The global single-use mixers market size was estimated at around USD 1.26 billion in 2022 and it is projected to hit around USD 2.84 billion by 2032, growing at a CAGR of 8.45% from 2023 to 2032. The single-use mixers market in the United States was accounted for USD 495.7 million in 2022.

Key Pointers

Report Scope of the Single-use Mixers Market

| Report Coverage | Details |

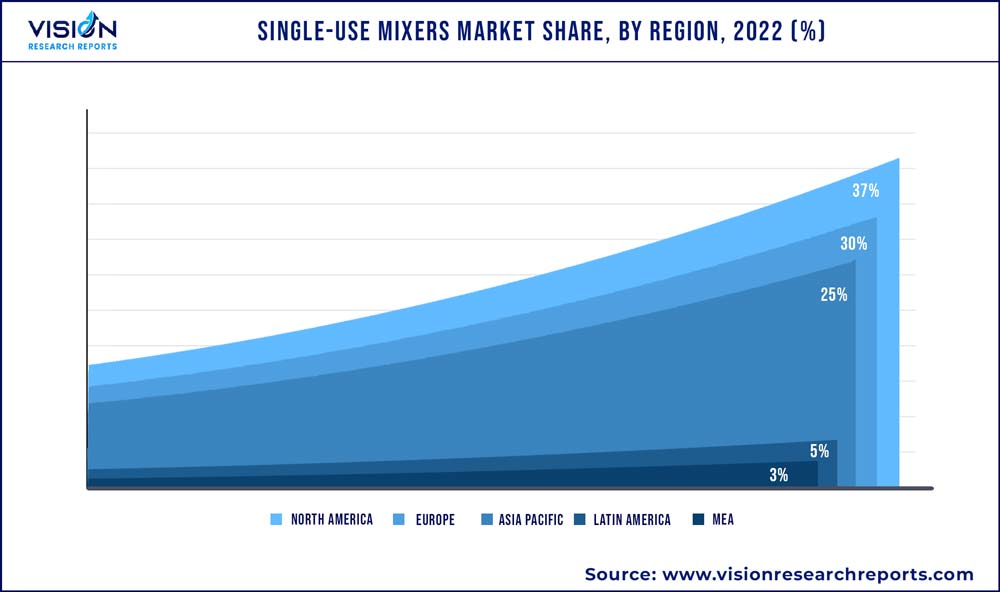

| Revenue Share of North America in 2022 | 37% |

| CAGR of Asia Pacific from 2023 to 2032 | 13.27% |

| Revenue Forecast by 2032 | USD 2.84 billion |

| Growth Rate from 2023 to 2032 | CAGR of 8.45% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Sartorius Stedim Biotech; Danaher; Merck KGaA; Thermo Fisher Scientific, Inc.; Meissner Filtration Products, Inc.; DrM, Dr. Mueller AG; VWR International, LLC.; CerCell A/S; AGILITECH; Holloway America, LLC. |

The growing demand for biopharmaceuticals, the increasing concern for the environment, and the rising menace of cross-contamination are the major factors responsible for the growth of the single-use mixers industry. In addition, the increasing adoption of single-use technology, and huge cost benefits in terms of construction and operation are other drivers which are expected to fuel the market growth of single-use mixers (SUM).

According to an article published by WHO, in November 2022, nearly 16 billion vaccine doses, worth USD 141 billion, were supplied in the year 2021, which is approximately thrice the market volume of 2019 (that is 5.8 billion) and about three-and-a-half times the market value of 2019 (USD 38 billion). The primary driver to increase the industry growth of SUM is the production of vaccines. The COVID-19 vaccines were principally responsible for the rise, demonstrating the great potential for scaling up vaccine production in response to medical requirements. In addition, despite an expansion in manufacturing capacity worldwide, it is still very concentrated, 70% of vaccination doses are supplied by ten manufacturers alone (excluding COVID-19). Due to the urgent need for vaccines and therapeutics to combat the pandemic, the development and manufacturing of vaccines and therapeutics require the use of single-use technologies such as SUM, which helped to ensure the products are safe and free from contamination. Thus, increasing the demand for the production of vaccines is anticipated to propel the upsurge of the market.

Various government initiatives in the production of vaccines are also expected to grow the demand for SUM over the forecast period. For instance, until March 2022, the U.S. government invested around USD 31.9 billion to develop, make, and buy mRNA covid-19 vaccines, including significant investment in the three decades prior to the pandemic. Furthermore, in June 2020, to accelerate the production, and distribution of vaccines against COVID-19, the European Commission unveiled the EU Vaccines Strategy. In addition, in May 2021, the federal government confirmed a USD 200 million investment to support the construction of a factory in Mississauga, Ontario, that will produce millions of mRNA vaccines. Hence, various initiatives and investments made by governments are expected to bolster the expansion of the industry.

The growing trends in the biopharmaceutical industry are anticipated to be the progression of the industry.The shift towards personalized medicine is driving the growth of the biopharmaceutical industry, thus, fueling the growth of SUM. Moreover, the increasing demand for biosimilars is also driving the growth of single-use technology. In May 2021, the biopharmaceutical industry reaffirms its commitment to working with governments to assist the initiatives that it made to the G20's COVID-19 response. Specifically, the industry pledged to continue providing treatments, vaccines, and diagnostics to combat the COVID-19 pandemic, and to support the World Health Organization's Access to COVID-19 Tools Accelerator (ACT-A) initiative. Thus, anticipated to propel the development of the market during the estimated period.

Product Insights

In 2022, the consumables & accessories segment dominated with a market share of 59% and is estimated to have the highest CAGR of 9.37% during the forecast period. This is attributed to the increasing demand for mixing various fluids such as buffers, culture media, and processes for various research purposes and vaccine production. Furthermore, many consumables and accessories such as mixing bags, can be customized as per the demand of the client, thus reducing the costs and minimizing the contamination risk, henceforth helping keep the environment clean.

Mixing systems are an important tool for R&D applications in the biopharmaceutical industry. Factors such as flexibility, scalability, cost-effectiveness, and reduced contamination risk make them an attractive option for R&D centers. Moreover, the mixing system eliminates the need for cleaning and sterilization, which reduces the time and resources required to prepare and conduct experiments.

Application Insights

In 2022, the research and development (R&D) & process development segment dominated the industry with a market share of 66% due to the tractability, scalability, cost-effectiveness, and reproducibility provided by these systems. SUM is particularly well-suited for vaccine development, where small variations in experimental conditions can have a significant impact on the final product. Thus, R&D & process development centers are increasingly turning to single-use technology to support them in conducting experiments speedily and with greater precision, which is driving the progress of the research and development (R&D) & process development segment for the industry.

Commercial manufacturing is anticipated to have the highest CAGR of 10.19% during the forecast period. The acceptance of technology in commercial manufacturing has been steadily increasing over the past decade. However, there are still some barriers to widespread adoption at the commercial level. One of the main reasons for the limited uptake of disposable is the perception of higher costs compared to traditional stainless-steel equipment. Although disposable equipment is more expensive upfront, it often delivers cost savings over the period due to reduced cleaning and validation requirements, and shorter turnaround times. Furthermore, these mixers generate less waste compared to traditional mixing methods, which helps reduce the environmental impact of commercial manufacturing processes. Biopharma companies have slowly started to use SUM for commercial manufacturing, that is, for large-scale production of biologics focusing on efficient and consistent production.

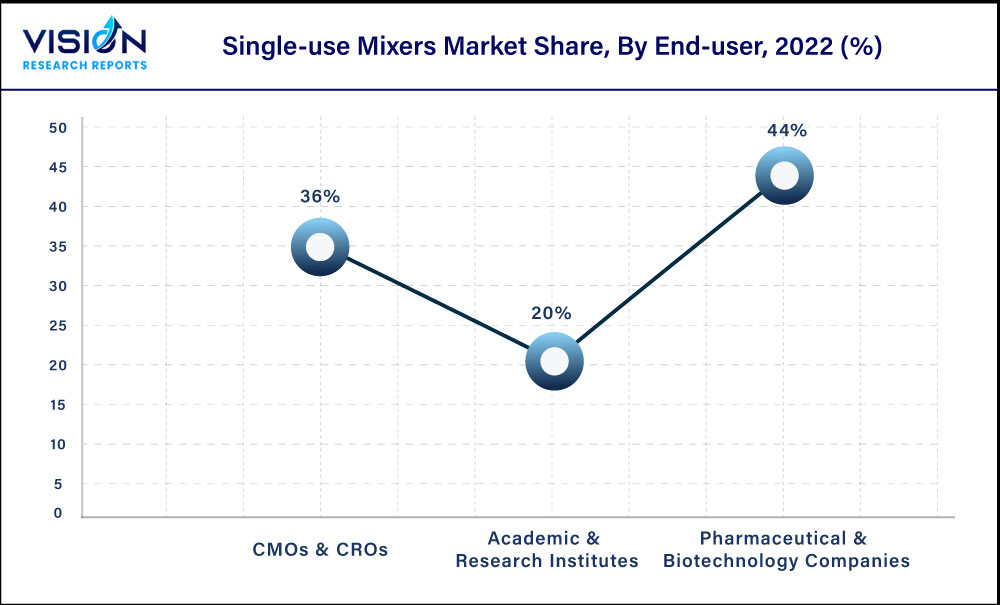

End-User Insights

In 2022, the pharmaceutical & biotechnology companies segment dominated with a market share of 44% due to the major commercial success of biologics. Bio-manufacturers are the key end-users of single-use technologies, including SUM. The benefits such as cost-effectiveness, compliance, flexibility, and adoption of innovative techniques give pharmaceutical & biotechnology opportunities to improve the manufacturing process. Thus, the rising demand for better production of vaccines and other biologics in a cost-effective way is anticipated to strengthen the industry in future years.

CMOs & CROs segment is anticipated to have the highest CAGR of 9.99% during the forecast period. Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) maintain competitiveness by producing biologics more effectively and affordably, especially for R&D and clinical trials. For instance, according to an article published by SIAPARTNERS in April 2022, approximately 60% of the companies indicated savings of around 10% to 25% through outsourcing, while the remaining 40% reported their savings up to 40%. The use of single-use technologies offers many benefits for CMOs and CROs, including improved flexibility, faster turnaround times, and reduced capital expenditures, hence it is anticipated to increase the demand for the market.

Regional Insights

In 2022, North America dominated the industry with a revenue share of 37%. The large share of this region is attributed to an increase in the adoption of novel technologies and biopharmaceuticals in the region for the analysis and treatment of clinical ailments. Additionally, a great number of market players in the region are engaged in the constant improvement of advanced tools for biopharmaceutical research. Moreover, government funding for research is estimated to bolster the industry of SUM. For instance, in June 2021, the U.S. Department of Agriculture’s (USDA) National Institute of Food and Agriculture (NIFA) made an investment of USD 5.4 million in bioengineering, bioprocessing, and biofuels, along with various other biobased product research.

Asia Pacific is anticipated to register the highest CAGR of 13.27% during the forecast period. The significant progress in the pharmaceutical and biotechnology industries in the region is one of the major factors contributing to the development of single-use technology. The countries like China, India, and Japan are estimated to witness lucrative growth due to growing government investment in R&D centers, thus influencing the significant use of SUM in vaccine production and other research. In India, in the 2022 budget, the Ministry of Science and Technology was given a budget of Rs. 14,217 crores (i.e. USD 1,706.04 million).

Single-use Mixers Market Segmentations:

By Product

By Application

By End-User

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Single-use Mixers Market

5.1. COVID-19 Landscape: Single-use Mixers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Single-use Mixers Market, By Product

8.1. Single-use Mixers Market, by Product, 2023-2032

8.1.1 Mixing Systems

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Consumables & Accessories

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Single-use Mixers Market, By Application

9.1. Single-use Mixers Market, by Application, 2023-2032

9.1.1. Research and Development (R&D) & Process Development

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Commercial Manufacturing

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Single-use Mixers Market, By End-User

10.1. Single-use Mixers Market, by End-User, 2023-2032

10.1.1. Pharmaceutical & Biotechnology Companies

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. CMOs & CROs

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Academic & Research Institutes

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Single-use Mixers Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by End-User (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-User (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by End-User (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-User (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-User (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-User (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by End-User (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-User (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-User (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-User (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-User (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-User (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-User (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by End-User (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-User (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-User (2020-2032)

Chapter 12. Company Profiles

12.1. Sartorius Stedim Biotech

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Danaher

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Merck KGaA

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Thermo Fisher Scientific, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Meissner Filtration Products, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. DrM, Dr. Mueller AG

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. VWR International, LLC.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. CerCell A/S

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. AGILITECH

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Holloway America, LLC.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others