develop cancer during their lifetime. The single-cell omics analysis offers a brief identification of various immune subsets at higher resolution and offers an opportunity to understand overall tumor progression. In addition, individual cellular omics involve analysis of individual cells that facilitate accurate diagnosis and monitoring of treatment efficacy.

New advances in single-cell technologies are facilitating the opportunity to discern biological insights within individual cells. Moreover, the newer single-cell platforms have fueled cellular separation and analysis capabilities that have created higher interest among researchers, particularly in the arena of individual cellular genomics. Thus, the evolving demand for novel single-cell analysis platforms is pushing manufacturers to launch innovative products in the market. For instance, in June 2021 Cellenion and SCIENION launched cellenCHIP 384 for single-cell omics sample preparation. With this launch, the company expanded its automated capabilities and high throughput workflows.

Moreover, the increasing importance of single-cell omics and their evolving application in cell biology and personalized medicine have garnered momentum for this technology. In addition, rising interest in single-cell analysis research and rising funding programs are projected to support market growth. For instance, in November 2022, the Texas A&M University System received a grant of USD 1.19 million from NIH to leverage single-cell sequencing technology. This project aims to bolster cancer diagnosis, treatment, and prevention.

Furthermore, the other remarkable trend in this discipline is the advent of multi-omics. This approach improves data efficiency and quality through the study of multiple analytes concurrently with techniques such as splitting samples, combined analysis, or altering one class of analytes into another. An example of such a multi-omics method is transcriptomes, which work by sequencing (CITE-seq by Illumina) and cellular indexing of epitopes. This method combines the sequencing and capturing of RNA inside the cell by utilizing barcoded antibodies that interact with the epitopes on the cell surface.

Product Type Insights

The single-cell genomics segment was the leading revenue contributor for the market in 2022 and held 46% of the market share. Factors such as increasing demand from a wide range of end-users, potential clinical applications of single-cell genomics platforms, and technological advancements are the major factors driving segment growth. New technologies like microfluidics, high-throughput sequencing platforms, and droplet-based methods enabled researchers to study cellular heterogeneity at unprecedented resolution.

Moreover, efforts from market players to accelerate their single-cell level sequencing capabilities are another factor supporting segment uptake. For instance, in February 2023 Singular Genomics Systems, Inc. announced the launch of Max Read kits for single cell applications on the C4 sequencing platform of a company. This newly launched product will increase the output and decrease the overall cost of experiments.

The growing interest in metabolomics, rising funding from government and non-government organizations to accelerate metabolomics research, and rising applications in disease research are some of the factors driving the single-cell metabolomics segment. Moreover, the potential of advances in metabolomics and integration of single-cell metabolomics in cancer diagnostics owing to its higher sensitivity of detecting cancer cells are likely to create high momentum for the segment in the coming years.

Application Insights

The oncology segment led the single-cell omics market in 2022 with a share of 56% and the segment is also projected to exhibit the highest growth rate during the 2023-2032 period. The rising burden of cancer globally, rapid evolution in single-cell analysis techniques, and rising adoption of omics-based tools to study cancer progression are projected to support a high market share of the segment. According to Globocan 2020, China reported around 4.57 million cancer cases with around 3 million deaths. Thus, the higher burden of cancer has significantly augmented the demand for novel approaches to reduce and manage the global burden. The omics-based tools remain extremely significant to study tumor progression and analyze tumor cell heterogeneity that can aid effective diagnosis and foster treatment outcomes.

Furthermore, the rising adoption of personalized medicine for the treatment of a variety of cancers has contributed to segment uptake as single-cell genomics becomes increasingly important in precision medicine to foster diagnosis and overall monitoring of disease. Market players such as Mission Bio; CYTENA; Illumina; and others offer comprehensive solutions for different cancers.

The immunology segment is projected to hold the second-fastest CAGR of 15.93% during the forecast period. Ongoing research studies, supportive government legislation, and robust demand for advanced therapeutics have driven the segment to a certain extent. In addition, the rising adoption of single-cell omics in developing various immunotherapies and therapeutic antibodies has propelled segment uptake.

End-User Insights.

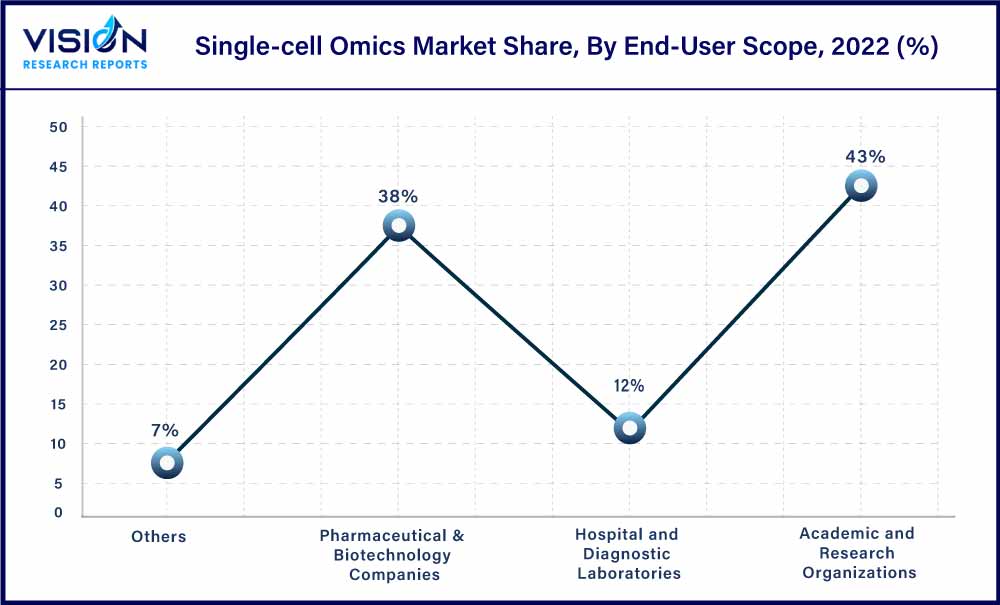

The academic and research organizations segment dominated the end-user segment of the market with a 43% market share in 2022. The rising usage of technology on college campuses, increasing research efforts to develop novel modeling tools, and rising research studies by various research institutes to explore diverse applications of cellular biology are projected to drive segment growth. Moreover, researchers are exploring numerous applications of single-cell technologies across various fields, including transcriptomics, genomics, proteomics, epigenomics, and metabolomics. For instance, in March 2023, Schmidt Futures granted USD 550 million to a new research facility focused on developing single-cell proteomics technologies.

Increasing efforts by pharmaceutical and biotech companies to develop advanced targeted therapeutics, increasing R&D investments, and rising efforts from these companies to facilitate drug discovery is anticipated to drive segmental growth. In addition, rising collaboration between companies to develop novel technologies is further contributing to segment expansion. For instance, in February 2023 Ultima Genomics, Inc partnered with 10x Genomics to enable the integration of chromium single cellular applications on ultima sequencers.

Regional Insights

North America accounted for the largest share of the global market and accounted for 47% of the market in 2022. The presence of several market players and various developments made by them are some of the key factors driving regional growth. Moreover, the presence of advanced healthcare and rising R&D activities for the development of novel technologies are other factors propelling the regional market. In addition, supportive government legislation, the rising importance of cellular therapies, and the growing trend for precision medicine are further supporting the regional market. For instance, the U.S. has implemented the precision medicine initiative to improve health and treat diseases.

Asia Pacific is estimated to grow at the fastest rate of 17.86% CAGR from 2023 to 2032. Factors such as the increasing burden of target disease and rising demand for advanced therapeutics are anticipated to drive the single-cell omics market in the region. The rising interest of market players to capture untapped market potential and rising investments by them in the region are facilitating the region’s market growth. Moreover, growing agreements between companies to strengthen their market avenues is another potential factor driving the regional market. For instance, in December 2021, Mission Bio and SequMed signed an agreement that allowed Mission Bio to leverage its offerings in China.

Single-cell Omics Market Segmentations:

By Product Type Scope

By Application Scope

By End-User Scope

By Regional Scope

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Type Scope Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Single-cell Omics Market

5.1. COVID-19 Landscape: Single-cell Omics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Single-cell Omics Market, By Product Type Scope

8.1. Single-cell Omics Market, by Product Type Scope, 2023-2032

8.1.1 Single-Cell Genomics

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Single-Cell Transcriptomics

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Single-Cell Proteomics

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Single-Cell Metabolomics

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Single-cell Omics Market, By Application Scope

9.1. Single-cell Omics Market, by Application Scope, 2023-2032

9.1.1. Oncology

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Cell Biology

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Neurology

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Immunology

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Single-cell Omics Market, By End-User Scope

10.1. Single-cell Omics Market, by End-User Scope, 2023-2032

10.1.1. Pharmaceutical & Biotechnology Companies

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Academic and Research Organizations

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Hospital and Diagnostic Laboratories

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Single-cell Omics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.1.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.1.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.2.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.2.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.3.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.3.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.4.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.4.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.5.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.5.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product Type Scope (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application Scope (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-User Scope (2020-2032)

Chapter 12. Company Profiles

12.1. CYTENA GmbH

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. 10x Genomics.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. BD.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. CELLENION.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. PerkinElmer Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. ANGLE plc

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Illumina, Inc..

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Bio-Rad Laboratories, Inc

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Mission Bio.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Standard BioTools Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others