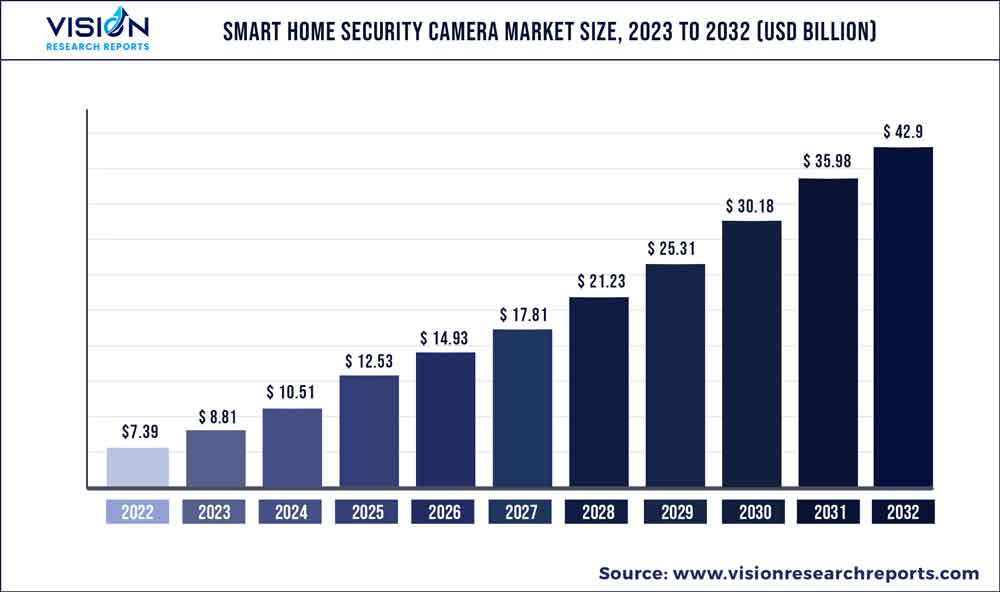

The global smart home security camera market was surpassed at USD 7.39 billion in 2022 and is expected to hit around USD 42.9 billion by 2032, growing at a CAGR of 19.23% from 2023 to 2032. The smart home security camera market in the United States accounted for USD 2.6 billion in 2022.

Key Pointers

Report Scope of the Smart Home Security Camera Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 40.06% |

| CAGR of Europe | 18.86% |

| Revenue Forecast by 2032 | USD 42.9 billion |

| Growth rate from 2023 to 2032 | CAGR of 19.23% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Vivinit Smart Home, Inc.; ADT Inc.; SimpliSafe inc.; Brinks Home Security; iSmart Alarm, Inc.; Skylinkhome; Protect America, Inc.; Samsung Electronics Co, Ltd.; Frontpoint Security Solution, LLC; Arlo Technologies, Inc.; Nest Labs; Wyze Lab, Inc.; blink; eufy; Ring LLC |

Rapid growth in smart home penetration across North America is positively impacting the demand for smart home security cameras.

The rapid adoption of IoT in smart homes is also supporting market growth. Consumers are shifting from traditionally mountable Wi-Fi cameras to the deployment of smart home security cameras to increase the security of their premises. These advanced smart home security cameras offer several benefits, which boost their installation in many households across the region. The ease of installation and easy availability of smart home security cameras drive the product demand.

In September 2021 Blink launched a new USD 50 video doorbell. The Blink Video Doorbell is wired as well as wire-free and works with Amazon's voice assistant Alexa. The new Blink Video Doorbell is a first-of-its-kind device from the security brand. It has 1080p resolution, two-way talk, and, most interestingly, up to two years of battery life.

The wireless product segment is the fastest-growing segment over the forecast period. This is a result of the increase in the availability of wireless products offered by major players in the market. Moreover, wireless smart home security camera offers varied advantages including easier set-up and customizable, among others.

The market is fragmented at the global level with a major share occupied by Vivint Smart Home Inc., ADT LLC, Arlo Technologies, Inc., and others. Key players operating in the market are implementing strategic initiatives such as acquisitions to drive their companies’ growth in the future as well as to solidify their positions in the market. These strategies also help in increasing their geographical reach, cutting down competition, and gaining additional share in the market. For strategic and financial buyers alike, the most attractive M&A targets will have strong leadership including a deep bench of rising, future leaders.

Technology Insights

In terms of value, the wired segment dominated the market with a share of over 50.04% in 2022. Package theft is at an all-time high according to the experts at Rensselaer Polytechnic Institute, with approximately 1.7 million shipments stolen or lost every day in the U.S. Furthermore, according to UNC Charlotte research (2013) on the habits and motivations of criminals, 83% admit that they specifically look for an alarm system, and 60% would change their minds if one was installed. In addition, as per Alarms.org, residences without a security system are 300 times more likely to be burgled. As a result, an increasing number of residents have been installing smart security cameras to discourage criminals and secure their homes.

The wireless segment is expected to register the highest CAGR of 19.85% from 2023 to 2032. Wireless technology-enabled security systems are one of the most significant advancements in home security solutions and IoT, with many homeowners preferring them for effective protection. For those that already use smart home products like Amazon Alexa, Google Assistant, and the like, smart cameras are a welcome addition to a broader smart home system.

Companies are constantly adding new features to wired cameras, such as improved night vision, two-way audio with echo cancellation, and customizable motion zones. Ring, a security camera producing company, for example, released the Ring Floodlight Cam Wired Pro in April 2021, which includes features such as 3D Motion Detection and Bird's Eye View, a 110db siren and color night vision, Audio+ that improves consumer hearing, Customizable Motion Zones that trigger recordings, and Privacy Zones that exclude areas in the camera field of view from video recording. Ring Floodlight Cam Wired Pro users can easily hardwire the device to the outside of their homes and link it to Wi-Fi for continuous power.

Application Insights

Indoor Camera segment held the largest share of over 38.03% in 2022. This is mostly due to an increase in the number of theft and burglary cases, which has raised public awareness about the importance of protecting one's house from criminal activity. Indoor smart cameras offer a variety of capabilities, including instant messaging in the event of a theft, alarm activation, and movement and behavior recognition, which has led to their widespread use in a variety of applications.

Doorbell Camera segment is expected to register the highest CAGR of 19.84% from 2023 to 2032. According to Security.org's survey on “porch pirates” in 2019, 40% of Americans have had items stolen; however, with a doorbell camera, consumers are notified as soon as the packages are delivered and they can even instruct the deliverymen where to place them. Consumers are warned immediately if anyone passes by or attempts to steal the package and can call out to them through the doorbell camera speakers. As 52% of Americans are concerned that a package may be stolen during the holidays, 23% of those polled in 2020 by C+R Research indicated they would install a doorbell or surveillance camera to avoid theft.

Regional Insights

In 2022, North America was the largest region and accounted for the maximum share of more than 40.06% of the overall revenue. According to Berg Insight’s research published in March 2021, the North American smart home market recorded strong growth during 2019, increasing by 28.5% (YoY) to reach 172.6 million smart home systems in 43.1 million smart homes. This corresponds to 30.2% of all households, placing North America as the most advanced smart home market in the world. In terms of units sold, the most popular point solutions to date are smart thermostats, smart light bulbs, smart plugs, connected security cameras, and voice-controlled smart speakers.

Europe is expected to register a significant CAGR of 18.86% during the forecast period. Emerging technologies and applications such as multi-dimensional perception, UHD, low light imaging, artificial intelligence, and cloud technology open new possibilities for the home security camera industry in the region. Major countries such as Germany, and the U.K. contribute significantly to the growth of the market owing to the increasing crime rates coupled with the rising penetration of smart devices in the countries.

Germany has been reporting crime at an alarming rate, with an increase of almost 10% compared to the previous year, on a year-on-year basis. According to a consumer survey by reichelt elektronik magazine, almost 53% of the participants said they relied on an emergency call to security services in case of a crime. Moreover, the number of CCTV cameras in the U.K. may be as many as 5.2 million, with 1 camera for every 13 people, as the popularity of public surveillance, home CCTV, and doorbell security cameras increases in the country.

Smart Home Security Camera Market Segmentations:

By Technology

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Smart Home Security Camera Market

5.1. COVID-19 Landscape: Smart Home Security Camera Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Smart Home Security Camera Market, By Technology

8.1. Smart Home Security Camera Market, by Technology, 2023-2032

8.1.1. Wired

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Wireless

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Smart Home Security Camera Market, By Application

9.1. Smart Home Security Camera Market, by Application, 2023-2032

9.1.1. Doorbell Camera

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Indoor Camera

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Outdoor Camera

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Smart Home Security Camera Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Technology (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Technology (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Vivinit Smart Home, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. ADT Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. SimpliSafe inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Brinks Home Security

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. iSmart Alarm, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Skylinkhome

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Protect America, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Samsung Electronics Co, Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Frontpoint Security Solution, LLC

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Arlo Technologies, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others