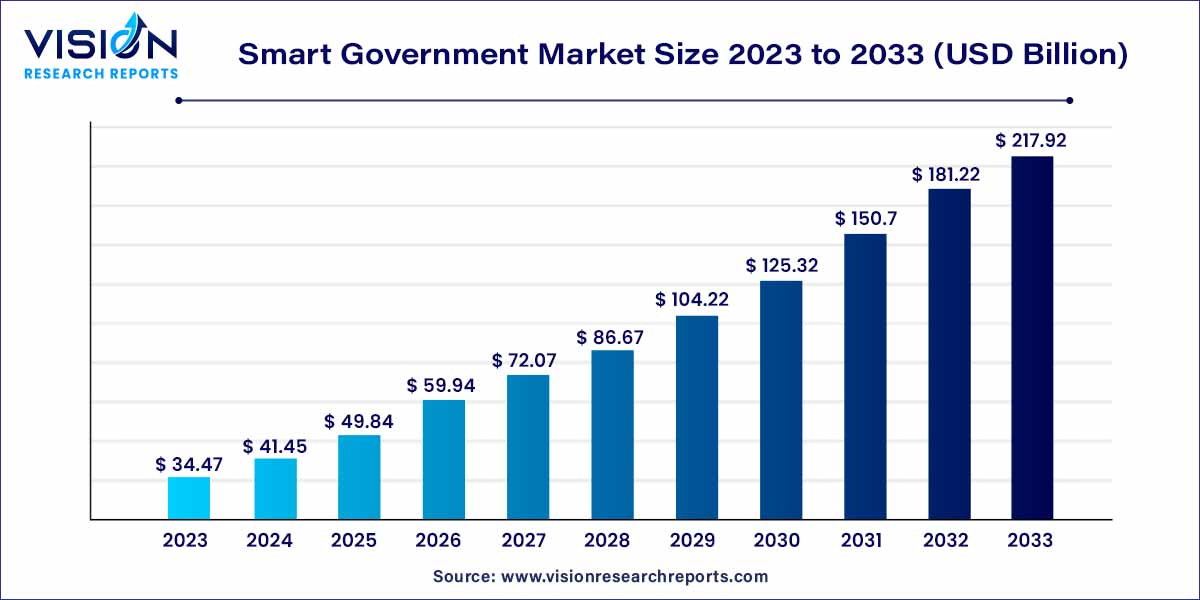

The global smart government market size was estimated at around USD 34.47 billion in 2023 and it is projected to hit around USD 217.92 billion by 2033, growing at a CAGR of 20.25% from 2024 to 2033. The market for smart governments is expanding as more people come to understand how crucial technical innovation is to solving sustainability-related problems. Incorporating intelligent transportation systems, smart grids, and networked buildings are examples of smart infrastructure technologies that can be used to improve overall urban sustainability by cutting emissions and energy usage.

In recent years, the concept of "smart government" has gained traction as administrations worldwide seek innovative solutions to address complex challenges and enhance public service delivery. A smart government leverages technology and data-driven approaches to improve efficiency, transparency, and citizen engagement across various domains, ranging from healthcare and education to transportation and urban planning.

The growth of the smart government market is propelled by a multitude of factors contributing to its expansion. Firstly, the increasing demand for enhanced government services and operational efficiency serves as a significant driver. As citizens expect more streamlined and accessible services, governments are compelled to invest in smart solutions to meet these evolving needs. Additionally, the rapid advancements in digital technologies, such as IoT, AI, and blockchain, provide governments with innovative tools to optimize processes and improve decision-making. Moreover, the growing emphasis on data-driven governance fosters the adoption of analytics and data management solutions, enabling governments to derive actionable insights and enhance policy formulation. Furthermore, the rising trend of urbanization and the associated challenges of managing urban infrastructure drive the implementation of smart city initiatives, further fueling market growth. Overall, these interconnected factors converge to create a conducive environment for the expansion of the smart government market, driving innovation, efficiency, and citizen engagement.

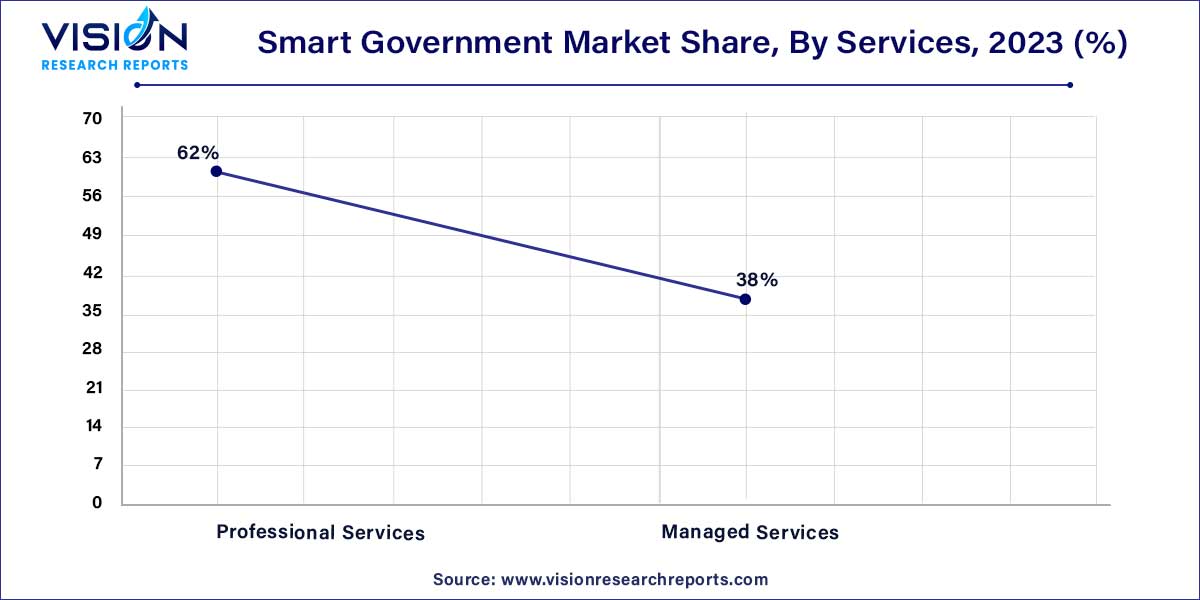

The professional services sector held the largest market share at 62% in 2023, dominating the smart government market. This dominance is attributed to the increasing complexity associated with integrating advanced technologies like AI and IoT into governmental systems. Professional services offer expertise in strategy development, implementation, and customization, assisting governments in navigating the intricacies of technological integration. The evolving regulatory landscape necessitates specialized guidance, leading to a heightened demand for consultancy services to ensure compliance with regulations and seamless integration of smart technologies. Furthermore, with governments prioritizing efficiency and citizen-centric services, professional service providers offer tailored solutions, further bolstering growth in this sector.

In contrast, the managed services segment is projected to witness a significant CAGR over the forecast period. These services typically operate on subscription-based models, allowing governments to better predict and manage expenses. By outsourcing tasks such as system maintenance, updates, and cybersecurity to specialized providers, governments can reduce operational costs while ensuring optimal performance and security of their technological infrastructure. This cost-effective approach promotes the adoption of managed services as a strategic solution within the smart government domain.

In 2023, the Government Resource Planning System (GRP) segment commanded the largest share of market revenue. The growth of Government Resource Planning Systems stems from their ability to centralize and optimize various administrative functions. These systems provide a unified platform that consolidates financial, human resources, procurement, and operational data, aligning with the trend toward cohesive and efficient governance. The increasing demand for streamlined operations, data-driven decision-making, and enhanced transparency in government operations is driving the adoption of GRP systems. By offering real-time insights and facilitating seamless coordination across departments, GRP systems play a significant role in modernizing and enhancing the efficiency of smart government initiatives.

Conversely, the remote monitoring segment is poised to register a notable Compound Annual Growth Rate (CAGR) over the forecast period. The growth of remote monitoring can be attributed to its ability to enable real-time tracking and management of critical infrastructure and services. As urban and rural areas become increasingly complex, remote monitoring technologies provide a means to oversee diverse systems such as utilities, transportation, environmental factors, and public safety from a centralized location. This empowers governments to proactively address issues, optimize resource allocation, and ensure the continuous operation of essential services. Moreover, the surge in demand for remote monitoring reflects governments' efforts to enhance efficiency, reduce operational costs, and enhance responsiveness to citizen needs, thereby driving its significant growth within the smart government sector.

In 2023, the cloud segment dominated the smart government market, capturing the largest share of market revenue. The proliferation of cloud technology in the smart government sector is attributed to its ability to provide scalable and cost-effective solutions for storing and processing extensive volumes of data. Cloud services empower governments to efficiently manage and access data, applications, and resources from remote locations, fostering collaboration and information sharing across various departments. Additionally, the adaptable nature of cloud-based solutions allows governments to swiftly embrace new technologies, innovate services, and swiftly adapt to evolving requirements without substantial infrastructure investments. The heightened focus on data security, disaster recovery, and accessibility further propels the adoption of cloud technologies in the smart government domain, facilitating efficient, secure, and agile operations.

Conversely, the on-premise segment is projected to witness a significant Compound Annual Growth Rate (CAGR) over the forecast period. The growth of on-premise solutions is driven by specific security, compliance, and data sovereignty prerequisites. Some governmental entities are subject to regulations or security standards that mandate direct control over their data and infrastructure, thus favoring on-premise solutions. Furthermore, certain sensitive operations or critical systems may necessitate the high level of customization and control that on-premise solutions afford, enabling governments to tailor technology to their unique requirements without reliance on external providers.

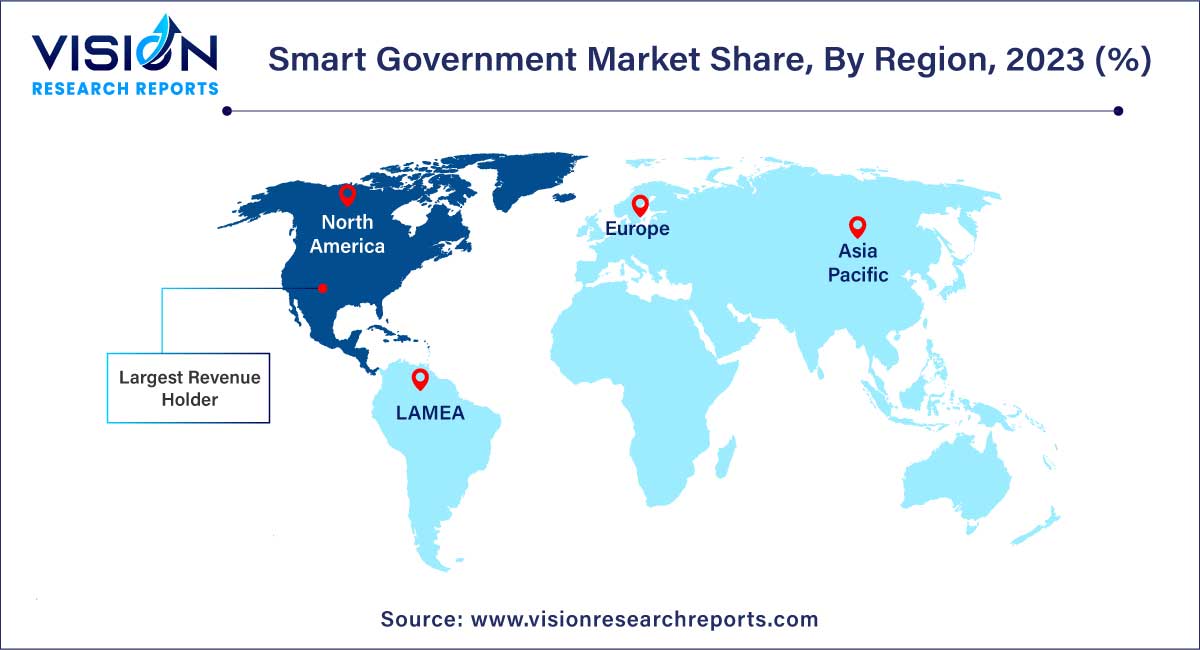

In 2023, North America commanded the highest share of global revenue. The region's robust technological infrastructure and advanced digital maturity create a conducive environment for the integration of advanced technologies into governmental operations. Additionally, strong government initiatives and investments in smart city projects, coupled with the presence of prominent technology firms and research institutions, bolster the region's advancement in this sector. Moreover, the increasing emphasis on leveraging technology to enhance public services, improve efficiency, and address urban challenges expedites the adoption of smart government solutions in North America.

Meanwhile, Asia Pacific is poised to experience significant CAGR growth over the forecast period. The region's rapid urbanization and population growth drive the demand for innovative solutions to efficiently address urban challenges. Governments across Asia Pacific are increasingly prioritizing digital transformation and investing in smart city initiatives to enhance public services and infrastructure. Furthermore, the presence of tech-savvy populations and a thriving tech industry create an environment conducive to the adoption of advanced technologies in governmental operations. Consequently, the region's focus on utilizing technology for inclusive development and governance enhancement accelerates the adoption of smart government solutions in Asia Pacific.

By Services

By Solutions

By Deployment

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others