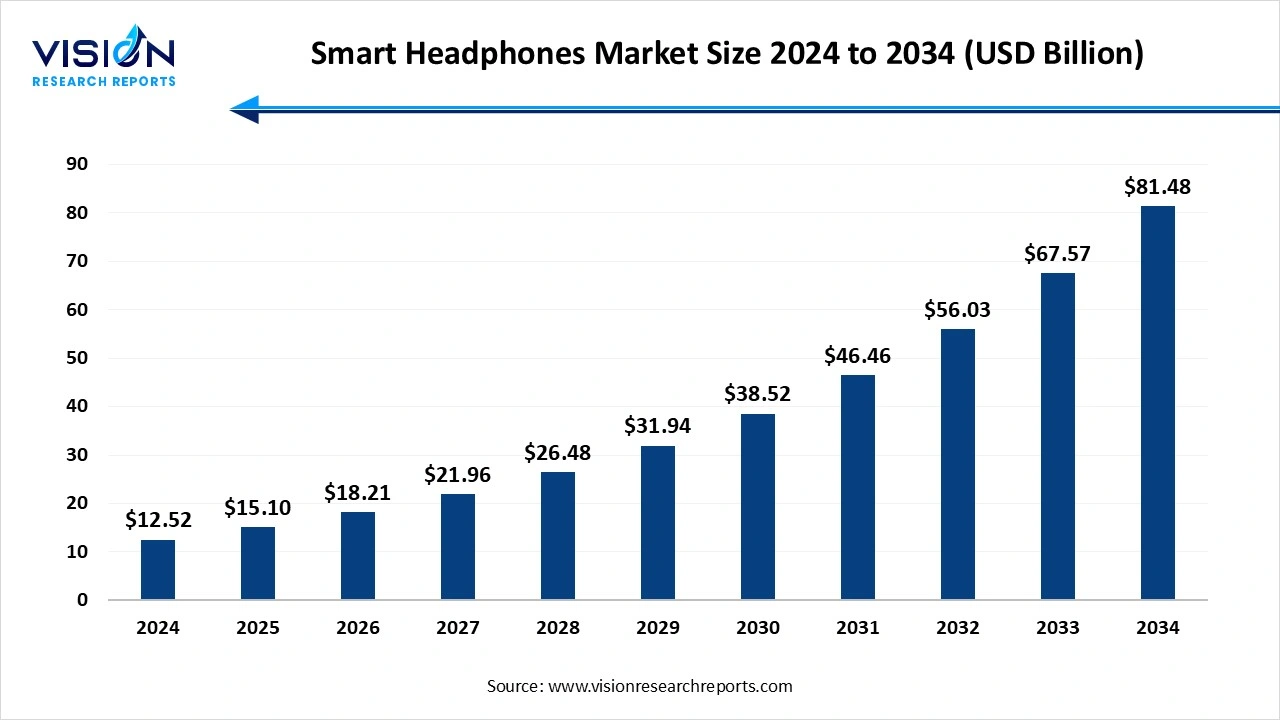

The global smart headphones market was valued at USD 12.52 billion in 2024 and it is predicted to surpass around USD 81.48 billion by 2034 with a CAGR of 20.6% from 2025 to 2034.

The global smart headphones market is experiencing rapid growth, driven by increasing consumer demand for multifunctional audio devices that offer features such as voice assistants, noise cancellation, fitness tracking, and seamless connectivity. Technological advancements in Bluetooth technology, rising smartphone penetration, and growing adoption of wireless audio solutions have further accelerated market expansion. Key players are continuously innovating with enhanced battery life, adaptive sound settings, and personalized audio experiences, making smart headphones an essential accessory for tech-savvy consumers worldwide.

The growth of the smart headphones market is primarily driven by increasing consumer demand for wireless and multifunctional audio devices. Features such as active noise cancellation, voice assistants (like Siri and Google Assistant), fitness tracking, and seamless integration with smartphones have made smart headphones a preferred choice among users. The convenience of hands-free control and improved audio quality also enhances user experience, contributing to market expansion.

Rapid advancements in Bluetooth technology, rising smartphone adoption, and growing interest in immersive audio experiences further fuel market growth. Manufacturers are focusing on innovation, including longer battery life, adaptive sound settings, and enhanced comfort, which attracts a diverse consumer base, from fitness enthusiasts to remote workers and travelers.

The smart headphones market faces several key challenges, including intense competition among established brands and new entrants, which leads to aggressive pricing strategies and shrinking profit margins. Rapid technological advancements also force manufacturers to continuously innovate, increasing research and development costs. Additionally, maintaining product differentiation in a saturated market is difficult, as most brands offer similar features like active noise cancellation, voice assistant support, and wireless connectivity.

Another significant challenge is user privacy and data security concerns, as smart headphones with voice assistant integration can collect and process personal data. Battery life and durability issues also impact user satisfaction, with consumers expecting longer playback times and robust designs suitable for various environments.

North America led the global smart headphones market, capturing the largest revenue share of 37% in 2024. The United States, in particular, stands out as a key market due to the widespread adoption of wireless audio solutions, along with the growing popularity of smart headphones equipped with features like voice assistants, active noise cancellation, and superior sound quality. The region's advanced infrastructure and strong presence of leading tech companies further fuel the market's growth.

The smart headphones market in the Asia Pacific region is projected to expand at a compound annual growth rate (CAGR) of 23.2% during the forecast period. The region's large and young population, rising disposable incomes, and increasing smartphone penetration are major drivers behind the growing demand for wireless audio solutions. the region's strong manufacturing capabilities and the presence of several global and local brands contribute to the affordability and availability of smart headphones, making them accessible to a broad consumer base.

In-ear headphones led the market and accounted for the largest revenue share of 58% in 2024.In-ear smart headphones, also known as earbuds, are compact, lightweight, and highly portable, making them popular among users who prioritize convenience and mobility. These headphones are equipped with advanced features such as active noise cancellation, touch controls, voice assistant integration, and fitness tracking capabilities, appealing to tech-savvy individuals and fitness enthusiasts alike.

The over-ear headphones market is projected to experience a compound annual growth rate (CAGR) of 20.3% throughout the forecast period. These headphones offer better passive noise isolation due to their larger ear cups, which is further enhanced by active noise cancellation technology. Over-ear smart headphones also provide extended battery life and superior comfort for long listening sessions, making them suitable for gaming, remote work, and travel.

Wireless headphones led the global smart headphones market, accounting for a dominant revenue share of 79% in 2024. Wireless smart headphones have gained widespread popularity due to their convenience, eliminating the hassle of tangled cables and offering greater mobility. These headphones leverage Bluetooth technology for seamless connectivity with various devices, making them ideal for on-the-go use. Advanced features such as active noise cancellation, voice assistant support, touch controls, and extended battery life further enhance their appeal, driving significant demand in the market.

The wired headphones market is projected to experience substantial growth, with a compound annual growth rate (CAGR) of 19.9% anticipated throughout the forecast period. These headphones provide superior sound quality with minimal latency, making them suitable for gaming, music production, and other audio-critical applications.

Online distribution channels dominated the market, capturing the largest revenue share of 63% in 2024. Online distribution channels, including e-commerce platforms, brand websites, and online marketplaces, have become increasingly popular due to their convenience, extensive product selection, and competitive pricing. Consumers can easily compare products, read reviews, and access exclusive online discounts, making online shopping a preferred choice, especially among tech-savvy and younger consumers.

Offline distribution channels are projected to be the fastest-growing segment, with a compound annual growth rate (CAGR) of 20% from 2025 to 2034. These channels offer consumers the advantage of experiencing products firsthand before making a purchase, which is essential for those who prioritize audio quality, comfort, and fit. Offline channels also provide personalized customer support, making them popular among consumers who prefer in-person assistance.

Active noise cancellation (ANC) technology dominated the global smart headphones market, accounting for the highest revenue share of 39% in 2024. ANC technology uses sophisticated algorithms and microphones to detect external noise and generate sound waves that effectively cancel out unwanted ambient sounds. This technology enhances the audio experience by providing immersive, distraction-free listening, making it highly popular among travelers, remote workers, and audiophiles.

The biometric monitoring technology market is projected to experience significant growth, with a compound annual growth rate (CAGR) of 23.2% anticipated during the forecast period. Equipped with sensors, biometric monitoring smart headphones can track various health metrics such as heart rate, calories burned, steps taken, and even oxygen saturation levels. These headphones cater to health-conscious consumers, fitness enthusiasts, and athletes, providing real-time insights into their physical activity and overall well-being.

The music and entertainment segment accounting for the largest revenue share of 39% in 2024. Smart headphones designed for music and entertainment are equipped with advanced features such as active noise cancellation, high-fidelity sound, customizable equalizer settings, and voice assistant support. These features allow users to enjoy their favorite music, podcasts, and streaming content without distractions.

Gaming applications are projected to experience the highest compound annual growth rate of 22.5% during the forecast period. Gaming-focused smart headphones are designed with low-latency audio transmission, surround sound technology, and clear communication capabilities through built-in microphones. These headphones enhance gameplay by providing accurate sound positioning, allowing gamers to react swiftly to in-game events. Features such as customizable RGB lighting, comfortable over-ear designs, and multi-platform compatibility make smart headphones a preferred choice among gamers.

By Type Insights

By Connectivity

By Distribution Channel

By Technology

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Smart Headphones Market

5.1. COVID-19 Landscape: Smart Headphones Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Smart Headphones Market, By Type

8.1. Smart Headphones Market, by Type

8.1.1. In Ear

8.1.1.1. Market Revenue and Forecast

8.1.2. On Ear

8.1.2.1. Market Revenue and Forecast

8.1.3. Over Ear

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Smart Headphones Market, By Connectivity

9.1. Smart Headphones Market, by Connectivity

9.1.1. Wired

9.1.1.1. Market Revenue and Forecast

9.1.2. Wireless

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Smart Headphones Market, By Distribution Channel

10.1. Smart Headphones Market, by Distribution Channel

10.1.1. Online

10.1.1.1. Market Revenue and Forecast

10.1.2. Offline

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Smart Headphones Market, By Technology

11.1. Smart Headphones Market, by Technology

11.1.1. Active Noise Cancellation (ANC)

11.1.1.1. Market Revenue and Forecast

11.1.2. Smart Assistant Integration

11.1.2.1. Market Revenue and Forecast

11.1.3. Biometric Monitoring

11.1.3.1. Market Revenue and Forecast

11.1.4. Others

11.1.4.1. Market Revenue and Forecast

Chapter 12. Global Smart Headphones Market, By Application

12.1. Smart Headphones Market, by Application

12.1.1. Sports and Fitness

12.1.1.1. Market Revenue and Forecast

12.1.2. Gaming

12.1.2.1. Market Revenue and Forecast

12.1.3. Music and Entertainment

12.1.3.1. Market Revenue and Forecast

12.1.4. Others

12.1.4.1. Market Revenue and Forecast

Chapter 13. Global Smart Headphones Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Type

13.1.2. Market Revenue and Forecast, by Connectivity

13.1.3. Market Revenue and Forecast, by Distribution Channel

13.1.4. Market Revenue and Forecast, by Technology

13.1.5. Market Revenue and Forecast, by Application

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Type

13.1.6.2. Market Revenue and Forecast, by Connectivity

13.1.6.3. Market Revenue and Forecast, by Distribution Channel

13.1.6.4. Market Revenue and Forecast, by Technology

13.1.7. Market Revenue and Forecast, by Application

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Type

13.1.8.2. Market Revenue and Forecast, by Connectivity

13.1.8.3. Market Revenue and Forecast, by Distribution Channel

13.1.8.4. Market Revenue and Forecast, by Technology

13.1.8.5. Market Revenue and Forecast, by Application

13.2. Europe

13.2.1. Market Revenue and Forecast, by Type

13.2.2. Market Revenue and Forecast, by Connectivity

13.2.3. Market Revenue and Forecast, by Distribution Channel

13.2.4. Market Revenue and Forecast, by Technology

13.2.5. Market Revenue and Forecast, by Application

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Type

13.2.6.2. Market Revenue and Forecast, by Connectivity

13.2.6.3. Market Revenue and Forecast, by Distribution Channel

13.2.7. Market Revenue and Forecast, by Technology

13.2.8. Market Revenue and Forecast, by Application

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Type

13.2.9.2. Market Revenue and Forecast, by Connectivity

13.2.9.3. Market Revenue and Forecast, by Distribution Channel

13.2.10. Market Revenue and Forecast, by Technology

13.2.11. Market Revenue and Forecast, by Application

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Type

13.2.12.2. Market Revenue and Forecast, by Connectivity

13.2.12.3. Market Revenue and Forecast, by Distribution Channel

13.2.12.4. Market Revenue and Forecast, by Technology

13.2.13. Market Revenue and Forecast, by Application

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Type

13.2.14.2. Market Revenue and Forecast, by Connectivity

13.2.14.3. Market Revenue and Forecast, by Distribution Channel

13.2.14.4. Market Revenue and Forecast, by Technology

13.2.15. Market Revenue and Forecast, by Application

13.3. APAC

13.3.1. Market Revenue and Forecast, by Type

13.3.2. Market Revenue and Forecast, by Connectivity

13.3.3. Market Revenue and Forecast, by Distribution Channel

13.3.4. Market Revenue and Forecast, by Technology

13.3.5. Market Revenue and Forecast, by Application

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Type

13.3.6.2. Market Revenue and Forecast, by Connectivity

13.3.6.3. Market Revenue and Forecast, by Distribution Channel

13.3.6.4. Market Revenue and Forecast, by Technology

13.3.7. Market Revenue and Forecast, by Application

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Type

13.3.8.2. Market Revenue and Forecast, by Connectivity

13.3.8.3. Market Revenue and Forecast, by Distribution Channel

13.3.8.4. Market Revenue and Forecast, by Technology

13.3.9. Market Revenue and Forecast, by Application

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Type

13.3.10.2. Market Revenue and Forecast, by Connectivity

13.3.10.3. Market Revenue and Forecast, by Distribution Channel

13.3.10.4. Market Revenue and Forecast, by Technology

13.3.10.5. Market Revenue and Forecast, by Application

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Type

13.3.11.2. Market Revenue and Forecast, by Connectivity

13.3.11.3. Market Revenue and Forecast, by Distribution Channel

13.3.11.4. Market Revenue and Forecast, by Technology

13.3.11.5. Market Revenue and Forecast, by Application

13.4. MEA

13.4.1. Market Revenue and Forecast, by Type

13.4.2. Market Revenue and Forecast, by Connectivity

13.4.3. Market Revenue and Forecast, by Distribution Channel

13.4.4. Market Revenue and Forecast, by Technology

13.4.5. Market Revenue and Forecast, by Application

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Type

13.4.6.2. Market Revenue and Forecast, by Connectivity

13.4.6.3. Market Revenue and Forecast, by Distribution Channel

13.4.6.4. Market Revenue and Forecast, by Technology

13.4.7. Market Revenue and Forecast, by Application

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Type

13.4.8.2. Market Revenue and Forecast, by Connectivity

13.4.8.3. Market Revenue and Forecast, by Distribution Channel

13.4.8.4. Market Revenue and Forecast, by Technology

13.4.9. Market Revenue and Forecast, by Application

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Type

13.4.10.2. Market Revenue and Forecast, by Connectivity

13.4.10.3. Market Revenue and Forecast, by Distribution Channel

13.4.10.4. Market Revenue and Forecast, by Technology

13.4.10.5. Market Revenue and Forecast, by Application

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Type

13.4.11.2. Market Revenue and Forecast, by Connectivity

13.4.11.3. Market Revenue and Forecast, by Distribution Channel

13.4.11.4. Market Revenue and Forecast, by Technology

13.4.11.5. Market Revenue and Forecast, by Application

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Type

13.5.2. Market Revenue and Forecast, by Connectivity

13.5.3. Market Revenue and Forecast, by Distribution Channel

13.5.4. Market Revenue and Forecast, by Technology

13.5.5. Market Revenue and Forecast, by Application

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Type

13.5.6.2. Market Revenue and Forecast, by Connectivity

13.5.6.3. Market Revenue and Forecast, by Distribution Channel

13.5.6.4. Market Revenue and Forecast, by Technology

13.5.7. Market Revenue and Forecast, by Application

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Type

13.5.8.2. Market Revenue and Forecast, by Connectivity

13.5.8.3. Market Revenue and Forecast, by Distribution Channel

13.5.8.4. Market Revenue and Forecast, by Technology

13.5.8.5. Market Revenue and Forecast, by Application

Chapter 14. Company Profiles

14.1. Apple Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Sony Corporation

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Bose Corporation

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Sennheiser Electronics GmbH & Co. KG

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Samsung Electronics Co., Ltd.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Jabra (GN Audio)

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Beats by Dre (a subsidiary of Apple)

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. JBL (Harman International)

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Huawei Technologies Co., Ltd.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. LG Electronics

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others