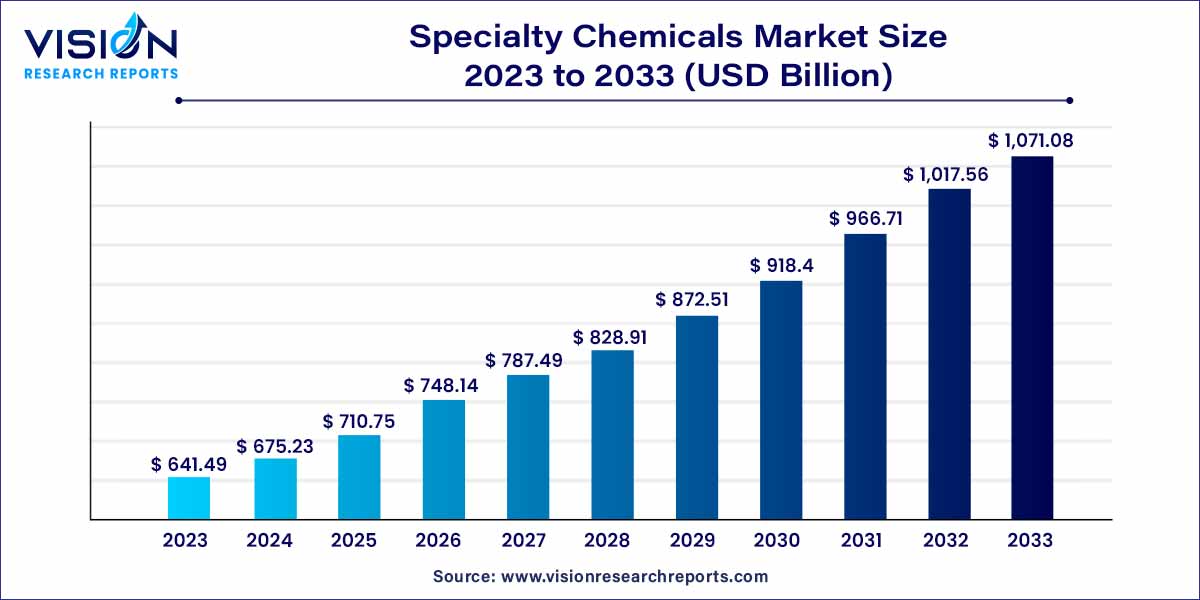

The global specialty chemicals market size was estimated at around USD 641.49 billion in 2023 and it is projected to hit around USD 1,071.08 billion by 2033, growing at a CAGR of 5.26% from 2024 to 2033.

Specialty chemicals constitute a pivotal segment within the broader chemical industry, renowned for delivering unique and high-value solutions across various sectors. These chemicals, also referred to as specialty or performance chemicals, are distinct in their composition and cater to specific applications, often providing enhanced performance or functionality.

The specialty chemicals market is experiencing robust growth, driven by several key factors. Firstly, the increasing demand for customized solutions across diverse industries, including agriculture, healthcare, and electronics, is a significant growth driver. The ability of specialty chemicals to cater to specific requirements and enhance the performance of end products positions them as indispensable components in various applications. Secondly, the industry's focus on sustainability is contributing to growth, with companies adopting eco-friendly formulations and manufacturing practices to align with evolving environmental regulations and consumer preferences. Additionally, the ongoing digital transformation is reshaping the specialty chemicals landscape, optimizing production processes and supply chain management, thereby fostering efficiency and innovation. Furthermore, collaborations and strategic partnerships within the sector are playing a pivotal role in driving research and development, facilitating knowledge exchange, and addressing complex challenges. As industries continue to evolve and demand tailored, high-performance solutions, the specialty chemicals market is well-positioned for sustained expansion.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 1,071.08 billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.26% |

| Revenue Share of Asia Pacific in 2023 | 50% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The other products segment held the largest revenue share of 27% in 2023. This category encompasses various specialty chemicals, including but not limited to lubricating oil additives and surfactants. The substantial growth in this segment can be attributed primarily to the rising awareness among consumers regarding the benefits associated with specialty chemicals. Additionally, the expansion of end-use industries is anticipated to further propel market growth.

Specialty surfactants play a crucial role alongside commodity surfactants in a diverse array of domestic and industrial products. Notably, they find application in high-performance, low-volume products such as alkyl polyglycosides and sulfosuccinates. In these niche areas, specialty surfactants complement commodity surfactants as vital components. The surge in demand within automotive, metalworking, and other end-use industries is expected to drive the need for lubricating oil additives, consequently contributing to the growth of this segment in the foreseeable future.

Anticipated growth is also on the horizon for the institutional and industrial cleaners segment throughout the forecast period. These cleaners stand as the primary consumers of surfactants within the industrial domain. They are integral components in general-purpose cleaning, commercial floors, surfaces, and areas where characteristics such as ease, efficiency, hygiene, technical performance, and food safety hold significant importance.

The industrial and institutional cleaning sector is experiencing rapid growth and diversification, driven by the recurring nature of regulatory requirements, products, and services related to cleanliness and hygiene. A key driving force for industrial and institutional cleaning products is the demand for environmentally friendly, efficient, and labor-efficient cleaning solutions. Surfactants, serving as wetting agents, detergents, foaming agents, dispersants, and emulsifiers, play a pivotal role in meeting these evolving industry needs.

Asia Pacific region dominated the market with the largest market share of 50% in 2023. This significant dominance is credited to several factors, including robust economic advancement, widespread industrialization, and the flourishing growth of key end-use sectors. Notably, China and India play pivotal roles in propelling regional market expansion. The demand for additives in the Asia Pacific is notably influenced by sectors such as food and beverages, personal care and cosmetics, and pharmaceutical applications. Within the region, China, India, and Japan stand out as key manufacturing hubs, with China particularly holding the mantle as the global manufacturing leader. This leadership position further contributes to an upswing in the demand for related products.

The cosmetic industry in countries like the UAE, Kuwait, and Saudi Arabia is witnessing a surge in demand for cosmetic chemicals. This upswing is anticipated to enhance the industry's penetration into these markets. The presence of a youthful and dynamic population, coupled with high purchasing power, is expected to be a significant contributing factor to market growth throughout the forecast period. As these regions demonstrate an increasing appetite for cosmetic chemicals, the industry is poised to benefit from this trend.

By Product

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Specialty Chemicals Market

5.1. COVID-19 Landscape: Specialty Chemicals Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Specialty Chemicals Market, By Product

8.1.Specialty Chemicals Market, by Product Type, 2024-2033

8.1.1. Specialty Polymers

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Institutional & Industrial Cleaners

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Electronic Chemicals

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Rubber Processing Chemicals

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Flavors & Fragrances

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Construction Chemicals

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Food & Feed Additives

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Cosmetic Chemicals

8.1.8.1. Market Revenue and Forecast (2021-2033)

8.1.9. Oilfield Chemicals

8.1.9.1. Market Revenue and Forecast (2021-2033)

8.1.10. Mining Chemicals

8.1.10.1. Market Revenue and Forecast (2021-2033)

8.1.11. Pharmaceutical & Nutraceutical Additives

8.1.11.1. Market Revenue and Forecast (2021-2033)

8.1.12. Plastic Additives

8.1.12.1. Market Revenue and Forecast (2021-2033)

8.1.13. Printing Inks

8.1.13.1. Market Revenue and Forecast (2021-2033)

8.1.14. CASE (Coatings, Adhesives, Sealants & Elastomers)

8.1.14.1. Market Revenue and Forecast (2021-2033)

8.1.15. Specialty Pulp & Paper Chemicals

8.1.15.1. Market Revenue and Forecast (2021-2033)

8.1.16. Specialty Textile Chemicals

8.1.16.1. Market Revenue and Forecast (2021-2033)

8.1.17. Catalysts

8.1.17.1. Market Revenue and Forecast (2021-2033)

8.1.18. Water Treatment Chemicals

8.1.18.1. Market Revenue and Forecast (2021-2033)

8.1.19. Corrosion Inhibitors

8.1.19.1. Market Revenue and Forecast (2021-2033)

8.1.20. Flame Retardants

8.1.20.1. Market Revenue and Forecast (2021-2033)

8.1.21. Others

8.1.21.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Specialty Chemicals Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Product (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Product (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Product (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

Chapter 10. Company Profiles

10.1. Solvay

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Evonik Industries AG

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Clariant AG

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Akzo Nobel N.V.

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. DuPont

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Kemira Oyj

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Lanxess

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Croda International Plc

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9. Huntsman International LL

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. The Lubrizol Corporation

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others