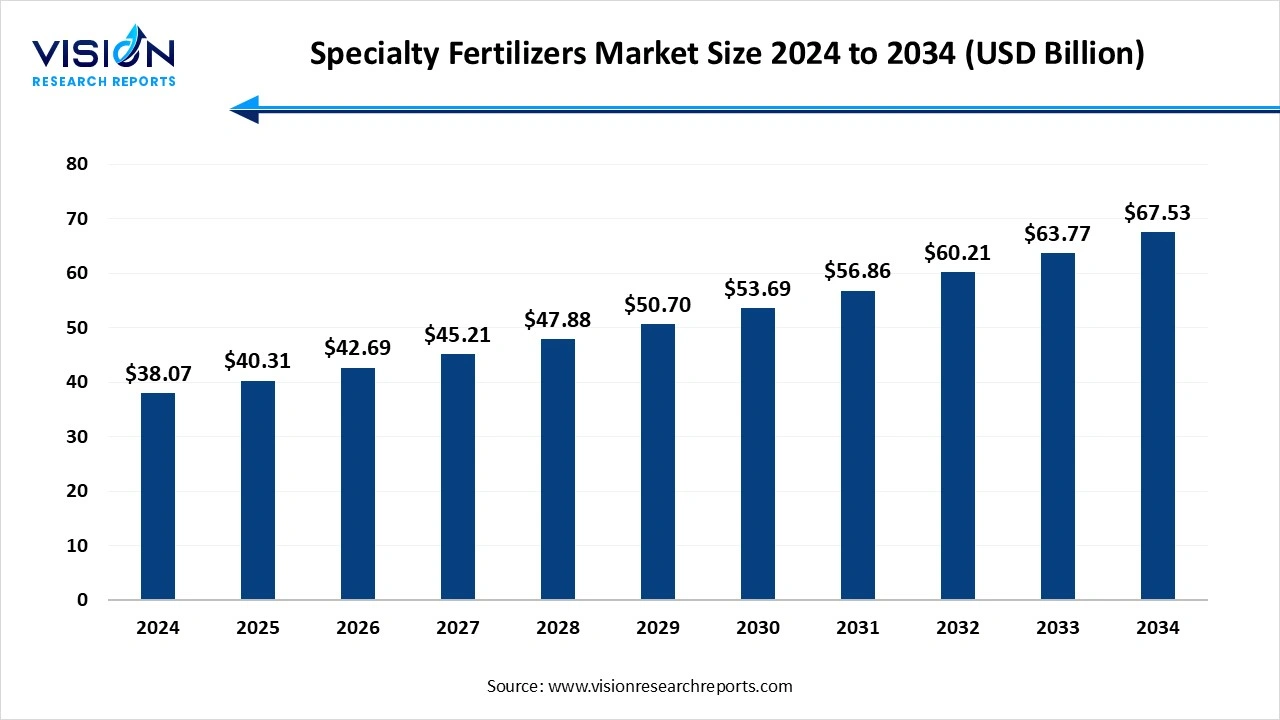

The global specialty fertilizers market was surpassed at USD 38.07 billion in 2024 and is expected to hit around USD 67.53 billion by 2034, growing at a CAGR of 5.90% from 2025 to 2034.

The specialty fertilizers market has witnessed significant growth in recent years, driven by the increasing demand for efficient and sustainable agricultural inputs. Unlike conventional fertilizers, specialty fertilizers are formulated to provide controlled or slow nutrient release, improve nutrient uptake, and minimize environmental losses. This has made them an essential component in precision farming and high-value crop cultivation. Factors such as rising global food demand, decreasing arable land, and increasing awareness of environmental concerns have further fueled the adoption of these advanced fertilizers. Technological innovations, including water-soluble fertilizers, micronutrient blends, and customized nutrient delivery systems, are reshaping market dynamics and creating new opportunities across both developed and emerging regions.

One of the primary growth drivers of the specialty fertilizers market is the increasing demand for high-efficiency agricultural inputs. With global population growth placing unprecedented pressure on food systems, farmers are turning to specialty fertilizers to maximize crop yields while minimizing resource use. These fertilizers, Such as slow- and controlled-release variants, micronutrient-enriched formulas, and water-soluble blends, Enhance nutrient uptake and reduce losses due to leaching or volatilization.

Another critical factor fueling market growth is the rising emphasis on environmental sustainability and regulatory compliance. Governments and agricultural bodies around the world are promoting the use of eco-friendly fertilizers as part of their efforts to reduce greenhouse gas emissions, prevent soil degradation, and protect water resources from contamination. Specialty fertilizers, with their targeted application and reduced environmental footprint, align well with these objectives.

The Asia Pacific region led the specialty fertilizers market, capturing the largest revenue share of 33% in 2024. Countries such as China, India, and Southeast Asian nations are witnessing rapid adoption of specialty fertilizers driven by government initiatives promoting sustainable agriculture and efficient nutrient management. The region’s diverse cropping patterns, ranging from rice and cereals to fruits and vegetables, create a significant demand for tailored fertilizer solutions. Additionally, rising awareness about environmental concerns and soil health is encouraging farmers to shift from conventional fertilizers to advanced specialty products that enhance nutrient use efficiency and reduce ecological impact

Europe holds a significant share of the specialty fertilizers market, driven by stringent environmental regulations and the increasing focus on organic and sustainable farming practices. Countries like Germany, France, and Italy are witnessing growing adoption of micronutrient fertilizers and bio-based formulations as farmers aim to improve soil fertility while complying with eco-friendly standards. The presence of well-developed agricultural research institutions and active government support programs facilitates the introduction and dissemination of innovative specialty fertilizers.

The CRF technology segment generated the highest revenue share in the market in 2024. Designed to release nutrients gradually over a defined period, CRFs enhance nutrient use efficiency by synchronizing nutrient availability with plant uptake. This controlled delivery not only reduces nutrient losses through leaching, volatilization, or runoff but also minimizes the need for frequent applications, thereby lowering labor and operational costs for farmers.

The water-soluble fertilizers segment is projected to experience the highest CAGR throughout the forecast period 2025 to 2034. These fertilizers dissolve completely in water, allowing for uniform application and precise nutrient delivery through irrigation systems. Their suitability for modern farming practices such as drip irrigation and hydroponics has driven widespread adoption, particularly in greenhouse cultivation, horticulture, and intensive farming operations. Water-soluble fertilizers are highly effective in correcting micronutrient deficiencies and supporting crop growth during critical developmental stages.

The urea ammonium nitrate (UAN) fertilizer segment held the largest share of market revenue in 2024. UAN is a highly efficient nitrogen source, blending urea and ammonium nitrate in a solution that can be applied directly to the soil or through fertigation systems. This fertilizer type is particularly favored in large-scale farming operations for its ease of handling, uniform nutrient distribution, and compatibility with other crop protection products. Its ability to be applied during key growth stages provides farmers with more control over nutrient timing, ultimately improving crop yields.

The micronutrient fertilizers segment is projected to experience the highest CAGR throughout the forecast period. These fertilizers supply essential nutrients such as zinc, boron, iron, manganese, copper, and molybdenum, which are required in small amounts but have a profound impact on crop development and resistance to stress. Deficiencies in these elements can severely limit crop yield and quality, even when macronutrient levels are sufficient.

The fruits and vegetables segment generated the highest market revenue share in 2024. These crops are highly sensitive to nutrient imbalances and require carefully managed fertilization programs to achieve optimal yield, flavor, appearance, and shelf life. Specialty fertilizers such as water-soluble formulations, micronutrients, and controlled-release products are widely used in the cultivation of fruits and vegetables to ensure efficient nutrient uptake throughout the growing season. With the rise in protected cultivation practices like greenhouses and hydroponics, the demand for specialty fertilizers in this segment has seen substantial growth.

The cereals and grains segment is anticipated to register the highest compound annual growth rate (CAGR) during the forecast period from 2025 to 2034. Crops such as wheat, rice, maize, and barley form the backbone of global food security and are cultivated extensively across diverse agro-climatic zones. Traditional fertilizers often result in significant nutrient losses, which not only reduce yield potential but also contribute to environmental concerns such as water pollution. Specialty fertilizers, including controlled-release nitrogen sources and micronutrient-enriched blends, offer a more efficient solution by releasing nutrients in a timely and consistent manner, tailored to the growth stages of these crops

The fertigation segment dominated the market, accounting for the largest revenue share of 55% in 2024. This technique allows for precise and efficient nutrient delivery directly to the root zone, optimizing nutrient uptake and minimizing wastage. In large-scale cereal and grain cultivation, fertigation enhances crop growth by enabling timely application of essential nutrients in measured quantities, thereby improving yield and reducing environmental impact. The compatibility of specialty fertilizers—such as water-soluble and controlled-release formulations—with fertigation systems further drives their adoption.

The foliar segment is expected to register the highest CAGR during the forecast period. This technique is especially valuable during critical growth stages or when soil conditions limit nutrient availability. Foliar feeding allows for the quick correction of nutrient deficiencies, helping to improve crop health, enhance stress tolerance, and boost overall productivity. Specialty fertilizers designed for foliar use often include micronutrients and other essential elements that are not always sufficiently absorbed from the soil.

By Technology

By Type

By Crop-Type

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Specialty Fertilizers Market

5.1. COVID-19 Landscape: Specialty Fertilizers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Specialty Fertilizers Market, By Technology

8.1. Specialty Fertilizers Market, by Technology

8.1.1. Controlled-release Fertilizers

8.1.1.1. Market Revenue and Forecast

8.1.2. Water-soluble Fertilizers

8.1.2.1. Market Revenue and Forecast

8.1.3. Liquid Fertilizers

8.1.3.1. Market Revenue and Forecast

8.1.4. Micronutrients

8.1.4.1. Market Revenue and Forecast

8.1.5. Others

8.1.5.1. Market Revenue and Forecast

Chapter 9. Global Specialty Fertilizers Market, By Type

9.1. Specialty Fertilizers Market, by Type

9.1.1. Urea Ammonium Nitrate

9.1.1.1. Market Revenue and Forecast

9.1.2. Calcium Ammonium Nitrate

9.1.2.1. Market Revenue and Forecast

9.1.3. Monoammonium Phosphate

9.1.3.1. Market Revenue and Forecast

9.1.4. Sulfate of Potash

9.1.4.1. Market Revenue and Forecast

9.1.5. Potassium Nitrate

9.1.5.1. Market Revenue and Forecast

9.1.6. Urea Derivatives

9.1.6.1. Market Revenue and Forecast

9.1.7. Blends of NPK

9.1.7.1. Market Revenue and Forecast

9.1.8. Others

9.1.8.1. Market Revenue and Forecast

Chapter 10. Global Specialty Fertilizers Market, By Crop-Type

10.1. Specialty Fertilizers Market, by Crop-Type

10.1.1. Cereals & Grains

10.1.1.1. Market Revenue and Forecast

10.1.2. Frutis & Vegetables

10.1.2.1. Market Revenue and Forecast

10.1.3. Oilseeds & Pulses

10.1.3.1. Market Revenue and Forecast

10.1.4. Other

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global Specialty Fertilizers Market, By Application

11.1. Specialty Fertilizers Market, by Application

11.1.1. Fertigation

11.1.1.1. Market Revenue and Forecast

11.1.2. Foliar

11.1.2.1. Market Revenue and Forecast

11.1.3. Soil

11.1.3.1. Market Revenue and Forecast

Chapter 12. Global Specialty Fertilizers Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Technology

12.1.2. Market Revenue and Forecast, by Type

12.1.3. Market Revenue and Forecast, by Crop-Type

12.1.4. Market Revenue and Forecast, by Application

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Technology

12.1.5.2. Market Revenue and Forecast, by Type

12.1.5.3. Market Revenue and Forecast, by Crop-Type

12.1.5.4. Market Revenue and Forecast, by Application

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Technology

12.1.6.2. Market Revenue and Forecast, by Type

12.1.6.3. Market Revenue and Forecast, by Crop-Type

12.1.6.4. Market Revenue and Forecast, by Application

12.2. Europe

12.2.1. Market Revenue and Forecast, by Technology

12.2.2. Market Revenue and Forecast, by Type

12.2.3. Market Revenue and Forecast, by Crop-Type

12.2.4. Market Revenue and Forecast, by Application

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Technology

12.2.5.2. Market Revenue and Forecast, by Type

12.2.5.3. Market Revenue and Forecast, by Crop-Type

12.2.5.4. Market Revenue and Forecast, by Application

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Technology

12.2.6.2. Market Revenue and Forecast, by Type

12.2.6.3. Market Revenue and Forecast, by Crop-Type

12.2.6.4. Market Revenue and Forecast, by Application

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Technology

12.2.7.2. Market Revenue and Forecast, by Type

12.2.7.3. Market Revenue and Forecast, by Crop-Type

12.2.7.4. Market Revenue and Forecast, by Application

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Technology

12.2.8.2. Market Revenue and Forecast, by Type

12.2.8.3. Market Revenue and Forecast, by Crop-Type

12.2.8.4. Market Revenue and Forecast, by Application

12.3. APAC

12.3.1. Market Revenue and Forecast, by Technology

12.3.2. Market Revenue and Forecast, by Type

12.3.3. Market Revenue and Forecast, by Crop-Type

12.3.4. Market Revenue and Forecast, by Application

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Technology

12.3.5.2. Market Revenue and Forecast, by Type

12.3.5.3. Market Revenue and Forecast, by Crop-Type

12.3.5.4. Market Revenue and Forecast, by Application

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Technology

12.3.6.2. Market Revenue and Forecast, by Type

12.3.6.3. Market Revenue and Forecast, by Crop-Type

12.3.6.4. Market Revenue and Forecast, by Application

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Technology

12.3.7.2. Market Revenue and Forecast, by Type

12.3.7.3. Market Revenue and Forecast, by Crop-Type

12.3.7.4. Market Revenue and Forecast, by Application

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Technology

12.3.8.2. Market Revenue and Forecast, by Type

12.3.8.3. Market Revenue and Forecast, by Crop-Type

12.3.8.4. Market Revenue and Forecast, by Application

12.4. MEA

12.4.1. Market Revenue and Forecast, by Technology

12.4.2. Market Revenue and Forecast, by Type

12.4.3. Market Revenue and Forecast, by Crop-Type

12.4.4. Market Revenue and Forecast, by Application

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Technology

12.4.5.2. Market Revenue and Forecast, by Type

12.4.5.3. Market Revenue and Forecast, by Crop-Type

12.4.5.4. Market Revenue and Forecast, by Application

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Technology

12.4.6.2. Market Revenue and Forecast, by Type

12.4.6.3. Market Revenue and Forecast, by Crop-Type

12.4.6.4. Market Revenue and Forecast, by Application

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Technology

12.4.7.2. Market Revenue and Forecast, by Type

12.4.7.3. Market Revenue and Forecast, by Crop-Type

12.4.7.4. Market Revenue and Forecast, by Application

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Technology

12.4.8.2. Market Revenue and Forecast, by Type

12.4.8.3. Market Revenue and Forecast, by Crop-Type

12.4.8.4. Market Revenue and Forecast, by Application

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Technology

12.5.2. Market Revenue and Forecast, by Type

12.5.3. Market Revenue and Forecast, by Crop-Type

12.5.4. Market Revenue and Forecast, by Application

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Technology

12.5.5.2. Market Revenue and Forecast, by Type

12.5.5.3. Market Revenue and Forecast, by Crop-Type

12.5.5.4. Market Revenue and Forecast, by Application

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Technology

12.5.6.2. Market Revenue and Forecast, by Type

12.5.6.3. Market Revenue and Forecast, by Crop-Type

12.5.6.4. Market Revenue and Forecast, by Application

Chapter 13. Company Profiles

13.1. Yara International ASA

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. ICL Group Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Haifa Group

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. SQM S.A.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. K+S AG

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Coromandel International Limited

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Nutrien Ltd.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Mosaic Company

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Haifa Chemicals Ltd.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Gulf Cryo

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others