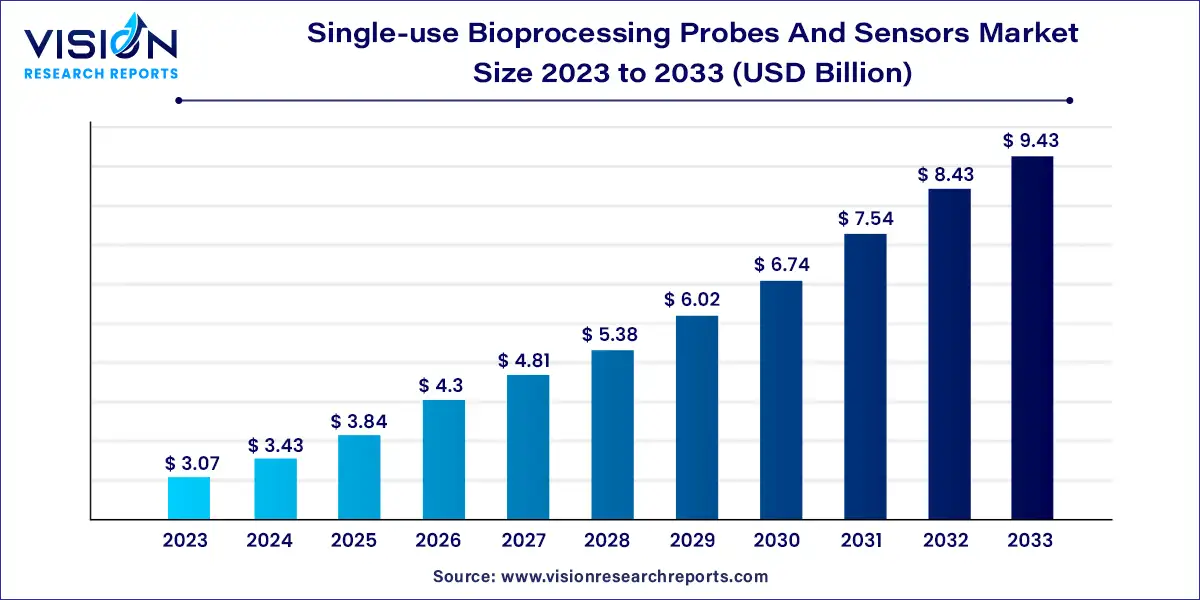

The global single-use bioprocessing probes and sensors market size was estimated at around USD 3.07 billion in 2023 and it is projected to hit around USD 9.43 billion by 2033, growing at a CAGR of 11.88% from 2024 to 2033.

The single-use bioprocessing probes and sensors market is experiencing significant growth driven by the increasing adoption of single-use technologies in bioprocessing applications. These probes and sensors play a crucial role in monitoring and controlling various parameters such as temperature, pH, dissolved oxygen, and pressure in bioprocessing operations.

The growth of the single-use bioprocessing probes and sensors market is propelled by an increasing demand for biopharmaceuticals and biologics is driving the adoption of single-use technologies in bioprocessing. These technologies offer advantages such as reduced risk of cross-contamination and lower operational costs, making them attractive to biopharmaceutical manufacturers. Additionally, advancements in sensor technologies, including miniaturization and wireless connectivity, enable real-time monitoring and optimization of bioprocessing operations, further fueling market growth. Moreover, stringent regulatory requirements for biopharmaceutical manufacturing and the need for enhanced process flexibility and scalability are driving the adoption of single-use probes and sensors.

| Report Coverage | Details |

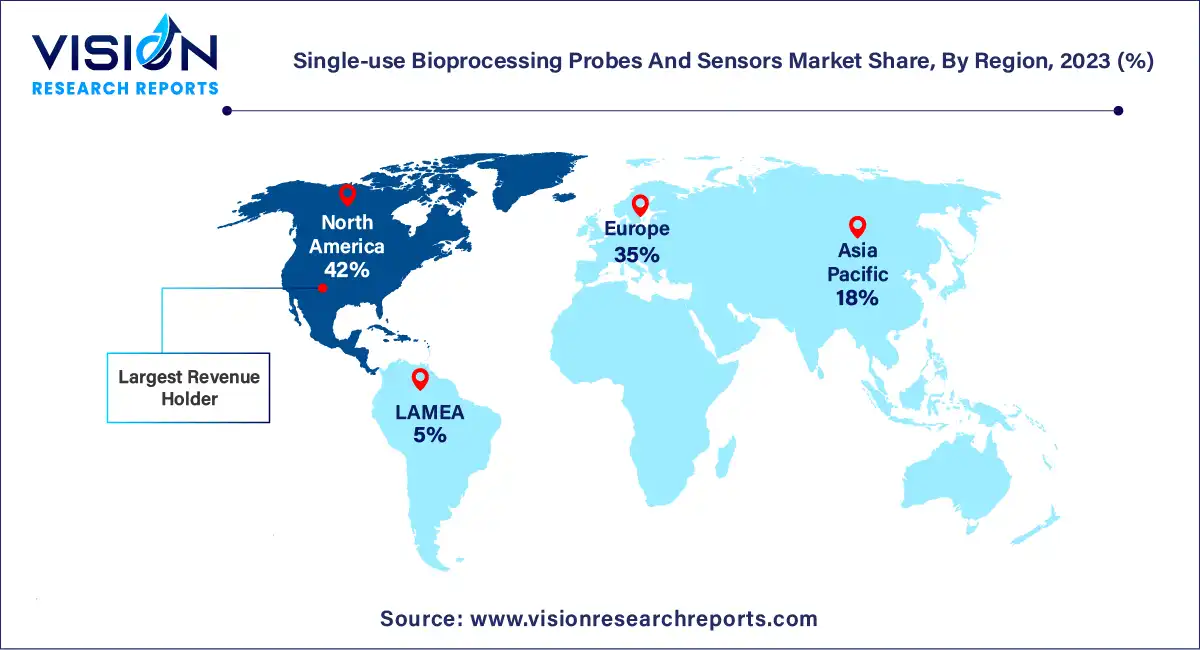

| Revenue Share of North America in 2023 | 42% |

| CAGR of Asia Pacific from 2024 to 2033 | 12.75% |

| Revenue Forecast by 2033 | USD 9.43 billion |

| Growth Rate from 2024 to 2033 | CAGR of 11.88% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on the sensor type, the market is segmented into sensors of pH, oxygen, pressure, temperature, conductivity, flow sensors, and others. pH sensors accounted for the largest market share of 21% in 2023 and are expected to grow at the fastest CAGR during the forecast period. It is one of the vital products that is generally utilized for water measurements. These sensors help measure the acidity and alkalinity of water in other solutions. Factors, such as the high usage rate and increasing product penetration, have propelled the segment growth and demand. Moreover, technological advances in the segment, such as pH sensors with an in-built temperature sensor, are anticipated to fuel the segment's growth over the forecast period.

The oxygen sensors segment is projected to grow at a lucrative CAGR of 12.99% from 2024 to 2033. Factors, such as the increasing prevalence of chronic disorders and the development of disposable sensors, are projected to drive a high growth rate in the segment. Moreover, many disposable sensors facilitate users to measure Dissolved Oxygen (DO) separately. DO level measurement is the physicochemical parameter monitored mostly in bioprocessing engineering. Several companies engaged in marketing and manufacturing disposable sensors to measure DO include Hamilton Company; Eppendorf AG; Applikon Biotechnology, Inc., Finesse; and Polestar Technologies.

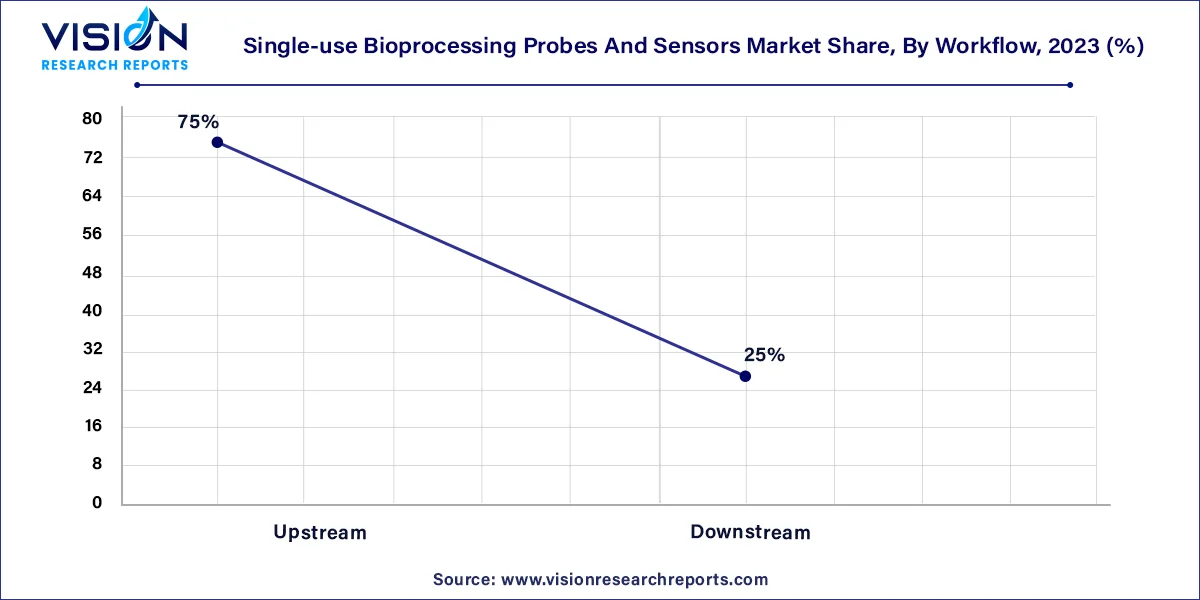

On the basis of workflow, the market is segmented into upstream and downstream. The upstream segment dominated the market with a revenue share of 75% in 2023. The high revenue share of the segment is attributed to the increasing adoption of single-use media bags and bioreactors by manufacturers involved in the upstream manufacturing process. An effective upstream method typically depends on identifying Critical Process Parameters (CPPs) and using a bioreactor sensor type, which can deliver adequate control over CPPs. In an upstream process, Critical Process Parameters (CPPs) that are typically scrutinized comprise Dissolved Oxygen (DO), temperature, and pH.

Moreover, additional factors, such as viable-cell density, culture viability, specific growth rate, nutrient levels, and other measurable parameters are considered CPPs. The downstream processing is projected to register a lucrative CAGR of 11.81% from 2024 to 2033. The purification/polishing and affinity capture steps are considered expensive in this process. The continuous efforts by key players operating in the market to increase the use of disposables in the downstream process are anticipated to support the segment's growth over the forecast period.

The biopharmaceutical & pharmaceutical companies segment accounted for the largest revenue share of 44% in 2023. Consistent new product developments in the market are driving the segment's growth. Moreover, increased adoption of disposables among in-house bio manufacturers to efficiently fulfill the worldwide rising demand for biopharmaceuticals is one of the major aspects of the growth of the biopharmaceutical manufacturer segment.

The academic & research institutes segment is anticipated to register the fastest CAGR of 15.15% from 2024 to 2033. The factors attributed to the growth of the segment include increasing research & development activities in the fields of biotechnology, pharmaceuticals & bioengineering. The research activities need accurate and reliable data, which drives the demand for single-use bioprocessing probes and sensors. Moreover, the advantages of single-use probes and sensors over traditional ones are anticipated to drive their demand over the forecast period.

North America dominated the market with a share of 42% in 2023. The regional market covers two countries, i.e., the U.S. and Canada. The dominance of the region is due to the existence of several biopharmaceutical manufacturers in the U.S. These manufacturers include FUJIFILM Diosynth Biotechnologies U.S.A., Inc.; DPx Holdings; CMC Biologics; Amgen; and AbbVie, Inc. Many companies operating in the region undertakes steps associated with bioprocessing. In addition, the region is home to various small- and large-scale OEMs like Entegris, Inc., PBS Biotech, Inc., Thermo Fisher, GE Healthcare, and Pall Corporation. These players contribute to the large market share of the region. The rising investment in the market is also propelling the region’s growth. For instance, in February 2023, Thermo Fisher Scientific, Inc., invested USD 40 million for the expansion of its single-use technology manufacturing facility in Pennsylvania.

These factors support the regional market growth in the industry. Asia Pacific is expected to grow at a significant CAGR of 12.75% from 2024 to 2033. The recognition and emergence of countries in the Asia Pacific as a hub for biopharmaceutical outsourcing will support the region’s growth. In addition, major industry players are focusing on expanding into Asian countries. For instance, in January 2023, Thermo Fisher Scientific, Inc. revealed the launch of a new manufacturing facility in China. The facility utilizes single-use technologies to manufacture drug substances and products and is expected to support a wide range of production volumes and scales. The presence of emerging economies, such as China and India, and the introduction of disposable products by bio manufacturers are driving the market growth.

By Sensor Type

By Workflow

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Sensor Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Single-use Bioprocessing Probes and Sensors Market

5.1. COVID-19 Landscape: Single-use Bioprocessing Probes and Sensors Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Single-use Bioprocessing Probes and Sensors Market, By Sensor Type

8.1. Single-use Bioprocessing Probes and Sensors Market, by Sensor Type, 2024-2033

8.1.1 pH Sensor

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Oxygen Sensor

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Pressure Sensors

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Temperature Sensors

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Conductivity Sensors

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Flow Meters & Sensors

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Single-use Bioprocessing Probes and Sensors Market, By Workflow

9.1. Single-use Bioprocessing Probes and Sensors Market, by Workflow, 2024-2033

9.1.1. Upstream

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Downstream

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Single-use Bioprocessing Probes and Sensors Market, By End-use

10.1. Single-use Bioprocessing Probes and Sensors Market, by End-use, 2024-2033

10.1.1. Biopharmaceutical & Pharmaceutical Companies

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. CROs & CMOs

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Academic & Research Institutes

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Other End-users

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Single-use Bioprocessing Probes and Sensors Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Sensor Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Thermo Fisher Scientific Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Sartorius AG.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Danaher.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. PreSens Precision Sensing GmbH.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. ABEC.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Hamilton Company

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. PendoTECH.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Equflow

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. PARKER HANNIFIN CORP.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Dover Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others