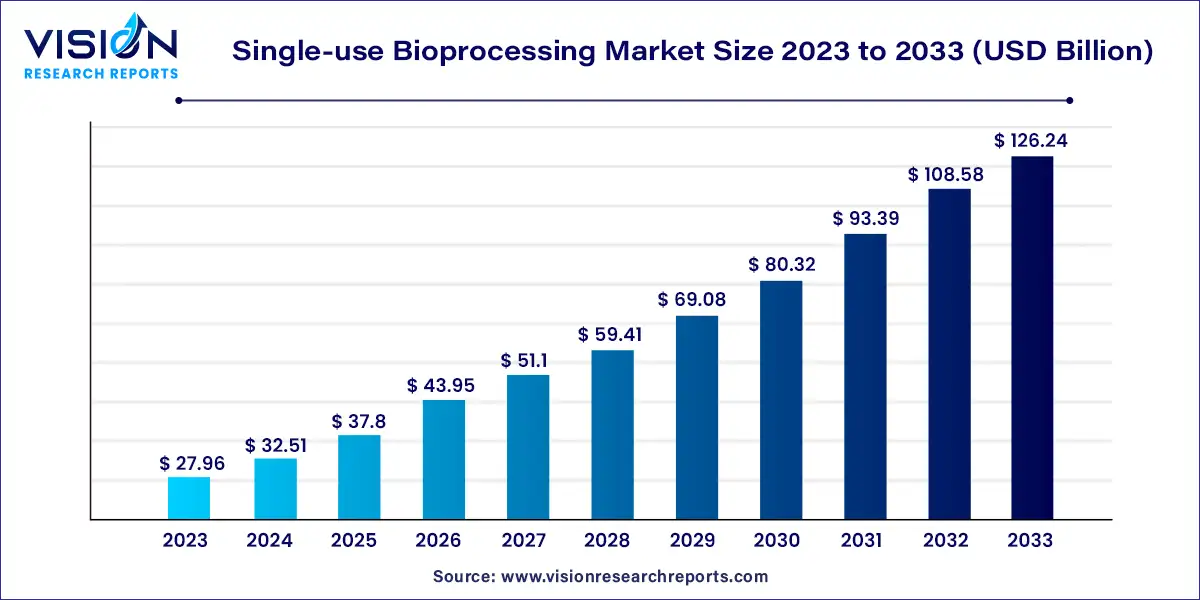

The global single-use bioprocessing market size was estimated at around USD 27.96 billion in 2023 and it is projected to hit around USD 126.24 billion by 2033, growing at a CAGR of 16.27% from 2024 to 2033.

In recent years, the biopharmaceutical industry has witnessed a significant paradigm shift towards single-use bioprocessing solutions. This transformative trend has revolutionized the way biopharmaceuticals are manufactured, offering unparalleled flexibility, cost-effectiveness, and efficiency. In this overview, we delve into the dynamics driving the single-use bioprocessing market and its implications for the biopharmaceutical sector.

The growth of the single-use bioprocessing market is propelled by an increasing demand for biologics and biosimilars fuels the adoption of single-use systems due to their ability to streamline production processes and reduce costs. Additionally, the inherent flexibility and scalability of single-use bioprocessing solutions enable manufacturers to quickly adapt to changing market dynamics and scale production as needed, driving market expansion. Moreover, the stringent regulatory requirements in the biopharmaceutical industry necessitate the adoption of technologies that minimize the risk of contamination and ensure product quality and safety, further driving the demand for single-use systems.

The segment of simple and peripheral elements dominated the market in 2023, holding a significant market share of 50%. This was primarily attributed to continuous innovations in these products and the increasing importance of bioprocessing operations within the overall manufacturing process. Tubing, filters, connectors, and transfer systems were the key contributors to this segment's dominance, with tubing and connectors being commonly provided by most single-use suppliers in a format compatible with single-use bags, bioreactors, and other bioprocessing equipment. For example, Thermo Fisher Scientific, Inc. offers customization options to integrate tubing and connectors into its bioprocessing container bags and other equipment, further bolstering this segment's growth.

On the other hand, the segment of apparatus and plants is projected to exhibit rapid growth throughout the forecast period, driven primarily by its extensive penetration in the bioprocessing domain, largely fueled by the availability of a diverse range of single-use bioreactors. These bioreactors come in various working volume ranges, starting from as low as 15 mL and extending up to 6000 L. For instance, products like the Ambr 15 and 250 from Sartorius AG cater to smaller volumes, while larger volumes are served by offerings such as the CSR 7500 SUB from ABEC. This diverse range of options empowers end-users to seamlessly scale their production processes from clone selection and benchtop production to the harvesting of high-volume yields of biologics. Consequently, the availability of such a broad spectrum of apparatus and plants for bioprocessing is expected to be a major driver for this segment's growth.

The upstream bioprocessing segment emerged as the market leader in 2023, holding the largest share. This dominance can be attributed to ongoing developments and advancements in technologies specifically tailored for upstream bioprocessing. Notably, products like the Ambr 15 micro-bioreactor system from Sartorius AG exemplify this trend, offering high-throughput upstream process development alongside efficient cell culture processing and media and feed optimization. With automated experimental setup and sampling capabilities, these advanced solutions have the potential to significantly reduce the time required for upstream bioprocessing operations, thus fueling growth within this segment.

Conversely, the fermentation segment is poised to experience a notable compound annual growth rate (CAGR) over the forecast period. This anticipated growth is largely driven by the introduction of several innovative fermentation offerings designed to optimize conditions for bioprocessing reactions. For instance, Thermo Fisher Scientific, Inc.'s HyPerforma Enhanced S.U.F enhances oxygen mass transfer and temperature control within the culture by increasing the surface areas of turbine impellers and cooling jackets, respectively. Additionally, companies like Cytiva are actively introducing single-use fermentation solutions such as the Xcellerex XDR MO, a stirred tank system boasting powerful mixing capabilities, efficient temperature control, and high oxygen transfer capacities tailored for microbial cell culture. These significant innovations are expected to contribute substantially to revenue generation within the fermentation segment.

Biopharmaceutical manufacturers emerged as the dominant players in the market, capturing the highest share in 2023. This dominance is attributed to the increasing commercial success of biologics in recent years and the growing reliance on contract manufacturing and research services. Contract research organizations (CROs) and contract manufacturing organizations (CMOs) offer numerous advantages in bioprocessing operations, including scalability, flexibility, reduced internal infrastructure requirements, and dedicated supply channels. These benefits are driving the widespread adoption of contract services and are expected to contribute positively to industry growth in the foreseeable future.

Meanwhile, academic and clinical research institutes are projected to exhibit the fastest compound annual growth rate (CAGR) during the period 2024-2033. The availability of benchtop-scale bioprocessing equipment and advancements in single-use systems have accelerated their adoption in academic and research settings. For instance, institutes like the National Institute for Bioprocessing Research and Training (NIBRT) in Ireland provide contract research services for biologics while also offering workshops and training programs focused on single-use technologies. Furthermore, the involvement of academic institutes and scientific communities in the development of novel biologics such as cell and gene therapies and vector production is expected to drive increased adoption of single-use systems, thanks to their cost reduction and flexibility benefits.

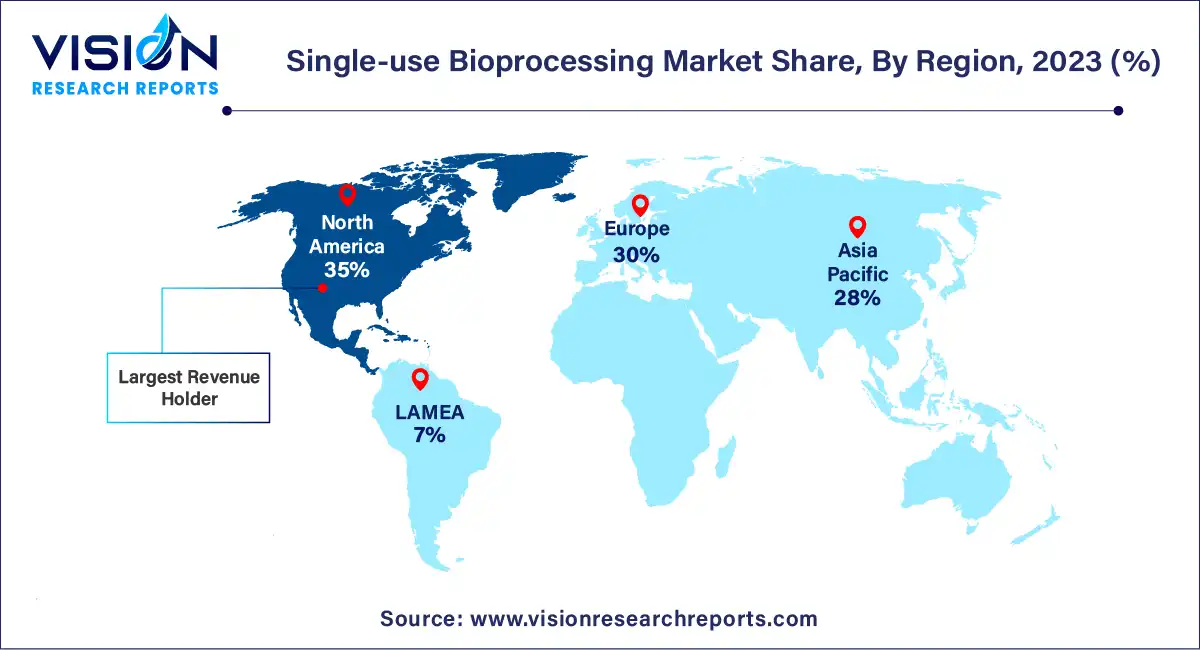

In 2023, North America commanded the largest revenue share, accounting for over 35% of the market. This can be attributed to the region's well-established pharmaceutical and biomanufacturing industry, along with a high level of research and development (R&D) activities. Additionally, the increasing emphasis on vaccine production to combat diseases has propelled the demand for single-use bioprocessing equipment in the region. Moreover, the presence of the Bio-process System Alliance (BPSA) in North America, dedicated to advancing the adoption of single-use technologies, is expected to further boost sales of disposable systems.

Conversely, the Asia Pacific region is projected to witness the fastest growth rate during the forecast period. The region's expanding bioprocessing market has attracted multiple investments from global companies, facilitating the establishment of regional presence and tapping into untapped opportunities. Furthermore, the growing interest of contract service providers in expanding their operations in the Asia Pacific region, coupled with the trend of adopting disposable systems in contract manufacturing organizations (CMOs), is driving continued investments by both local and global companies. For example, in September 2021, Lonza expanded its drug development facility in Singapore, enhancing its capacity to meet the increasing manufacturing demands in the region.

By Product

By Workflow

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Single-use Bioprocessing Market

5.1. COVID-19 Landscape: Single-use Bioprocessing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Single-use Bioprocessing Market, By Product

8.1. Single-use Bioprocessing Market, by Product, 2024-2033

8.1.1 Simple & Peripheral Elements

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Apparatus & Plants

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Work Equipment

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Single-use Bioprocessing Market, By Workflow

9.1. Single-use Bioprocessing Market, by Workflow, 2024-2033

9.1.1. Upstream Bioprocessing

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Fermentation

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Downstream Bioprocessing

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Single-use Bioprocessing Market, By End-use

10.1. Single-use Bioprocessing Market, by End-use, 2024-2033

10.1.1. Biopharmaceutical Manufacturers

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Academic & Clinical Research Institutes

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Single-use Bioprocessing Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Sartorius AG

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Danaher Corp.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Thermo Fisher Scientific, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Merck KGaA

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Avantor, Inc

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Eppendorf SE

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Corning Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Boehringer Ingelheim International GmbH

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Lonza

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Infors AG

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others