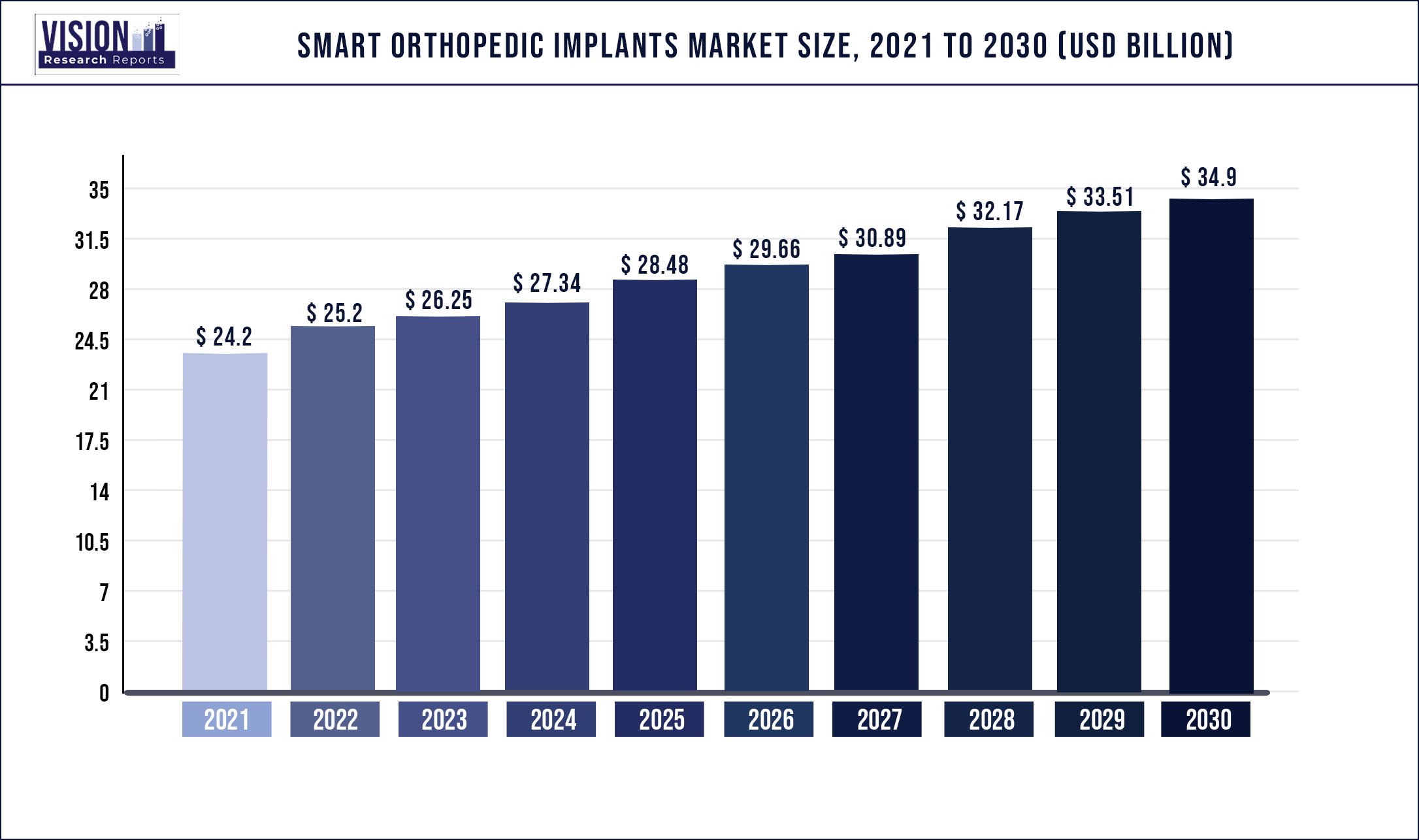

The global smart orthopedic implants market was surpassed at USD 24.2 billion in 2021 and is expected to hit around USD 34.9 billion by 2030, growing at a CAGR of 4.15% from 2022 to 2030.

The key factors driving the market growth include the rising number of orthopedic surgeries performed across the globe, the growing geriatric population, and technological advancements. According to the U.S. Census Bureau, in 2019, an estimated 75 million Americans were aged 60 years and older, out of the 328 million U.S. population. This indicates that a high number of the population in the country is vulnerable to chronic and acute orthopedic disorders, leading to an increased volume of surgeries.

The COVID-19 pandemic resulted in reduced demand and decreased sales in the overall orthopedic implants market including smart orthopedic implants. Market players had to face several challenges, such as restricted access to primary care, movement restrictions, supply chain challenges, difficulty in conducting clinical trials, and other logistical bottlenecks. However, the major impact was the postponement/cancellation of elective surgeries due to the pandemic. Most countries implemented lockdowns and social distancing norms while regulatory bodies and academic societies recommended the postponement of elective surgeries, thus leading to a negative impact on the market. The resumption of elective surgical procedures is expected to lead to increased demand for smart orthopedic implants over the coming years.

The adoption of robotic systems and digital enabling technologies, such as navigation systems, in orthopedic procedures is making these surgeries safer, with low postoperative complications, and better patient outcomes. This is thus a key driver estimated to propel the research, development, and applications of smart orthopedic implants. Market players are leveraging this trend to launch new products, integrate enabling technologies, expand R&D activities, and increase their market share. For instance, in April 2022, eCential Robotics partnered with Amplitude Surgicalto develop a joint robotic solution for knee surgery. Zimmer Biomet’s Persona IQ Smart Knee is a flagship product in the market that was granted De Novo classification by the FDA in August 2021.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 24.2 billion |

| Revenue Forecast by 2030 | USD 34.9 billion |

| Growth rate from 2022 to 2030 | CAGR of 4.15% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Application, component, procedure, end-use, region |

| Companies Covered |

Globus Medical, Inc.;Medtronic, plc;Wright Medical Group N.V.; Zimmer Biomet Holdings, Inc;Johnson & Johnson;Stryker Corporation; NuVasive, Inc.; Smith & Nephew plc.; Arthrocare Corporation; BioTek Instruments, Inc.; Conmed Corporation; Integra Life Sciences Holdings Corporation; KYOCERA Corporation; Teijin nakashima medical co. ltd. |

Application Insights

On the basis of applications, the global smart orthopedic implants total addressable market has been further categorized and segmented into the knee, hip, and others. The knee application segment dominated the global market in 2021 and will maintain the leading market position throughout the forecast years. The segment accounted for the maximum share of more than 47.00% of the overall revenue in 2021. On the other hand, the hip application segment is estimated to register the fastest growth rate during the forecast years. One of the key factors contributing to the fast-paced growth of this segment includes the increasing prevalence of knee & hip disorders.

In addition, the rising product advancements and incorporation of digital technologies in the existing line of joint replacement products are projected to support the growth of this segment. Stryker’s acquisition of OrthoSensor in 2021, for instance, was a move to develop smart sensor technologies and implants to empower orthopedic surgeons with data-driven solutions and bolster the company’s digital ecosystem. The growing number of knee and hip replacement procedures is another key market driver. As per the OECD, over 184,000 total knee replacement procedures were performed in Germany in 2018. This number increased to over 188,000 procedures in 2019.

Component Insights

On the basis of components, the global market has been segmented into implants and electronic components. The electronic components segment is estimated to grow at the fastest CAGR of more than 6.20% during the forecast period. The segment comprises sensors and software that make an implant “smart”. This includes additional capabilities, such as remote patient monitoring, tracking of relevant parameters to support post-operative care, and clinical decision-making. Persona IQ smart knee, for instance, is embedded with the canturio-te & CHIRP System developed by Canary Medical.

It allows patients and physicians to track parameters, such as walking speed, cadence, step count, range of motion, etc. The implants component segment accounted for the highest share of the global revenue in 2021. This is attributed to the high cost of implants, availability of products, and initiatives by market players. Large multinational companies are operating in the joint replacement implants market including Stryker, Zimmer Biomet, Depuy Synthes, Microport, B. Braun, Corin, and others. These companies are involved in deploying various strategic initiatives to increase their market presence and share.

Procedure Insights

On the basis of procedures, the global market has been categorized into total replacement, partial replacement, and others. The total replacement procedure segment dominated the global market in 2021 and accounted for the maximum share of more than 57.00% of the overall revenue. The key factors that contributed to the high market share of this segment include the increased prevalence of orthopedic diseases, a high number of joint replacement surgeries performed, and technological advancements. The Persona IQ Smart Knee by Zimmer Biomet, for example, is indicated for patients undergoing a cemented total knee arthroplasty procedure.

The partial replacement procedure segment, on the other hand, is expected to grow at the fastest CAGR during the forecast period. The others segment comprising revision and resurfacing replacement procedures is also projected to grow notably in the coming years. This is due to a notable number of total replacement surgeries failing over time due to failed or worn-out implants, thus leading to the need for revision replacements. Revision procedures are performed to relieve discomfort and enable recovery in the motion. As per information provided by the Arthritis Foundation, annual knee and hip revision procedures are expected to reach 120,000 and 72,000, respectively, by 2030.

End-use Insights

On the basis of end-used, the global market has been bifurcated into hospitals and others. The other end-use segment has been further categorized into Ambulatory Surgical Centers (ASCs) and research institutes. The others segment is anticipated to register the fastest CAGR of more than 5.00% from 2022 to 2030. This is due to the related cost-effectiveness and increasing number of ambulatory centers. According to the Centers for Medicare & Medicaid Services (CMS) in March 2022, there are approximately 187 Medicare-Certified ASCs in the state of Washington, 442 in Texas, 368 in Georgia, 817 in California, and 457 in Florida.

These numbers are expected to increase over the coming years. The hospitals end-use segment dominated the global market in 2021. The segment accounted for the largest share of the overall revenue in the same year. This is owing to the high volume of orthopedic procedures performed in hospital settings and the adoption of emerging technologies in large hospitals. Deenanath Mangeshkar Hospital in India, for instance, performed over 1500 joint replacements in 2021. The majority of these were total knee replacements followed by some hip replacements along with revision total knee and hip replacements.

Regional Insights

North America dominated the global market in 2021 and accounted for the maximum share of more than 42.5% of the overall revenue. The high share of the region is attributed to the presence of leading companies, such as Zimmer Biomet. Moreover, the high penetration of digital technologies and robotic systems in healthcare is another key factor attributed to the large share of the region. The growing prevalence of orthopedic disorders is estimated to propel regional growth in the coming years. As per the Centers for Disease Control and Prevention (CDC), the prevalence of doctor-diagnosed arthritis is expected to reach 78.4 million adults by 2040 in the U.S.

The market in the Asia Pacific region is estimated to register the fastest growth rate during the next eight years. The fast-paced growth can be attributed to the rising investments by key market players to strengthen their regional presence, the growing number of surgeries performed and the rapidly improving healthcare infrastructure across the region. As per a study published in the National Library of Medicine, about 146,189 arthroplasties were performed in Japan for all joints in 2017. Among these, over 80,000 accounted for knees while hip joint surgeries were estimated at over 59,000.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Smart Orthopedic Implants Market

5.1. COVID-19 Landscape: Smart Orthopedic Implants Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Smart Orthopedic Implants Market, By Application

8.1. Smart Orthopedic Implants Market, by Application, 2022-2030

8.1.1. Knee

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Hip

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Smart Orthopedic Implants Market, By Component

9.1. Smart Orthopedic Implants Market, by Component e, 2022-2030

9.1.1. Implants

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Electronic Components

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Smart Orthopedic Implants Market, By Implants Procedure

10.1. Smart Orthopedic Implants Market, by Implants Procedure, 2022-2030

10.1.1. Total Replacement

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Partial Replacement

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Smart Orthopedic Implants Market, By End-use

11.1. Smart Orthopedic Implants Market, by End-use, 2022-2030

11.1.1. Hospitals

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Others (ASCs, Research Institutes)

11.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Smart Orthopedic Implants Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Application (2017-2030)

12.1.2. Market Revenue and Forecast, by Component (2017-2030)

12.1.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.1.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Application (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.1.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Application (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Component (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.1.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Application (2017-2030)

12.2.2. Market Revenue and Forecast, by Component (2017-2030)

12.2.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.2.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Application (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.2.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Application (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Component (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.2.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Application (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Component (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.2.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Application (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Component (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.2.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Application (2017-2030)

12.3.2. Market Revenue and Forecast, by Component (2017-2030)

12.3.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.3.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Application (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.3.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Application (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Component (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.3.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Application (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Component (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.3.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Application (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Component (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.3.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Application (2017-2030)

12.4.2. Market Revenue and Forecast, by Component (2017-2030)

12.4.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.4.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Application (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.4.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Application (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Component (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.4.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Application (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Component (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.4.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Application (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Component (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.4.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Application (2017-2030)

12.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.5.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Application (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.5.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Application (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Component (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Implants Procedure (2017-2030)

12.5.6.4. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 13. Company Profiles

13.1. Globus Medical, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Medtronic, plc

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Wright Medical Group N.V.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Zimmer Biomet Holdings, Inc

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Johnson & Johnson

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Stryker Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. NuVasive, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Smith & Nephew plc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Arthrocare Corporation

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. BioTek Instruments, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

13.11. Conmed Corporation

13. 11.1. Company Overview

13. 11.2. Product Offerings

13. 11.3. Financial Performance

13. 11.4. Recent Initiatives

13.12. Integra Life Sciences Holdings Corporation

13. 12.1. Company Overview

13. 12.2. Product Offerings

13. 12.3. Financial Performance

13. 12.4. Recent Initiatives

13.13. KYOCERA Corporation

13. 13.1. Company Overview

13. 13.2. Product Offerings

13. 13.3. Financial Performance

13. 13.4. Recent Initiatives

13.14. Teijin nakashima medical co. ltd.

13. 14.1. Company Overview

13. 14.2. Product Offerings

13. 14.3. Financial Performance

13. 14.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others