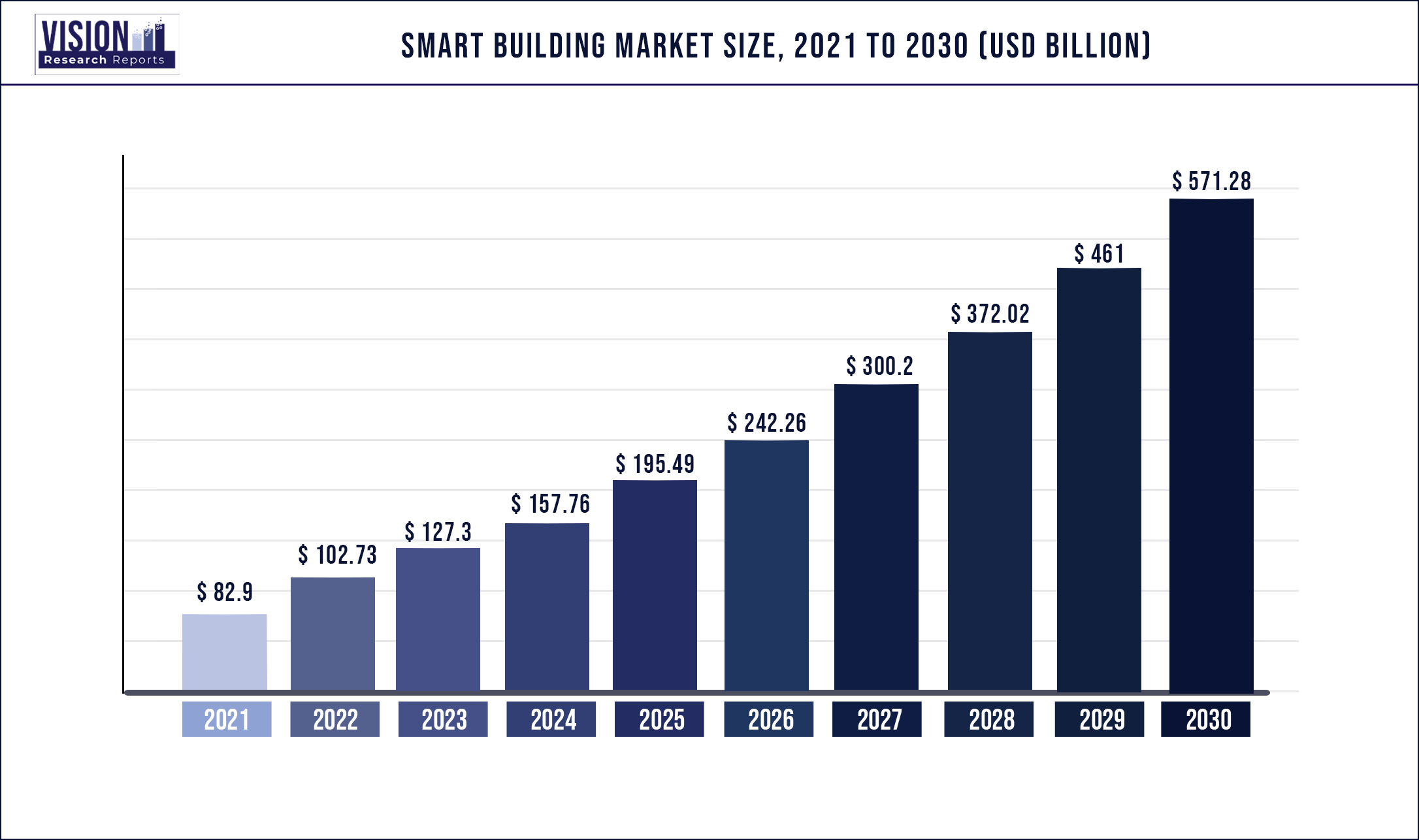

The global smart building market was estimated at USD 82.9 billion in 2021 and it is expected to surpass around USD 571.28 billion by 2030, poised to grow at a CAGR of 23.92% from 2022 to 2030.

Report Highlights

The growing demand for energy-efficient systems, the rise in adoption of Internet of Things (IoT)-enabled Building Management systems (BMS), and growing industry standards and regulations are anticipated to drive the adoption of smart building solutions and services.

Big data, cloud computing, and Internet of Things (IoT) technologies optimize workplaces, enhance individual working environments, increase productivity, and help employees adapt to changing lifestyles and careers. For instance, in December 2020, Hitachi, Ltd. launched an IoT platform for enhanced building operation quality and added value. The platform offered enhanced user experience and high management efficiency. These developments are expected to set the framework for inventing revolutionary technologies that will significantly improve human lifestyles in the coming years.

To enhance the management and performance of smart buildings, companies are providing maintenance and support for upgrading solutions. Moreover, the companies are pursuing routine solution evaluations to make specialized technological modifications and procedure improvements for performance optimization. Companies such as Johnson Controls, Siemens AG, and IBM Corporation invest a huge amount in R&D to introduce new technologies to the market and maintain their market dominance. For instance, in December 2020, Johnson Controls incorporated Microsoft's Digital Twin in its OpenBlue IoT platform, enabling it to construct in-depth digital replicas of actual structures, assets, and systems.

Several government bodies worldwide are pursuing smart building initiatives, emphasizing sustainability, drafting energy efficiency legislations, and encouraging public-private partnerships toward this end. Further, the rapid adoption of smart solutions by city administrations is prompting governments worldwide to support and fund the development of smart cities. For instance, an Australian consortium obtained government funding worth up to AUD 28 million (USD 16.3 million) to pursue an initiative aimed at transforming the way buildings is planned and constructed in Australia. All these efforts are expected to play a vital role in driving the growth of the market during the forecast period.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 82.9 billion |

| Revenue Forecast by 2030 | USD 571.28 billion |

| Growth rate from 2022 to 2030 | CAGR of 23.92% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Solution, service, end use, region |

| Companies Covered |

ABB Ltd.; Cisco Systems Inc.; Emerson Electric Co.; Hitachi, Ltd..; Honeywell International Inc.; Johnson Controls; Legrand.; Schneider Electric SE; Siemens; and Telit |

Solution Insights

The safety & security management segment accounted for the largest market share of 35.7% in 2021. Through proper planning, security management systems can easily integrate with smart buildings and help keep the building and people inside safe. Smart buildings are often equipped with Internet Protocol (IP)-enabled safety and security devices that provide facilities managers with a raft of new capabilities. These include data collection and analysis, integration with other in-house systems, and consolidated administration.

Further, for safety and security, several smart buildings are incorporated with fire advanced fire systems, by which managers can overview the health and performance of their buildings and fire systems remotely through their laptops, desktops, and smartphones. These benefits associated with advanced safety & security management systems are expected to drive the growth of the segment during the forecast period.

The energy segment is expected to grow at a CAGR of 26.73% during the forecast period. The segment growth can be attributed to the growing awareness of the benefits of implementing Energy Management Systems (EMS) across industrial, commercial, and residential properties. Further, an increase in the number of government initiatives aimed at reducing energy consumption is one of the key factors driving the growth of the market.

For instance, the government of India developed the Energy Conservation Building Code (ECBC) in May 2007 to set minimum requirements for the design and construction of energy-efficient buildings and systems. In October 2021, the U.S. Department of Energy (DOE) invested USD 61 million in smart building projects, promoting the adoption of renewable energy sources, and using technology to transform homes and offices into energy-efficient buildings.

Service Insights

The implementation segment accounted for the largest market share of 40.2% in 2021. The segment growth is attributed to the rise in the adoption of smart building services and software across various business sectors. Advanced building technology systems are installed and used as part of the service of smart buildings. Smart buildings use a range of actuators, sensors, and microchips to gather data and manage based on a business's activities and services. This infrastructure offers owners, operators, and facility managers the chance to enhance their assets' dependability and performance, ensuring constant comfort, security, energy efficiency, low operating costs, and convenience. Further, it also optimizes the use of available space and reduces the impact of buildings on the environment. These benefits offered by implementation services will enhance the segment growth.

The support and maintenance segment are expected to grow at a CAGR of 29.06% during the forecast period. Smart building solutions are implemented with the assistance of support services. To enhance the management and performance of smart buildings, vendors provide ongoing support and maintenance for upgrading solutions. Further, service providers for smart buildings assist in the implementation of intelligent automation and techniques for the cost-effective and efficient maintenance and operation of buildings. For instance, predictive building maintenance lowers the cost of handling real estate assets in a smart building and enhances the tenant experience, and stops malfunctions and minor issues from escalating to major difficulties. These capabilities will supplement the growth of the segment during the forecast period.

End-use Insights

The commercial segment held a market share of 53.6% in 2021 and is expected to dominate the market by 2030. In commercial buildings, advanced IoT sensors are installed in smart commercial buildings to gather data from various building systems and subsystems. The building operator can use this data to automate and improve building operations and maintenance. Moreover, building operators can use this data to enhance building controls and automate crucial building-management duties, such as heat and lighting, and discover operational inefficiencies in their construction. For instance, in June 2021, Endeavor Business Media, LLC launched Smart Buildings Technology, a new brand dedicated to incorporating integrated intelligence into new and existing commercial buildings. These benefits associated with advanced technologies in commercial buildings will further drive the demand for smart buildings during the forecast period.

The residential segment is expected to grow at a CAGR of 25.7% during the forecast period. The segment growth can be attributed to the rise in demand for smart home lighting, HVAC management, smart door lock security systems, and smart meters to manage and monitor the building's mechanical and electrical systems. For instance, in September 2020, technology giants such as Amazon, Apple, and Google joined the Zigbee Alliance to create a single, open-source smart home platform. With security as one of its key design elements, the project intends to develop and foster the adoption of a new, royalty-free networking standard to improve compatibility across smart home products. The robust demand for these technologies in residential buildings will stimulate the growth of the market during the forecast period.

Regional Insights

The North America regional market dominated the market in 2021 and accounted for a market share of 33.3%. The regional growth can be attributed to the increasing public and private investments and growing digitalization. Furthermore, in the U.S., various end-use industries are focusing on converting their existing offices into smart offices. For instance, in April 2022, JPMorgan Chase announced establishing a new smart headquarters with all-electric operation systems in New York. The company planned to use renewable power generated by a hydroelectric plant in New York state, controlled by energy management systems and equipped with Artificial Intelligence (AI) and Machine Learning (ML). With this initiative, it is expected to boost the market growth, and subsequently increase the demand for smart buildings in the region.

The Asia Pacific is anticipated to rise as the fastest developing regional market at a CAGR of 28.23% due to increasing internet penetration, high urbanization, and shifting consumer focus toward remote management services through IoT technology. Further, shifting the focus of consumers toward converting their existing buildings into smart buildings is boosting the regional market growth. For instance, in January 2022, Singtel, a telecommunication company, announced its collaboration with Lendlease, a real estate group, to convert its Comcentre headquarters in Singapore into a smart building with an investment of USD 2.21 billion. These key factors are creating demand for smart buildings in the region.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Smart Building Market

5.1. COVID-19 Landscape: Smart Building Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Smart Building Market, By Solution

8.1. Smart Building Market, by Solution, 2022-2030

8.1.1 Safety & Security Management

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Energy Management

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Building Infrastructure Management

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Others (Network Management And Workplace Management)

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Smart Building Market, By Service

9.1. Smart Building Market, by Service, 2022-2030

9.1.1. Consulting

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Implementation

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Support & Maintenance

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Smart Building Market, By End-use

10.1. Smart Building Market, by End-use, 2022-2030

10.1.1. Residential

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Industrial

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Smart Building Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Solution (2017-2030)

11.1.2. Market Revenue and Forecast, by Service (2017-2030)

11.1.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Solution (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Service (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Solution (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Service (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Solution (2017-2030)

11.2.2. Market Revenue and Forecast, by Service (2017-2030)

11.2.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Solution (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Service (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Solution (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Service (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Solution (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Service (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Solution (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Service (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Solution (2017-2030)

11.3.2. Market Revenue and Forecast, by Service (2017-2030)

11.3.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Solution (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Service (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Solution (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Service (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Solution (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Service (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Solution (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Service (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Solution (2017-2030)

11.4.2. Market Revenue and Forecast, by Service (2017-2030)

11.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Solution (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Service (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Solution (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Service (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Solution (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Service (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Solution (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Service (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Solution (2017-2030)

11.5.2. Market Revenue and Forecast, by Service (2017-2030)

11.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Solution (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Service (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Solution (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Service (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. ABB Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Cisco Systems Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Emerson Electric Co.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Hitachi, Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Honeywell International Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Johnson Controls

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Legrand

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Schneider Electric SE

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Siemens

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Telit

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others