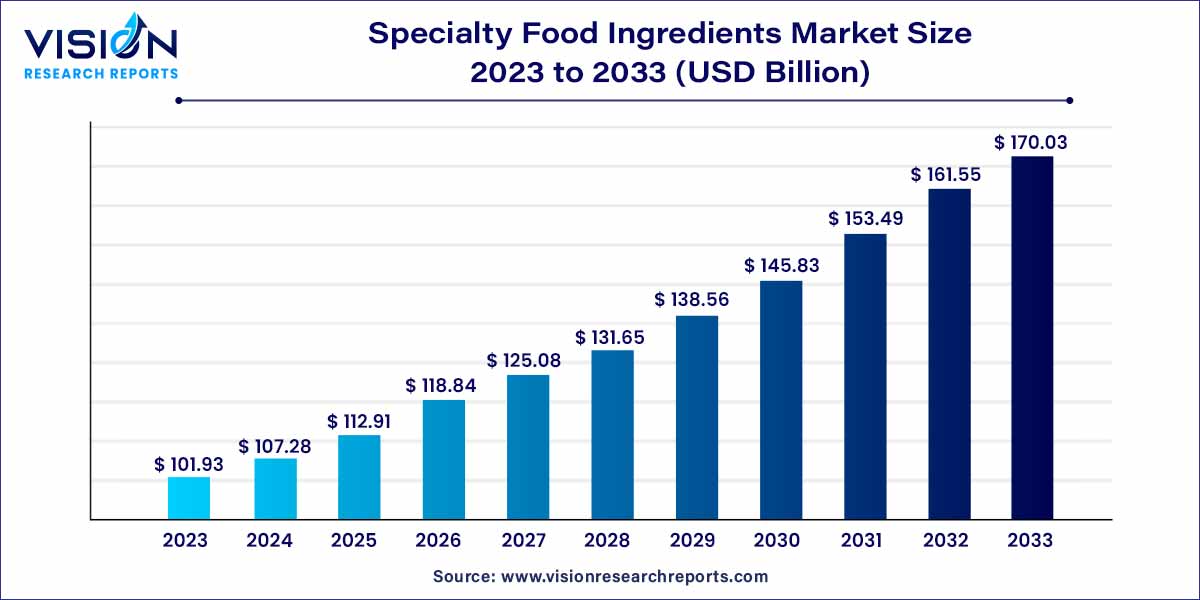

The global specialty food ingredients market was estimated at USD 101.93 billion in 2023 and it is expected to surpass around USD 170.03 billion by 2033, poised to grow at a CAGR of 5.25% from 2024 to 2033.

The specialty food ingredients market is a dynamic sector characterized by a diverse array of products that play a pivotal role in shaping the modern food industry. These ingredients, known for their unique properties and contributions to flavor, texture, and nutritional value, have become integral components in the formulation of a wide range of food products.

The specialty food ingredients market is experiencing robust growth driven by several key factors. Changing consumer preferences play a pivotal role, with an increasing focus on health and wellness prompting a demand for high-quality ingredients that enhance both taste and nutritional value. The market is further propelled by innovations in food processing technologies, allowing manufacturers to create unique and differentiated products. The globalization of culinary trends has also contributed to the surge in demand, as consumers seek authentic and diverse flavors. Additionally, the clean label movement has influenced consumer choices, with a preference for natural and minimally processed ingredients. Despite challenges such as regulatory complexities and supply chain disruptions, these factors collectively contribute to the market's dynamic expansion, presenting opportunities for industry players to meet evolving consumer demands and maintain competitiveness.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 170.03 billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.25% |

| Revenue Share of Asia Pacific in 2023 | 34% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

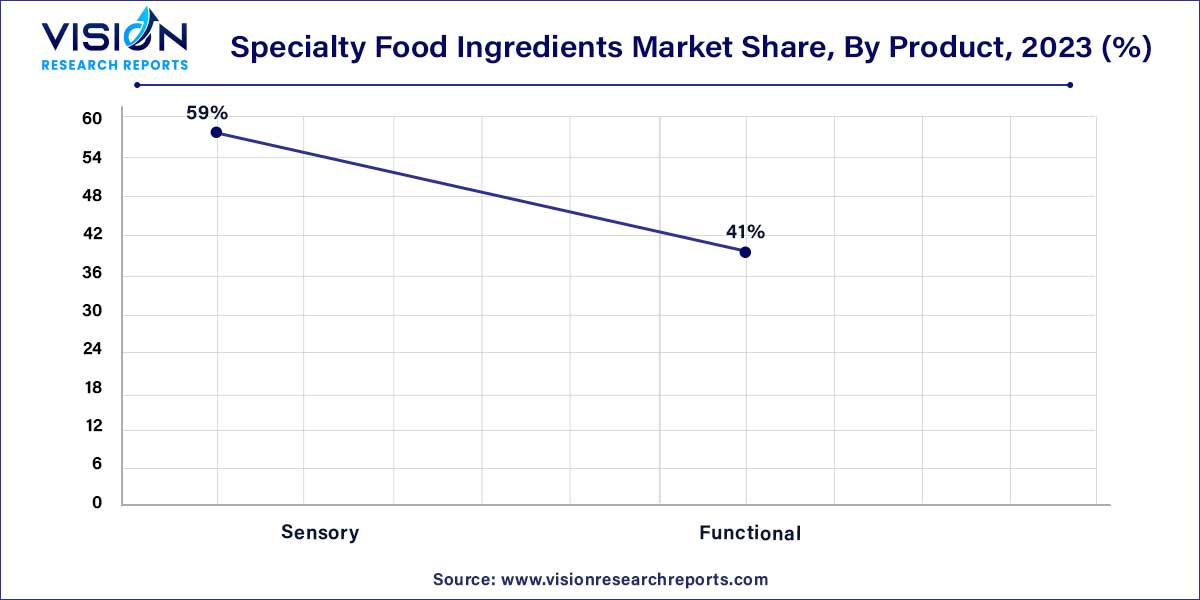

The sensory segment held the largest revenue share of 59% in 2023. This dominance is attributed to the indispensable role sensory ingredients play in elevating the taste, aroma, flavor, and texture of food products. The heightened demand for such ingredients in packaged and convenience foods, as well as confectioneries, is anticipated to be a pivotal driver for the escalating demand for these sensory elements.

The flavor product market is notably influenced by the increasing preference for organic and natural ingredients. The ever-evolving tastes of consumers contribute to a surging demand for diverse flavor profiles. This trend is particularly evident in the flavor industry, strongly influenced by the consumption patterns in various foods and beverages. The rising popularity of ready-to-eat food products further fuels this growth, making a substantial impact on the food flavor market. The global demand for natural ingredients stands out as a primary catalyst propelling this market forward.

Vitamins find widespread application in meals, fortification in oils and fats, supplements, and infant formula. The choice of vitamins is contingent upon specific formulation requirements. Minerals, constituting essential components of a balanced diet, serve diverse functions and aid in the absorption of certain vitamins, such as calcium facilitating the absorbance of vitamin D by cells from the diet.

As a key ingredient, antioxidants play a crucial role in shielding finished products from issues like fat rancidity and color changes due to oxidation caused by bacteria, fungi, molds, and yeasts. The types of antioxidants employed depend on the formulation requirements of the specific diet. Preservatives, serving to maintain product quality over an extended period without compromise, are witnessing increased adoption due to changing consumer preferences for safe and hygienic packaged food, especially in developed regions. These distinctive product attributes enable manufacturers to meet the precise needs of processors, foreseeing a substantial boost in market growth over the next eight years.

The food and beverage segment contributed the largest market share of 71% in 2023. This dominance is primarily attributed to shifting consumer lifestyles and evolving food preferences, resulting in substantial growth within the processed food manufacturing sector. This, in turn, is expected to drive the demand for specialty food ingredients. Additionally, the escalating consumption of both alcoholic and non-alcoholic beverages, particularly among the younger demographic, is anticipated to further fuel growth within the industry.

The personal care industry has experienced significant growth, driven by heightened consumer awareness regarding the ingredients used in such products. Consumers are increasingly opting for natural and health-focused products, steering clear of harmful chemicals. Consequently, manufacturers are incorporating these special ingredients widely into their product offerings to meet the rising demand for natural and healthy personal care items.

Recognizing the value of specialty food ingredients, the pharmaceutical industry is increasingly integrating them into the development of new products aimed at improving patient health outcomes. These ingredients find application in various pharmaceutical realms, including drug delivery systems, nutraceuticals, and functional foods, showcasing their versatility and potential impact on health-related advancements.

The Asia Pacific region led the market with the largest market share of 34% in 2023. This commanding position is largely attributed to the surging popularity of convenience food, particularly in China, which has emerged as the largest market for emulsifiers in the region. The expansive population in China further contributes to the growth of the food and beverage, pharmaceutical, and personal care industries, establishing them as key drivers for the overall industry in the country.

Europe, in the same year, emerged as the second-largest regional market for specialty food ingredients. However, a relatively sluggish growth trajectory is anticipated over the forecast period. Renowned for its globally acclaimed cuisines, Europe experiences a continuous evolution in consumer preferences, leading to the frequent innovation of new recipes. Countries such as France, Italy, and Belgium stand out as major importers of specialty ingredients within the region. The presence of a significant number of processing and confectionery companies in Germany and the UK contributes to both production and demand for specialty food ingredients, reinforcing the region's position in the market.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Specialty Food Ingredients Market

5.1. COVID-19 Landscape: Specialty Food Ingredients Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Specialty Food Ingredients Market, By Product

8.1. Specialty Food Ingredients Market, by Product, 2024-2033

8.1.1. Sensory

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Functional

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Specialty Food Ingredients Market, By Application

9.1. Specialty Food Ingredients Market, by Application, 2024-2033

9.1.1. Food & Beverage

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Pharmaceutical

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Personal Care

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Specialty Food Ingredients Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Naturex

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Givaudan

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Eli Fried Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. KF Specialty Ingredients

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Ingredion

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Associated British Foods Plc

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Kerry Group

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Agropur Cooperative

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Ashland Inc

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Archer Daniels Midland Company

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others