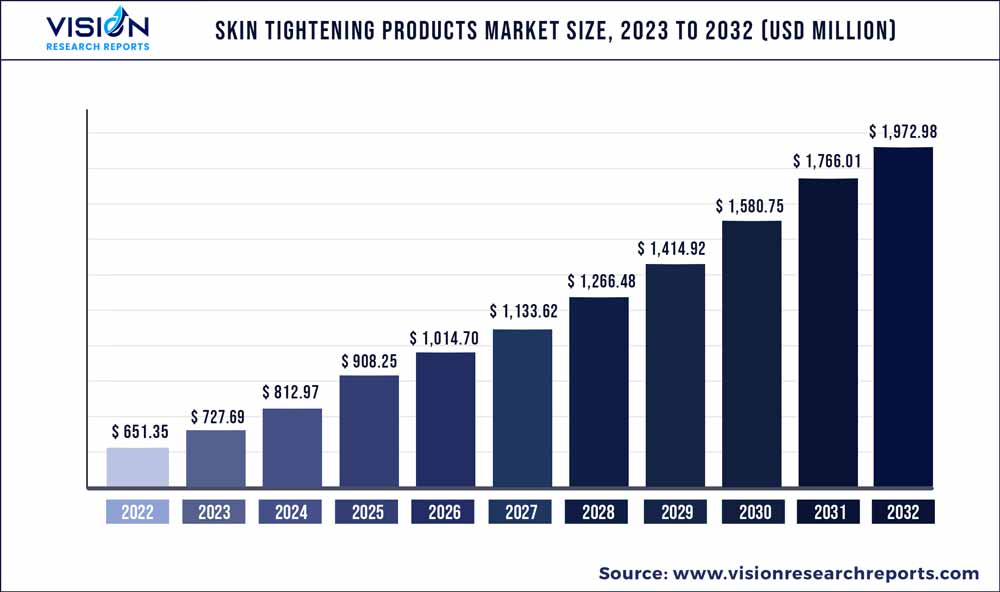

The global skin tightening products market was estimated at USD 651.35 million in 2022 and it is expected to surpass around USD 1,972.98 million by 2032, poised to grow at a CAGR of 11.72% from 2023 to 2032.

Key Pointers

Report Scope of the Skin Tightening Products Market

| Report Coverage | Details |

| Market Size in 2022 | USD 651.35 million |

| Revenue Forecast by 2032 | USD 1,972.98 million |

| Growth rate from 2023 to 2032 | CAGR of 11.72% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Neutrogena; Olay; Skin Ceuticals; The Ordinary; Kiehl’s; Clarins; Estée Lauder Inc; Murad, Dr. Dennis Gross Skincare; StriVectin |

The market expansion is anticipated to be fueled by a rising preference for non-invasive surgical procedures and increased consciousness regarding physical appearance.

The demand for non-surgical skin tightening treatments is increasing among people due to several factors, including the desire for a more youthful appearance without undergoing surgery, less downtime, and fewer risks and complications compared to invasive procedures. Additionally, the advancements in technology have made non-surgical skin tightening treatments more effective and accessible, with less discomfort and fewer side effects.

Another driving factor for the use of organic creams or serums is the growing awareness of the harmful effects of synthetic chemicals and additives in cosmetic products. Many people are now opting for natural and organic products to improve their skin texture and appearance, as they believe these products are safer and more effective in the long run. Additionally, natural products are often considered more sustainable and eco-friendly, which is also becoming a more important factor for many consumers.

The COVID-19 pandemic has caused many people to prioritize their health and well-being, including their skin health.The pandemic has also led to an increase in demand for non-invasive and at-home skin treatments, as people have been avoiding surgical treatments over their skin. This has led to a surge in sales of at-home skincare devices, such as LED light therapy masks and microcurrent devices, as well as sales of skincare products that can be used at home, including serums, face oils, and creams.

Product Insights

The serums segment dominated the market in 2022 with a share of more than 38.22%. In terms of the product segment the market has been segmented into four sub-segments including face oils, serums, creams/lotions, and others. People rely on face serums for skin tightening due to various reasons such as aging, sun damage, and lifestyle factors. Serums containing ingredients like retinol, vitamin C, hyaluronic acid, antioxidants, peptides, collagen, and niacinamide can help to firm up the skin, reduce wrinkles, repair sun damage, and combat the effects of poor lifestyle choices. In October 2021, NovaBay Pharmaceuticals, Inc. introduced a new product, the 15% niacinamide pore minimizing serum, to the DERMAdoctor Image Porefect collection. This formula is designed to minimize pores, decrease blackheads, even out skin tone, smooth rough skin, and improve acne and oily or combination skin. Additionally, it contains antioxidants that neutralize free radicals and ingredients that support collagen production.

The creams/lotions segment is projected to expand at a CAGR of 12.88% during the forecast period. People prefer using creams and lotions to tighten their skin as opposed to more invasive procedures like surgery or injections, which can be painful, expensive, and require significant downtime for recovery. Several creams and lotions are formulated with ingredients such as retinol, hyaluronic acid, peptides, and antioxidants, which are known to have skin-tightening and anti-aging benefits. These ingredients can help to stimulate collagen production, increase skin hydration, and reduce the appearance of wrinkles and fine lines.

Application Insights

The face-lifting segment dominated the market in 2022 with a share of more than 47.37%. Consumers prefer skin-tightening products containing ingredients such as retinoid, hyaluronic acid, and peptides to improve the texture and appearance of their skin, resulting in a more youthful and radiant appearance.

The anti-aging segment is projected to expand at a CAGR of 12.53% during the forecast period. The skincare industry has increasingly focused on personalized skincare solutions that address individual skin concerns and needs. This has led to the development of targeted skincare routines that can help reduce the appearance of aging and improve skin health. Ingredients like retinol, and vitamin C, can help to stimulate collagen production, increase skin hydration, and reduce the appearance of wrinkles and fine lines. In November 2022, Vitabrid C12 released a new product called the Wrinkle Serum Professional. The kit includes a 12-hour active Vitamin C powder (Vitabrid C12 FACE Brightening) and a Vitamin C and peptide serum (Vitabrid C12 Wrinkle Serum) to complement it. Together, these products provide anti-aging and antioxidant benefits, resulting in smoother, more youthful, and radiant skin.

Distribution Channel Insights

The specialty stores distribution channel dominated the distribution channel segment with a share of 34.84% in 2022. Specialty stores are a popular distribution channel for buying skincare products as they offer a wide selection of products that cater to different skin types, concerns, and preferences. These stores typically carry a range of high-quality and specialized skincare products from established brands, making it easier for consumers to find products that meet their needs.Additionally, specialty stores provide personalized recommendations and advice for skincare to customers thereby, helping them make informed decisions about the products they buy, leading to increased customer satisfaction and loyalty. Some of the specialty stores for skin tightening products include Sephora and Ulta that offer consumers with high end beauty and skincare products.

The online distribution channel segment is estimated to expand at a CAGR of about 13.96% during the forecast period. This segment has witnessed immense popularity over the past few years. The shift in consumer preference toward online channels is due to the convenience that the channel provides, such as high discounts, availability of a diverse range of products on a single platform, easy payment methods, on-door delivery, and others. Additionally, online retailers often carry a large variety of skincare including skin tightening products from different brands, compared to traditional brick-and-mortar stores. It allows consumers to choose the product that best fits their needs.

Regional Insights

North America dominated this market with a share of 32.07% in 2022. The percentage of health-conscious consumers in North America has increased as a result of campaigns and government initiatives that have stimulated market growth in the region. In addition, the region is home to notable brands like Candela Corporation, Hologic, Inc., Fotona, Cutera, and others that prioritize product innovation in order to meet the market's growing demand and gain a competitive edge.

Asia Pacific is expected to witness a CAGR of 12.88% from 2023 to 2032. The demand for skin tightening products in the Asia Pacific region is rapidly growing. People in countries like Japan, South Korea, China, and India are increasingly interested in skincare and are actively seeking ways to improve their skin texture. With the rise of social media and beauty influencers, there is more awareness of the importance of taking care of one's skin.

Skin Tightening Products Market Segmentations:

By Product

By Application

By Distribution Channel

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others