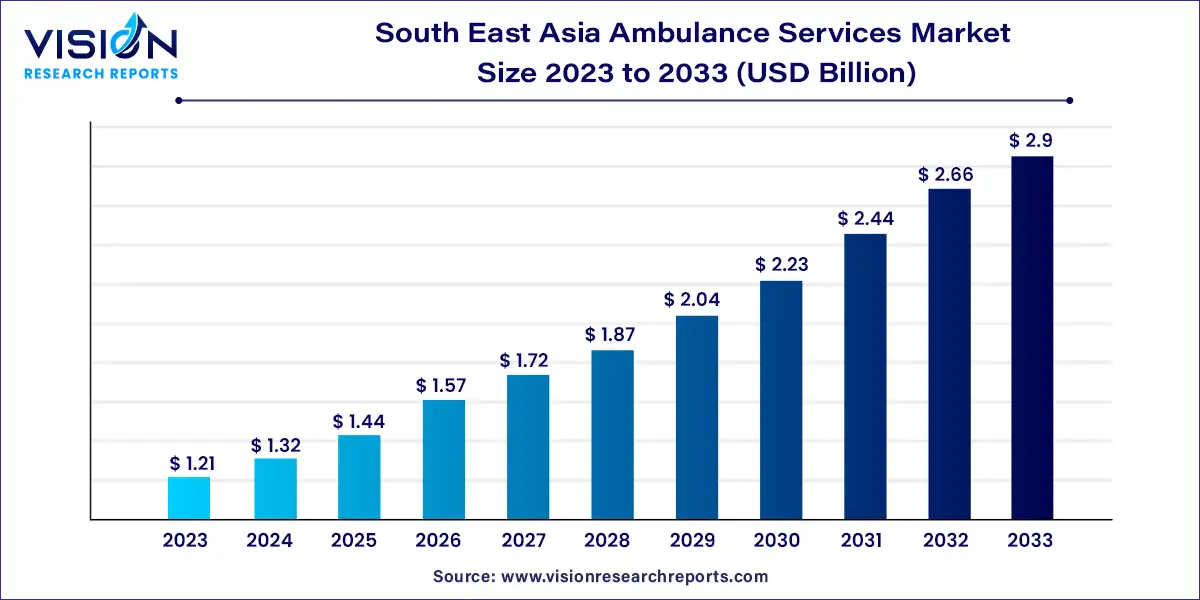

The Southeast Asia ambulance services market size was estimated at USD 1.21 billion in 2023 and it is expected to surpass around USD 2.9 billion by 2033, poised to grow at a CAGR of 9.14% from 2024 to 2033.

The ambulance services market in South East Asia is witnessing notable growth driven by various factors such as increasing healthcare infrastructure, rising demand for emergency medical services, and government initiatives aimed at improving pre-hospital care.

The growth of the ambulance services market in South East Asia is propelled by an increasing urbanization and population density in urban areas have led to a higher incidence of accidents and medical emergencies, thereby driving the demand for ambulance services. Additionally, the expanding healthcare infrastructure in many South East Asian countries, coupled with government initiatives aimed at improving emergency medical response systems, has created a conducive environment for the growth of the ambulance services sector. Moreover, advancements in medical technology and communication systems have enhanced the capabilities of ambulance providers to deliver prompt and efficient emergency care, further fueling market expansion.

| Report Coverage | Details |

| Market Size in 2023 | USD 1.21 billion |

| Revenue Forecast by 2033 | USD 2.9 billion |

| Growth rate from 2024 to 2033 | CAGR of 9.14% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The ground ambulance segment dominated the market and held the largest revenue share of 59% in 2023, owing to several advantages of ground ambulances over water and air ambulance which include, accessibility, cost-effectiveness, stability and safety, no need for landing zones or ports, and flexible routes. Ground ambulance includes motorcycle, bus, all-terrain vehicles, car/SUV, and bicycle,. Ground ambulances are used to move patients from the location of a medical emergency or accident to a hospital to receive further evaluation and medical care. They are a critical component of the emergency medical services (EMS) system and act as a bridge between the emergency site and the medical facility.

The air ambulance segment is anticipated to witness the fastest growth rate of a CAGR of 9.76% over the forecast period. Air ambulances offer several important benefits in emergency medical situations, particularly when time and distance are critical factors. Some of the key advantages of air ambulances include rapid response and time-saving, long-distance transportation, access to remote areas, avoiding road traffic and congestion, and advanced medical equipment.

The emergency services segment dominated the market and held the largest revenue share of 69% in 2023. The growth of the emergency services segment can be attributed to the prevalence of various chronic disorders, particularly cardiovascular disease. Emergency ambulance services are designed to respond to critical medical situations where immediate medical attention is required. These ambulances are equipped with advanced medical equipment and staffed with trained paramedics or Emergency Medical Technicians (EMTs) who can provide life-saving interventions and stabilize patients during transportation. Emergency ambulance services are dispatched in response to emergency helpline calls for medical emergencies such as heart attacks, severe injuries, strokes, respiratory distress, and other life-threatening conditions. The primary goal of emergency ambulance services is to transport patients quickly to the nearest appropriate medical facility for emergency care.

Nonemergency ambulance services are expected to witness a growth rate of a CAGR 8.69% during the forecast period. Non-emergency ambulance services are used for patients who require transportation to medical facilities but are not in critical condition and do not need immediate medical intervention. These ambulances are often used for scheduled medical appointments, inter-hospital transfers, outpatient procedures, or when a patient needs transportation to a medical facility and cannot use other means of transport due to their medical condition or mobility challenges.

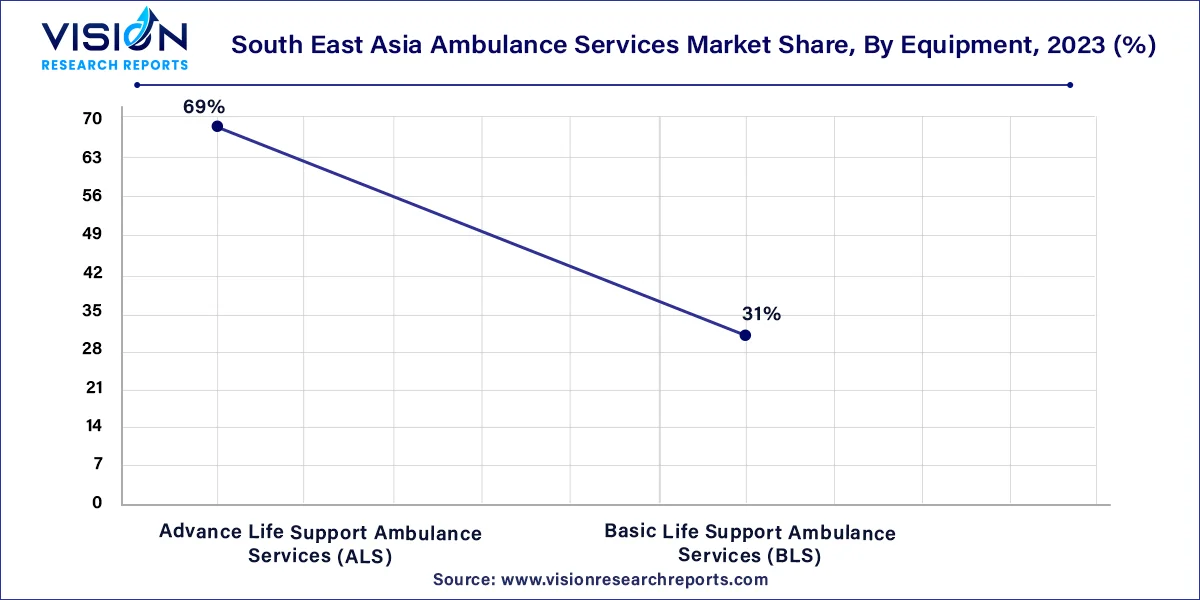

The Advance Life Support (ALS) ambulance services segment dominated the market and held the largest revenue share of 69% in 2023. This ambulance provides a higher level of medical care and intervention compared to Basic Life Support (BLS) ambulances. ALS ambulances are equipped with advanced medical equipment and staffed with highly trained healthcare professionals, typically Paramedics or Advanced EMTs (AEMTs). These ambulances are dispatched in response to critical medical emergencies where patients require advanced medical care during transportation to the hospital. Furthermore increase in number of people suffering from cardiac arrest is expected to contribute to the segment growth. For instance, according to Singapore heart foundation, over 3,000 people in Singapore have sudden cardiac arrest each year, with more than 80% taking place in homes and public places.

The basic life support (BLS) is expected to expand at a CAGR of 8.57% from 2024 to 2033. BLS ambulances are a type of emergency medical transportation that provides essential medical care and support to patients in non-critical conditions or stable medical situations. BLS ambulances are typically the first responders to medical emergencies and play a vital role in providing initial care and transportation to medical facilities. Key features of basic life support (BSS) ambulances include, emergency medical technicians (EMTs), basic medical equipment, cardiopulmonary resuscitation (CPR), oxygen administration and others.

By Transport Vehicles

By Emergency Services

By Equipment

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Transport Vehicles Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on South East Asia Ambulance Services Market

5.1. COVID-19 Landscape: South East Asia Ambulance Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. South East Asia Ambulance Services Market, By Transport Vehicles

8.1. South East Asia Ambulance Services Market, by Transport Vehicles, 2024-2033

8.1.1 Ground Ambulance

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Water Ambulance

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Air Ambulance

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. South East Asia Ambulance Services Market, By Emergency Services

9.1. South East Asia Ambulance Services Market, by Emergency Services, 2024-2033

9.1.1. Emergency Services

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Non-emergency Services

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. South East Asia Ambulance Services Market, By Equipment

10.1. South East Asia Ambulance Services Market, by Equipment, 2024-2033

10.1.1. Advance Life Support Ambulance Services (ALS)

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Basic Life Support Ambulance Services (BLS)

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. South East Asia Ambulance Services Market, Regional Estimates and Trend Forecast

11.1. South East Asia

11.1.1. Market Revenue and Forecast, by Transport Vehicles (2021-2033)

11.1.2. Market Revenue and Forecast, by Emergency Services (2021-2033)

11.1.3. Market Revenue and Forecast, by Equipment (2021-2033)

Chapter 12. Company Profiles

12.1. Hope ambulances.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Asia Medvac Services.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Prime Air Ambulances.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Medical Air Services.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. First Ambulance.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Emsos Medicals

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Red Ambulance Services.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others