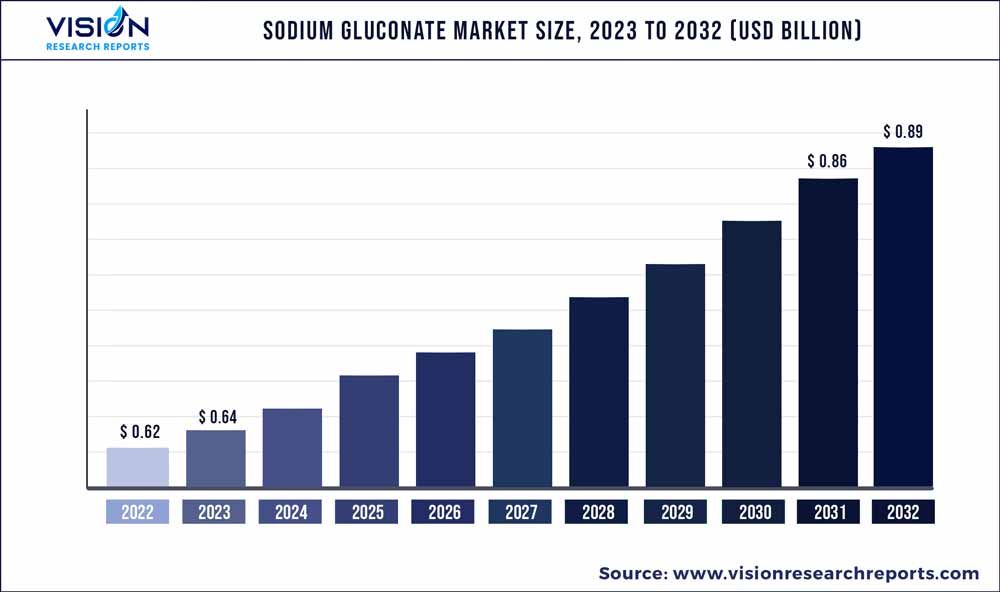

The global sodium gluconate market size was estimated at around USD 0.62 billion in 2022 and it is projected to hit around USD 0.89 billion by 2032, growing at a CAGR of 3.73% from 2023 to 2032. The sodium gluconate market in the United States was accounted for USD 132.7 million in 2022.

Key Pointers

Report Scope of the Sodium Gluconate Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 37% |

| Revenue Forecast by 2032 | USD 0.89 billion |

| Growth Rate from 2023 to 2032 | CAGR of 3.73% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Shandong Fuyang Bio-Tech CO.LTD; Fermentation Products, Inc.; Jungbunzlauer Suisse AG; Zhucheng Dongxiao Biotechnology Co., Ltd.; Shandong Qilu Bio-Technology Group Co., Ltd.; Weifang Honghai, Shandong Kaison; Qingdao Kehai |

Increasing usage in printing, textile dyeing, detergents, metal surface water treatment, and personal care products, is likely to positively influence the demand in the market. Moreover, it has exceptional chelating properties, thus, making it useful for application areas that might come in contact with hard water. Sodium gluconate is a crystalline powder having attributes such as non-toxic, non-corrosive, biodegradable, and water-soluble. It also has exceptional chelating power and is used as a surface cleaning agent. In addition, the rising usage of the product in the food and beverage industry to remove bitterness from food items is anticipated to increase the product demand in the coming years.

Sodium gluconate is an off-white powdered compound produced by the fermentation of sugar which is derived from corn and beets. It forms chelates with iron, calcium, aluminum, copper, and other heavy metals, and also surpasses all other chelating agents, such as Ethylenediamine tetraacetic acid (EDTA), Nitrilotriacetic acid (NTA) and related compounds. Furthermore, the product is listed as a generally permitted food additive and permits its usage across all foodstuffs. In addition, the U.S. FDA has also acknowledged it as generally recognized as safe (GRAS) and has approved the use of the product in food items as a nutrient supplement.

It is a good sequestrant for iron, copper, magnesium, calcium, and aluminum. It is also used as a steel surface cleaning agent, as well as a chelating agent for cement, plating, and alumina dyeing industries. The key industry drivers, such as increasing population, rising disposable incomes, growing construction sector, and growing demand from the textile industry, are expected to aid the industry growth. However, the high cost associated with the manufacturing of the product is expected to hamper the growth of the industry. Also, substantial modifications in the supply chain of sodium gluconate are imposing the prominence of high-quality products at affordable cost thus obstructing the industry growth rate.

End-use Insights

The construction sector dominated the market with a revenue share of more than 33% in 2022. This is attributable to its wide usage as used as a plasticizer and retardant across the industry. Various factors such as easy workability, retarding setting times, improved resistance from freeze-thawing, and reduction in cracking and dry shrinkage are likely to positively influence the market demand across regions. Furthermore, the increasing demand for sodium gluconate from the textile industry in cleaning and degreasing fiber is the major factor influencing the industry's growth.

There is a shift in consumer preference and people are choosing online platforms for buying household products due to their convenience and affordable pricing. With the outbreak of the COVID-19 pandemic, consumers have become more aware of personal hygiene, and thus, the demand for household cleaning products is rising in key economies across the globe including U.S. India, Japan, and China among others. Sodium gluconate is one of the key ingredients used in the formulation of detergents and thus, with the rising demand for detergents, the demand for the product is also anticipated to rise over the forecast period.

Furthermore, growing demand from the construction industry plasticizer along with the increased utilization of the product in food products due to its bitterness is anticipated to accelerate the growth rate over the forecast period. Also, increasing demand from various manufacturing sectors is likely to provide beneficial opportunities for product growth. It inhibits bitter flavors and is used in vegetables, preserved fish, processed fruit, processed meats, dairy products, cereals, and many other applications. Increasing concerns over diseases along with the rising health awareness among consumers are expected to augment the product demand in the coming years. However, the high manufacturing cost might become a barrier to the growth of the market over the forecast period.

Regional Insights

Asia Pacific region dominated the market with a revenue share of 37% in 2022. This can be attributed to the high demand for the product from the construction industry, especially from China, which is a major producer and consumer of sodium gluconate. North America is also another significant region as the product is widely used in various industries across the region, such as metal cleaning, and textile among others.

Increased demand from the food and beverage industry of the region is also projected to benefit the product demand over the forecast period. Continuous industrialization, rapid urbanization, and growing demand for clean water as well as processed food are some of the other key factors driving the product demand in Asia Pacific.

In Europe, the market is expected to witness an expansion owing to the rising demand for the product from various manufacturing sectors, the presence of prominent players, and the adoption of high technology. Additionally, improved governments’ expenditure on structural expansion is expected to trigger the development of the product in the coming years.

Sodium Gluconate Market Segmentations:

By End-use

By Regional

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Sodium Gluconate Market

5.1. COVID-19 Landscape: Sodium Gluconate Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Sodium Gluconate Market, By End-use

8.1.Sodium Gluconate Market, by End-use Type, 2023-2032

8.1.1. Construction

8.1.1.1.Market Revenue and Forecast (2020-2032)

8.1.2. Food & Beverage

8.1.2.1.Market Revenue and Forecast (2020-2032)

8.1.3. Pharmaceuticals

8.1.3.1.Market Revenue and Forecast (2020-2032)

8.1.4. Textiles

8.1.4.1.Market Revenue and Forecast (2020-2032)

8.1.5. Water Treatment

8.1.5.1.Market Revenue and Forecast (2020-2032)

8.1.6. Other End-uses

8.1.6.1.Market Revenue and Forecast (2020-2032)

Chapter 9. Global Sodium Gluconate Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by End-use (2020-2032)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by End-use (2020-2032)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by End-use (2020-2032)

9.2. Europe

9.2.1. Market Revenue and Forecast, by End-use (2020-2032)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by End-use (2020-2032)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by End-use (2020-2032)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by End-use (2020-2032)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by End-use (2020-2032)

9.3. APAC

9.3.1. Market Revenue and Forecast, by End-use (2020-2032)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by End-use (2020-2032)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by End-use (2020-2032)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by End-use (2020-2032)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by End-use (2020-2032)

9.4. MEA

9.4.1. Market Revenue and Forecast, by End-use (2020-2032)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by End-use (2020-2032)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by End-use (2020-2032)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by End-use (2020-2032)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by End-use (2020-2032)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by End-use (2020-2032)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by End-use (2020-2032)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 10.Company Profiles

10.1. Shandong Fuyang Bio-Tech CO.LTD

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. Fermentation Products, Inc.

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. Jungbunzlauer Suisse AG

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Zhucheng Dongxiao Biotechnology Co., Ltd.

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. Shandong Qilu Bio-Technology Group Co., Ltd.

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. Weifang Honghai, Shandong Kaison

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. Qingdao Kehai

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others